As the founder of a blockchain venture fund, I can admit that the last few years have been brutal for the crypto industry. However, I arrived in Singapore for the hope of Token2049. I’ve seen projects rise to massive valuations over the past year. As they finally prepare to launch, I was optimistic that the next bull cycle could be right around the corner.

Asia represents a crucial stage for crypto companies. This is where they meet the exchanges, market makers, liquidity providers, and traders who will help bring their tokens to life. Singapore was therefore an opportunity to assess the viability of all the projects that were preparing to be commercialized. Do they have real communities, builders, friendliness – and demand – supporting them?

I immediately questioned these expectations. I checked into my hotel, where rooms can cost upwards of $700 even if you book several months in advance, only to be greeted by community managers from various projects in their early 20s who were staying down the hall . It was before the conference even started, and they were already hosting multi-thousand dollar dinners by the pool. And that was just the beginning. Every night I saw parties that must have cost hundreds of thousands of dollars, with DJs of the kind you usually only see at Coachella or Ibiza.

At this point, you might be wondering: well, it’s just crypto, right? And yes, the last bull cycle of 2021 was dominated by massive, flashy parties, many of them hosted by my fellow VCs. But there was real interest from retail investors and a lot of capital was flowing to make us believe that this was normal. This is no longer true today, and it’s not the investors who throw the parties. Most projects and venture capital firms themselves are struggling to raise funds, with some of the largest venture capital firms having reduced their funding target. So where does the money come from?

The answer is clear: the money is coming from venture capital firms, which are pumping money into new layer 1 and layer 2 blockchains that haven’t even launched a testnet yet, but are still collecting valuations of more than a billion dollars. And clearly, a lot of that funding goes to what we call marketing expenses, which are really just giant parties.

It would all be great if you could prove that there is some sort of return on investment – like branded parties for consumer goods – but I have yet to see any evidence that a wild night out at a nightclub generates any return on investment.

Videos posted about X events with lines stretching across floors certainly create the feeling of “I want to check out this project.” But do I want to build on this party-based project? This is an artificial economic boom built on venture capital money.

The Future of Crypto

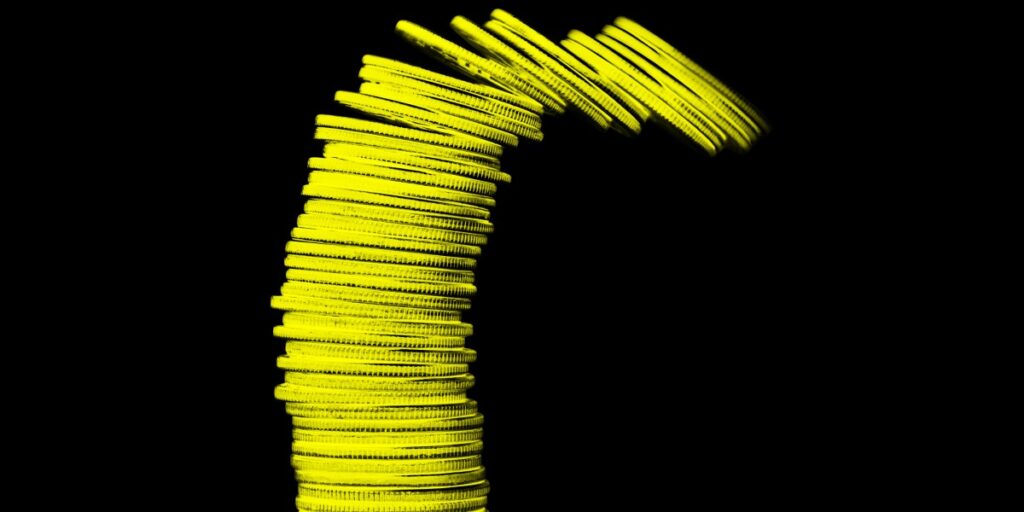

Now I know you won’t shed any tears over the waste of risk money. But if you care about the future of the crypto industry, the consequences are real. Crypto projects raise money through tokens, which means that to maintain their astronomical valuations, their token launches must maintain a certain floor price. We saw the opposite with all of the high-profile token launches last year, from Wormhole to Celestia to Etherfi to Avail, which plummeted in value.

Yes, venture capital funding is rebounding and projects are increasing again at huge valuations. But everyone knows it’s a bubble. This is the first time since the beginning of crypto that we have multi-billion dollar venture capital firms that have too much money to deploy. Pumping money into their own projects at a higher valuation is good for them, because they have higher unrealized valuations, all so they can raise more funds without really paying anything back to their investors. Venture capital firms lost all accountability for their projects when they started making token investments, because there is no board of directors or financial transparency requirements.

The positive side is that many credible venture capital firms have started to lose patience. No one pays tribute to 22 year olds who raise millions of dollars and just throw parties instead of having build days.

In 2017, it was a new space. We had a lot of young founders and I thought we would find maturity. But this year is the first time I’m starting to feel like we won’t reach that moment. When I talk to exchanges and liquidity players, they realize that retail investors are not just coming from party hype and that valuations are too high for ordinary customers to support and make profits.

It should now be a time of introspection for every venture capitalist in the crypto space as we head into the expected bull cycle. Let’s not get excited about inflating an unrealized valuation. We need sustainability if we want family offices, high net worth individuals and retail clients to continue to believe in our world.

Kavita Gupta is the founder and managing partner of Delta Blockchain Fund. You can follow her at @kavitagupta19.