- The POPCAT breakout occurred thanks to appreciable trading volume

- Fibonacci Extension Levels Presented Next Targets

Starting September 25, Popcat (POPCAT) faced resistance near its July highs at the psychological level of $1. He crossed this level convincingly on October 3. In doing so, the bulls opened up clean air above them.

The memecoin set a new all-time high at $1.22, and further gains would lie in ATH territory. What are the next POPCAT course objectives?

Fibonacci Extension Levels Give Trading Targets

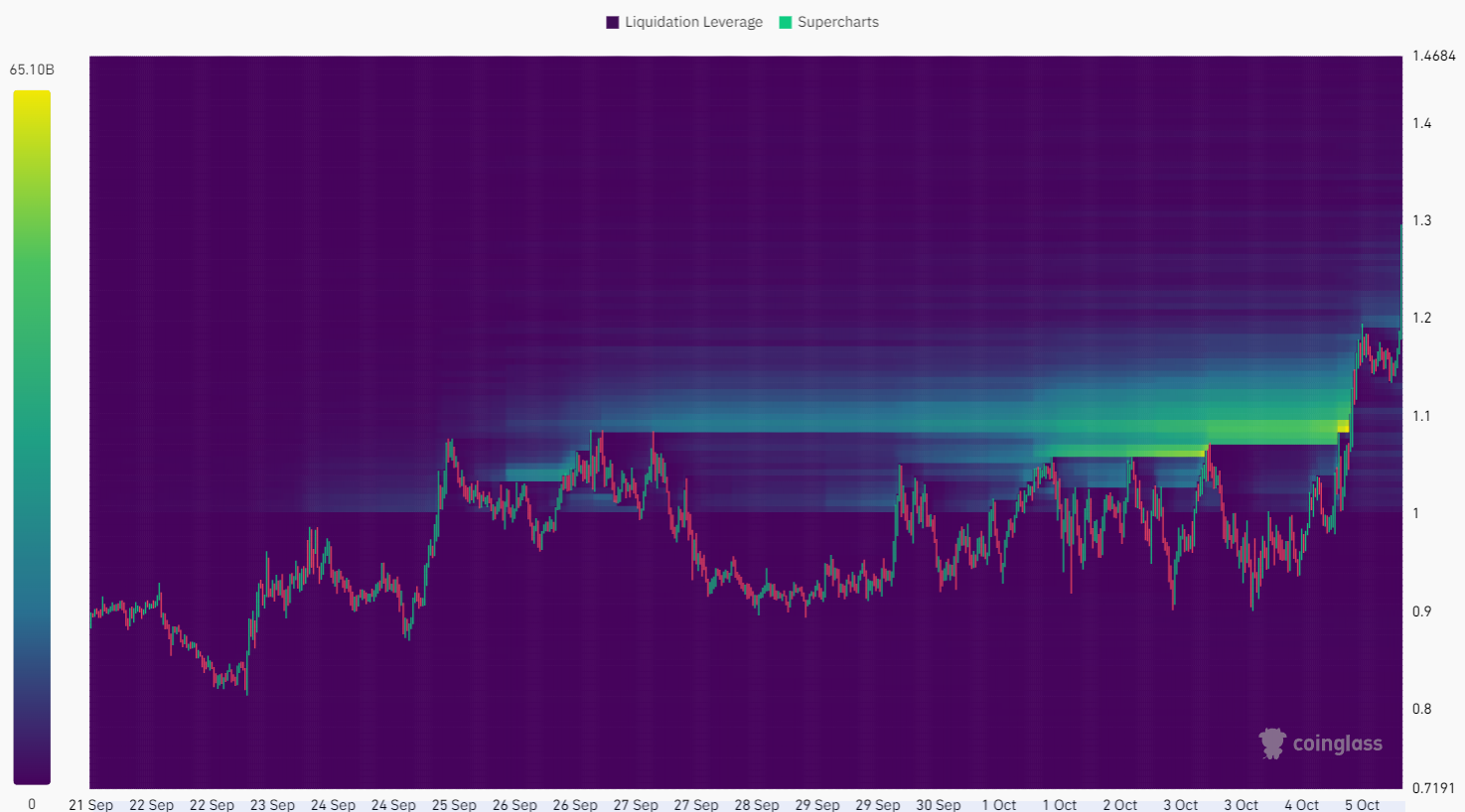

Source: POPCAT/USDT on TradingView

Investors with a high time horizon may want to hold on to their POPCAT bags for the next 6-8 months. The “sell in May, go away” statement, which generally applies to cryptocurrencies, would apply to them.

Fibonacci extension levels would be key for traders in the coming weeks. The price was already above the 23.6% extension level at $1.18. The next targets are $1.46 and $1.75.

OBV has yet to move above July’s resistance level – a sign that buying pressure is present, but not overwhelming. The MACD showed intense bullish momentum, with a crossover well above zero as well.

How Traders Can Use Liquidation Levels to Their Advantage

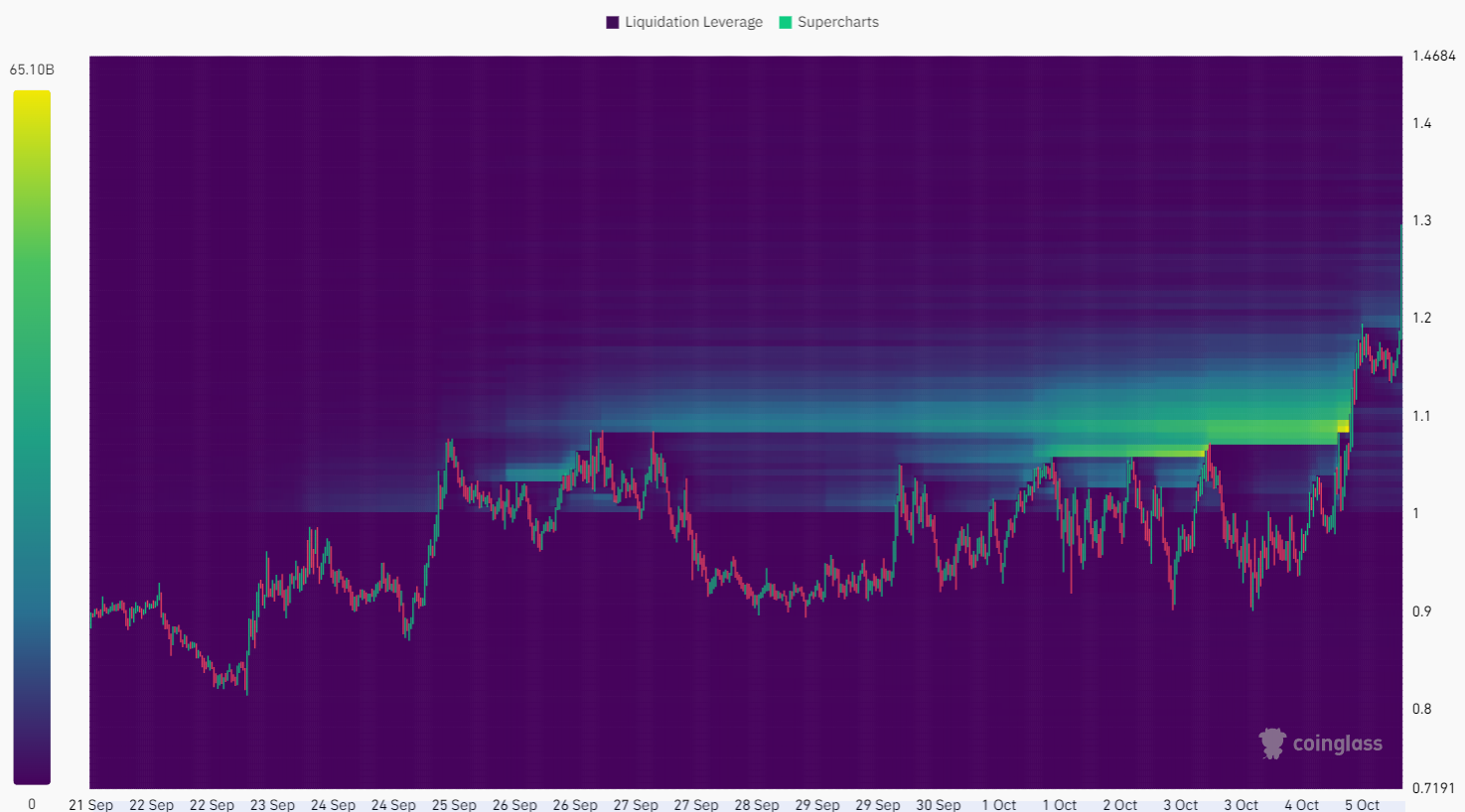

Source: Coinglass

The liquidity pocket around $1 to $1.1 has been swept away and the token has cleared this area as well. The scarcity of overhead liquidation levels means that there are no obvious upside targets based on liquidity levels.

Realistic or not, here is the market capitalization of POPCAT in terms of BTC

However, traders can monitor lower timeframe heatmaps to detect a buildup of liquidity levels below price, especially if POPCAT prices overextend upwards. At press time, there was a slight pocket of liquidity between $1.1 and $1.3 that could reverse if prices decline.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.