Key notes

- MiniPay has processed 350 million transactions since the end of 2023 and serves more than 12.6 million activated wallets with strong momentum in December.

- Opera’s fourth quarter 2025 revenue exceeded forecasts by $170 million, generating annual revenue above $608 million with 26% growth over 2024.

- The stock climbed to $14.87, with analysts setting a price target of $23.50, representing a 62% upside from current levels.

Shares of Opera Limited soared nearly 17% on Feb. 2 after the shipping company announced it would bring greater support for Tether’s stablecoin and gold tokens to its MiniPay mobile wallet.

The expansion of the partnership brings greater use of USDT and the addition of XAU₮0 – a gold-backed bridged token not issued by Tether – to MiniPay, Opera’s self-custodial wallet built on the Celo blockchain.

According to the press release, the integration targets users in Africa, Latin America and Southeast Asia who need stable digital dollars but often lack access to traditional banks. MiniPay has processed 350 million transactions since its launch in late 2023 and now serves more than 12.6 million activated wallets.

Tether and Opera expand financial access to emerging markets with MiniPay

Learn more:

– Attach (@attach) February 2, 2026

The platform shows its momentum in December

Data from December 2025 shows strong momentum: MiniPay users made over 3.5 million peer-to-peer payments and transferred over 96 million USDT through the platform that month. The wallet added 300,000 unique USDT buyers in December alone, a 33% growth from November, according to the company.

Paolo Ardoino, CEO of Tether, highlighted the practical mission behind the deal. “Tether’s mission has always been to provide simple, reliable access to stable value to the people who need it most,” he said.

Opera shares rally alongside rising revenue

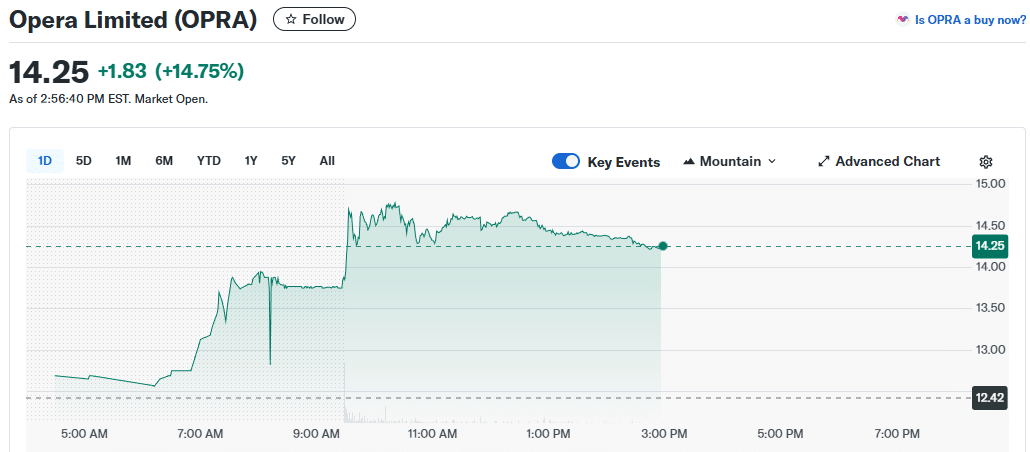

Investors reacted strongly to this news. Opera stock opened at $13.86 on Monday, up from the previous close of $12.42, and traded as high as $14.87 during the session. This increase pushed the company’s market capitalization to approximately $1.30 billion, according to Yahoo! Finance.

Opera increase of 17% | Source: Yahoo! Finance

This rally was accompanied by another positive signal. The same day, Opera revealed that its revenue for the fourth quarter of 2025 would exceed $170 million, surpassing previous forecasts of $162 million to $165 million. This brings full-year 2025 revenue above $608 million, representing growth of more than 26% from 2024, or about $130 million in absolute gains. The company also expects full-year adjusted EBITDA to exceed $141 million.

Analysts seem optimistic about Opera’s trajectory. The stock currently boasts a “Moderate Buy” consensus rating with an average price target of $23.50, approximately 62% above Monday’s trading levels. Opera plans to release full fourth quarter results on February 26, 2026.

These two announcements allow Opera to capitalize on two growth vectors: crypto-based payments in underbanked regions and the expansion of commercial partnerships that generate core revenue.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

José Rafael Peña Gholam is a cryptocurrency journalist and editor with 9 years of experience in the industry. He has written in leading media outlets like CriptoNoticias, BeInCrypto and CoinDesk. Specializing in Bitcoin, blockchain and Web3, he creates news, analysis and educational content for global audiences in Spanish and English.

José Rafael Peña Gholam on LinkedIn