One of the defining narratives of 2026 is that of “privacy.” As institutional players play a dominant role in crypto, privacy has become an essential technical feature for connecting blockchain to real-world businesses.

-

The main benefit of blockchain transparency can reveal companies’ trade secrets and investment strategies, creating significant risk for companies.

-

Fully anonymous privacy models like Monero do not support KYC or AML, making them unsuitable for regulated institutions.

-

Financial institutions need selective privacy that protects transaction data while remaining compatible with regulatory oversight.

-

Financial institutions must determine how to connect to Web3’s open marketplaces to grow.

One of the main features of blockchain is transparency. Anyone can inspect on-chain transactions in real time, including who sent funds, to whom, in what amount, and at what time.

But from an institutional point of view, this transparency raises obvious problems. Consider a scenario where the market can observe how much Nvidia transfers to Samsung Electronics, or precisely when a hedge fund deploys capital. Such visibility would fundamentally change competitive dynamics.

The level of information disclosure that individuals can tolerate differs from that which businesses and financial institutions can accept. Company transaction history and institutional investment timing constitute extremely sensitive information.

As a result, it is unrealistic to expect institutions to operate on blockchains where all of their activities are fully exposed. For these actors, a privacy-free system is less a practical infrastructure than an abstract ideal with limited real-world applicability.

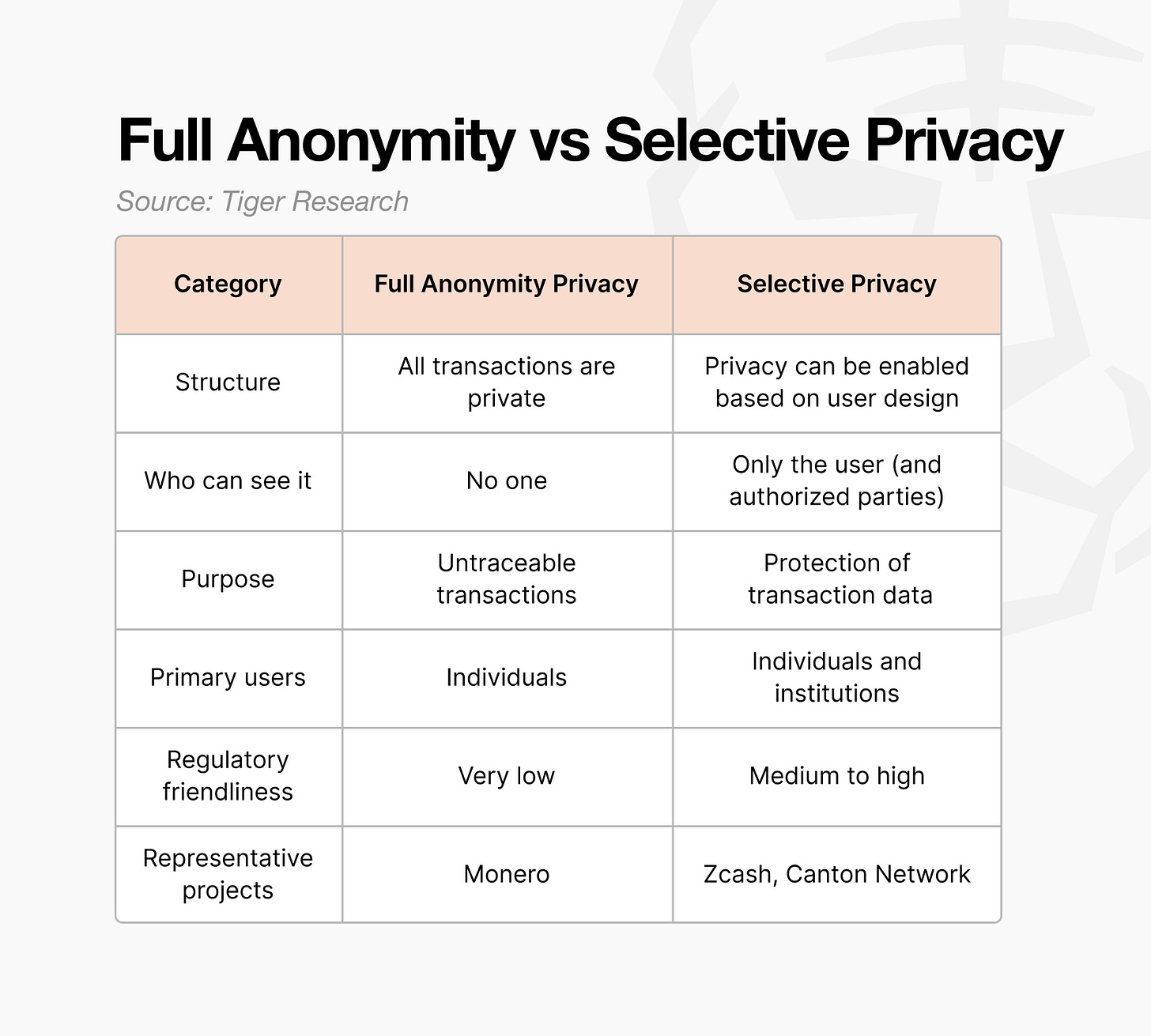

Blockchain privacy generally falls into two categories:

-

total confidentiality of anonymity

-

selective privacy.

The main distinction is whether information can be disclosed when verification is required by another party.

Simply put, the complete privacy of anonymity hides everything.

The sender, recipient, and transaction amount are all hidden. This model is directly opposed to classic blockchains, which favor transparency by default.

The main goal of complete anonymity systems is protection against third-party surveillance. Rather than allowing selective disclosure, they are designed to prevent external observers from extracting meaningful information.

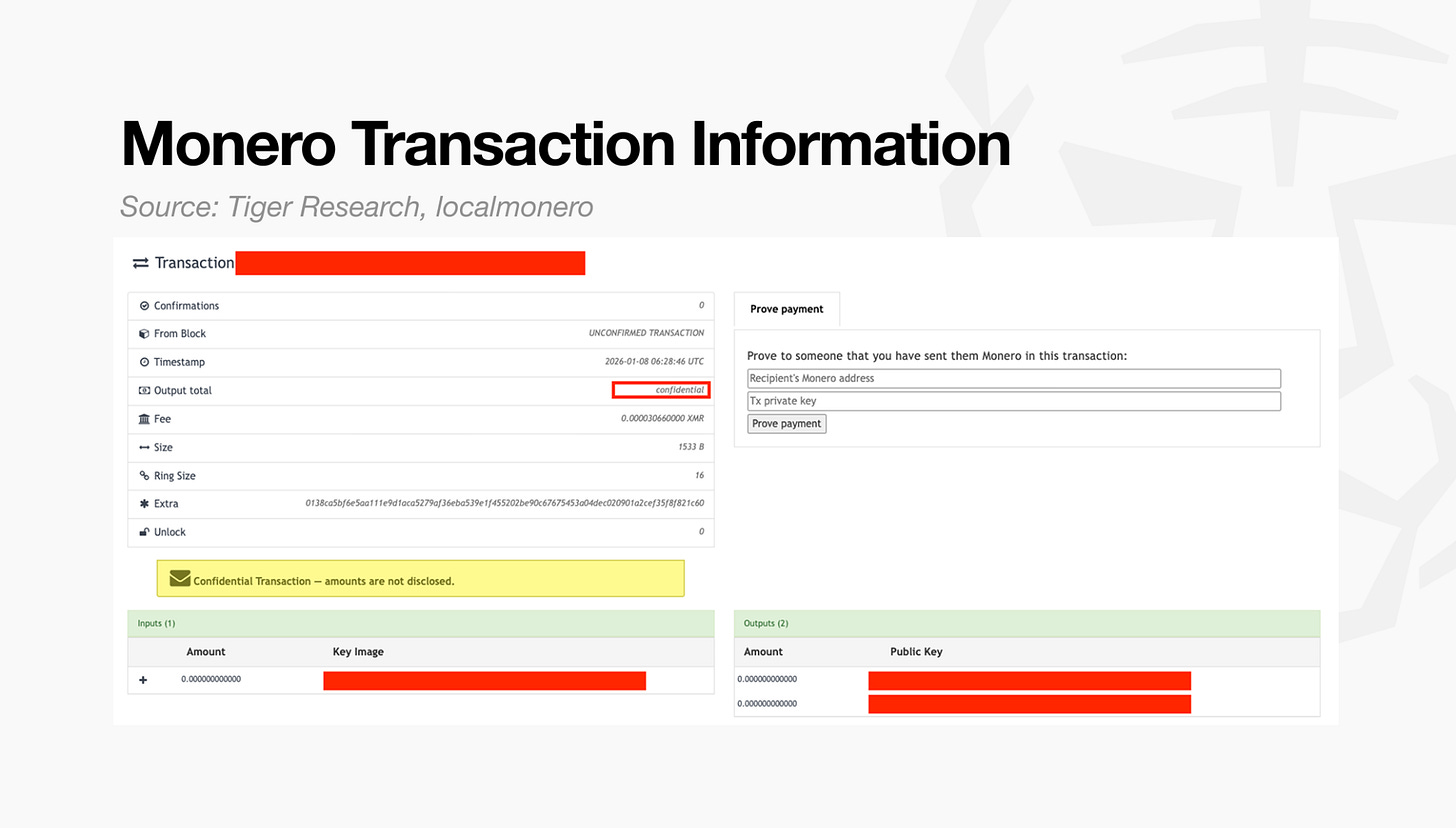

The image above shows Monero transaction records, a representative example of complete anonymity. Unlike transparent blockchains, details such as transfer amounts and counterparties are not visible.

Two characteristics illustrate why this model is considered completely anonymous:

-

Total production: Instead of a concrete number, the ledger displays the value as “confidential”. The transaction is recorded, but its content cannot be interpreted.

-

Ring size: Although only one sender initiates the transaction, the ledger mixes it with multiple decoys, making it appear that multiple parties sent funds simultaneously.

These mechanisms ensure that transaction data remains opaque to all external observers, without exception.

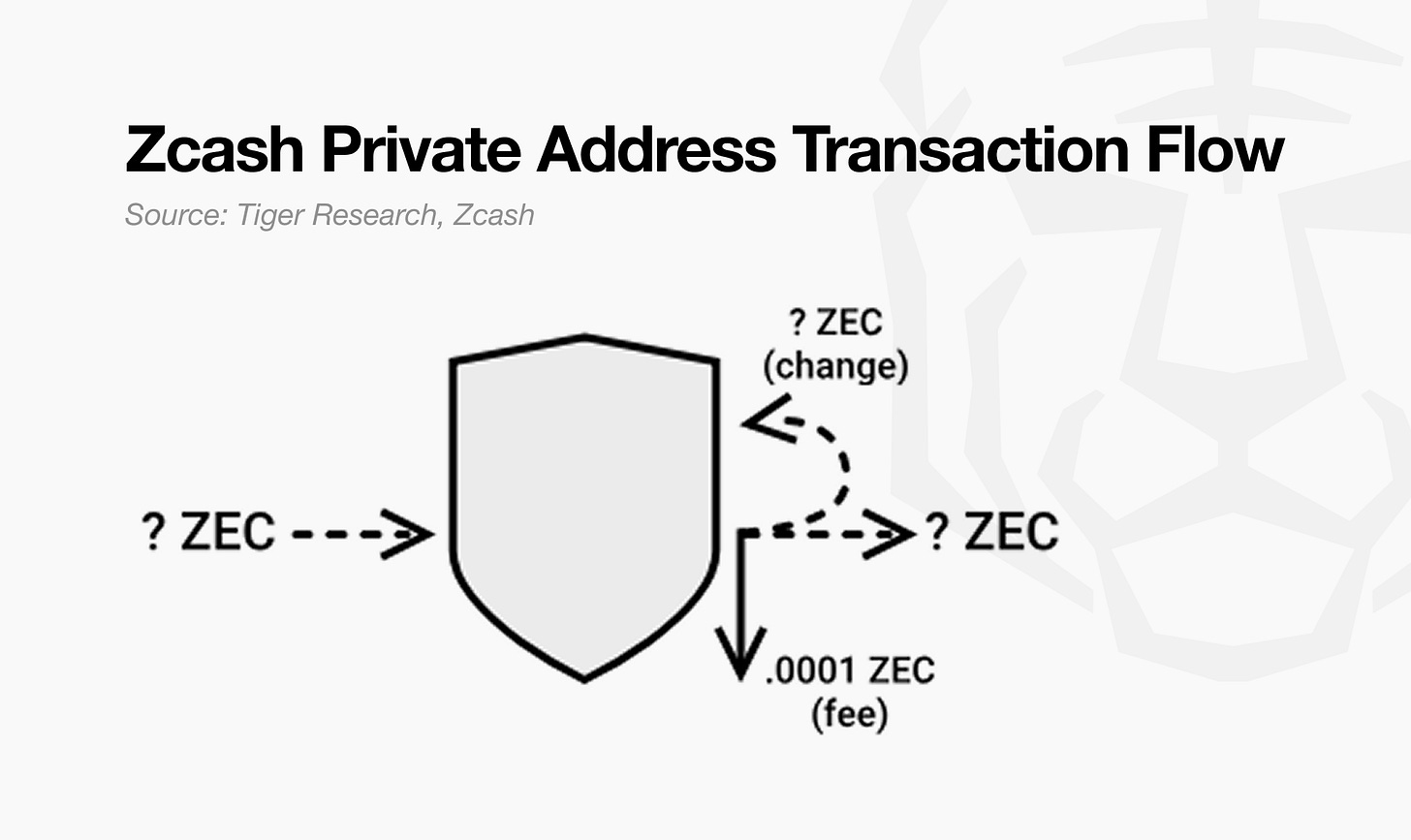

Selective privacy works on a different assumption. Transactions are public by default, but users can choose to make specific transactions private using designated privacy-enabled addresses.

Zcash provides a clear example of this. When initiating a transaction, users can choose between two types of addresses:

-

Transparent address: All transaction details are publicly visible, as with Bitcoin.

-

Protected address: Transaction details are encrypted and hidden.

The image above illustrates what Zcash can encrypt when protected addresses are used. Transactions sent to protected addresses are recorded on the blockchain, but their contents are stored in an encrypted state.

If the existence of a transaction remains visible, the following information is hidden:

-

Address type: Shielded addresses (Z) are used instead of transparent addresses (T).

-

Transaction recording: The ledger confirms that a transaction has taken place.

-

Amount, sender, recipient: All are encrypted and cannot be observed from the outside.

-

Access to visualization: Only parties with a viewing key can inspect transaction details.

This is the heart of selective privacy. Transactions remain on-chain, but users control who can see their content. If necessary, a user can share a viewing key to prove transaction details to another party, while all other third parties cannot access the information.

Most financial institutions are subject to know your customer (KYC) and anti-money laundering (AML) requirements for every transaction. They must keep transaction data internally and respond immediately to requests from regulators or supervisory authorities.

However, in environments based on the complete confidentiality of anonymity, all transaction data is irreversibly hidden. Since information cannot be accessed or disclosed under any conditions, institutions are structurally incapable of meeting their compliance obligations.

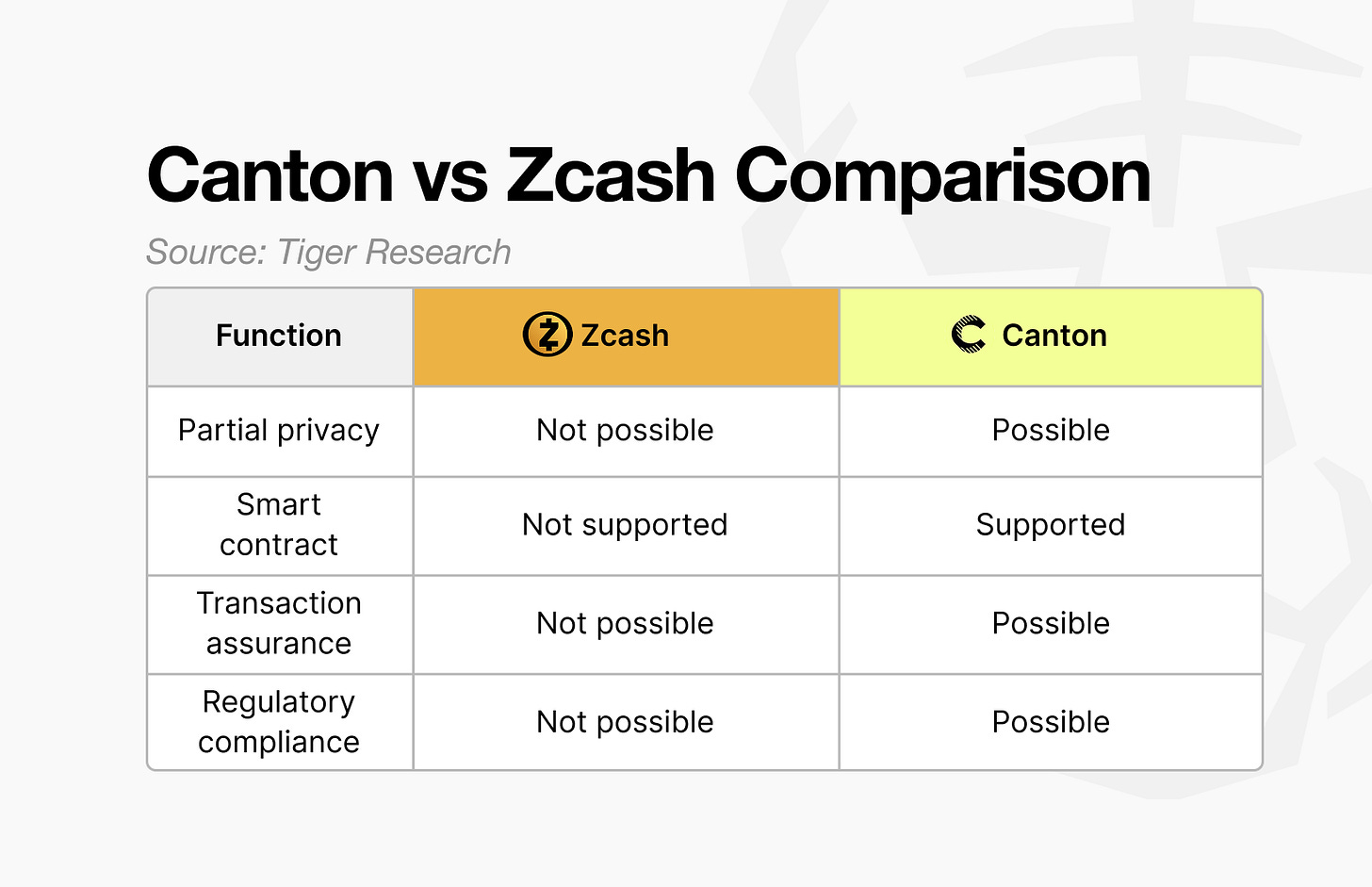

A representative example is Canton Network, which has been adopted by the Depository Trust & Clearing Corporation (DTCC) and is already used by more than 400 companies and establishments.

In contrast, Zcash, while also a privacy-selective project, has seen limited real-world institutional adoption.

What explains this difference?

Zcash offers selective privacy, but users do not choose what information to disclose. Instead, they must choose whether or not to disclose the entire transaction.

For example, in a transaction where “A sends $100 to B”, Zcash does not allow hiding only the amount. The transaction itself must be either fully hidden or fully disclosed.

In institutional transactions, different parties need different information. Not all participants need access to all data within a single transaction. However, Zcash’s structure imposes a binary choice between full disclosure and full privacy, making it unsuitable for institutional transaction flows.

Canton, on the other hand, allows transaction information to be managed in separate components. For example, if a regulator only asks for the transaction amount between A and B, Canton allows the institution to provide only that specific information. This functionality is implemented via Daml, the smart contract language used by the Canton network.

Other reasons why institutions have adopted Canton are discussed in more detail in previous sections. Cantonal research.

Privacy blockchains have evolved in response to changing demands.

Early projects such as Monero were designed to protect the anonymity of individuals. However, as financial institutions and businesses have begun to enter blockchain environments, the meaning of privacy has changed.

Privacy is no longer about making transactions invisible to everyone. Instead, the primary focus has become protecting transactions while meeting regulatory requirements.

This shift explains why selective privacy models like Canton Network have gained traction. What institutions needed was not just privacy technology, but infrastructure designed to match real-world financial transaction workflows.

In response to these demands, more institutionally focused privacy projects continue to emerge. Going forward, the key differentiator will be how effectively privacy technology can be applied to real-world transaction environments.

There could be other forms of privacy protection that would oppose the current institutional trend. In the short term, however, privacy blockchains will likely continue to evolve around institutional transactions.

Read more reports related to this research.This report has been prepared on the basis of documents deemed reliable. However, we do not expressly or implicitly guarantee the accuracy, completeness or adequacy of the information. We accept no liability for any loss arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All plans, estimates, forecasts, objectives, opinions and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of other people or other organizations.

This material is provided for informational purposes only and should not be relied upon as legal, business, investment or tax advice. Any reference to securities or digital assets is for illustrative purposes only and does not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Tiger Research permits fair use of its reports. “Fair use” is a principle that broadly allows the use of specific content for purposes of public interest, provided that this does not detract from the commercial value of the material. If use is consistent with the intent of fair use, the reports may be used without prior permission. However, when citing Tiger Research reports, it is mandatory to 1) clearly state “Tiger Research” as the source, 2) include the Tiger Research report. logo. If the material is to be restructured and published, separate negotiations are necessary. Unauthorized use of the reports may result in legal action.