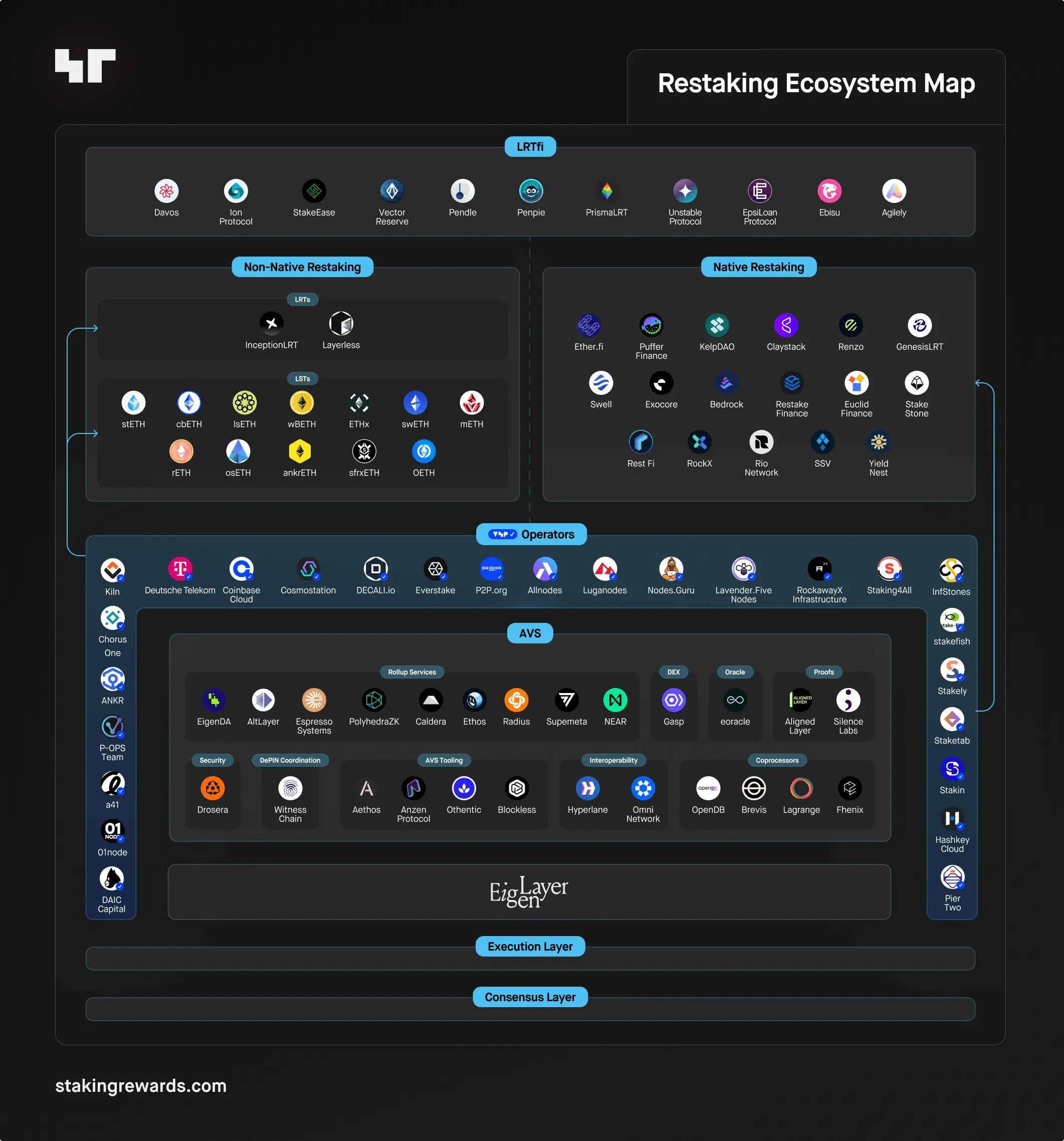

The DeFi space is growing, with staking and liquid restoration protocols attracting more and more attention. These developments allow users to stake and reuse assets multiple times, providing the potential for higher returns. However, as these systems become more complex, they also introduce potential systemic vulnerabilities.

Projects like EigenLayer are pushing the boundaries of yield maximization, but are these yields sustainable? The question remains whether these innovations set DeFi up for lasting success or create the next wave of risks.

The growing influence

Restructuring protocols, led by platforms like EigenLayer, have become a major force in the decentralized finance (DeFi) industry. Resttaking refers to the process by which users take assets staked on one protocol, such as Ethereum’s Liquid Staking Tokens (LST), and stake them again on another platform to obtain additional returns.

This process unlocked significant earning potential, leading to the rise in retaking. In 2024, Liquid Resume Tokens (LRT) saw a whopping 4,900% growth in total value locked (TVL), surpassing $15 billion from just $280 million in early 2024.

“The pressure toward higher returns is key to keeping bets attractive, especially as the total amount of ETH staked on the Beacon Chain increases and the average APY (annual percentage yield) decreases. This is one of the main reasons why DeFi and restoration protocols have been so well received,” Alon Muroch, CEO and founder of SSV.Labs, told BeInCrypto in an exclusive interview.

Read more: Ethereum Resttaking: what is it and how does it work?

Restructuring protocols offer users the opportunity to maximize returns on their staked assets without having to sacrifice liquidity. However, as the readjustment deepens, concerns about liquidity and security risks emerge.

“Each additional level of rollover increases both risk and reward, making it a choice users should make based on their risk tolerance. While this introduces more potential points of failure, it also opens up opportunities for significantly higher returns. Ultimately, the user has the freedom to decide the level of exposure they are comfortable with,” Muroch added.

Balancing the promise and peril of recovery

Although the ability to reuse staked assets has been hailed as an innovation, it simultaneously introduces new levels of exposure. Essentially, reinvestment involves leveraging assets staked across different protocols, which may seem attractive for yield optimization, but it creates systemic vulnerabilities.

Muroch identified several main problems associated with recutting:

- Smart contract vulnerabilities. The complexity of the recovery mechanisms increases the potential for bugs and exploits in the smart contracts governing these protocols. Users can lose funds if a contract is compromised.

- Complexity and lack of understanding. As reskilling strategies become more complex, there is a risk that users will not fully understand the risks they are taking. Some actively validated services (AVS) are at higher risk than others due to more/complex reduction criteria for different AVS.

- Reduce risks. If a validator is found guilty of malicious behavior, a portion of their reinvested ETH may be reduced. This risk is compounded by the fact that node operators are subject to reduction conditions for both the Ethereum base layer and any additional AVS.

Additionally, the financial architecture behind the re-easing exposed DeFi to possible liquidity leaks. For example, EigenLayer’s current rollover system allows users to rollover Liquid Staking Tokens (LSTs) multiple times, thereby amplifying liquidity issues. These risks were evident in the Ankr exploit, where a hacker created 6 quadrillion fake aBNBc tokens, driving down the price of liquid staking derivatives on various protocols.

The lack of clarity in regulatory frameworks adds to the complexity of reinvestment. Muroch cautions that regulators will likely take a cautious approach to reinvestment, viewing it as distinct from traditional staking due to its additional levels of risk and complexity. They could impose stricter regulations to protect investors and ensure the stability of the financial ecosystem as these protocols gain traction.

The threat of an excessive recovery

EigenLayer, one of the largest restructuring protocols, has raised over $19 billion in TVL by mid-2024. While this impressive expansion demonstrates the market’s appetite for higher returns, it raises questions about the sustainability of these protocols.

EigenLayer’s dominance also poses a unique threat to the overall security of Ethereum. Since these restructuring platforms manage large amounts of staked ETH, any major failure could directly impact Ethereum’s security model.

Experts including Ethereum co-founder Vitalik Buterin have expressed concerns that if a rollback protocol fails, it could lead to calls for a hard fork of Ethereum to “repair” the damage, a result that threatens the network’s decentralized consensus.

Read more: How to Participate in an EigenLayer Airdrop: A Step-by-Step Guide

Muroch, however, downplayed the seriousness of the situation, describing it as “theoretically bad, but practically quite improbable.”

“If a significant amount of Ether is locked in EigenLayer and a large operator experiences a major outage event, it could result in a cascade of slashing damage. In a worst-case scenario, this could compromise the extensive security of the Ethereum network. However, the slashed operator would need to not resolve the issue for a long period of time for the security of Ethereum to be at risk,” he explained.

He also highlighted an important upside, noting that recovery increases the cost of corruption for potential attackers. This change strengthens security by focusing not just on individual protocols but on the sum total of all assets involved.

Hidden dangers of yield optimization

The search for higher returns has led investors to adopt increasingly complex strategies, which involve both financial and technical risks. Financially, restructuring protocols encourage users to invest their assets across multiple platforms, thereby tying up more capital in interconnected systems. This raises systemic financial risks, as vulnerabilities in one protocol could have broader consequences across the entire ecosystem.

Muroch cautions that readjustment is still a relatively new concept, making it difficult to predict its long-term effects. The possibility of unforeseen problems, particularly in volatile markets, adds uncertainty to the future of these strategies.

“Staking rewards have only recently been introduced, meaning it will take some time to fully understand their long-term effects. As always, “unknown unknowns” may arise. In the future, if the value of reinvested assets were to fall sharply, the massive reliance on remortgaging and complex financial derivatives could trigger a liquidity crisis,” he said.

This would likely cause users to liquidate their positions en masse, thereby worsening market volatility. In such a case, trust in the underlying protocols could further erode, potentially causing widespread destabilization in the DeFi space.

“At this point, it’s really speculative. Looking at DeFi’s past, trying to mine yields as hard as possible tends to end badly,” Muroch warned.

Ultimately, the success of restructuring protocols depends on their ability to balance maximizing returns with managing the inherent financial and technical risks they introduce. As these systems mature, the sector begins to diversify. New competitors are launching their own restructuring solutions, which could help decentralize risks currently concentrated on platforms like EigenLayer.

This change could reduce systemic vulnerabilities linked to a dominant protocol, leading to a more stable and resilient DeFi ecosystem over time.

“As enthusiasm wanes, the sustainability of these protocols will be tested and their true value will need to be assessed in a more stable market environment. This transition could reveal whether the innovations are robust or just speculative trends,” Muroch concluded.

Disclaimer

In accordance with The Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts and individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify the information independently and consult a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.