- Bitcoin sees spikes in slippage as traders urged to exercise caution.

- Bitcoin’s concentrated liquidation levels are near $60,000.

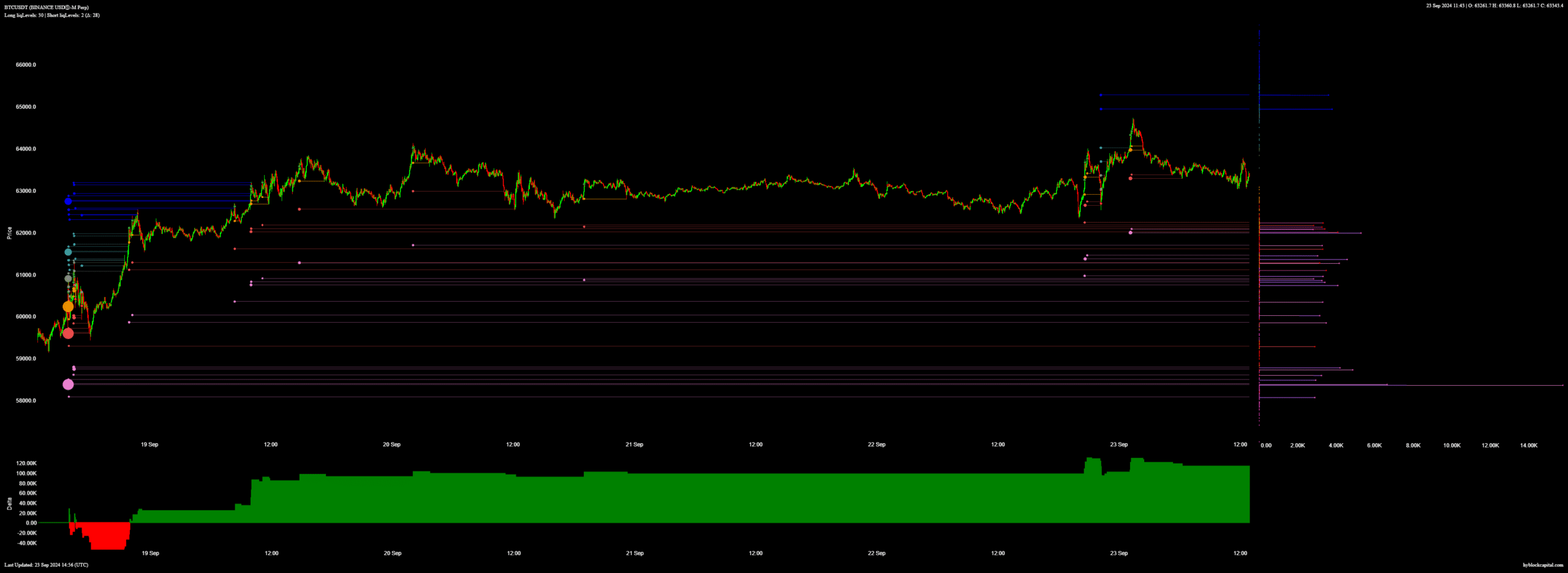

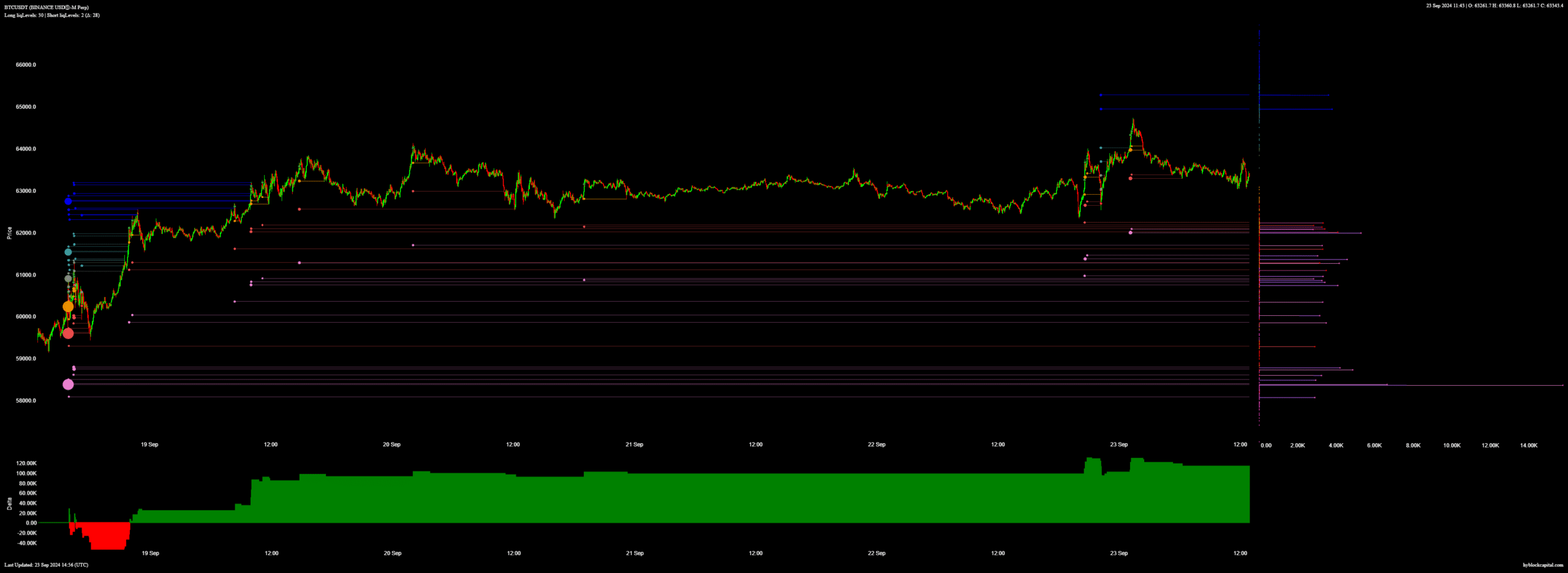

Bitcoin (BTC) continues to show strong momentum, with its price trading above $63,000 today. Current market data suggests that BTC has the potential to move even higher.

However, market volatility could increase due to recent slippage spikes, which may lead to short-term reversals. An important level to watch if Bitcoin stays above this level is $62,500.

If BTC breaks below this level, a cascade of liquidations could push prices lower. Despite these risks, Bitcoin’s overall uptrend remains intact, with potential support near the $60,000 price area.

Source: Hyblock Capital

Bitcoin Liquidation Updates

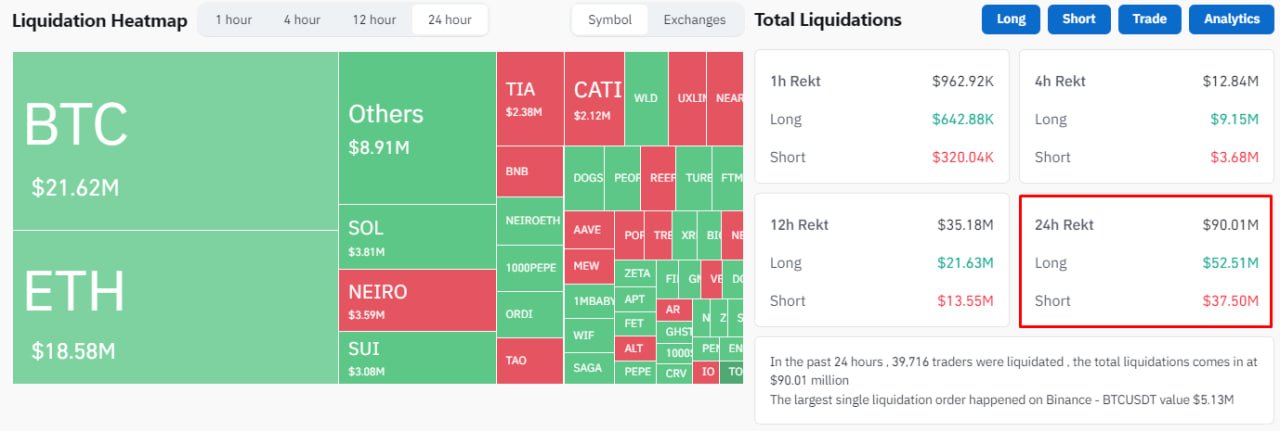

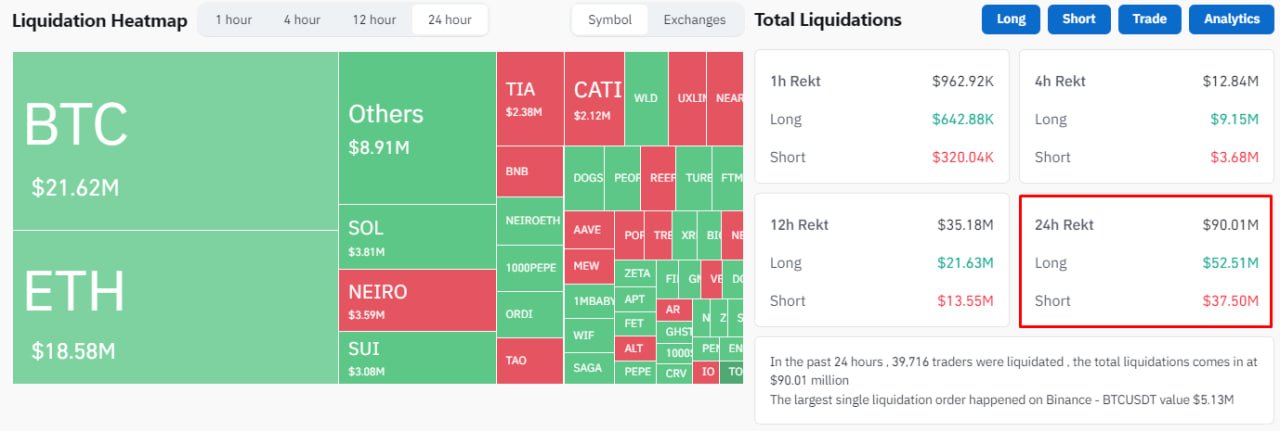

Liquidations continue to play a crucial role in BTC’s price movements. Over the past 24 hours, Bitcoin has seen a total of $23.29 million in liquidations, with $16.42 million in long positions and $6.87 million in short positions.

The broader cryptocurrency market saw 39,721 traders liquidated, with total liquidations reaching $90.03 million. The largest liquidation order took place on the Binance exchange for the BTC/USDT pair, valued at $5.13 million.

Source: Coinglass

These sell-offs can often indicate potential reversal areas in the market, providing indications of where the price might go next.

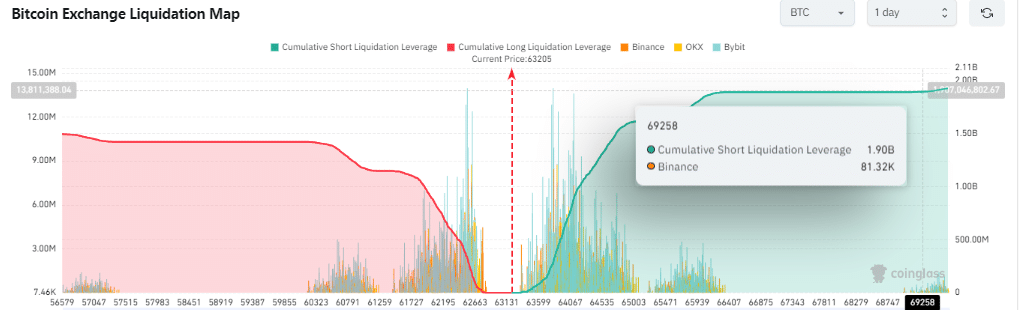

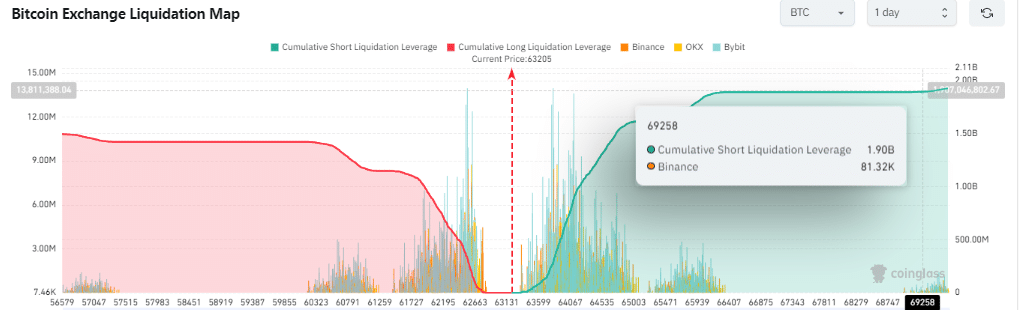

If Bitcoin reaches $69,000, an additional $1.9 billion would need to be liquidated, affecting 81,320 transactions. The price is expected to reach this liquidity level, although a short-term correction could occur before BTC climbs towards $69,000.

Source: Coinglass

Traders on social platforms are also advised to exercise caution, suggesting risk management of short liquidations accordingly as market volatility returns. DeFi Mann’s post on X, formerly Twitter, reads:

If You to have your short liquidation to 70,000 manage your risk Otherwise the market will manage it for You in the next 2 weeks

Concentration of liquidation levels

Finally, liquidation maps that show where large amounts of traders’ positions may be liquidated have highlighted Bitcoin’s key areas of potential volatility.

The highest concentrations of liquidation levels for Bitcoin are around $62,500 and $60,000. If prices drop below these levels, it could trigger further liquidations, leading to increased volatility and downward pressure.

Read Bitcoin (BTC) Price Prediction 2024-25

Source: Hyblock Capital

Bitcoin remains in a strong position, with upside potential. However, traders should be aware of the risk of increased volatility and liquidations, especially if BTC falls below critical levels like $62,500.

If market conditions remain favorable, BTC could continue its upward trend, targeting higher price levels in the near future.