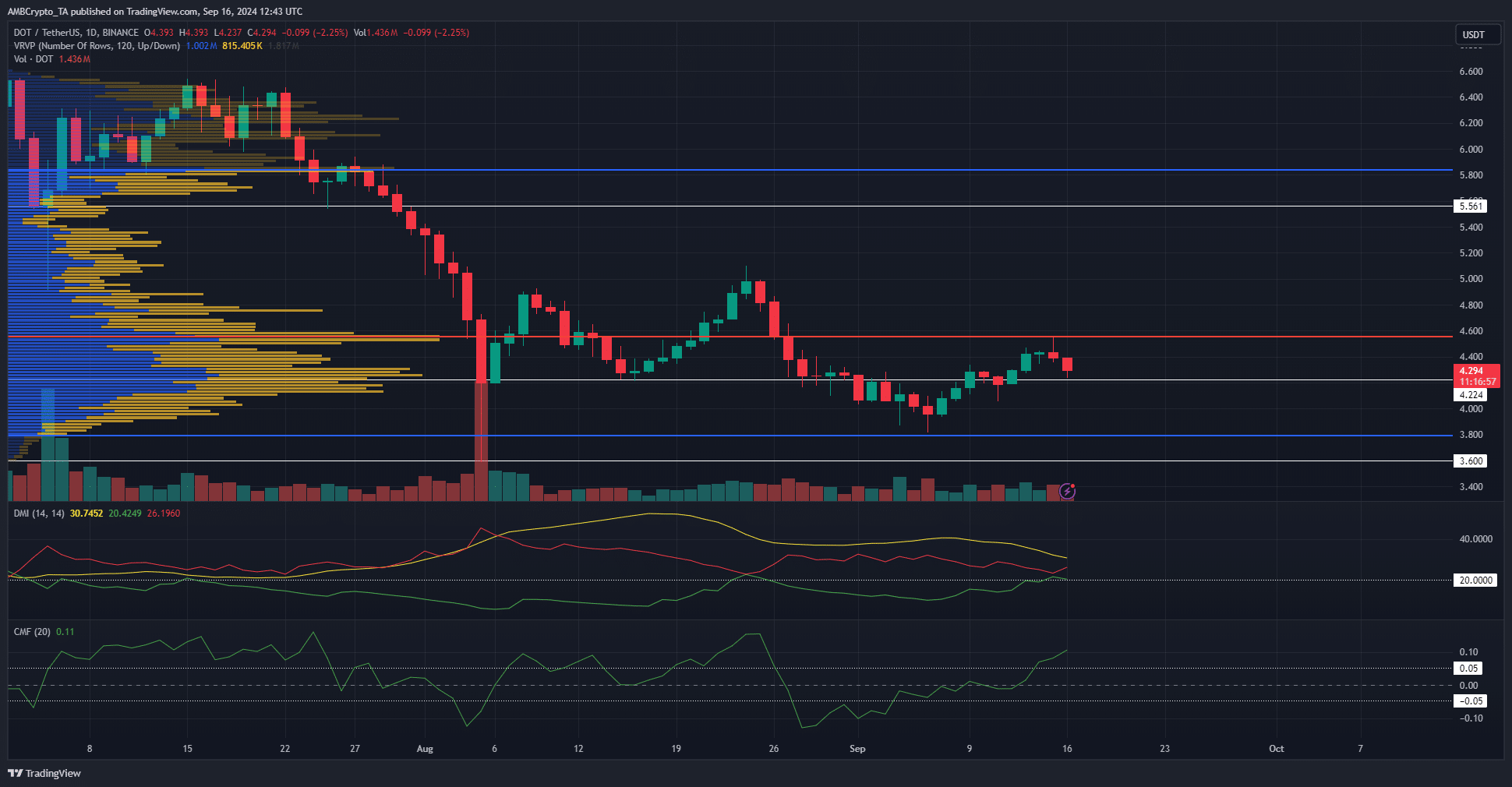

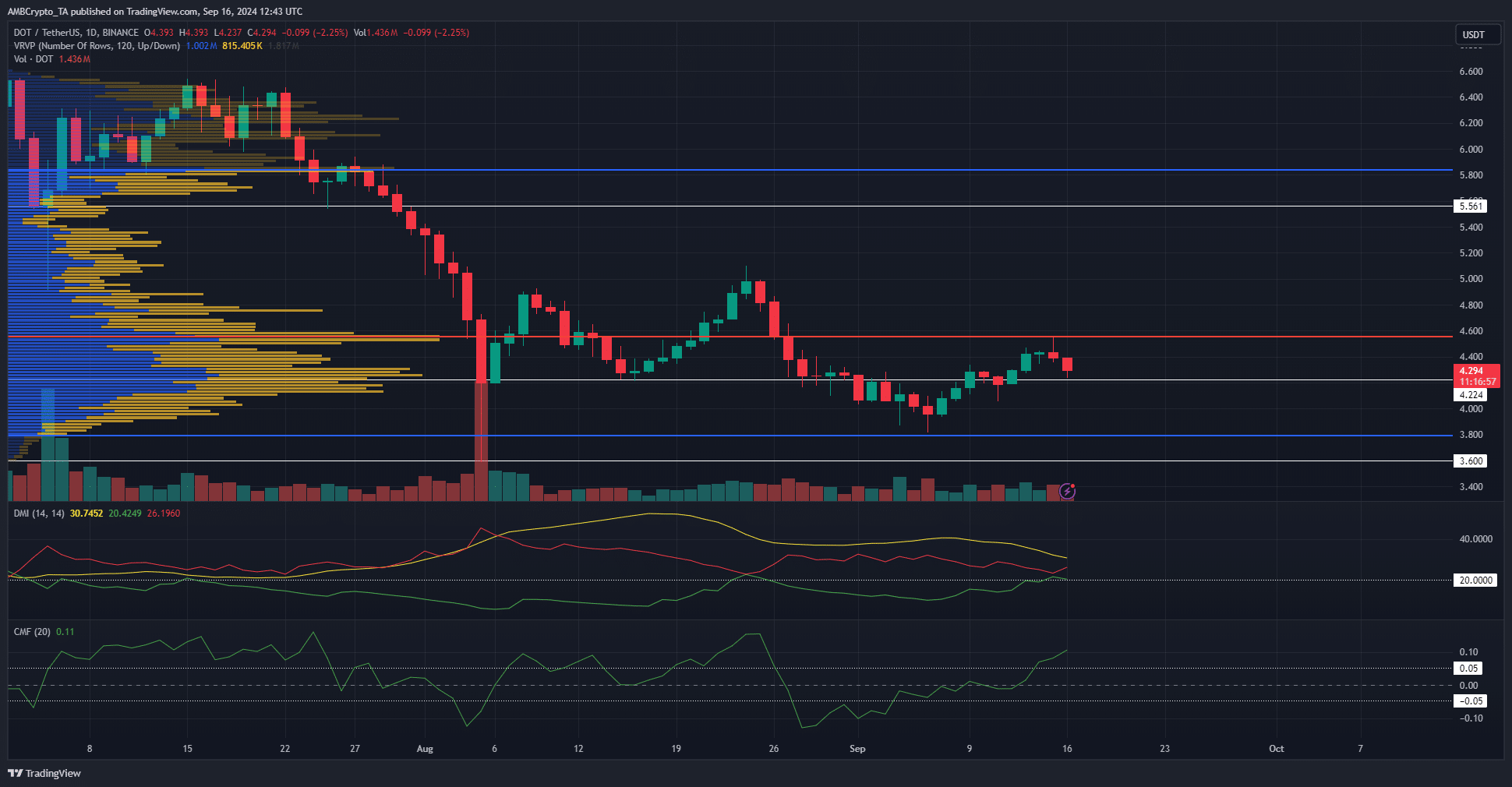

- Polkadot showed a bearish structure but the CMF signaled buying pressure.

- The VRVP tool’s $4 and $4.6 support and resistance zone would likely be respected in the coming weeks.

Polkadot (DOT) managed to bounce back from the $4 support area earlier this month, but its momentum has faltered over the past few days. At press time, it appeared to be heading towards the same support again.

The liquidity chart highlighted the possibility of a quick move higher in DOT to regain liquidity before a reversal. Should traders go long now or wait for a bounce to short it?

Volume profile shows DOT is below resistance zone

Source: DOT/USDT on TradingView

The visible DOT volume profile range extending to early July showed the point of control at $4.556. The price was rejected from this level a day earlier and was sinking towards the next high volume support node at $4.224.

The Directional Movement Index registered both the -DI (red) and ADX (yellow) above 20, indicating a strong downtrend in progress. Price action also showed an ongoing downtrend since June, with DOT forming a series of lower highs and lower lows.

The CMF, contrary to the trend and momentum indicators, stood at +0.11, which indicates a significant inflow of capital into the market. This increase in buying pressure is an encouraging sign.

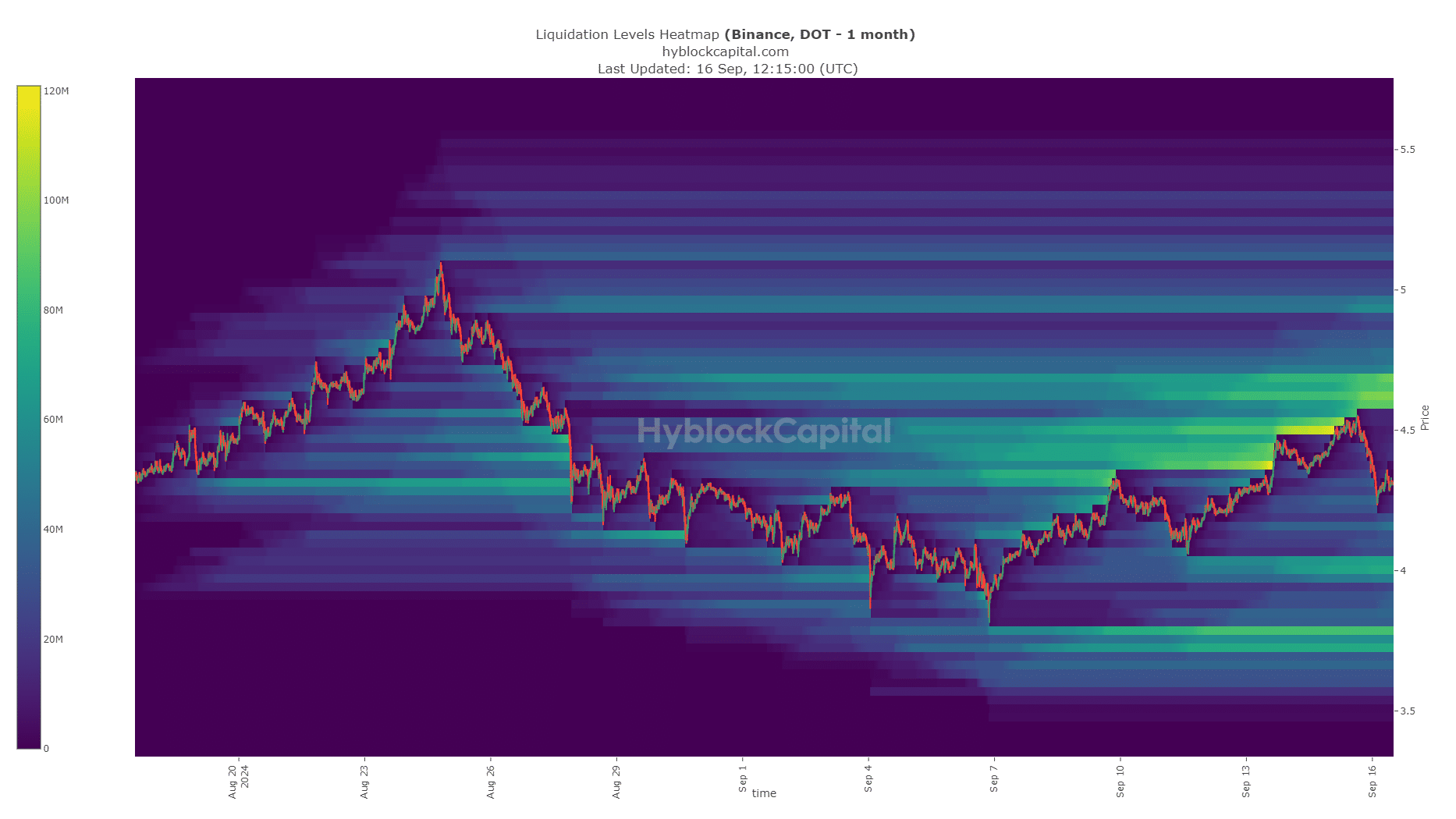

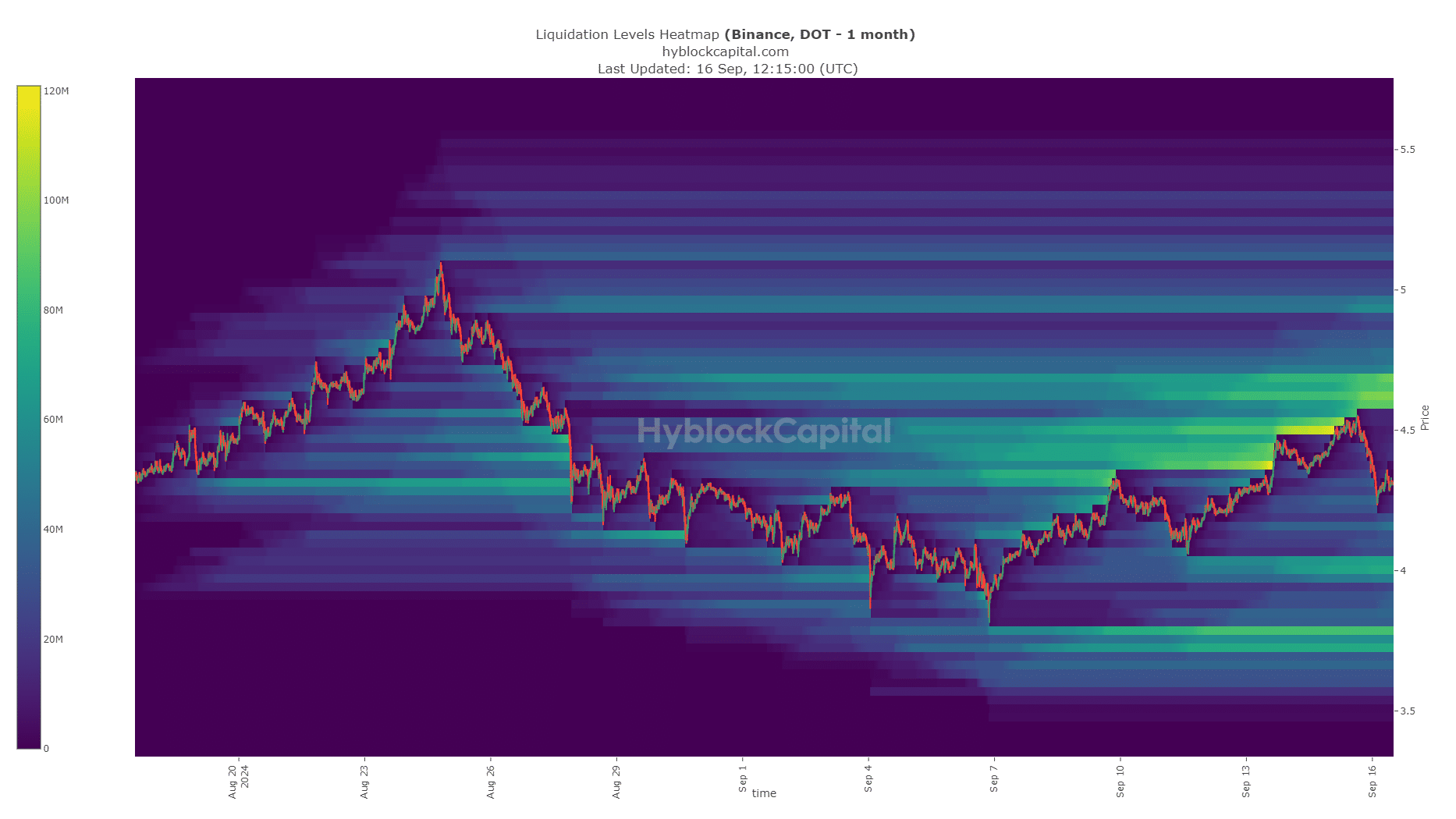

Magnetic zones could lead to the formation of mountain ranges

Source: Hyblock

AMBCrypto analyzed Polkadot’s 1-month liquidation heatmap and found two interesting liquidity clusters. The closest and widest liquidity band was located at $4.6-4.7, and the other was located at the $4 support zone.

Read Polkadot (DOT) Price Prediction 2024-25

The pocket to the north is stronger and more likely to draw prices towards it before a reversal to the $4 liquidity pool. This could see Polkadot establish a range between $4 and $4.7 in the coming weeks.

Disclaimer: The information presented does not constitute financial, investment, trading or other types of advice and represents the opinion of the author only.