- PEPE seemed very bullish and could rise by 30% to reach the $0.0000132 level.

- PEPE’s Long/Short ratio, at press time, stood at 1.084 – indicating strong bullish sentiment among traders.

PEPE, the third largest memecoin in the market, has been making waves in the crypto landscape with its significant price rise of over 27% in the last two days. However, following PEPE’s impressive performance, it seems that Arthur Hayes, former CEO of BitMEX, couldn’t help but join the rally.

Arthur Hayes’ big bet on PEPE

On September 27, 2024, on-chain analytics firm lookonchain revealed that Hayes withdrew 24.39 billion PEPE tokens, worth $252,680, from Binance.

This significant stock market pullback could be a sign that the PEPE rally may have just begun and could accelerate significantly in the coming days.

Current Price Dynamics

At press time, PEPE was trading near the $0.000001058 level, following a notable price rise of over 17.2% in the past 24 hours. During the same period, its trading volume jumped 40%, according to CoinMarketCap.

PEPE technical analysis and key levels

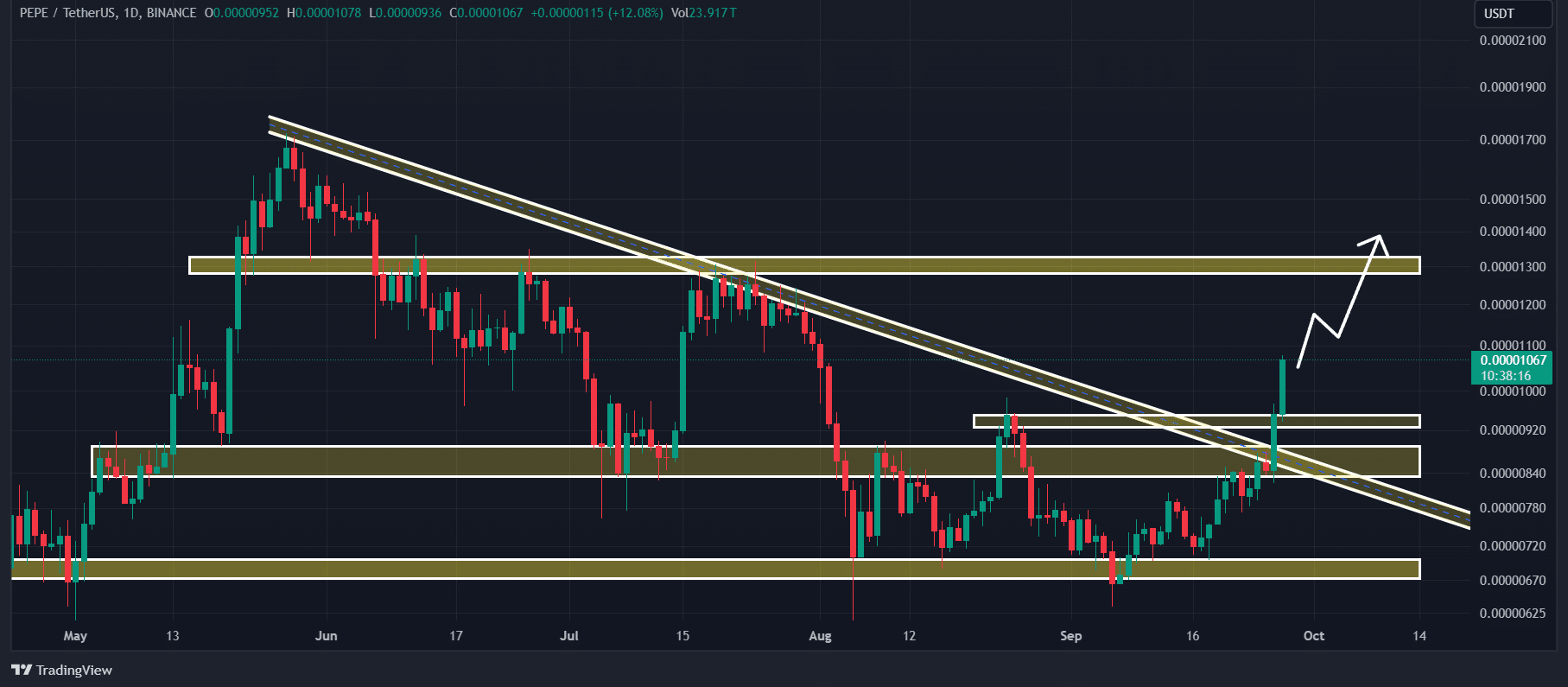

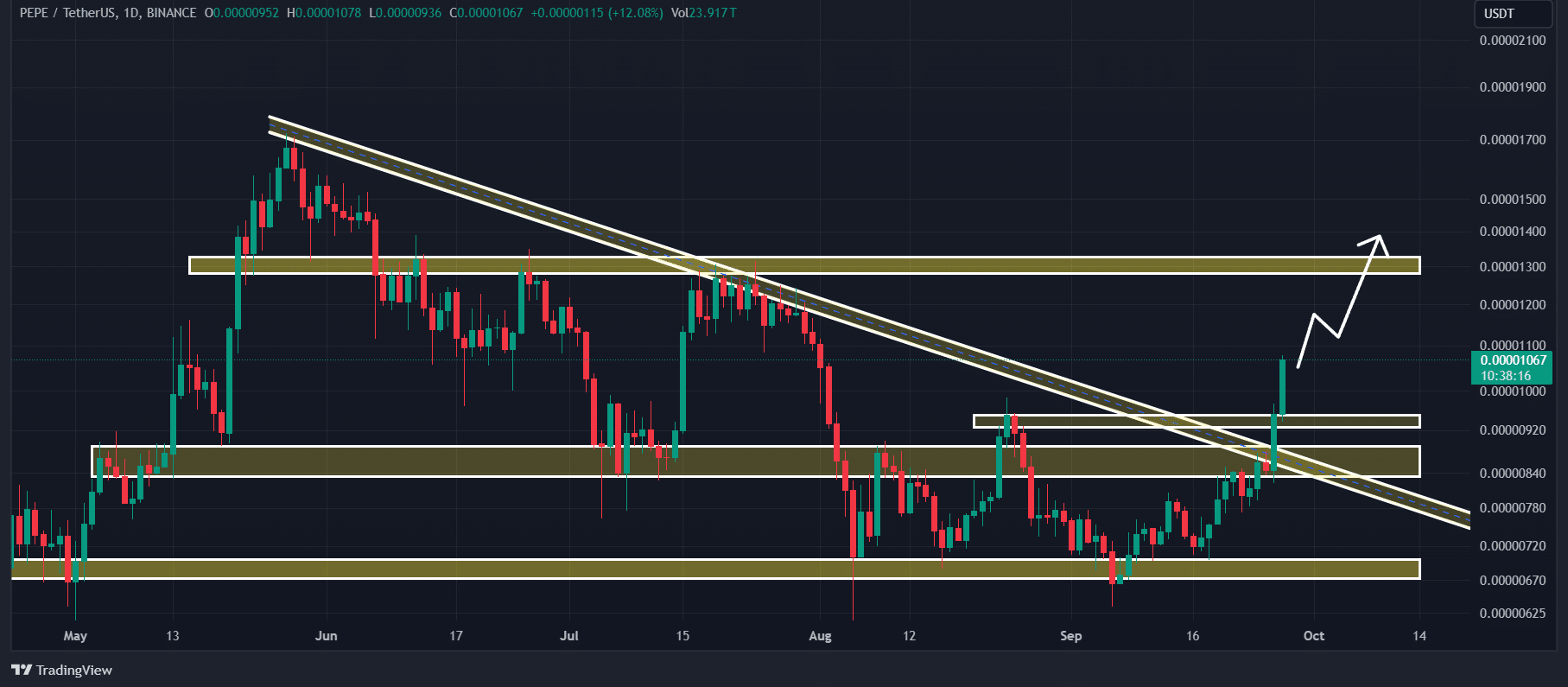

According to technical analysis from AMBCrypto, PEPE looked bullish and looked set to rebound by 30% in the coming days. This sentiment recently changed after the breakout of the long descending trendline and the horizontal $0.00000875 level.

Source: TradingView

Based on historical price dynamics, after a price increase of over 27% in just two days, a slight price correction could occur. However, in the long term, PEPE could be very bullish and could rise by 30% to reach the $0.0000132 level in the coming days.

Bullish measures of the PEPE chain

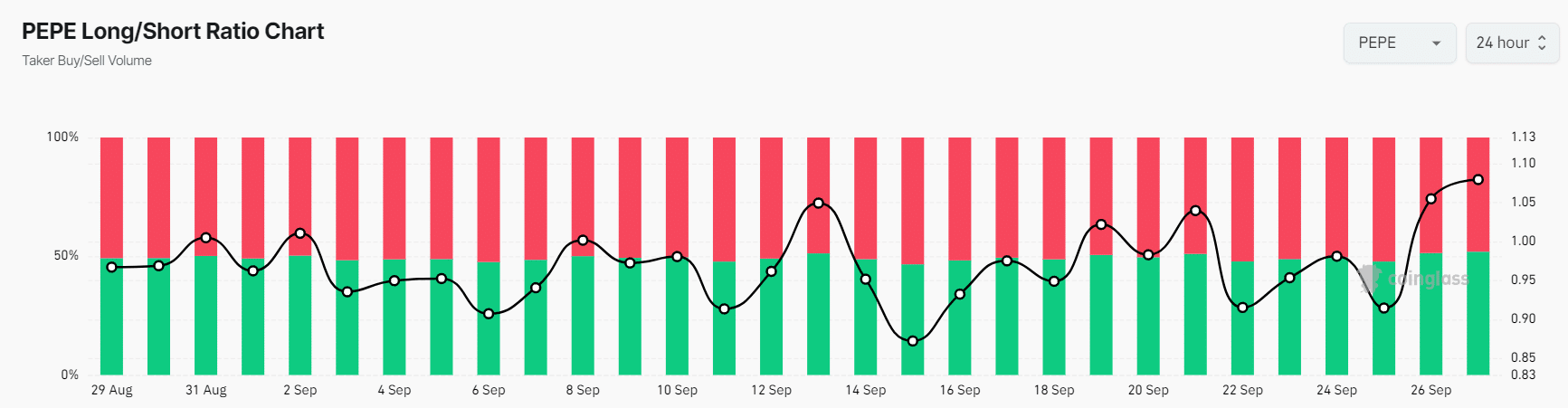

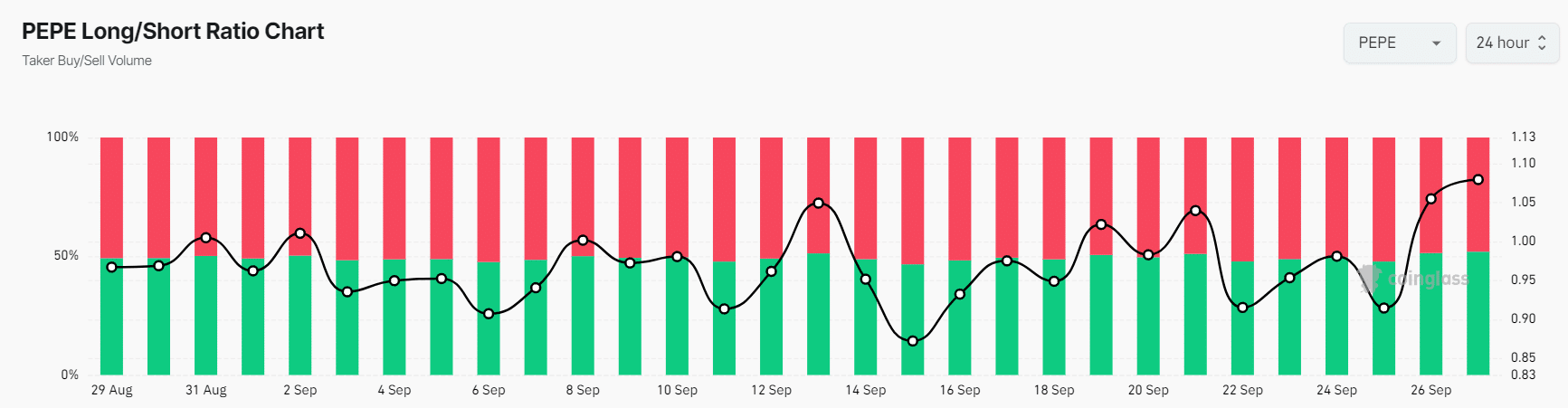

This positive outlook was further supported by on-chain measures. According to on-chain analytics firm Coinglass, PEPE’s Long/Short ratio stood at 1.084, indicating strong bullish sentiment among traders.

Source: Coinglass

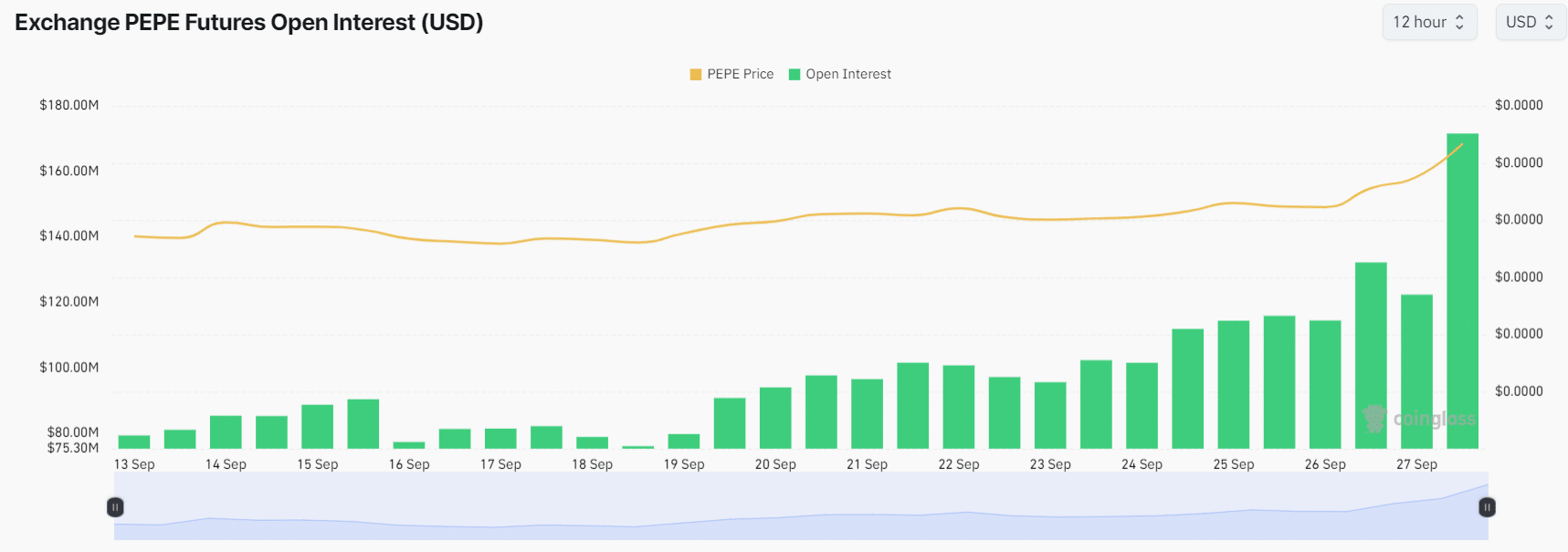

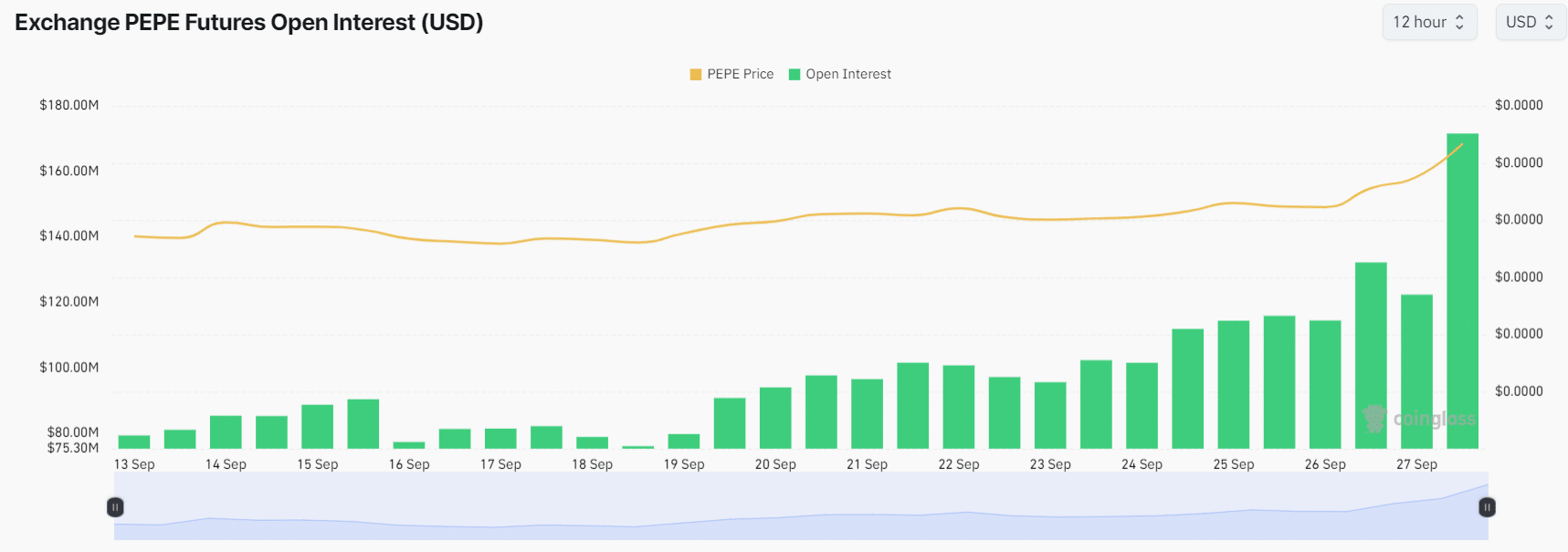

Additionally, its futures open interest increased by 30%, with steady growth ever since. This massive increase in PEPE Open Interest is a sign that bulls are potentially building larger long positions than short positions.

Source: Coinglass

However, investors and traders often use the combination of rising open interest and a long/short ratio greater than 1, when constructing long positions. At press time, 51% of top traders held long positions, while 48.09% held short positions.