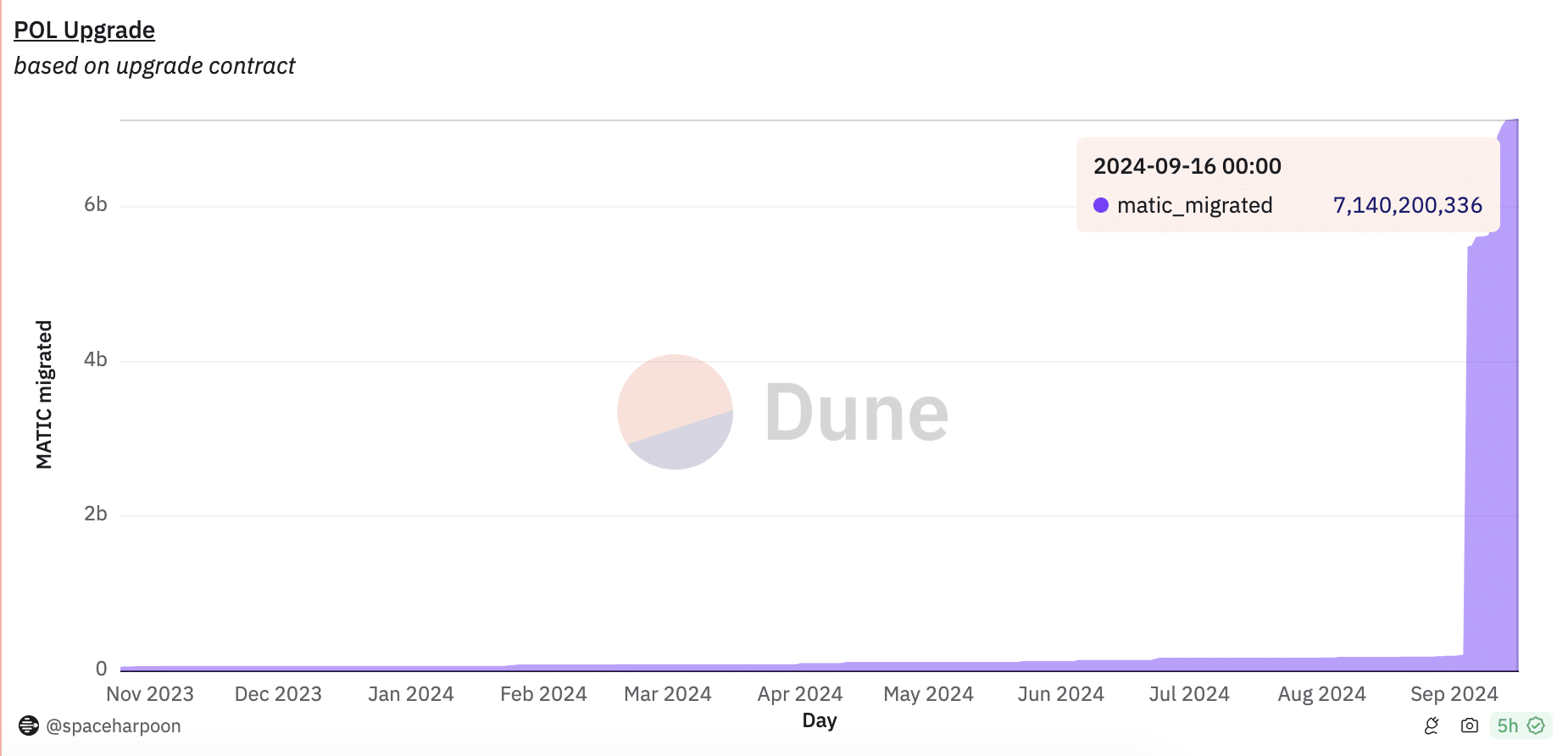

- POL trading surged after the listing, with $7.14 billion worth of MATIC tokens converted to the new token.

- Polygon has strengthened its role in tokenized RWA, holding $868.88 million in total value locked.

Binance (BNB) succeeded completed the transition from MATIC to POL, creating a wave of interest among traders.

With $7.14 billion worth of MATIC tokens already converted, representing 71.4% of the total supply, the market is closely monitoring the impact of this change on POL’s price movements, according to Dune.

Source: Dune

The new POL token is now available for trading on multiple pairs including POL/USDT, POL/BTC, and POL/ETH, among others.

POL performance after listing

Following its listing on Binance, POL experienced both volatility and an increase in trading volume. At press time, POL’s price was $0.3794with a 24-hour trading volume of $77,969,673.

The token has seen a decline of -6.29% over the past day, but has posted a modest gain of 0.85% over the past week. Despite this short-term decline, POL has maintained a market cap of $2.7 billion, fueled by its large circulating supply of 7.1 billion tokens.

According to Llama ChallengeTotal value locked (TVL) on Polygon was $868.88 million at press time, indicating strong engagement on the platform.

Additionally, the network’s stablecoins have a market capitalization of $1.982 billion, while the 24-hour trading volume reaches $58.59 million.

Over the past 24 hours, Polygon has seen $1.49 million inflows and 2.84 million transactions. The number of active addresses over the same period is 606,572, while new addresses have increased by 55,169.

Polygon’s Role in Tokenized RWA

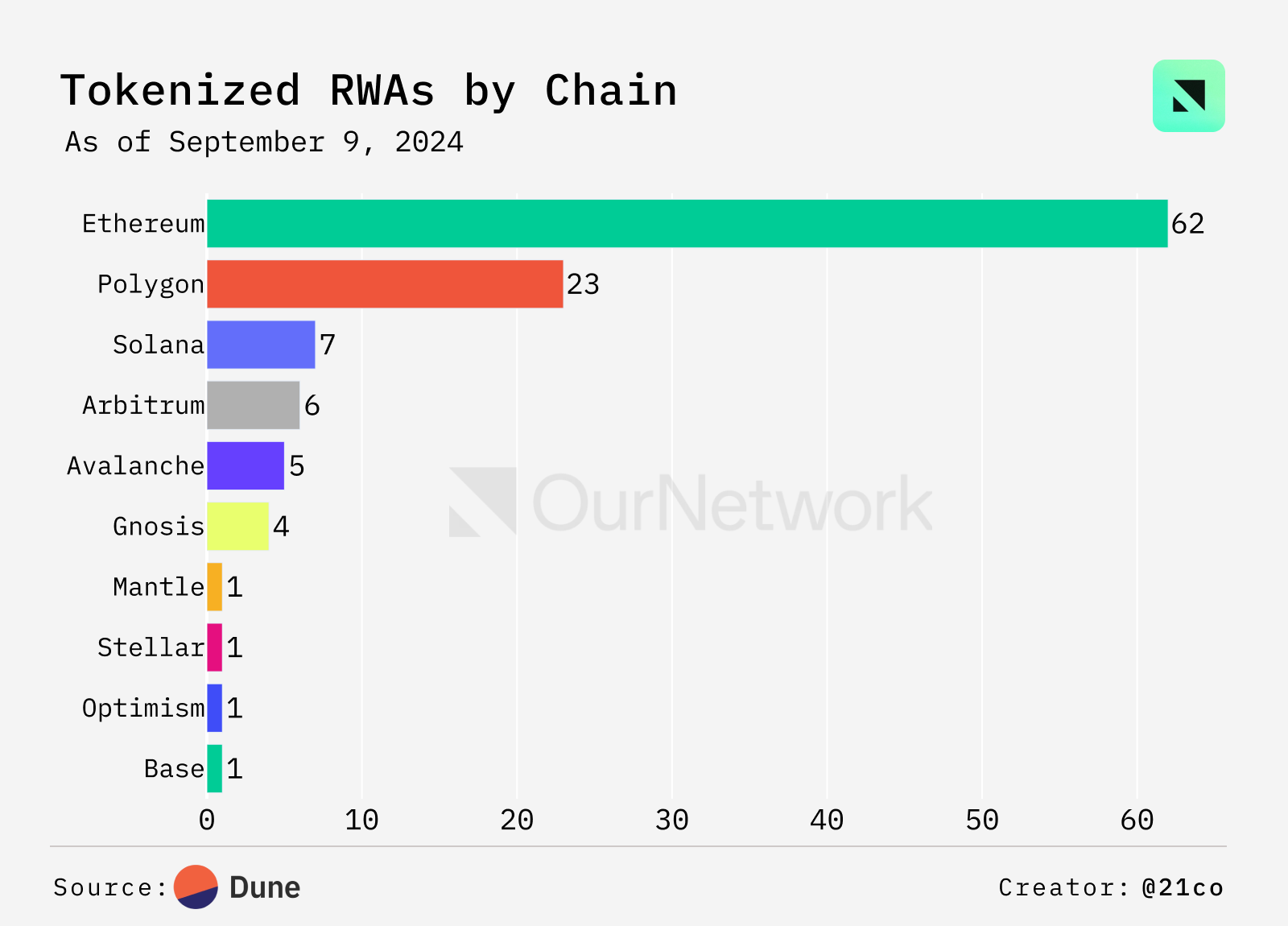

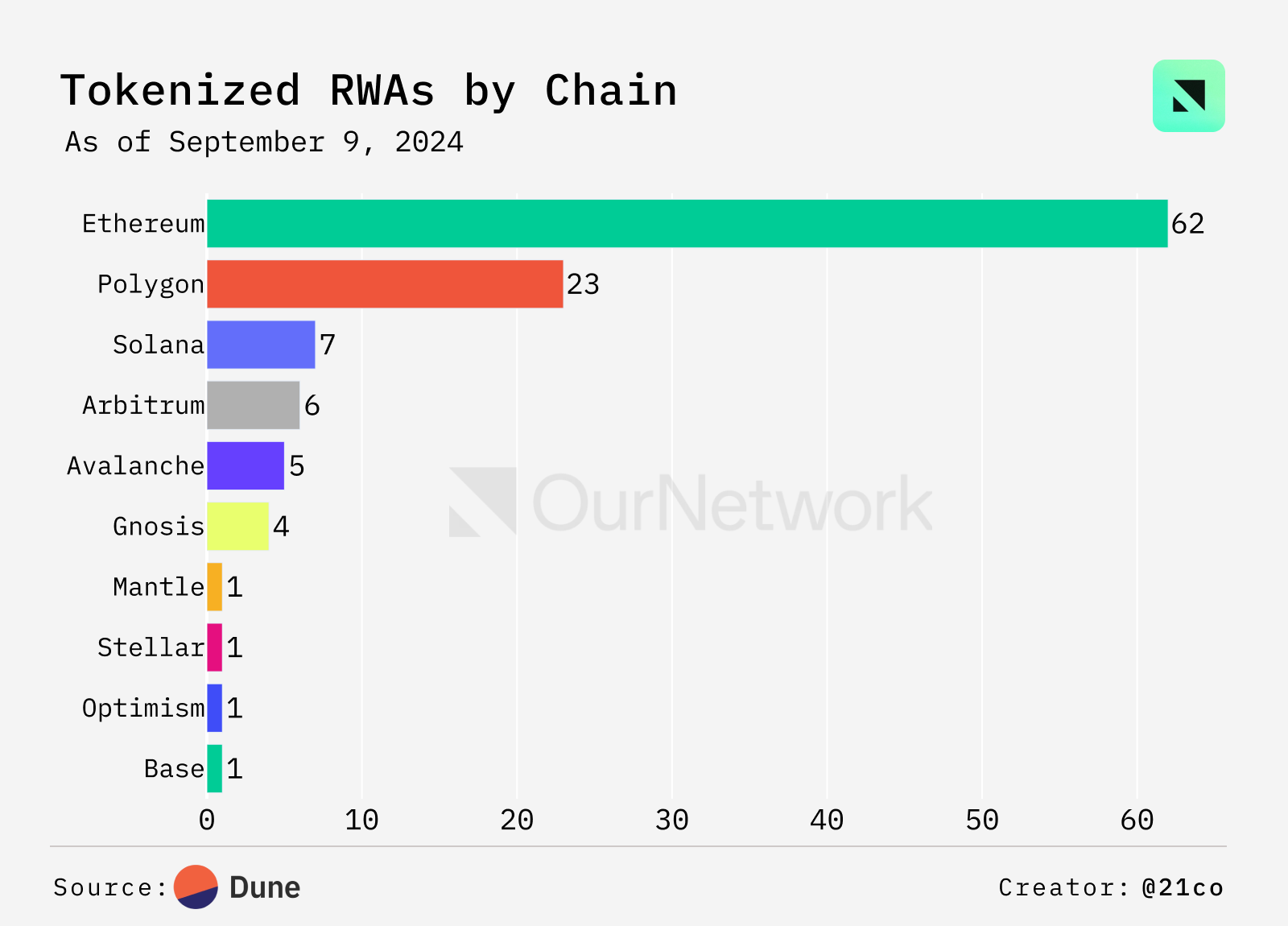

Polygon has established itself as the second-largest blockchain in the tokenized real-world asset (RWA) space, with 23 assets on its platform, after Ethereum (ETH)’s 62. market analysis,

“Polygon’s position in the RWA sector, with a total market capitalization of $531.58 million, reinforces its importance in the blockchain ecosystem.”

Source: OurNetwork

Read Polygon (MATIC) Price Prediction for 2024-2025

This substantial market share puts Polygon in a strong position as it enters the POL era.

With its continued growth in the RWA market, the platform is expected to attract more projects, which could impact POL’s long-term value.