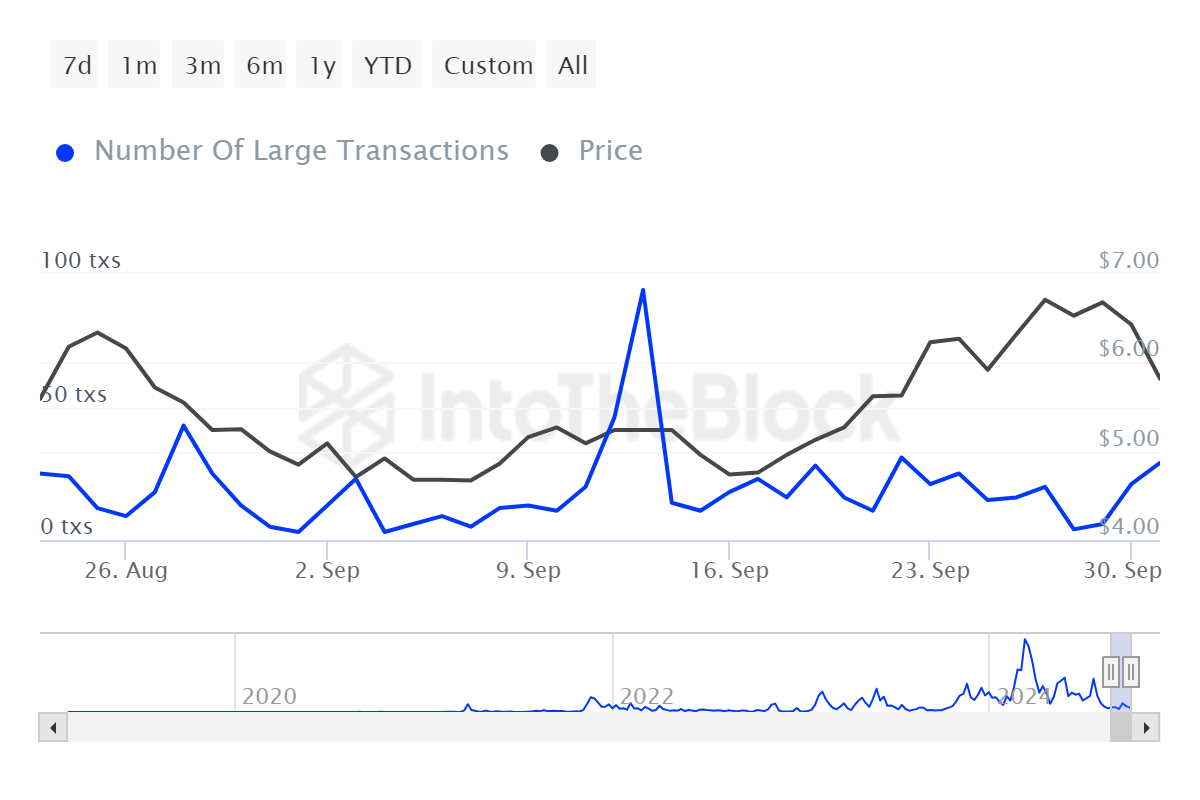

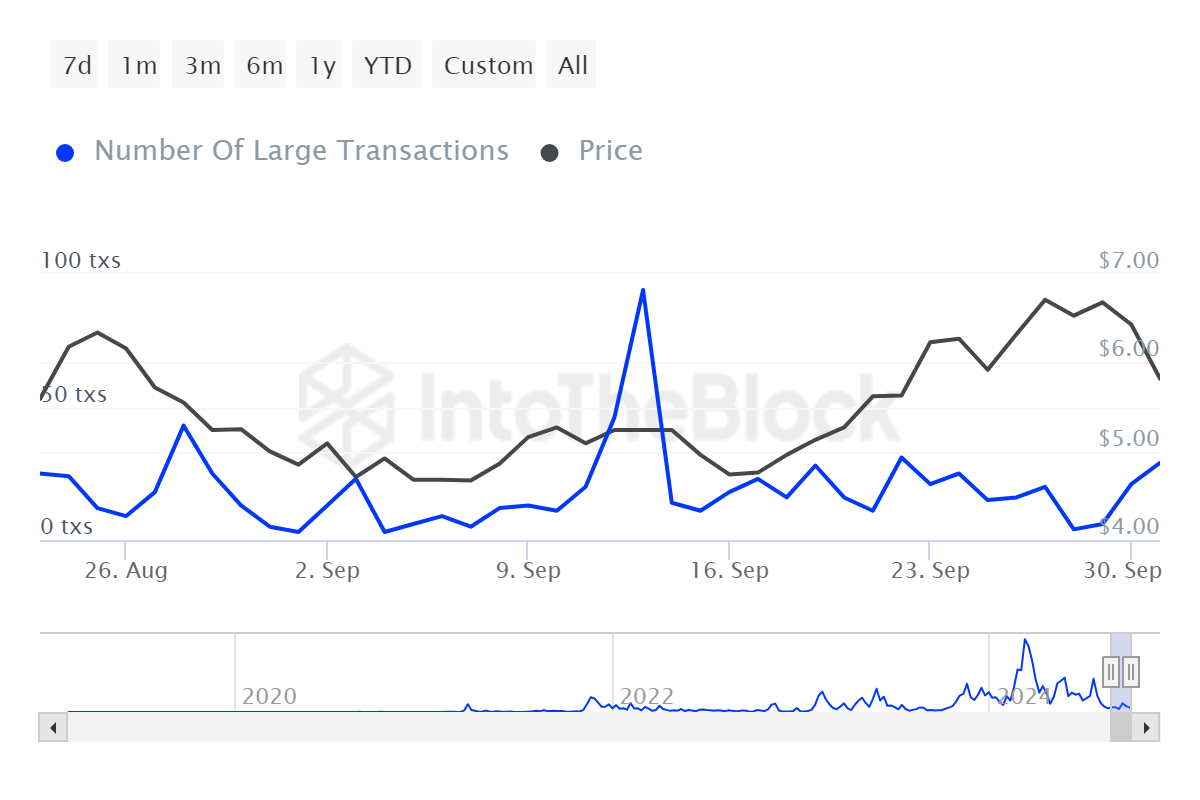

- Render saw a 3,038% increase in large transactions in 24 hours.

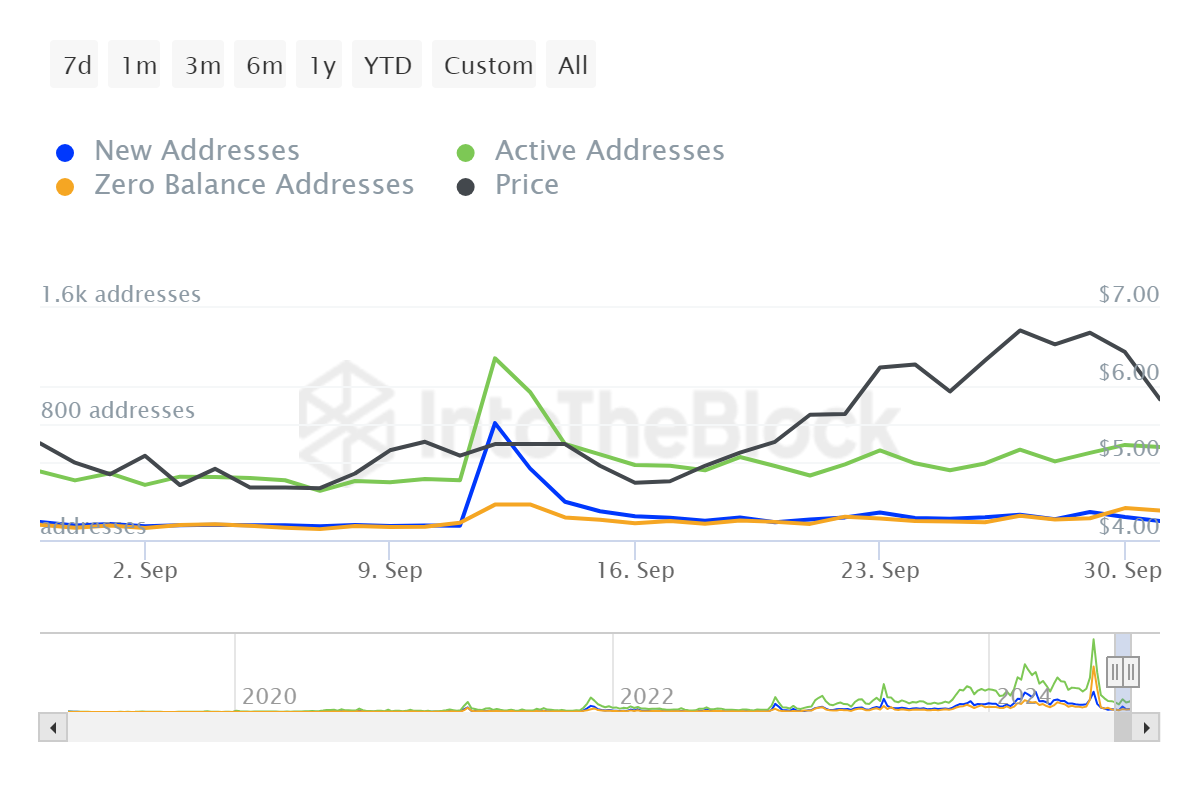

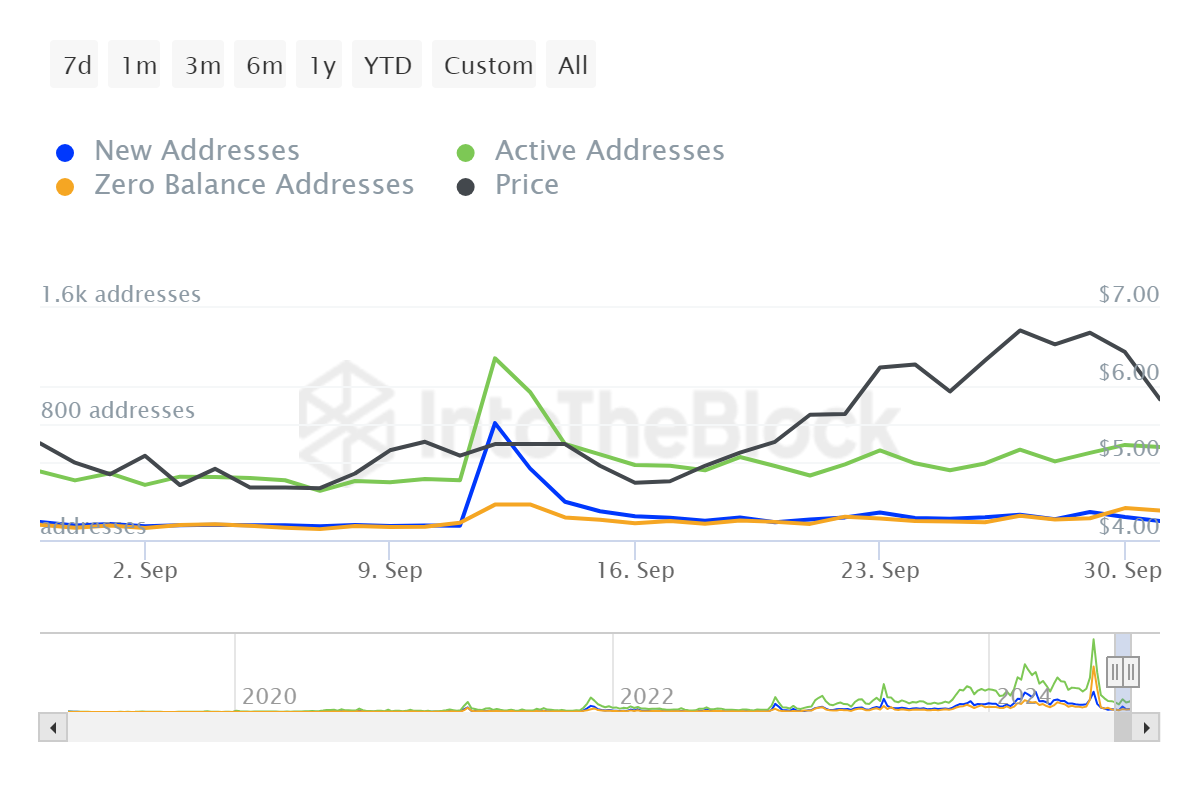

- Active addresses increased by 9% – a sign of growing market participation

Render (RNDR) has seen a drastic increase in large transactions, up 3,038% in the last 24 hours. This increase is a sign of a significant increase in trading activity and increased investor interest in the asset.

The number of active addresses is also taking a stand with an increase of 9% at the time of going to press. Are the institutional giants making their move, or are the crypto-whales quietly accumulating? Let’s find out…

Massive increase in large money movements

The impressive 3,038% increase in transactions on major Render networks highlighted greater interest from whales and institutional players. This trend usually goes hand in hand with higher price movements, where larger market players start accumulating tokens in anticipation of high prices.

The aforementioned spike in whale activity also coincided with a larger pivot in the market trend, which could signify a shift in the RNDR price action landscape.

Source: In the block

Rendering network’s pulse quickens as volatility surges

The tremors caused by the massive whale activity, however, were evident in market dynamics. According to AMBCrypto’s analysis of Render’s trading activity, for example, Render saw a 9% increase in active addresses.

More active addresses generally result in increased activity in trading and user interaction.

In fact, this metric often correlates with price volatility. And the evolving RNDR business landscape could indicate an influx of new participants into the market.

Source: In the block

The RNDR falls, but there is a rebound

RNDR price broke out of pennant form on September 23 – a bullish signal that normally precedes further upward movement. At the time, market participants predicted that RNDR price would test the $7.5 resistance level.

However, after the breakout, Render price retreated 15% to the previous pennant resistance support at $5.76. This level, at press time, was acting as critical support. Going forward, this creates potential for a bullish reversal.

Source: TradingView

With large trades increasing and bullish sentiment building, RNDR is currently at a key juncture.

If the $5.76 support level continues to hold, it could propel Render to new highs as market participants look to capitalize on the ongoing bullish momentum.