Join our Telegram channel to stay up to date with the latest news

BNB price jumped 1.5% in the past 24 hours to trade at $894 after Grayscale filed a registration statement with the U.S. Securities and Exchange Commission (SEC) to launch a Binance Coin (BNB) spot exchange-traded fund (ETF), signaling growing institutional interest in the asset.

The proposed ETF, which will trade on Nasdaq under the symbol GBNB, is designed to provide institutional investors with direct exposure to BNB without the need to hold or manage the token themselves. According to the SEC filing, Coinbase will act as the fund’s prime broker, while Coinbase Custody will protect the underlying assets.

📊 @Grayscale filed an S-1 with the SEC to convert its BNB Trust into a spot BNB ETF, following the trust’s registration in Delaware on January 8.

The ETF is expected to trade on NYSE Arca and would be backed 1:1 by BNB held in cold storage. If approved, it would give investors… pic.twitter.com/mv4UC2Qr7D

– Watcher.News (@watchernewsx) January 23, 2026

Grayscale also plans to support in-kind creation and redemption, allowing authorized participants to directly exchange BNB for ETF shares. In particular, the asset manager intends to introduce stakes within the ETF structure, potentially allowing investors to generate a return on their holdings. This feature could differentiate the product from other crypto ETFs, although regulatory approval for staking remains uncertain.

Grayscale joins VanEck and REX Osprey

Key details such as management fees, seed capital and launch date have not yet been disclosed. Grayscale’s move places it alongside VanEck, which filed for a BNB ETF in the first half of last year and has since submitted amendments that could allow it to launch before Grayscale. REX Osprey also entered the race by filing a BNB ETF under the Investment Company Act of 1940.

If approved, the BNB ETF would become Grayscale’s seventh single-asset crypto ETF, expanding its lineup beyond Bitcoin and Ethereum to include XRP, Solana, Dogecoin, and Chainlink. The company also recently filed to convert its Near Trust into an ETF. It has pending applications for Bittensor and Zcash, highlighting its broader strategy to diversify regulated crypto investment products.

The modest price increase suggests traders are cautiously optimistic, with investors closely watching how the SEC responds to another altcoin ETF proposal.

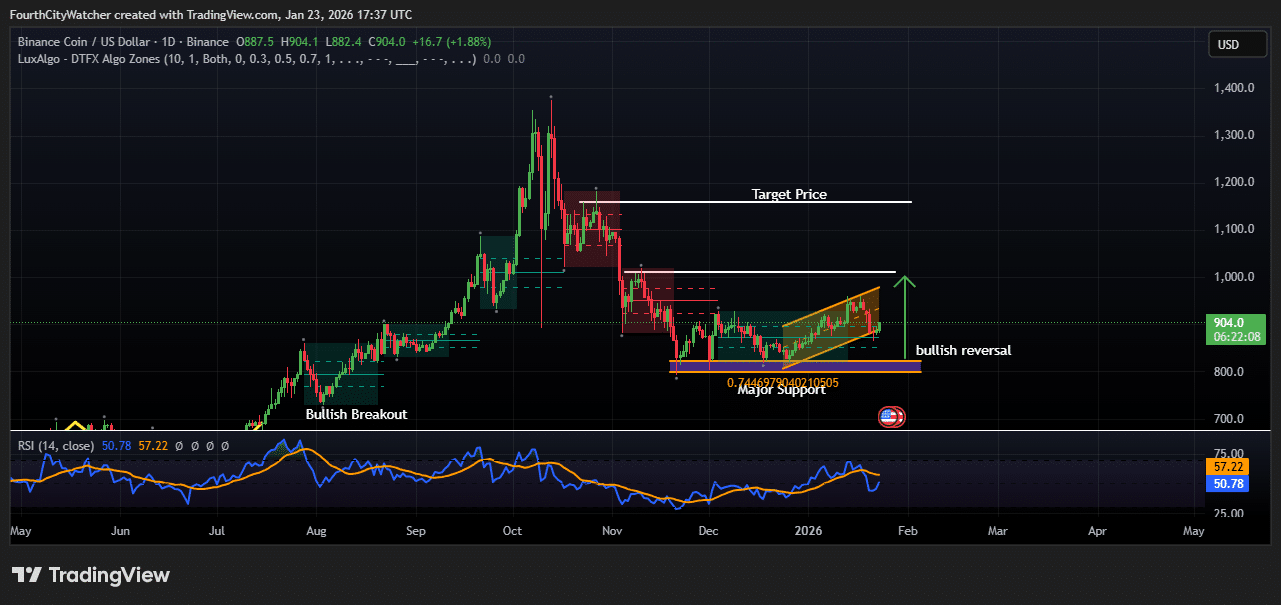

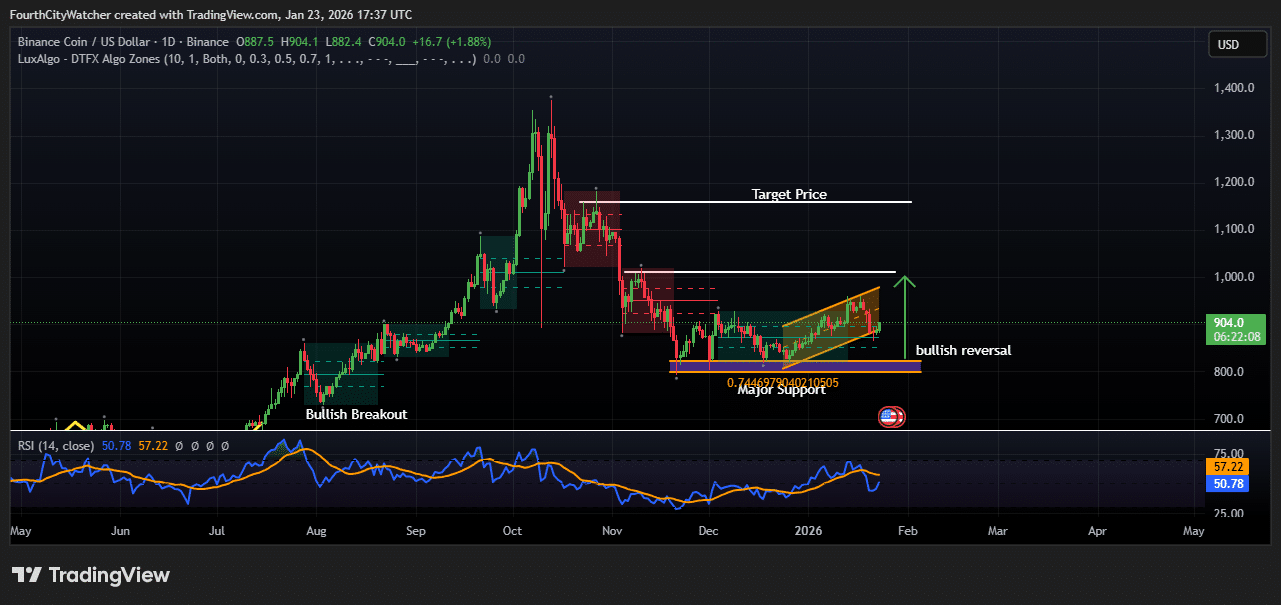

BNB price technical chart signals breakout

Binance Coin (BNB) price jumped nearly 2% in the past 24 hours to trade around $904, signaling a potential bullish reversal after weeks of consolidation. Technical indicators suggest that BNB could build momentum for a stronger upward move, supported by improving market sentiment and growing institutional interest.

On the daily chart, BNB is trading in an ascending channel, a structure that generally indicates gradual accumulation by buyers. The price has recently bounced off a well-defined major support zone around $780-$800, which has served as a demand zone several times. This rebound reinforces the importance of the support level and suggests that downward pressures are weakening.

BNBUSD chart analysis. Source: Tradingview

The current price action also shows that BNB is attempting to breach the median resistance near $920 to $950. A decisive close above this area could confirm a continuation uptrend, opening the door for a rally towards the next key resistance at $1,050. Beyond that, the chart highlights a longer-term target near $1,150, which corresponds to a previous consolidation zone and historical supply zone.

BNB Momentum Strengthens as RSI Strengthens

Momentum indicators are starting to become favorable. The relative strength index (RSI) on the daily time frame climbed to around 57, indicating strengthening bullish momentum while remaining below overbought conditions. This suggests that there could be room for further upside before the asset faces significant selling pressure.

From a broader perspective, the BNB structure shows a transition from a prolonged corrective phase to a potential trend reversal. The formation of higher lows since December supports the bullish thesis, especially if buyers manage to defend the ascending support line within the ascending channel.

Market participants are now monitoring whether BNB can maintain its advance above the psychological $900 level. Failure to hold this zone could result in a short-term pullback towards $850, although the broader outlook would remain constructive as long as the price remains above the main support zone.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news