Here’s a quick recap of the crypto landscape as of Wednesday, January 28 at 9:00 p.m. UTC.

Get the latest information on Bitcoin, Ether and altcoins, plus an overview of the top cryptocurrency market news.

Bitcoin and Ether Price Update

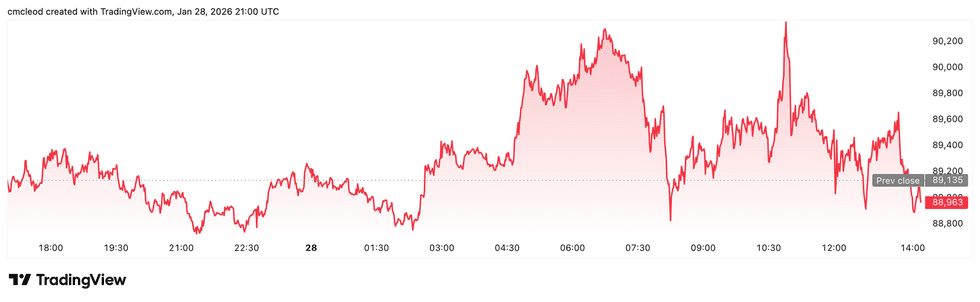

Bitcoin (BTC) was priced at US$89,089.42, down 0.3 percent over 24 hours.

Bitcoin Price Performance, January 28, 2025.

Chart via Trading View.

In an email to Investing News Network, Shawn Young of MEXC Research commented on the cryptocurrency bear market, forecasting a potential slight recovery for BTC and ETH in February, a historically strong month for the assets.

Despite the current sense of fear and a possible shift in the 4-year market cycle, strong institutional investments and developer efforts to address quantum threats are long-term catalysts that should drive future price growth.

“Once there is clarity on this,” he said, “it will serve as a major catalyst across the board.”

Ether (ETH) was priced at US$3,011.69, down 0.2 percent in the past 24 hours.

Altcoin Price Update

- XRP (XRP) was priced at US$1.92, down 0.1 percent over 24 hours.

- Solana (SOL) was trading at US$125.50, down 1.2 percent over 24 hours.

Today’s crypto news to know

Fidelity to launch stablecoin FIDD in February

Fidelity Investments plans to launch the Fidelity Digital Dollar (FIDD) stablecoin in February, making it one of the first mainstream asset managers to launch its own stablecoin.

Mike O’Reilly, President of Fidelity Digital Assets, made the announcement in an interview with Bloomberg today, touting the potential of stablecoins as fundamental payment and settlement instruments due to their real-time settlement benefits and 24/7/365 availability.

Eligible customers will be able to purchase or trade FIDD for US$1 on the Fidelity Digital Assets, Fidelity Crypto and Fidelity Crypto for Wealth Managers platforms. It will also be available on major crypto exchanges.

Coinbase Announces Prediction Market Rollout in All 50 States

Coinbase (NASDAQ: COIN) today announced the nationwide rollout of its prediction markets in partnership with Kalshi. While no official press release has been issued, the news was announced via a Coinbase article on

This expansion completes a rollout that was previously limited due to restraining orders and other legal actions in a handful of states. Various steps were taken by gambling regulators to prevent Kalshi from operating, arguing that its offerings constituted a form of gambling subject to state law. The new Coinbase partnership offers a more integrated and potentially definitive solution to these legal challenges.

Tether amasses huge gold reserves in Switzerland

Tether has quietly built what its CEO describes as the world’s largest non-sovereign gold hoard, holding around 140 tonnes of bullion worth around $23 billion in a high-security Swiss bunker.

In an interview with Bloomberg, CEO Paolo Ardoino said the company buys more than a ton of physical gold per week, a pace that puts it among the most active buyers in the global bullion market.

Executives say the strategy is designed to strengthen Tether’s balance sheet and protect against fiat currency risk, particularly for its flagship stablecoin USDT and gold-backed token XAUT.

Bullion traders note that sustained, price-insensitive buying of such magnitude can tighten supply and affect liquidity, particularly when central banks and ETFs are also accumulating.

Critics warn, however, that concentrating so much physical gold in a single private entity adds a new level of systemic risk and transparency.

South Dakota Reignites Bitcoin Push

A South Dakota lawmaker has reintroduced legislation that would allow the state to allocate up to 10% of certain state funds to Bitcoin, reviving a proposal that stalled last year.

Filed by Republican Rep. Logan Manhart, the bill would allow exposure through direct holdings, regulated custodians or approved exchange-traded products. It also sets strict standards for retention and security, including exclusive control of private keys, encrypted hardware storage, and regular audits.

The measure has cleared its first procedural hurdle and now goes to the state Commerce and Energy Committee.

Similar initiatives have gained traction elsewhere, with several US states exploring or adopting crypto reserve strategies.

Paypal Survey: Large Companies Lead the Adoption of Crypto Payments

Crypto payments are moving closer to routine payment, largely thanks to big companies, according to a new survey from PayPal (NASDAQ:PYPL) and the National Cryptocurrency Association.

The survey found that about 40% of U.S. merchants now accept cryptocurrencies, with the figure rising to 50% among companies with annual revenue above $500 million.

Merchants cited growing customer demand as the main driver, with most saying shoppers have asked about the possibility of paying with crypto and expect to use it regularly.

Ease of use remains the biggest barrier: Respondents said adoption would accelerate if crypto payments seemed as simple as card transactions.

PayPal said this demand is shaping product design as companies seek to integrate crypto without disrupting existing payment flows.

Don’t forget to follow us @INN_Technology for real-time updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any of the companies mentioned in this article.

From the articles on your site

Related articles on the web