This article is also available in Spanish.

Ethereum is down at writing, reflecting general performance across the board. The almost 2% decline in the crypto scene is due to the contraction in Bitcoin, Ethereum and top altcoins. Currently, the total market capitalization has fallen to $2.17 trillion. It could post even more losses if the bears continue, reversing September’s gains.

Ethereum under pressure, will $2,350 offer support?

Just last week, data from CoinMarketCap watch that Ethereum is down 10%, pushing losses below $2,400, a former support, now resistance. While it may seem like the sharp decline for most of this week is discouraging participation, some traders are accumulating around spot rates.

Related reading

In the block data October 3 shows that 1.89 million Ethereum addresses purchased 52 million ETH in a range between $2,311 and $2,383. The fact that a large number of buyers are choosing to buy, on average, at $2,350 means that this is a support level that traders should monitor closely.

Given the number of ETH accumulated, sellers should make more effort to break below this level, forcing the coin towards $2,100 and the August low. Comparing trader action and the September range, the $2,350 level falls to the Fibonacci retracement levels of around 61.8% and 78.6%.

What’s next for ETH?

Technically, prices of cryptocurrencies, including ETH, tend to find support around this Fibonacci retracement zone. Therefore, how price reacts between the $2,100 and $2,350 area will likely shape the medium to long-term trend.

Related Reading: What’s Holding Bitcoin Back? Analyst says $71,000 is the magic number

A refreshing bounce around this emerging support and Fibonacci retracement zone would be a huge boost. In this case, ETH could rebound even above $2,800 as bulls target $3,500.

Conversely, any sharp drop below the August and September lows could easily trigger panic selling. From this, ETH may fall below $2,100 and $2,000 and could fall as low as $1,800, confirming losses from early August.

Given the price movement, sellers have the upper hand. Over the past few trading sessions, centralized exchanges have seen massive outflows.

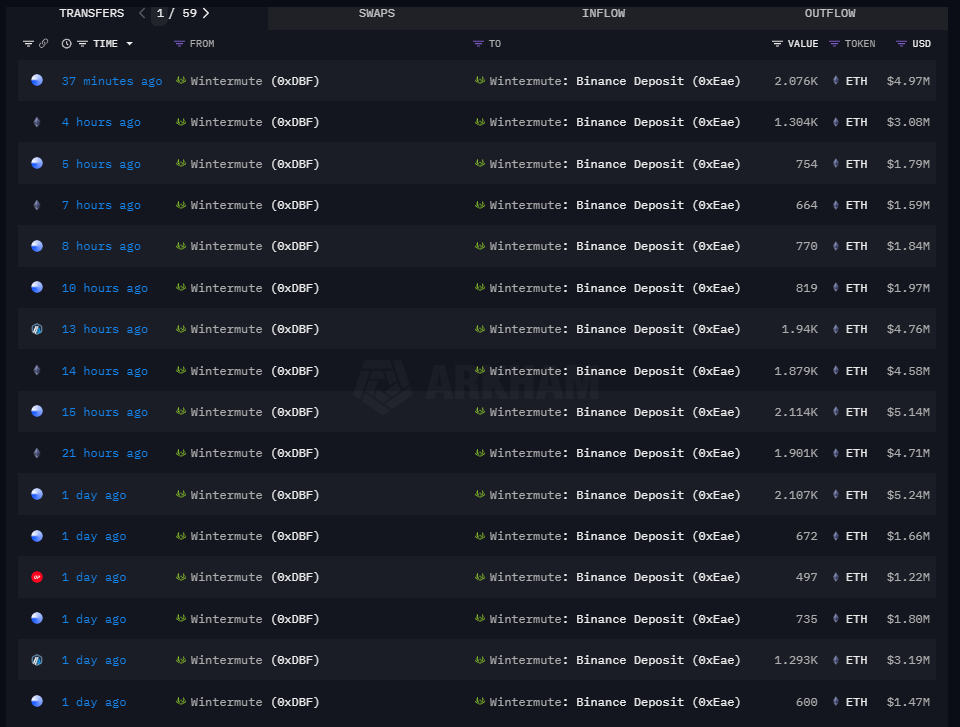

Earlier today, The Data Nerd revealed that Wintermute, a crypto market maker, moved 14,221 ETH to Binance, indicating they may sell. In August, Wintermute and other leading market makers, including Jump Capital, sold over 130,000 ETH, causing prices to decline.

Featured image of DALLE, chart by TradingView