One of the main topics of discussion at the 2026 edition of the World Economic Forum in Davos, Switzerland, was the showdown between the crypto industry and traditional banks over lobbying efforts on the final version of the crypto market structure bill under consideration in the US Senate, known as the CLARITY Act.

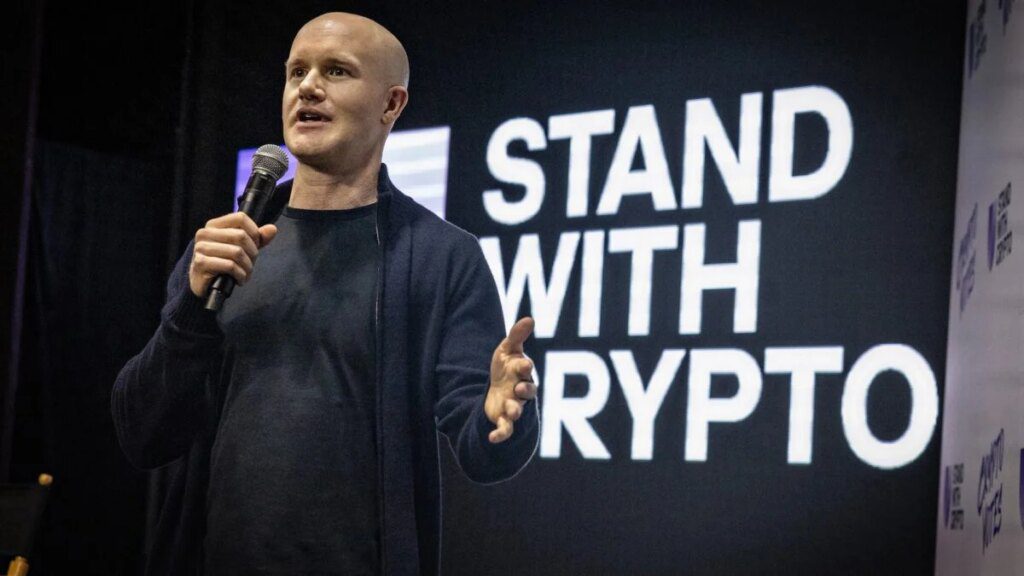

During an interview with CNBC in Davos on Tuesday, Brian Armstrong, CEO of crypto exchange giant Coinbase, was asked about the discussions and ongoing controversy surrounding the crypto regulation bill. In his remarks, Armstrong claimed that he was working on behalf of his users to create a better regulatory environment, while also claiming that banking interests were attempting to effectively prohibit competition from companies like Coinbase and other members of the crypto industry.

“Their lobbying groups and their trade groups are trying to shut out their competitors,” Armstrong said. “And so to me, you shouldn’t be able to ban competition.”

Ironically, Armstrong also noted that Coinbase works with five of the world’s 20 largest banks to provide core crypto infrastructure services. According to Armstrong, the business side of these banks sees crypto as an opportunity.

Last week, Coinbase withdrew its support for the CLARITY Act due to various concerns associated with a draft version that had been reviewed by the crypto exchange’s lawyers. Shortly thereafter, consideration of the bill by the Senate Banking Committee was postponed. Armstrong went so far as to post on X: “We’d rather have no bill than a bad bill. Hopefully we can all come up with a better bill.”

In short, the CLARITY Act aims to provide a final clarification on the rules of the game for everything related to crypto.

The proposed legislation is part of a series of promises President Trump made to the crypto industry before his election. At the time, Trump expressed a desire to make the United States the crypto capital of the world. Last year, progress was made toward this goal with the passage of the GENIUS Act, which provided regulatory clarity for stablecoin issuers in the United States. Additionally, Trump has signed several pro-crypto executive orders. According to a recent report, the Trump family’s fortune has also increased by $1.4 billion from cryptocurrencies alone over the past year.

With the CLARITY Act, the goal is to bring clarity to the entire cryptocurrency market, beyond stablecoins. For example, the bill includes clarifications on which types of crypto assets are commodities and which are traditional securities, allowing the CFTC and SEC to separately focus on their respective areas of regulatory concern. The bill is also likely to include various protections for non-custodial crypto developers who simply write code rather than operate financial services businesses, which is seen as a key priority among the cypherpunk-minded core user base, particularly in the wake of prison sentences handed down to developers behind the privacy-focused Bitcoin wallet Samourai Wallet.

The crypto industry desperately needed clarity on these kinds of issues under the Biden administration. However, Gary Gensler, who chaired the SEC at the time, said that this clarity existed and that the industry simply did not like that all crypto assets other than Bitcoin were considered unregistered securities.

A large number of enforcement actions have been taken against the crypto industry, including Coinbase, by Gensler’s SEC; however, the vast majority of pending cases have been dismissed since Trump’s inauguration. Late last week, House Democrats sent a letter to the SEC expressing concerns about the lack of crypto enforcement and accusations of a pay-to-play environment.

As crypto has become more centralized and largely moved away from its decentralized and cypherpunk origins, the industry has begun to compete more directly with traditional banking and its associated fintech applications. Indeed, UBS CEO Sergio Ermotti told CNBC about the relationship between crypto and banking: “No matter what, I believe that blockchain and this type of technology is the future of traditional banking. So you will see a convergence, I bet.”

This increasingly blurred line between crypto and traditional banks is why bank lobbyists have been concerned about some of the language in the CLARITY Act. After all, banks don’t want the rules changed in a way that benefits their new crypto competitors.

Of course, the crypto lobby has become a political power player in its own right, doling out $133 million to various pro-crypto candidates during the 2024 election cycle. Coinbase has spearheaded much of this activity by contributing about $50 million to the super PAC Fairshake and its affiliates and launching Stand with Crypto Alliance in 2023.

The key areas where crypto and banks are starting to clash are stablecoins and tokenized stocks. While traditional financial institutions appear prepared for the era of equity tokenization, as indicated by Monday’s NYSE announcement on that front, the stablecoin phenomenon has sparked concerns among banks who worry that customers will abandon traditional deposits for stablecoins that could potentially offer more lucrative interest rates. Although the GENIUS Act prevented stablecoin issuers from passing on interest on their cash reserves to their users, the legislation did not explicitly prevent stablecoin affiliates, such as Coinbase through its relationship with issuer USDC Circle, from paying interest. Banking industry lobbyists now want this perceived loophole fixed in the CLARITY Act.

This battle between crypto exchanges like Coinbase and traditional financial institutions has shown how far crypto has strayed from its initial philosophy of disrupting both central and commercial banks. Bitcoin purists now represent a smaller percentage of the overall crypto user base, a large portion of whom now interact with the kind of centralized, regulated intermediaries that this technology was initially intended to disrupt.

It is unclear whether the CLARITY Act will still pass the Senate this year. Crypto-based prediction market Polymarket currently estimates odds at 40% on low trading volume, which is down from a high of 80% about a week ago.

Speaking in Davos on Wednesday, President Trump said: “Congress is working very hard on crypto market structure legislation – Bitcoin, all of them – which I hope to sign very soon. »