- The Ethereum whale has spread fear among stakeholders after releasing around 19,000 ETH.

- However, a deeper downturn could still be on the horizon.

Ethereum (ETH) experienced a major shock when a prominent ICO The Ethereum whale sold 19,000 tokens – more than $47.5 million – in just two days, causing ripples across the market.

Despite starting October with consecutive red candlesticks on the daily chart, which prevented ETH from reaching $2.7k, the expected downward pressure from whale activity did not materialize .

Instead, ETH jumped about 2% from the previous day, attracting the attention of AMBCrypto.

Ethereum Whale Activity Signals Market Top

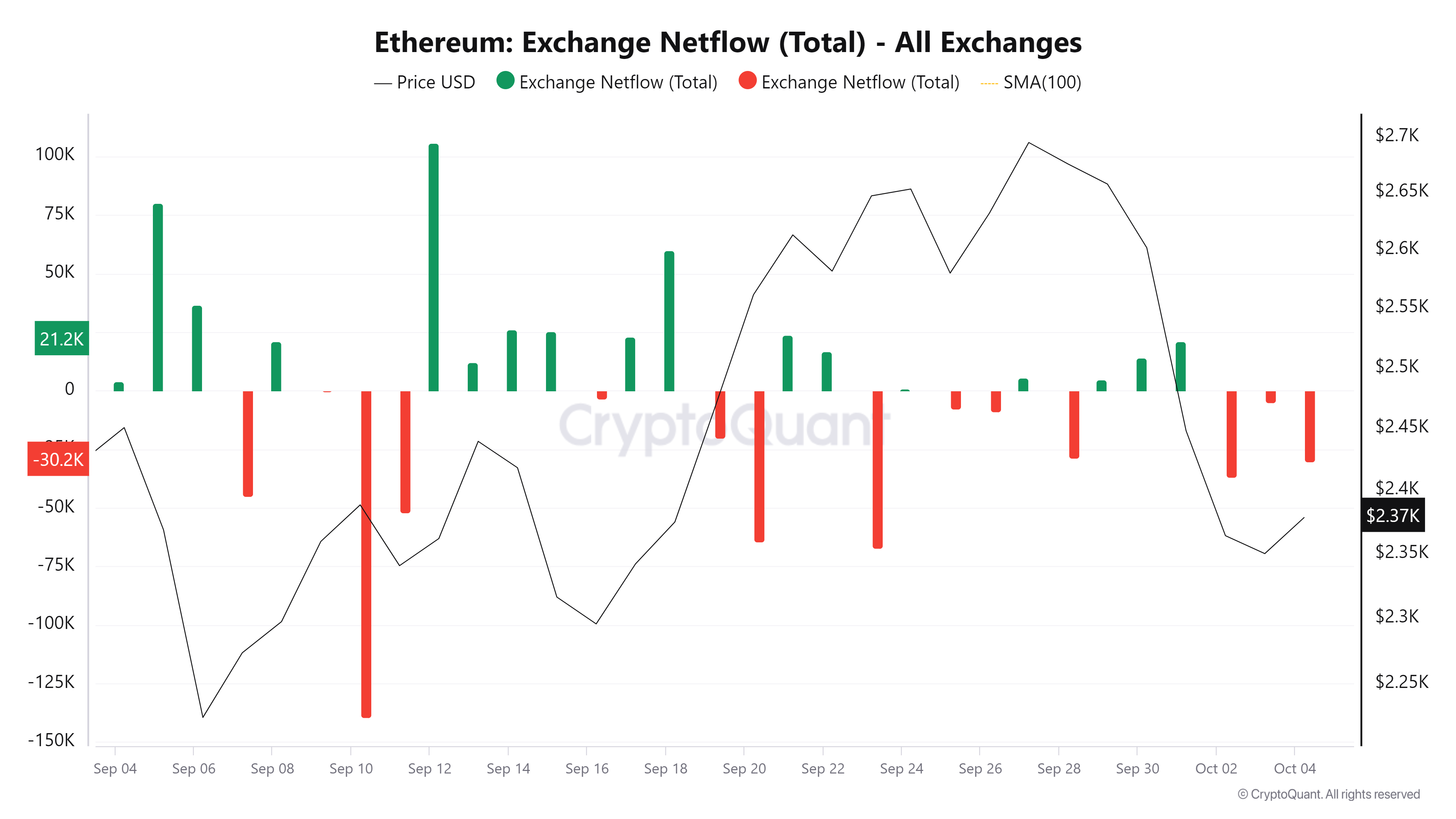

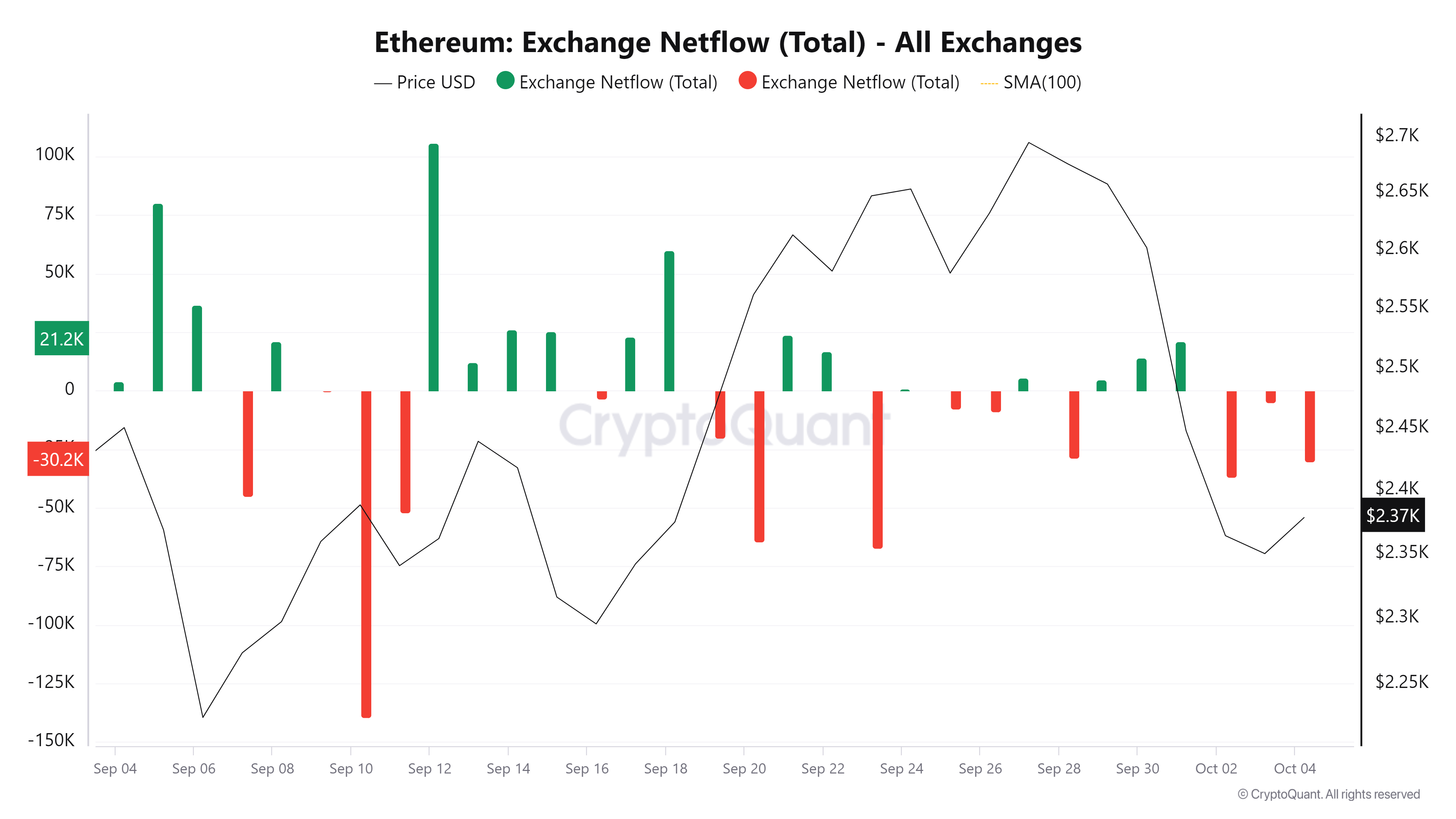

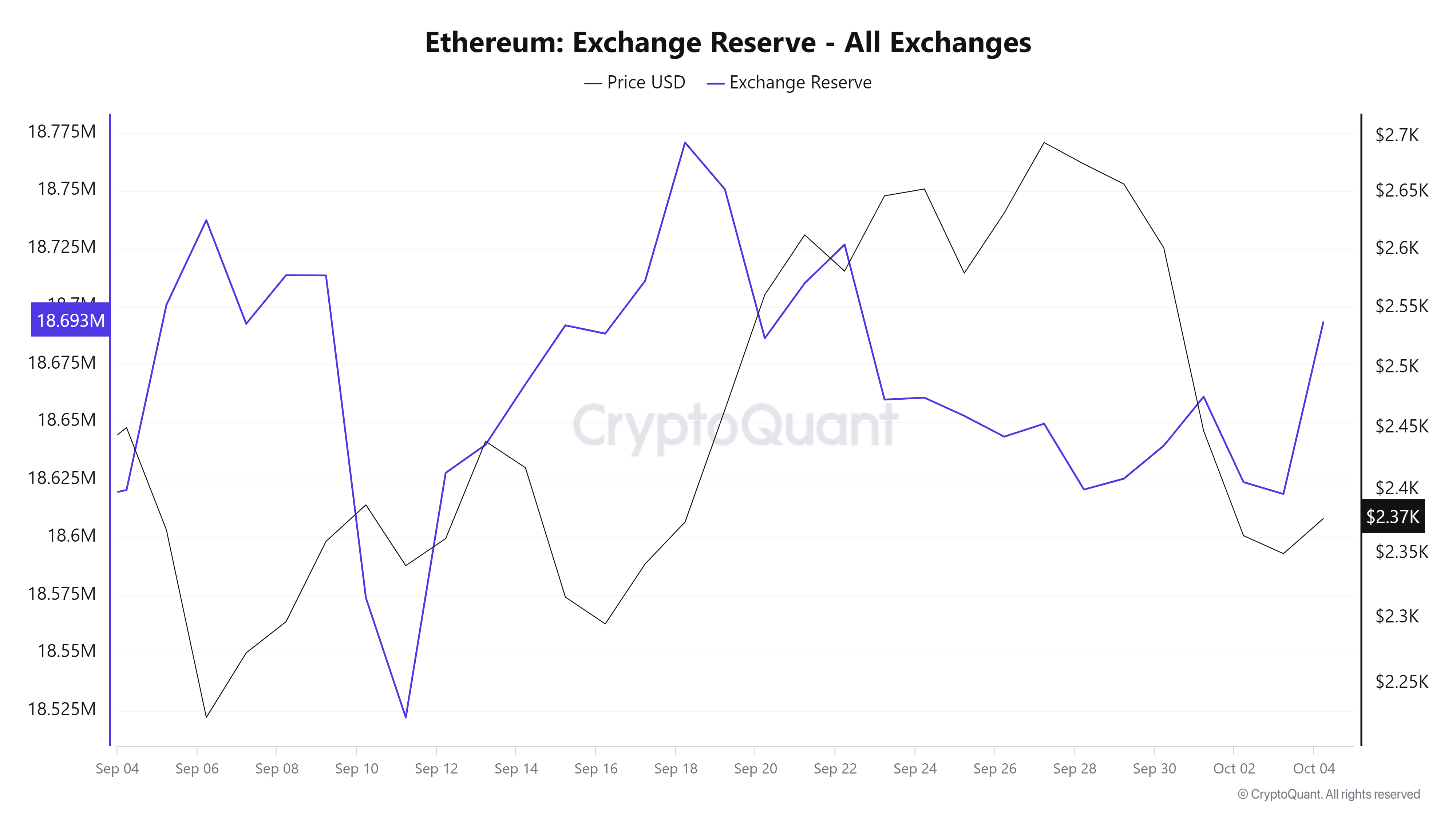

The chart below reveals an intriguing development. Typically, a significant rise in net outflows signals active buying, indicating traders’ confidence in a possible price correction.

Over the past three days, ETH net flows have remained negative, suggesting growing optimism.

Source: CryptoQuant

However, this optimism stands in stark contrast to recent Ethereum whale activity, which is signaling $2.6k – the price at which the sell-off took place – as a potential market top.

If so, a retracement from $2.37k, ETH’s current price, to $2.23k, its previous rejection level, could follow suit.

Additionally, the chart has another side. Traders who bought ETH over the past three days when it opened at $2.6k, anticipating a bull cycle, now find themselves in a net loss.

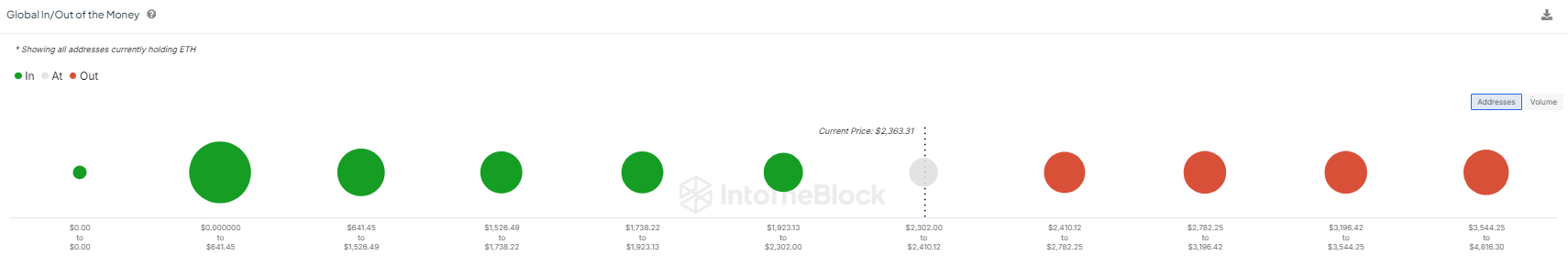

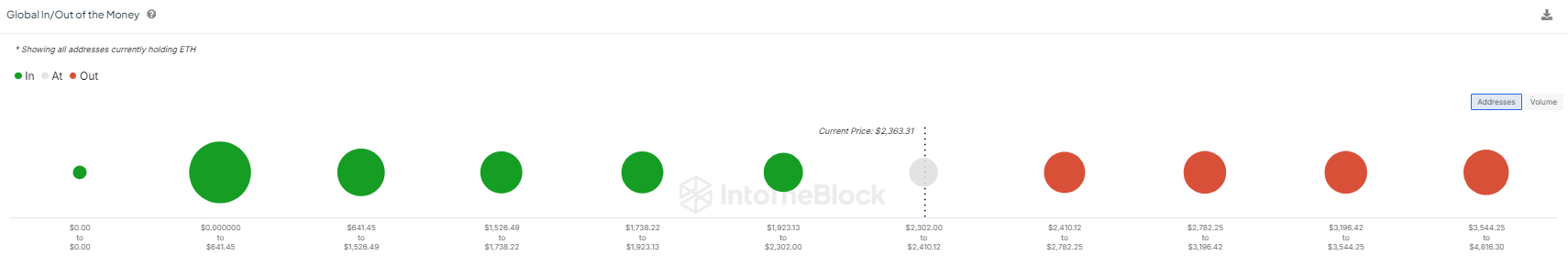

Source: DansLeBlock

This situation highlights the influence of recent Ethereum whale activity, which has led many investors into unfavorable positions.

Therefore, this widespread loss among traders could further decrease the likelihood of a market reversal, as sentiment diminishes in the face of significant selling pressure.

Fear Could Trigger Panic Selling

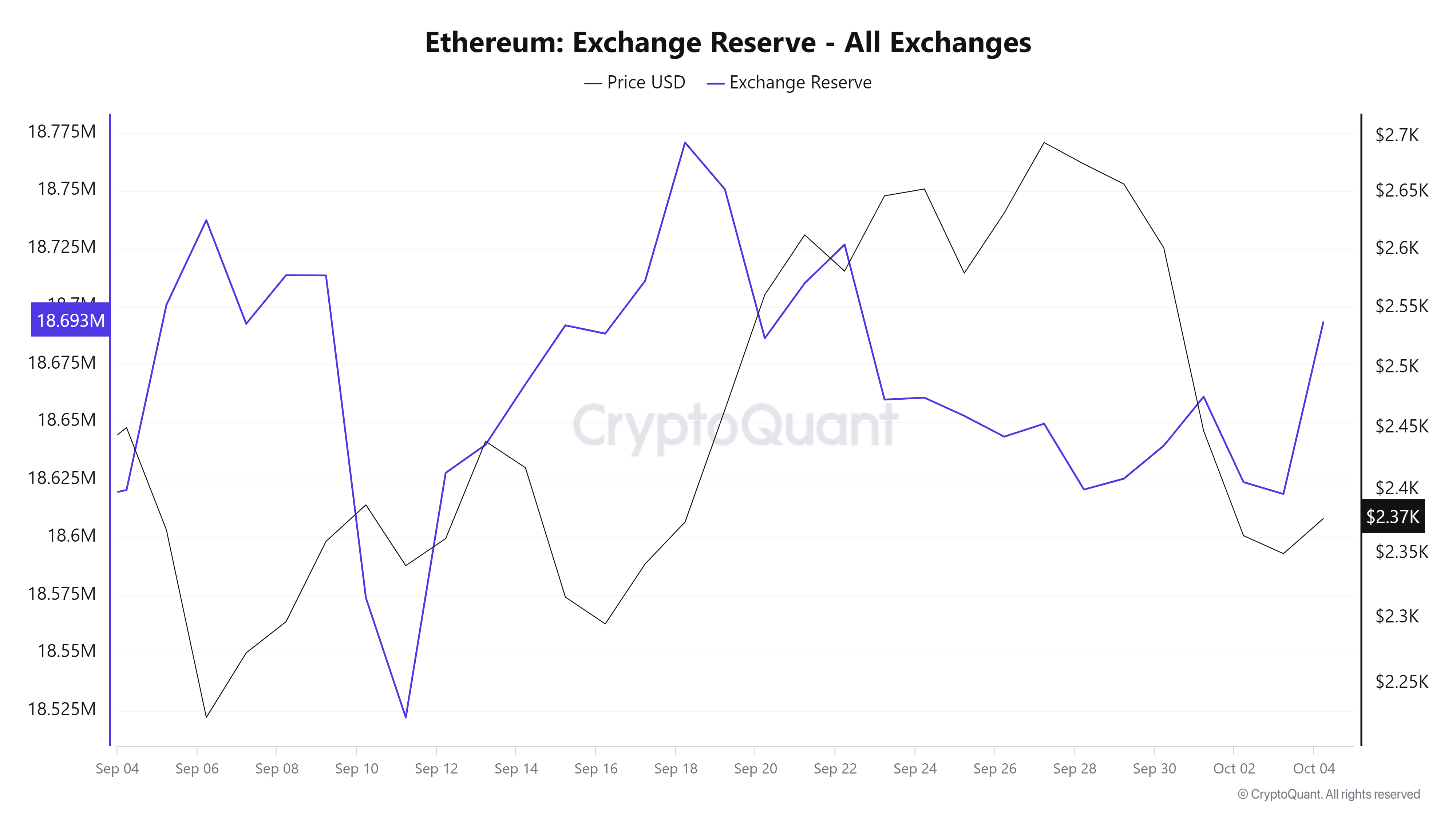

Clearly, the Ethereum whale has had a significant impact on ETH price action. This also affected investor confidence in a future recovery, as shown in the chart below.

Ethereum’s exchange reserves saw a sudden increase, with around 18.7 million ETH deposited on exchanges.

Source: CryptoQuant

This increase is a direct reflection of the fear that grips stakeholders following the sale of 19,000 ETH by the Ethereum whale.

Typically, extreme fear is necessary for an optimal “dip” buying opportunity. The slight 2% rise mentioned above, despite the significant sell-off, may well indicate this.

According to AMBCrypto, a more aggressive buyback could reverse the current trend by absorbing the selling pressure caused by the Ethereum whale. If that happens, it could pave the way for a market bottom, attracting buyers looking for lower prices.

Read Ethereum (ETH) Price Forecast 2024-2025

However, for this reversal to work, there must be extreme fear among investors. Without this fear, the chances of a lasting recovery diminish.

Therefore, in addition to the influence of the Ethereum whale, ETH could face a larger pullback before a significant rally occurs.