Although the market is literally a sea of red, with BTC hovering around $71,000 and sentiment locked in extreme fear, Tether USDT continues to trend down hard. In Q4 2025 (October-December), the issuer released its latest BDO-verified attestation, showing that USDT hit record highs even as altcoins bled and the October 10 liquidation cascade wiped out more than a third of the crypto’s total value.

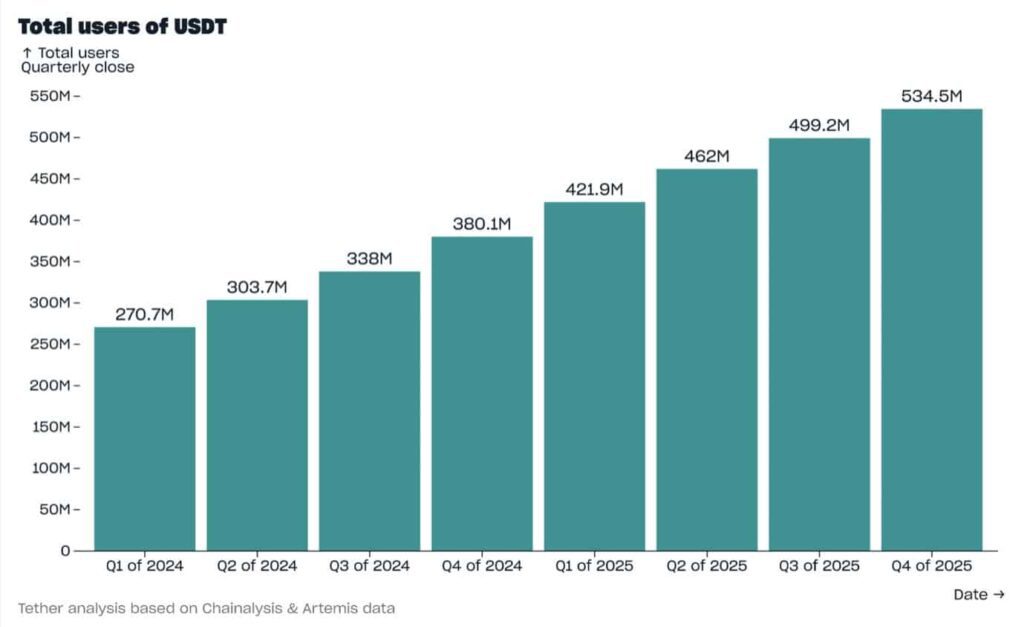

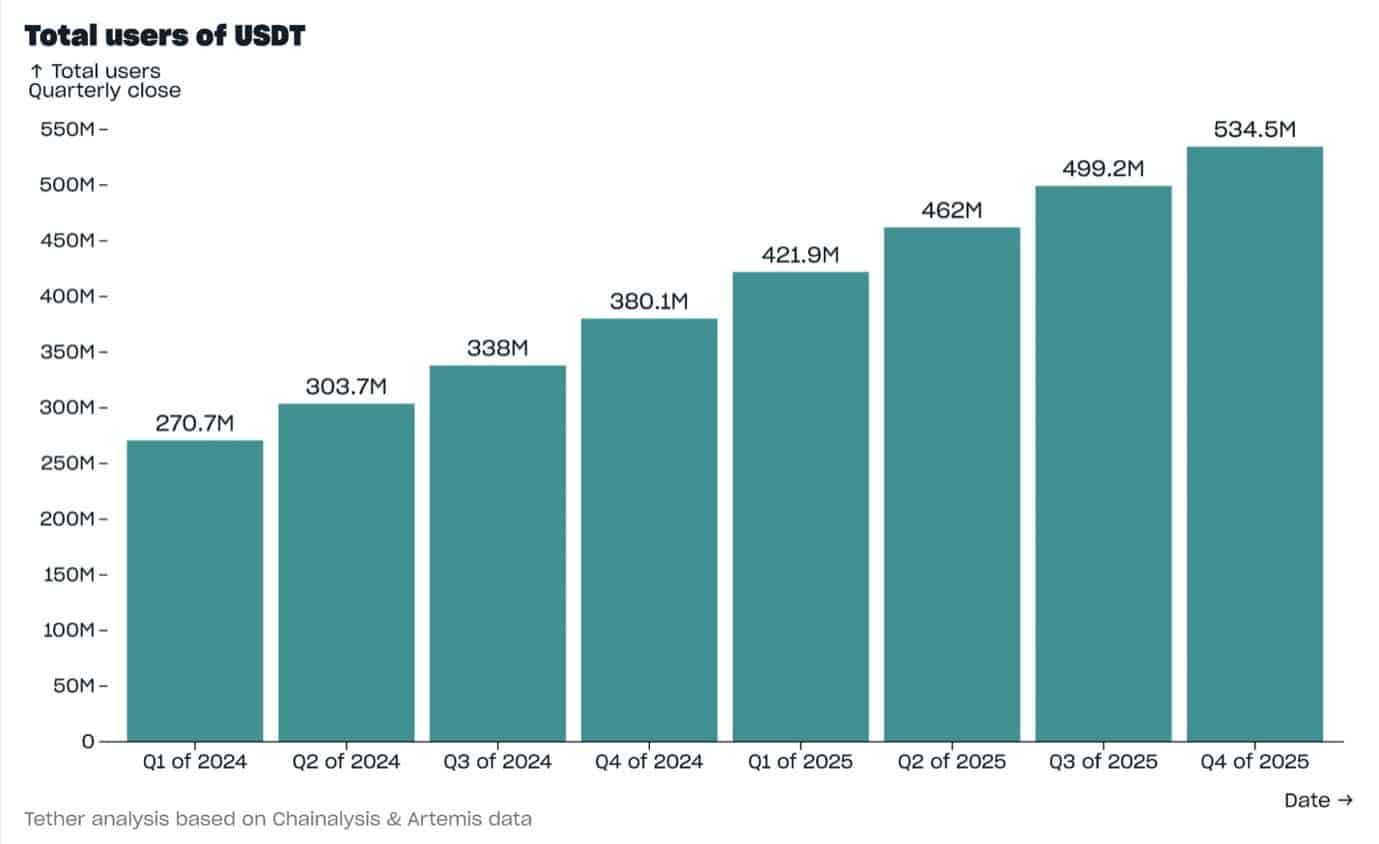

Tether reported that its stablecoin USDT added 35.2 million new users in the fourth quarter.

What can we extrapolate from this information? A simple conclusion is that users and liquidity are not leaving crypto entirely: they are turning to stablecoins as traders attempt to hit a potential market bottom. And USDT is the preferred choice.

USD₮ Q4 2025 Market Report

Learn more:– Attach (@attach) February 4, 2026

EXPLORE: Best New Cryptocurrencies to Invest in in 2026

USDT Dominance Reaches New Heights: Tether Records Users, Cap, and On-Chain Activity

USDT’s market cap soared to $187.3 billion, an increase of $12.4 billion in just three months, during one of the toughest quarters in recent memory.

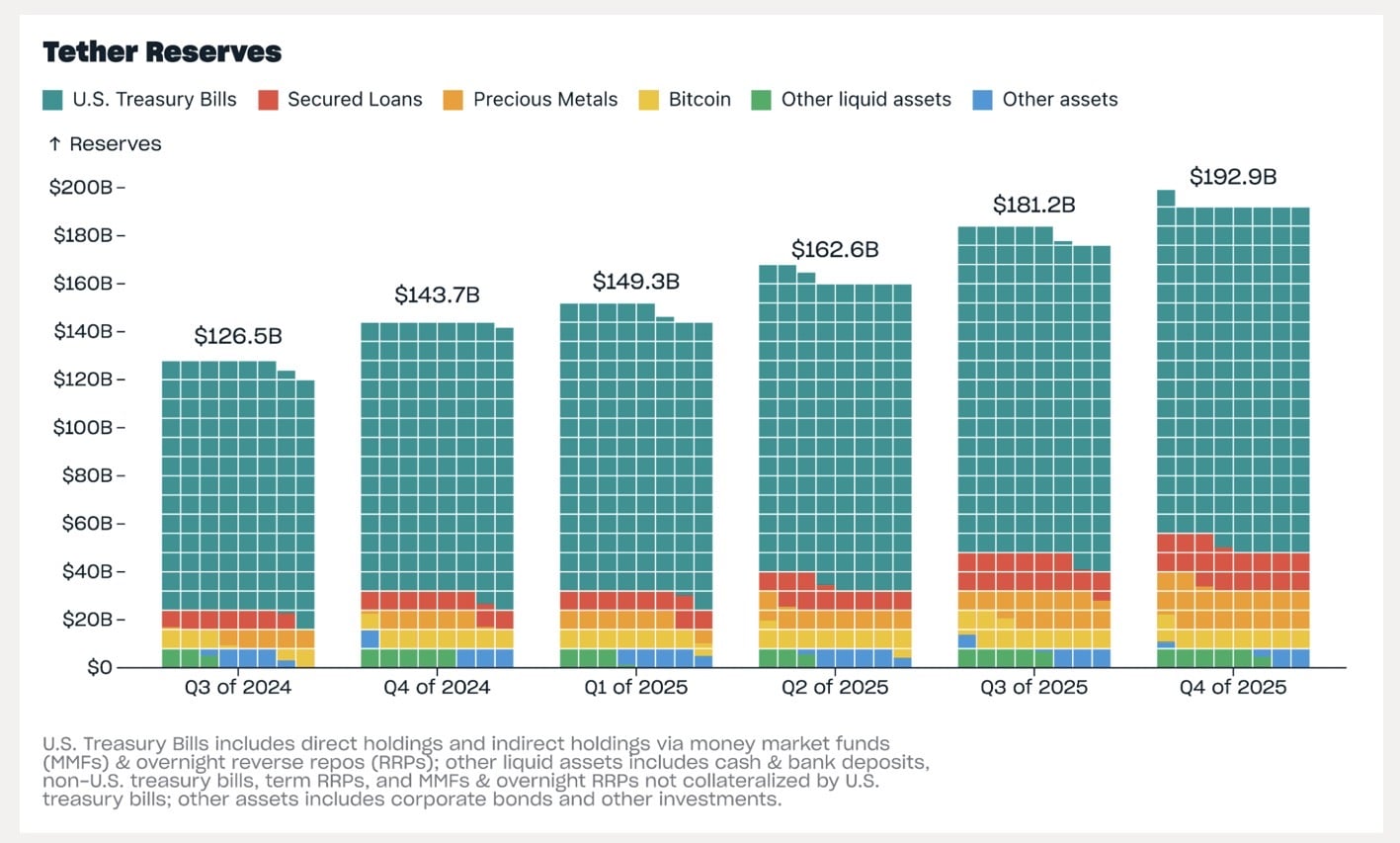

Reserves reached $192.9 billion (+$11.7 billion), generating $6.3 billion in excess equity over liabilities: essentially a big buffer for buybacks. Profits for the full year 2025 topped $10 billion, driven largely by juicy returns on the U.S. Treasury’s huge holdings.

User adoption has gone parabolic: Tether added 35.2 million new users in the fourth quarter alone, bringing the estimated global total to 534.5 million (an eighth consecutive quarter surpassing more than 30 million additions).

On-chain holders (wallets holding USDT ≥24h) climbed to 139.1 million, controlling approximately 70.7% of all stablecoin wallets. The channel’s monthly active users reached a record 24.8 million, securing approximately 68.4% market share. Transfer volume in Q4 reached $4.4 trillion with billions of on-chain transactions. Pure liquidity dominance.

During the October crash, USDT actually rose +3.5%, while its competitors declined or stagnated.

DISCOVER: The best Meme Coin ICOs to invest in 2026

Reserves Stacked Up for the Long Game: Treasuries, BTC, and Massive Gold Accumulation

On the makeup of the reserves: $141.6 billion in exposure to the U.S. Treasury, which makes Tether one of the top 20 global holders if classified as a country, larger than Saudi Arabia or Germany by some metrics. They also stacked more BTC: 96,184 coins (up from around 9,850 in Q4).

But the real flex is gold: 127.5 physical tonnes (up 21.9 tonnes QoQ), stored in ultra-secure Swiss safes.

This fits into Tether’s broader gold tactics. In addition to supporting USDT reserves for diversification purposes (hedging fiat/debt risks amid dollar skepticism and geopolitical chaos), they are aggressively ramping up purchases of physical gold: $24 billion peak.

XAUT dominates gold-backed tokens (around 60% share), with dedicated support distinct but synergistic with the overall USDT reserve strategy.

Tether’s scale, network effects, remittances from emerging markets and now the diversification of gold keep it undefeated.

DISCOVER:

- 16+ New and Upcoming Binance Announcements in 2026

- 99Bitcoins State of the Crypto Market Report for Q4 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

The post Growing In The Chaos: Tether USDT Adds 35.2 Million Users in Q4 appeared first on 99Bitcoins.