Analysts at TD Cowen have warned that political incentives could delay final rules on crypto market structure until 2029.

- The crypto market structure bill is expected to reach the Senate next week.

- Sen. Tim Scott said months of circulating the bill had prepared the bill for a procedural vote, although its final passage remains uncertain.

- Industry lawyers and policy experts widely expect a market structure bill to eventually pass, although the illicit financing provisions remain controversial.

The Market Structure for Crypto bill is poised to reach the U.S. Senate as early as next week, but Wall Street and political analysts are bracing for a much longer legislative delay before the bill becomes law.

Senator Tim Scott reportedly said on Tuesday that the proposed crypto market structure is expected to go before the Senate for deliberations soon. The bill aims to define regulatory responsibilities for digital assets and establish clearer rules for crypto markets.

“Next Thursday we will have a vote on market structure,” Scott told Breitbart News on Tuesday. “It’s important for us to officially appear and vote.” He said lawmakers spent more than six months circulating several drafts among committee members in an effort to reach consensus. In December, the Trump administration’s AI and crypto czar David Sacks also said he had met with US senators to support progress on broader crypto market structure legislation.

Crypto Market Structure Bill Moves Under a Cloud

Despite signs of near-term movement, TD Cowen cautioned that adoption this year is far from assured. In a Monday note cited by TheBlock, the company said U.S. crypto market structure legislation could slide until 2027, with final rules potentially taking effect in 2029 if political hurdles persist.

He adds that Democrats may have little incentive to speed up the process, particularly if they believe control of the House could shift after the 2026 midterm elections. Still, Jaret Seiberg, managing director of the firm’s Washington Research Group, said delays ultimately may not derail the legislation. “The time is favorable for enactment, as the problems will disappear if the bill is passed in 2027 and takes effect in 2029,” he wrote.

Crypto Industry Divided Over Legislative Timetable

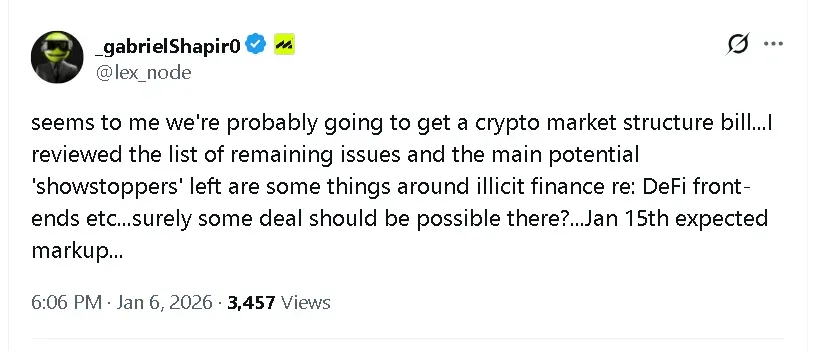

MetaLeX founder and crypto lawyer Gabriel Shapiro said the United States is “probably going to get a crypto market structure bill,” although concerns about illicit financing remain unresolved. “There could be a deal,” Shapiro wrote in an article on X.

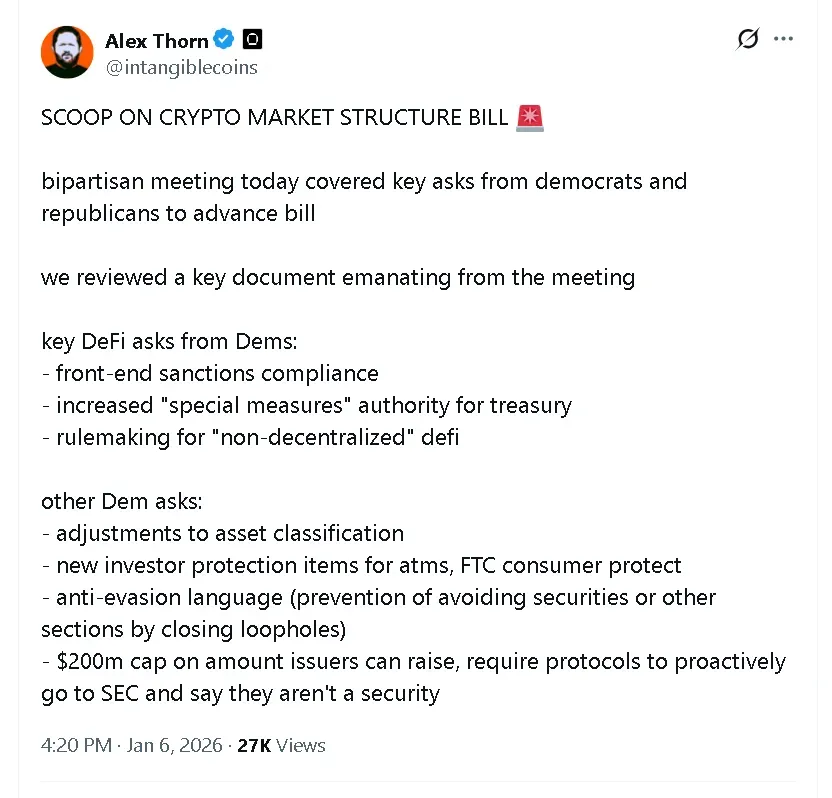

Others are less convinced. Alex Thorn, head of research at Galaxy Digital, said in an article on Tuesday that after reviewing documents from a bipartisan Senate meeting, it is “unclear whether the two parties can come together and create that bipartisanship,” citing several outstanding questions.

Some market participants say legislative uncertainty is already weighing on cryptocurrency prices. CoinShares attributed $952 million in outflows from crypto investment products in the week ended December 19 to delays in crypto legislation, citing prolonged regulatory uncertainty as a factor.

The overall cryptocurrency market was trading in the red early Wednesday morning. It fell 1.75% in the last 24 hours to around $3.23 trillion. Bitcoin price fell more than 2% to $91,700 as retail sentiment on Stocktwits moved into “extremely bullish” territory over the past day, amid “high” levels of chatter.

Read also: Arthur Hayes calls on Binance and Bybit to list this crypto token after it hits an all-time high

For updates and corrections, email newsroom(at)stocktwits(dot)com.

Learn about our editorial guidelines and ethics policy