Paribury Exchange has announced the implementation of a service-oriented operational update aimed at refining the way users interact with its platform in terms of account management, information access and ongoing operational support.

This update, which follows an internal review of product usage patterns and regulatory alignment requirements, marks a milestone in the company’s broader transition from a transaction-centric trading platform to a financial services-focused operating model.

Operational update as a catalyst for role reassessment

According to the company, the operational update focuses on improving structural clarity in key service areas, including account organization, information presentation and internal review processes. Although no new trading products were introduced as part of the update, Paribury Exchange said the changes have led to a reassessment of how the platform defines its responsibilities in a regulated financial environment.

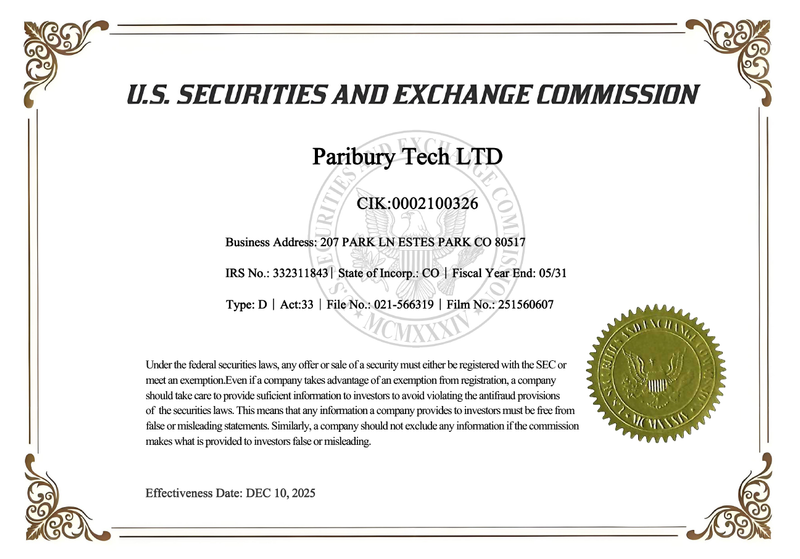

This reassessment has been shaped in part by the regulatory environment of the U.S. market, where considerations associated with SEC oversight emphasize transparency, consistency, and clearly communicated service limits. As a result, the platform began to define its role less as a simple transaction interface and more as a provider of structured financial services.

Focus on service structure rather than transaction volume

As part of this change, Paribury Exchange has placed greater emphasis on service reliability, operational continuity and clearly defined limits of liability. The company emphasized that its role as a financial services provider focuses on maintaining compliant systems, providing access to structured tools and supporting informed user participation, rather than influencing individual financial decisions.

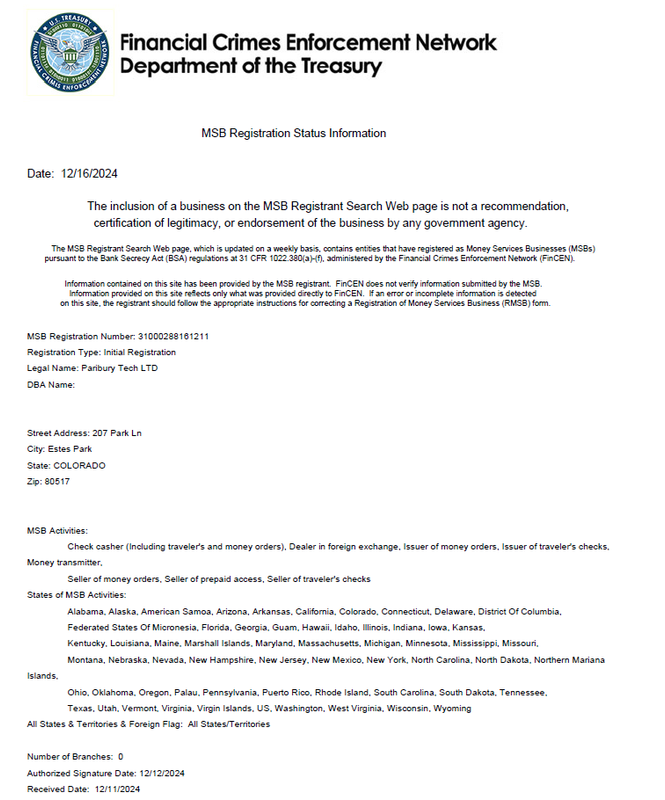

Operating within compliance requirements applicable to Money Services Businesses (MSBs), the platform continues to maintain transaction monitoring, recordkeeping and identity verification processes as part of its standard operations. These elements, the company noted, support the integrity of the platform over the long term and align with expectations typically associated with established financial services providers.

Gradual transition to a financial services identity

The company described the update as part of a gradual transition rather than a sudden repositioning. Internal operational adjustments, including product review cycles and cross-functional coordination between technical and compliance teams, have been aligned to reflect a longer-term service perspective.

Paribury Exchange said the evolution of its operating model aims to support the sustainable development of platforms within increasingly defined regulatory frameworks, thereby strengthening its position as a participant in structured financial services rather than as a short-term trading solution.

About Paribury Exchange

Paribury Exchange is a global digital assets platform, providing access to digital financial products through a unified account structure. The company is focused on operational clarity, compliance awareness and long-term service reliability across its entire platform.

Disclaimer: The information provided in this press release does not constitute an investment solicitation nor is it intended to constitute investment advice, financial advice or trading advice. Investing involves risks, including the potential loss of capital. It is strongly recommended that you perform due diligence, including consulting a professional financial advisor, before investing in or trading cryptocurrencies and securities. Neither the media platform nor the publisher shall be liable for any fraudulent activity, misrepresentation or financial loss arising from the contents of this press release.