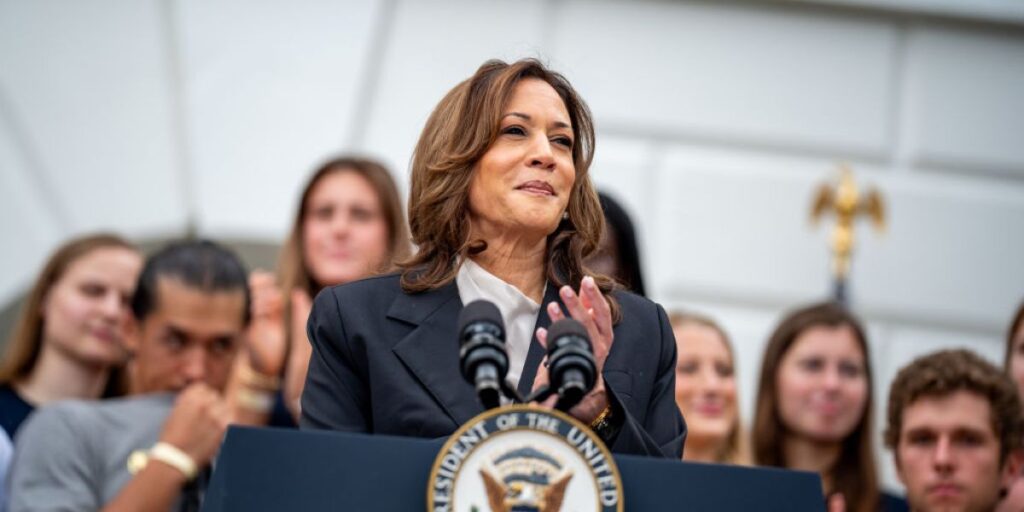

At a fundraiser in New York on September 22, Vice President Kamala Harris took an important step by publicly expressing support for emerging technologies, including artificial intelligence and cryptocurrencies, according to a report from Bloomberg. “We will encourage innovative technologies like AI and digital assets, while protecting our consumers and investors,” she said at the Cipriani event on Wall Street, helping to raise $27 million.

For the first time as a Democratic candidate, Harris provided insight into how her administration might approach digital assets. While his comments represent promising evidence of a pivot, six weeks into his campaign, it is becoming increasingly urgent to address the concerns of pro-crypto voters. This population – particularly the younger, politically energetic, pro-crypto population – has been skeptical, if not outright alienated, by the current administration’s approach.

What these young voters are looking for is not only clarity on Bitcoin, but also a comprehensive legal structure for all digital assets. They are also aware that former President Trump made significant overtures to the crypto industry, including appealing to Bitcoin maximalists.

That said, Trump’s latest crypto venture – a private DeFi project aimed at accredited investors – has raised eyebrows and accusations of opportunism, leaving the door open for pro-crypto voters to make a different choice. Given how slim the margins are in this election, even 10,000 voters could shift key electoral college votes in swing states, making the crypto community an important constituency.

Do you like crypto policy discussions? Come join Fortune on Mainnet in New York next week for a series of lively discussions and high-level networking.

Harris, whose campaign is focused on freedom and opportunity, has the chance to balance crypto regulation and make unprecedented progress benefiting not only the industry but the economy as a whole. If it chooses to capitalize on this opening, it should adopt three messages.

First, Harris can promise to provide the regulatory clarity that the crypto industry has long sought, including ending conflicting policies from agencies like the SEC and CFTC. As someone who has spent years writing, teaching, and advising in this space, I understand the need for a regulatory framework that protects consumers while fostering innovation. Contrary to popular belief, regulation and innovation are not mutually exclusive.

In my testimony before the House Financial Services Subcommittee on digital assets, I highlighted the danger of maintaining the status quo. Without clear direction, U.S.-based companies risk moving abroad, taking innovation and jobs with them. Harris’ call for “consistent and transparent rules of the road” is a step in the right direction. By championing frameworks such as the Financial Innovation and Technology for the 21st Century Act (FIT21), she could bring needed clarity to the industry and position the United States as a leader in digital finance.

Second, Harris must commit to ending SEC excesses and rebuilding trust with the industry. This should include help for entrepreneurs like Caitlin Long, CEO of Custodia Bank, who have faced significant obstacles, including being denied a master account by the Federal Reserve. Such actions stifle innovation and discourage responsible stakeholders from contributing to the ecosystem.

In my testimony, I expressed concerns about the SEC’s broad powers and lack of clear guidelines. A fairer regulatory environment would allow businesses to innovate without fear of arbitrary enforcement. While Harris can’t directly change laws, she can influence the broader policy direction her administration would follow if elected. Indeed, some Democrats have already shifted to a more welcoming pro-crypto message, paving the way for possible bipartisan progress in 2025.

Finally, Harris can integrate crypto into what she presents as a broader “opportunity economy” that prioritizes empowering small businesses, lowering costs for middle and working class families and to expanding financial access. Crypto and blockchain technology can help achieve these goals by providing DeFi-enabled services, particularly for the unbanked and underbanked, who can save, invest, and build wealth with fewer intermediaries and lower fees .

In my testimony, I highlighted the potential of digital assets to democratize access to finance and empower communities historically excluded from traditional finance. Although Harris cannot directly change laws, by integrating crypto innovation into her economic vision, she can create opportunities for underserved populations in the United States and around the world. Integrating digital assets into its platform would demonstrate that crypto is a tool for real-world financial inclusion, not just a niche technology.

The potential of digital assets is too great to neglect, and Vice President Harris has already taken an important step in recognizing the role of crypto in the future economy and appears to be charting her own presidential path. The crypto community, like many others, is hungry for thoughtful leadership that understands the balance between innovation and protection, and Harris is well-positioned to help guide this landscape.

Tonya M. Evans is the Dickinson Professor of Law at Penn State and author of Digital Money Demystified, host of the Tech Intersect podcast, and founder/CEO of Advantage Evans FinTech Academy & Consulting. Follow her on X @IPProfEvans and visit her website at ProfTonyaEvans.com.