Hyperliquid’s HYPE token returned to the center of market attention after the project significantly reduced the monthly unlock of team tokens, a move that reignited discussion over whether the token could revisit the $50 level seen at its previous high.

The team presented the change in the unlock schedule as a way to reduce dilution and ease supply pressure at a time when competition in the perpetual futures market is still strong.

Information provided by the Hyperliquid team indicates that the February 2026 Hyperliquid pool has been reduced to approximately 140,000 HYPE tokens, compared to approximately 1.2 million released in January, making up almost 90% of the team’s monthly releases.

Major contributors have been allocated approximately 23.8% of the maximum 1 billion HYPE supply, subject to a one-year cliff and a 24-month vesting period, with distributions now confirmed to take place on the 6th of each month.

HYPE rebounds 55% in a week as hyperliquid tightens token supply

The move comes as Hyperliquid faces lower decentralized exchange revenue and increasing competition among perpetual DEX platforms.

By slowing the pace of team unlocks, the project has reduced short-term selling pressure, a factor that market participants have been watching closely since HYPE launched via a community airdrop in November 2024.

Over 61% of the total supply remains locked, while the circulating supply currently stands at approximately 238 million tokens.

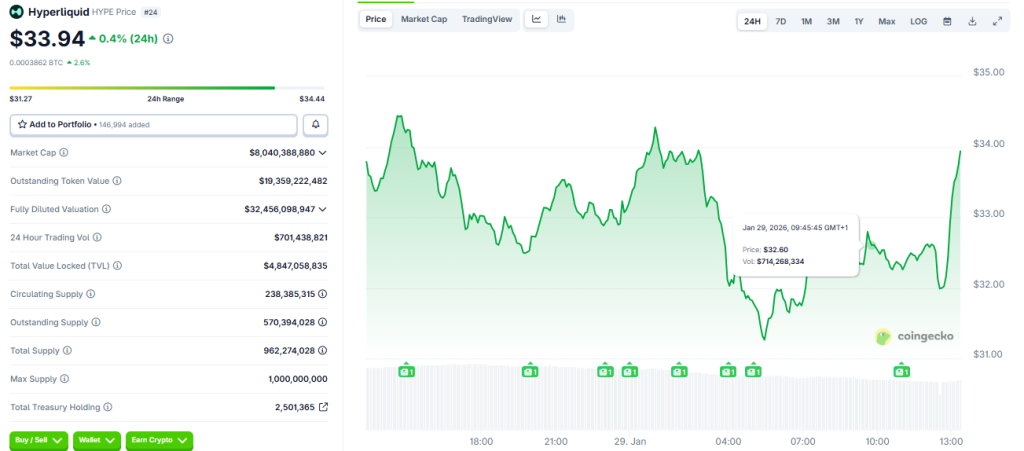

HYPE was trading around $33.9 at the time of writing, up slightly on the day but posting a weekly gain of over 55%.

The token is still about 43% below its all-time high of $59.30, reached during a surge last year, with the market cap climbing to just over $8 billion.

At the same time, overall protocol usage metrics did not show a drastic change.

The company announced this week that HIP-3 open interest (OI) hit a record $790 million, fueled by a recent surge in commodity trading. HIP-3 OI set new weekly highs, up sharply from $260 million just a month ago.

Additionally, the platform’s founder, Jeff Yan, said that the liquidity of Bitcoin futures on Hyperliquide had surpassed Binance in some order book comparisons.

Hyperliquide has processed more than $25 billion in cumulative trading volume since its launch, according to Flow Scan data, with the majority coming from futures markets built by third-party teams using the HIP-3 framework.

The total locked value of hyperliquid stands at nearly $4.6 billion, with annualized protocol revenue estimated at approximately $714 million, a portion of which is used for buybacks and burns that remove HYPE from circulation.

HYPE Reclaims 50-Day Moving Average After Months Below

From a technical perspective, analysts have highlighted a key change in HYPE’s price structure.

After months of trading below its 50-day moving average over a three-day period, the token recently broke above that level, ending a streak of lower highs that had defined the downtrend since November.

The area between around $28 and $29, which previously served as resistance, is now seen as potential support.

If this area holds up upon retesting, technicians believe it is possible to continue into the mid 30s and low 40s.

Getting back to $50 would require a much larger move, representing an increase of around 80% from the previous support zone.

This rally would be based on sustained volume and sustained defense of the recovered moving average and overall favorable market conditions.

Analysts observed that failure to surpass the 50-day average would negate the bullish pattern and HYPE would be prone to a fall to lows around $20.

HYPE Price Target Hits $50 as Hyperliquid Cuts Team Token Unlock by 90% — Is the Rally Sustainable? appeared first on Cryptonews.