- More than 18 million LINK tokens have been transferred to the Binance exchange.

- LINK has fallen less than 1% over the past 24 hours.

Recent data indicates that Chainlink (LINK) has been the most active in terms of development among ERC-20 coins over the past 30 days.

However, more intriguing data reveals that a significant volume of LINK tokens have been transferred to an exchange over the past 24 hours, possibly signaling further market movement.

Chainlink Dominates Development Activity

According to data from Santiment, Chainlink has seen the most development activity among ERC-20 tokens over the past 30 days, surpassing Ethereum and other major assets.

LINK recorded over 624 development activities, while Ethereum, the second most active, recorded around 298.

A closer look reveals that LINK development activity has been on the rise since a sharp decline in late July.

After dropping to around 38, development efforts quickly rebounded, reaching around 212 at the time of writing, highlighting the team’s continued progress.

Source: Santiment

Chainlink Unlocks Millions of Tokens

According to data from Etherscan, Chainlink recently unlocked and transferred 18.75 million LINK from five non-circulating supply addresses. Additionally, 18.125 million LINK, worth approximately $207 million, was transferred to Binance.

This token unlock is part of Chainlink’s quarterly schedule, where approximately 20 million LINK is moved every three months.

Since 2022, the project has unlocked approximately 133.4 million LINK, worth $1.29 billion, over eight unlocking events, seven of which were followed by price increases within 30 days.

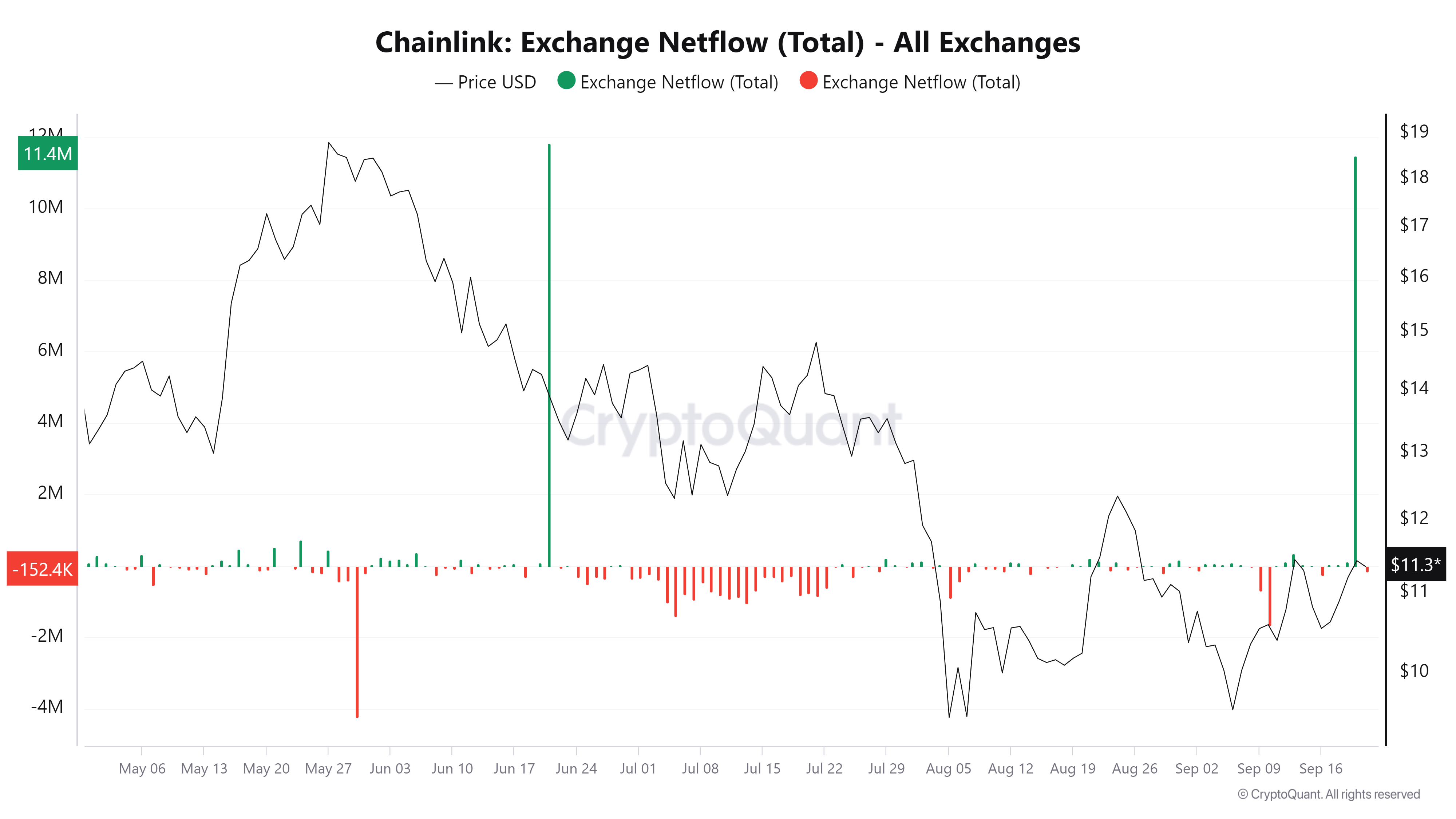

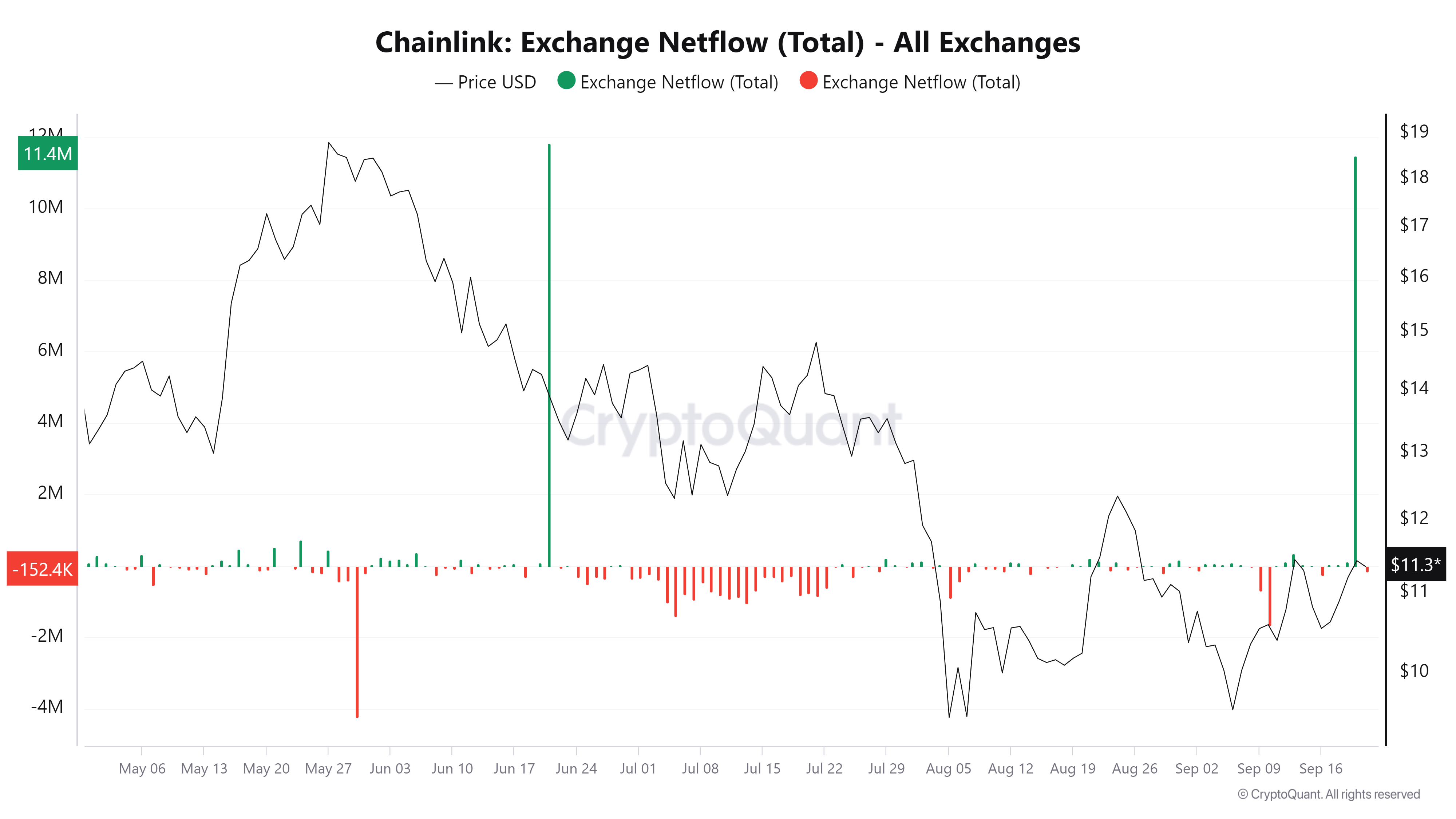

Additionally, the recent unlocking has had a significant impact on LINK’s exchange netflow. According to data from CryptoQuant, LINK recorded a positive netflow of over 11.4 million LINK, the highest since June, coinciding with a significant token unlocking.

Source: CryptoQuant

LINK shows signs of uptrend

At the time of writing, Chainlink is trading around $11,360, registering a slight decline of almost 1%. However, in the previous trading session, LINK closed at around $11,439, a gain of over 2%.

AMBCrypto analysis indicates that LINK has recently seen a notable uptrend, breaking above its 50-day moving average (yellow line).

Source: TradingView

Is Your Portfolio Green? Check Out the Chainlink Profit Calculator

Given the historical price performance after the token unlocking, LINK could see further upward movement in the coming weeks.

This rise could allow it to retest its 200-day moving average (blue line). It currently serves as longer-term resistance at around $14.