Naturally, you need to show “willpower” to buy Ethereum, XRP or any top 10 altcoin. The last few weeks have been brutal for promising tokens. And this is likely to continue as long as Bitcoin struggles to gain momentum.

To summarize, Ethereum is down from December 2025 highs near $3,500. Meanwhile, like Solana, Cardano and other best cryptos to buy, the XRP crypto, despite the XRP Army’s call for a moonshot, has fallen below $2 and has yet to reverse its losses.

Nonetheless, given this state of affairs in the crypto market, on-chain data suggests a different story. Yesterday, Santiment, an on-chain intelligence platform, said that XRP and Ethereum are in an “undervalued” zone based on the market value to realized value (MVRV) ratio.

The lower the 30-day MVRV of a coin, the less risk there is of opening or adding to your position.

A coin having a negative percentage means that the average traders you are competing with are out of money, and it is possible to enter while profits are lower than normal… pic.twitter.com/YH8y4IzkWc

–Santiment (@santimentfeed) January 26, 2026

DISCOVER: The best Meme Coin ICOs to invest in 2026

XRP Crypto and Ethereum Holders in “Pain”

For starters, the MVRV ratio measures the “health” of the asset in question. In this case, it’s all about the prices of the cryptocurrencies XRP and ETH. What it does is simple: it compares the current market price, that is, what it is currently selling, to the average price that everyone paid to obtain their coins.

When the ratio is high, it means that holders are making profits, and the opposite is true. Overall, analysts use this metric to determine whether a market is overheated (overvalued) or if everyone is suffering to the max (undervalued).

Santiment’s 30-day MVRV only considers people who purchased within the last month. When this number becomes negative, it means that recent buyers have lost money on average. Santiment considers this area “undervalued” because sellers are feeling pressure and fewer people are rushing to take profits.

Given this finding, it appears that ETH and XRP crypto prices are currently trading below the average entry price, and holders are under pressure and in the red. When Santiment shared its findings, Ethereum’s 20-day MVRV stood at almost -8%, while crypto XRP was at -6%.

Interestingly, the same metric for Bitcoin was slightly positive. This shows that despite all the eyes following Bitcoin, buyers who have scooped up digital gold in the last 30 days are at or above break-even. Meanwhile, those who purchased ETH or XRP crypto at that time are feeling the pain and could sell and capitulate, increasing pressure on the price.

DISCOVER: 9+ Best Memecoin to Buy in 2026

Relief Coming for XRP USD and Ethereum Crypto?

The good news is that the 30-day MVRV for Bitcoin is positive. If it were in negative territory, any massive sell-off would risk dragging the entire market down with it. When this happens, as recent price action shows, not only will the ETH USD and XRP cryptocurrencies be dumped, but the impact will spread, influencing sentiment and leading to redemptions in the XRP and Ethereum spot ETFs.

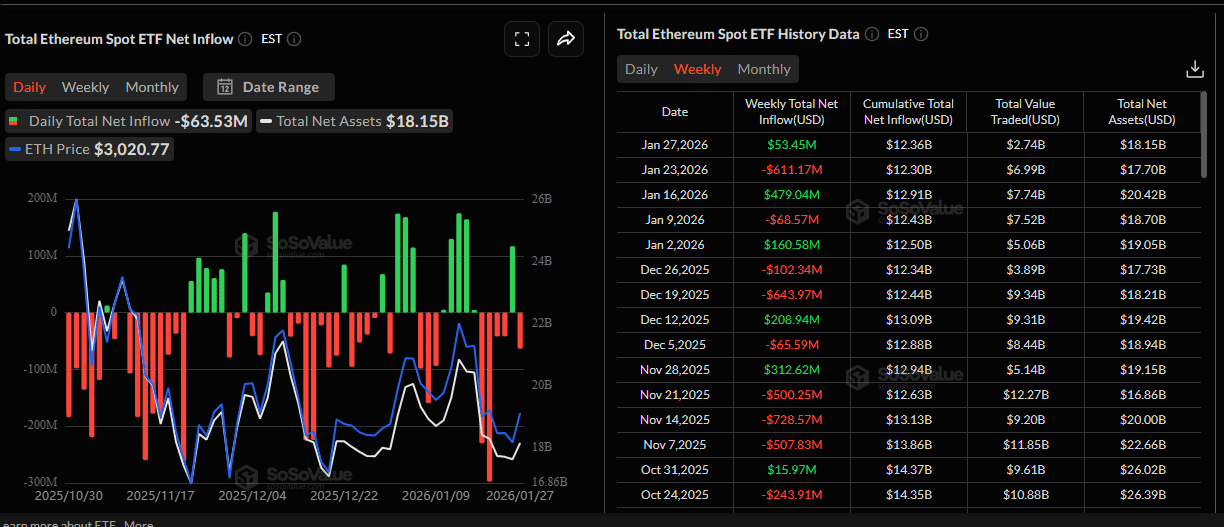

Ethereum crypto prices have fallen in recent weeks following massive outflows from spot ETFs. Trackers show that over $611 million worth of Ethereum ETF spot shares were repurchased, negatively weighing on the price.

(Source: SosoValue)

Besides ETFs, would the upcoming Glamsterdam upgrade in the first half of 2026 attract institutional investment into Ethereum. By the end of the year, the developers will also implement the Hegota upgrade. These two updates will make the network lighter, more performant, and more reliable, with the ability for institutions to run nodes securely.

While ETH USD saw losses, the XRP crypto sell-off was stronger. Specifically, the drop below $3, and then below $2, was primarily due to macroeconomic nerves. Threats of additional tariffs against eight European countries, coupled with weaker Bitcoin, accelerated dumping.

However, it is certain that XRP cryptography could reach a milestone. With the legal battle fully resolved, the “regulatory risk” that suppressed XRP for years is gone. This clarity has allowed US banks and regulated funds to use XRP for cross-border settlements without legal fear.

The integration of RLUSD into the XRP Ledger is the essential “bridge” for TradFi. Although RLUSD provides stability, XRP remains the “gas” and utility token that powers these high-speed transactions.

Ripple’s Brad Garlinghouse explains how major brokers can integrate institutions into DeFi.$XRP $RLUSD pic.twitter.com/SicNaiywl3

– ALLINCRYPTO (@RealAllinCrypto) January 28, 2026

The more RLUSD is adopted by institutions, the more gas is required to confirm the transaction. So far, RLUSD is among the largest stablecoins, with a market capitalization of $1.4 billion.

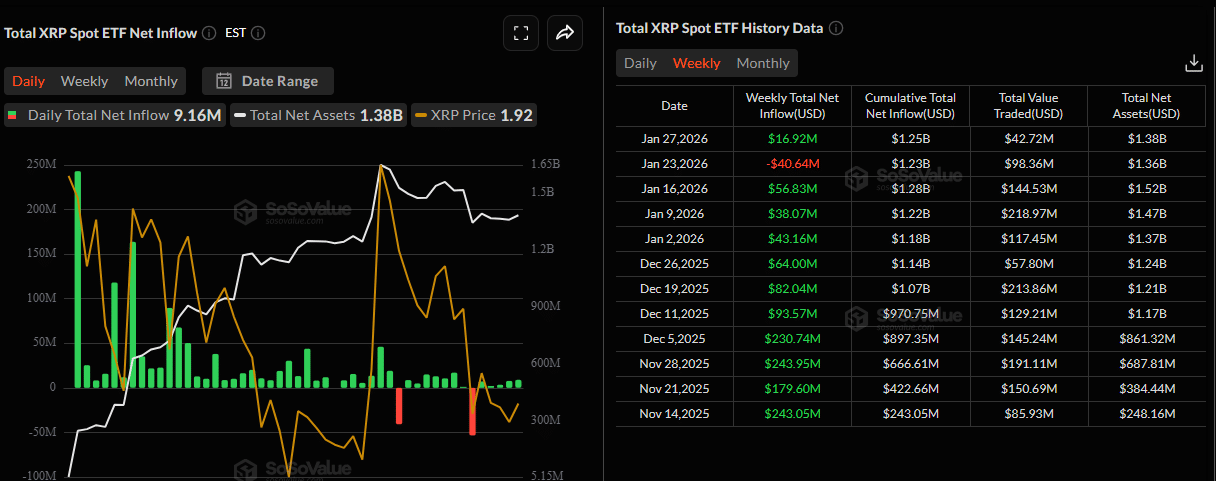

Institutions are also flocking to XRP. The data shows steady inflows into spot XRP ETFs since November 2025 until last week, indicating that the big guys could be “hoarding” XRP as a structural asset.

(Source: SosoValue)

DISCOVER:

- 16+ New and Upcoming Binance Announcements in 2026

- 99Bitcoins State of the Crypto Market Report for Q4 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

The post Santiment Reports XRP, Ethereum as Undervalued After Pullback appeared first on 99Bitcoins.

The lower the 30-day MVRV of a coin, the less risk there is of opening or adding to your position.

The lower the 30-day MVRV of a coin, the less risk there is of opening or adding to your position. A coin having a negative percentage means that the average traders you are competing with are out of money, and it is possible to enter while profits are lower than normal…

A coin having a negative percentage means that the average traders you are competing with are out of money, and it is possible to enter while profits are lower than normal…  Ripple’s Brad Garlinghouse explains how major brokers can integrate institutions into DeFi.

Ripple’s Brad Garlinghouse explains how major brokers can integrate institutions into DeFi.