- Crypto Flare bulls attempted a breakout but were rejected.

- The volume development indices showed a sustainable upward trend and a recovery was still unlikely.

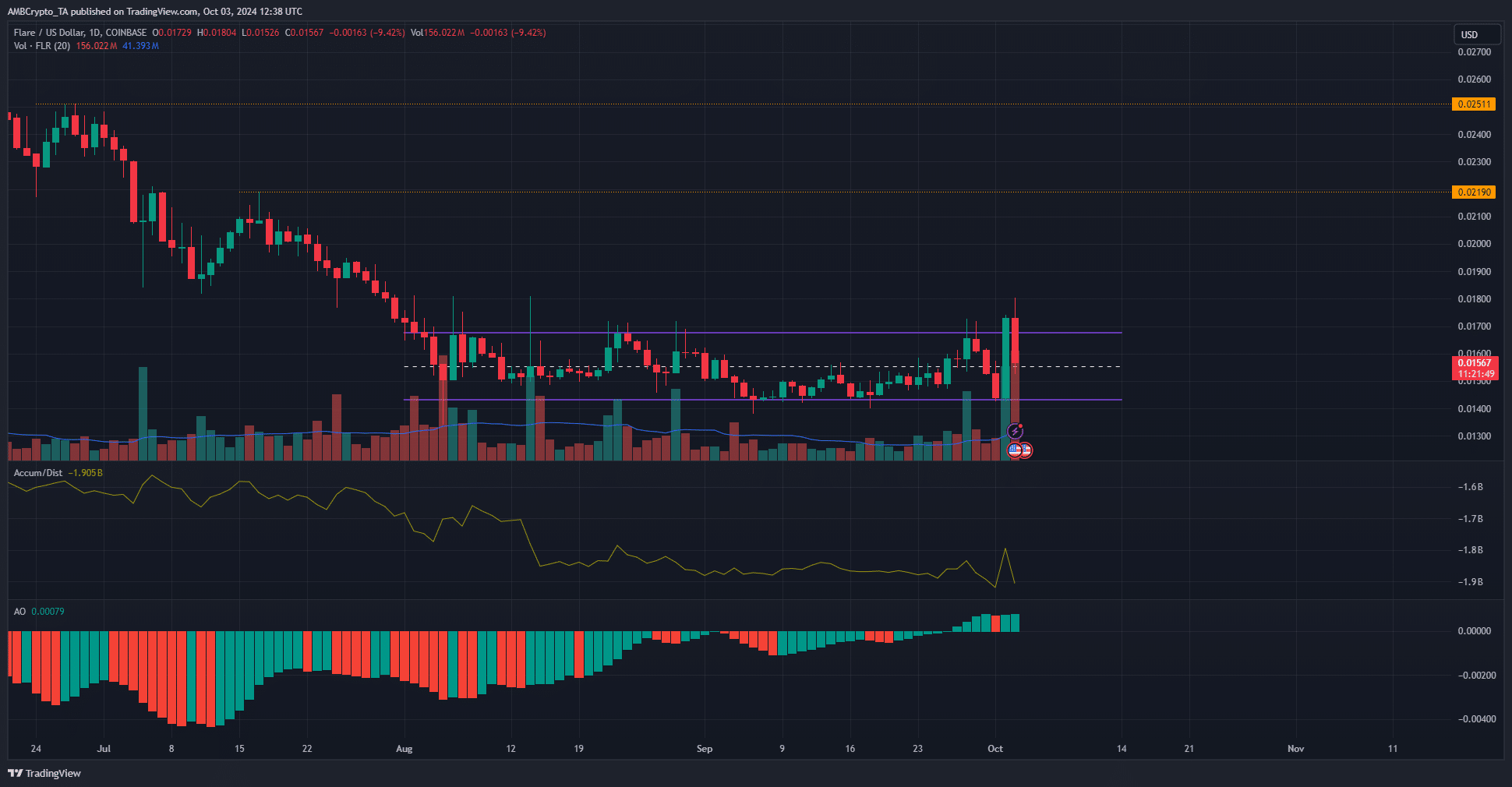

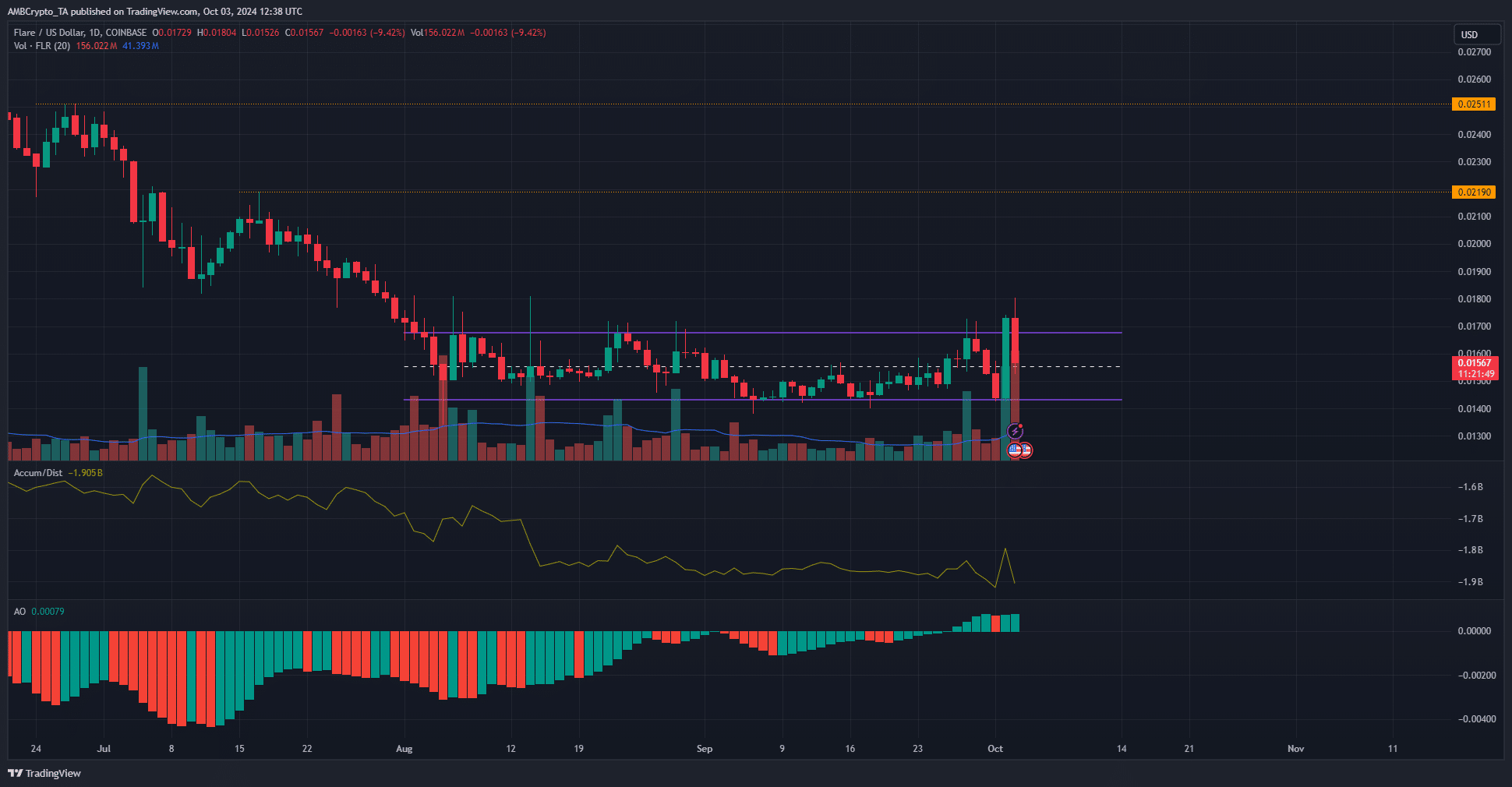

Flare (FLR) has been trading in a range since early August. This range spanned from $0.0143 to $0.0167, with a midpoint at $0.0155. The token saw a sharp increase in trading volume on October 2.

This increase was accompanied by a sharp rise in prices. The FLR broke out from the lows of the range to make a breakout on the same day, but has been forced lower since then.

The breakout of the range was categorically refused

Source: FLR/USDT on TradingView

This price drop was 12.42% from the local high of $0.018. This brought FLR back into the range formation, again testing the midrange level as support.

AMBCrypto looked at the A/D indicator to see if the price trend was likely to resume its upward momentum.

The A/D has been slowly declining since mid-August. The previous day’s increase did not allow it to surpass the peaks of August.

Indices for this volume indicator were bearish – Flare is probably not preparing for a recovery towards March levels.

The attempt to break the range can be considered a failure since the highs of the range were not flipped towards support.

It is possible that FLR bulls could achieve this in another attempt, but traders and long-term holders should remain cautious until the volume indicator trends upward.

Social activity increases following price activity

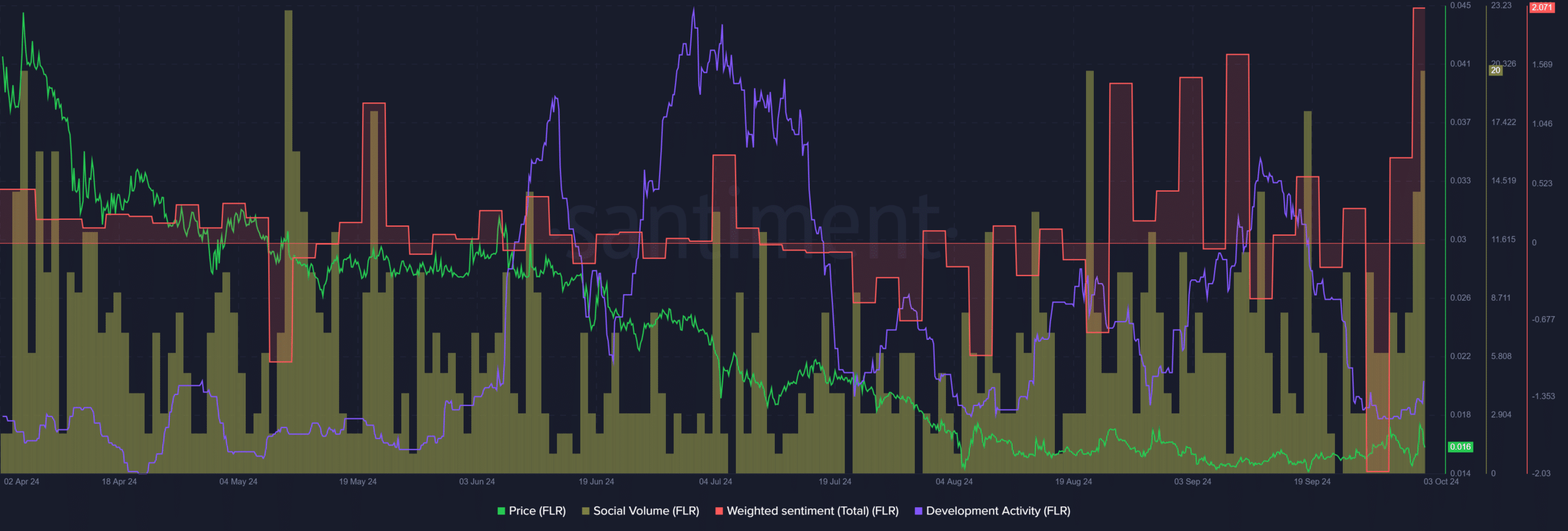

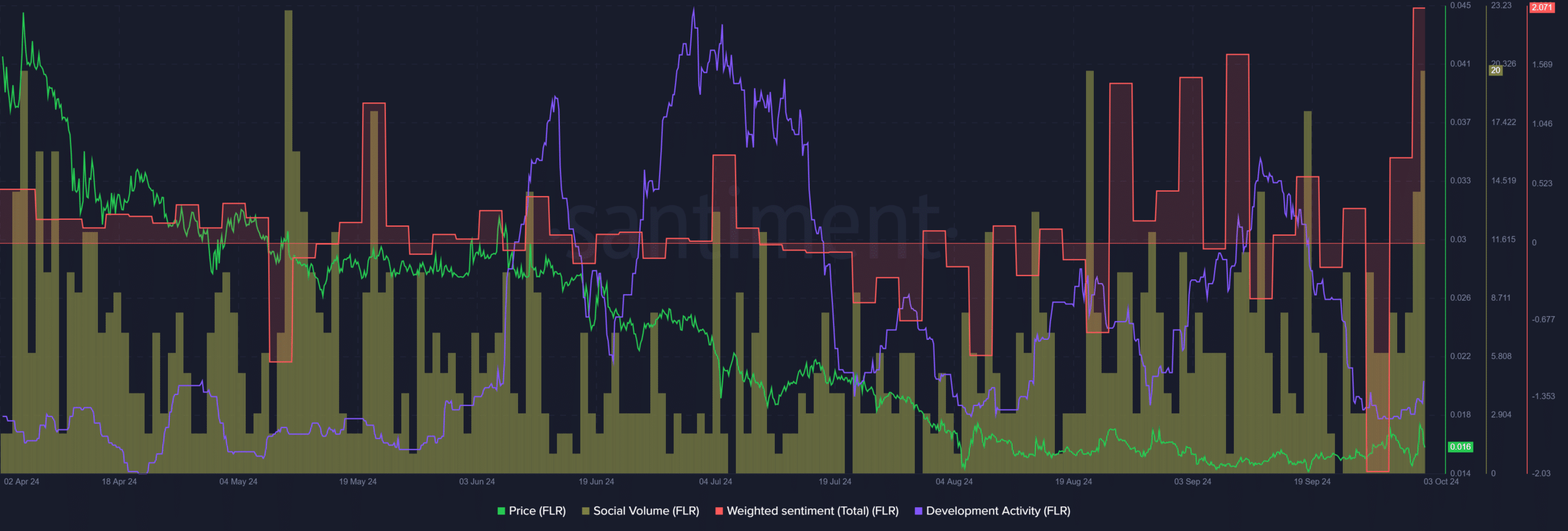

Source: Santiment

Weighted sentiment rose, reaching highs not seen since January. This reflects overwhelmingly positive engagement on social media following the breakthrough of the Flare range.

Realistic or not, here is the market capitalization of FLR in terms of BTC

Social volume also saw notable growth.

Development activity has been trending downward in recent weeks and is well below the highs it maintained in July and September. This could worry long-term investors.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.