Bitcoin just made its third consecutive weekly gain for the first time since July. Bitcoin USD has been hovering near recent highs, remaining firm amid political and geopolitical headlines. This resilience is part of a broader trend: large investors continue to buy quietly through regulated Bitcoin ETFs.

While the daily price movements seemed calm, the weekly chart tells a different story. Bitcoin soared even as traditional markets reacted to uncertainty in Washington and abroad. For beginners, this disconnect is important because it shows who is controlling the momentum at the moment.

DISCOVER: The Best Ethereum Meme Coins to Buy in 2026

Why is Bitcoin rising even when the headlines seem messy?

The short answer is ETFs. A Bitcoin ETF is like a wrapper of shares around Bitcoin that allows institutions to buy BTC without directly holding it. Think of it as a bridge between Wall Street and crypto.

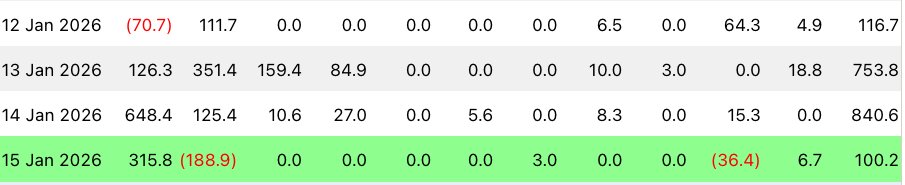

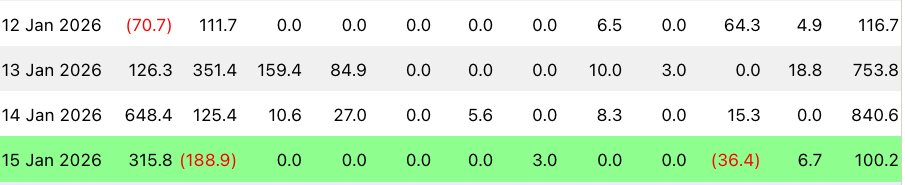

(Source: total Bitcoin ETFS / Coinglass)

US spot Bitcoin ETFs have brought in over $1.7 billion in just three days this week. Earlier in January, they saw an increase of $697 million in a single day. This regular purchase acts as a floor under the price.

This explains why Bitcoin USD can surge even when retail traders remain silent. Big funds move slowly, but they change in size. And they tend to hold, not turn over.

Institutional demand does the heavy lifting

ETF ownership now represents over 6% of Bitcoin’s total market capitalization. This share is large enough to shape price behavior. When ETFs buy, supply on exchanges tightens.

Products like BlackRock’s IBIT and Fidelity’s FBTC are driving most of this demand. These names are important because conservative investors trust them. This trust carries over to Bitcoin by association.

Cumulative Bitcoin ETF inflows this year reached 3.8k BTC, surpassing 3.5k BTC during the same period last year.

Historically, January inflows are modest, with large inflows typically beginning between February and April. pic.twitter.com/lk4YrKfz6L

– Ki Young Ju (@ki_young_ju) January 16, 2026

We explained how Bitcoin ETF inflows act as a sentiment gauge. When money flows, confidence follows. This week fits that pattern.

DISCOVER: Top 20 cryptocurrencies to buy in 2026

What does this mean for everyday Bitcoin buyers?

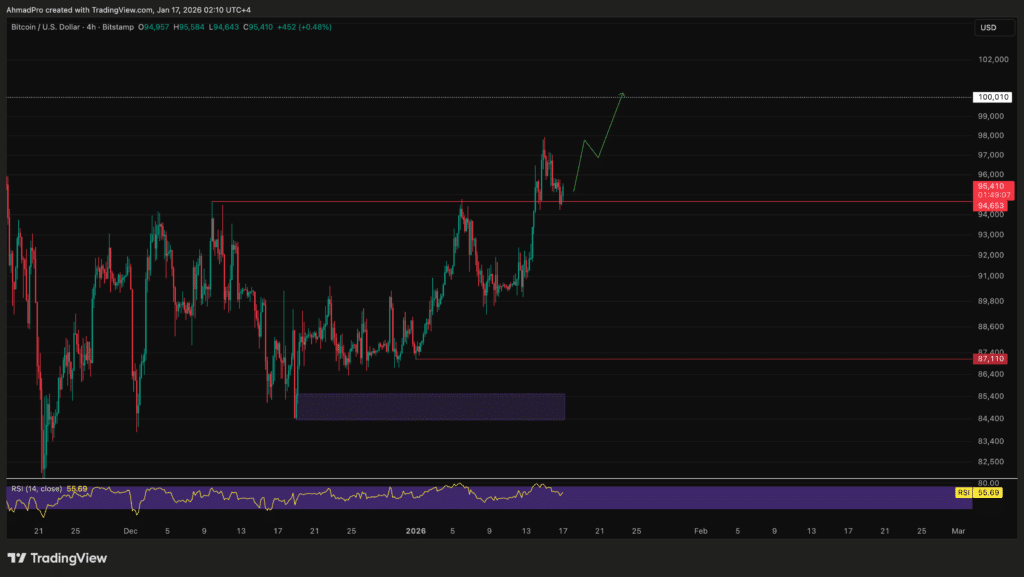

Three consecutive weekly gains don’t just mean the price is increasing. Bitcoin is still swinging hard. But that means the market has support beyond the hype.

For starters, this is a cue to zoom out. Weekly trends matter more than hourly candles. If institutions continue to accumulate, sudden crashes become more difficult to trigger.

(Source: BTCUSD/TradingView)

That said, volatility never goes away. Bitcoin has a long history of sharp declines after sharp rises. This is not a green light to get the rent money.

The risk side: most headlines are ignored

ETF flows can reverse. If macroeconomic conditions tighten or regulators change their tone, these same funds may suspend their purchases. This would remove a key support layer. Bitcoin USD also trades in a world shaped by interest rates and global risk. A calm crypto chart doesn’t cancel out real-world shocks.

Bitcoin ETF Daily Flow – US$

BTC (grayscale): 0 million

For full data and disclaimers visit:

– Farside Investors (@FarsideUK) January 16, 2026

This is why we emphasize position size. Start small. Learn the basics of guarding. Think of Bitcoin as a long-term education, not a short-term gamble.

If demand for ETFs remains stable, Bitcoin’s slow rise makes sense. Remember: strength is built slowly and risk management matters more than perfect timing.

DISCOVER: The Best Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X for the latest market updates and subscribe on YouTube for daily market analysis from experts

The post Bitcoin Posts Third Weekly Gain As ETF Money Flows In Quietly appeared first on 99Bitcoins.