The crypto market woke up when the Fed confirmed there would be no rate cut, keeping benchmark rates stuck in the 3.5% to 3.75% range. This stance was taken just as fears of a U.S. shutdown eased, sending the market lower again, with ETH USD falling back below the psychological support of $3,000.

The Fed’s decision to pause a rate cut came as Chairman Jerome Powell struck a cautious tone. Growth, he said, remains strong despite cracks in the real estate sector and looming tariffs that are driving up prices. Inflation is still stubborn and the Fed is clearly not ready to declare a rate cut and a victory. Two governors disagreed in favor of lowering Fed rates, but they were outvoted because rates will stay high for longer.

These are three clocks running at different speeds. We’re seeing monetary policy, politics, and cryptocurrency price action all attracting attention, not forgetting metal prices.

No consequences of the Fed rate cut and likelihood of US closure

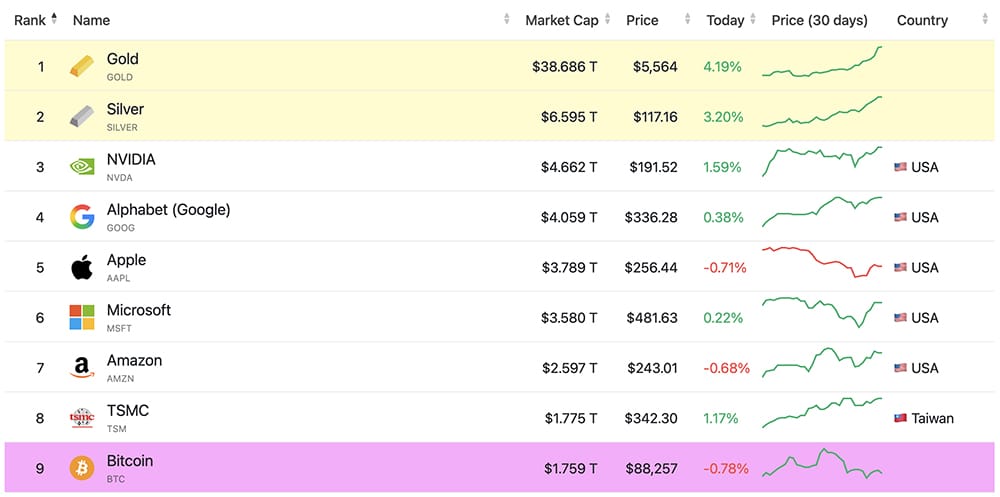

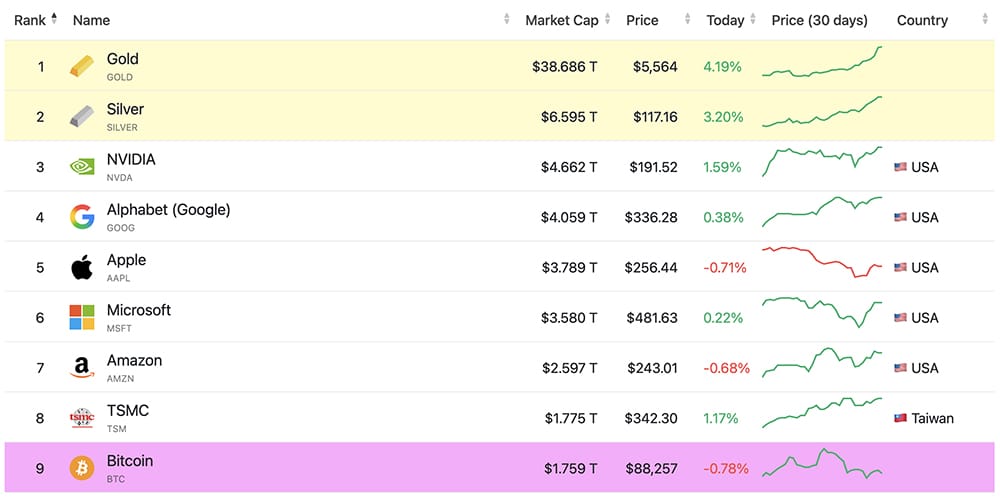

Following the move, gold rose above $5,500, reaching $5,555 after Powell’s speech, a daily gain of 2.5%. For comparison, gold took centuries to reach $1,000 before 2008, then added another $1,000 in just 28 days. This latest pump added an estimated market value of $1.75 trillion, the entire value of Bitcoin.

(source – CompaniesCap.Market)

However, Bitcoin tends to follow gold with a noticeable lag. When gold reached or formed lower highs in previous cycles, Bitcoin often went parabolic shortly after. This is probably why crypto stopped. The lack of a Fed rate cut keeps pressure on risk assets for now, but it also reinforces the inflation-hedging narrative that is keeping Bitcoin strong.

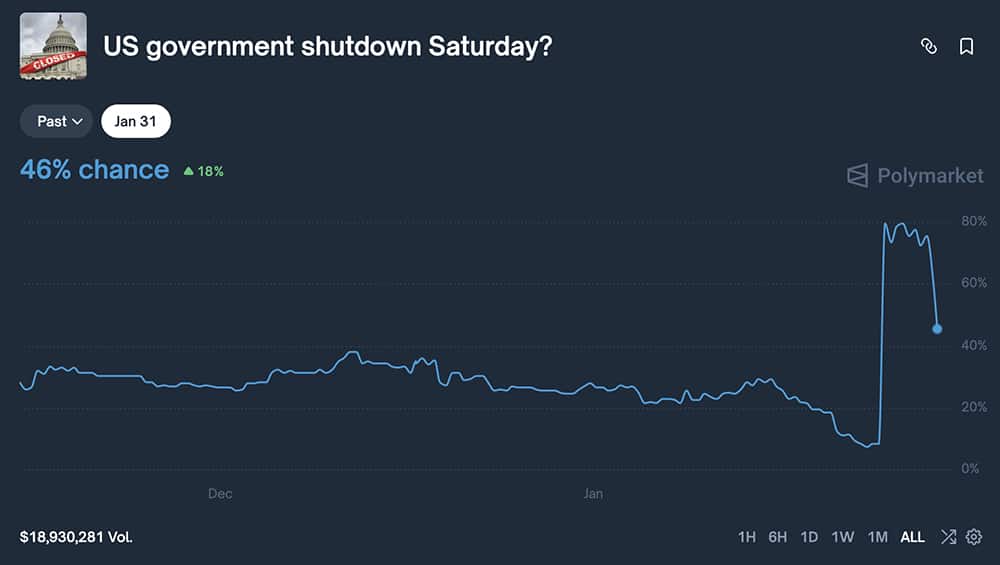

Beyond rates, the odds of a U.S. shutdown have become the political subplot we should be watching. On Polymarket, the likelihood of avoiding a shutdown increased as negotiations between the White House and Democrats showed signs of progress. With a continuing resolution expiring on January 30, sentiment has improved. With a volume of $19 million, it is a good political indicator.

The chances of a

The U.S. government shutdown by Saturday is on the decline.

This is bullish for crypto! pic.twitter.com/msSkyIvdnA

– Mister Crypto (@misterrcrypto) January 29, 2026

A complete U.S. shutdown would impact 78% of federal spending, disrupting healthcare, transportation and regulatory processes. For crypto, this will cause market stress which could drain liquidity. Easing shutdown fears, combined with the Fed’s lack of an immediate rate cut, has created an unexpected sense of calm.

The odds were 80% yesterday and are down to less than 50% now.

(source – Polymarket)

DISCOVER: 10+ Next Cryptos to 100X in 2026

ETH USD below $3,000, but?

At first glance, ETH USD sliding below $3,000 looks bad. It is down 1.3% today. According to Coinglass, open interest remains at $39 billion and liquidations have remained contained. One week at low volume.

(source – coin mechanism)

The chart, however, curls into a symmetrical triangle, frustrating the impatient, but could reward the hodlers. Holding above the $2,900 area, ETH USD’s structure remains intact, and a clear break higher still puts $3,400-$3,700 back on the radar.

BitMine, along with Tom Lee, recently staked over 209,000 ETH, bringing their total holdings past 2.2 million ETH, or north of $6.5 billion at current prices. All this while Ethereum continues to dominate decentralized finance, anchoring the bulk of the $121 billion in total value locked while quietly absorbing 60% of the real-world asset market, now valued at $23.59 billion. Tokenized Treasuries has chosen Ethereum.

Tom Lee(@fundstrat) #Bitmin staked another 250,912 $ETH($745 million) in the last 18 hours.

In all, #Bitmin has now bet 2,582,963 $ETH($7.67 billion), 61% of his total assets. pic.twitter.com/kHKaLmMgP4

– Lookonchain (@lookonchain) January 29, 2026

The deployment of ERC-8004 for trustless AI agents and a focus on post-quantum security are the long-term games ETH USD is playing. For now, a level below $3,000 reflects macroeconomic nervousness, like what the entire market is experiencing.

DISCOVER:

- 16+ New and Upcoming Binance Announcements in 2026

- 99Bitcoins State of the Crypto Market Report for Q4 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

There are no live updates available yet. Please come back soon!

The post Crypto Market News Today, Jan 29: No Fed Rate Cut, US Shutdown Chances Down, ETH USD Back Below $3,000 appeared first on 99Bitcoins.

The U.S. government shutdown by Saturday is on the decline.

The U.S. government shutdown by Saturday is on the decline.