- INJ inflated to double digits following its Upbit listing

- Will the update help INJ break its downward trend?

On October 17, Injective (INJ) saw a sharp 16% surge immediately after Korea’s largest crypto exchange, Upbit, announcement its referencing on the platform. The token rose from $20 to $23, partly driven by a massive 112% increase in daily trading volume.

Source: Coinmarketcap

Although the pump has diminished slightly at the time of publication, the list is crucial considering the impact of the Upbit list on Cats in a World of Dogs (MEW).

For perspective, MEW launched in March and has been listed on several exchanges, including Bybit and OKX. However, Upbit’s listing in September sparked a wild ride for the cat-themed memecoin.

The explosive pump happened because the exchange is Korea’s largest crypto trading platform. Which begs the question: Will INJ follow MEW’s steps?

Will the upward trend continue?

It remains to be seen whether INJ’s bullish trend will continue post-listing. However, the price movement after the update was triggered by speculators in the futures market rather than the spot market.

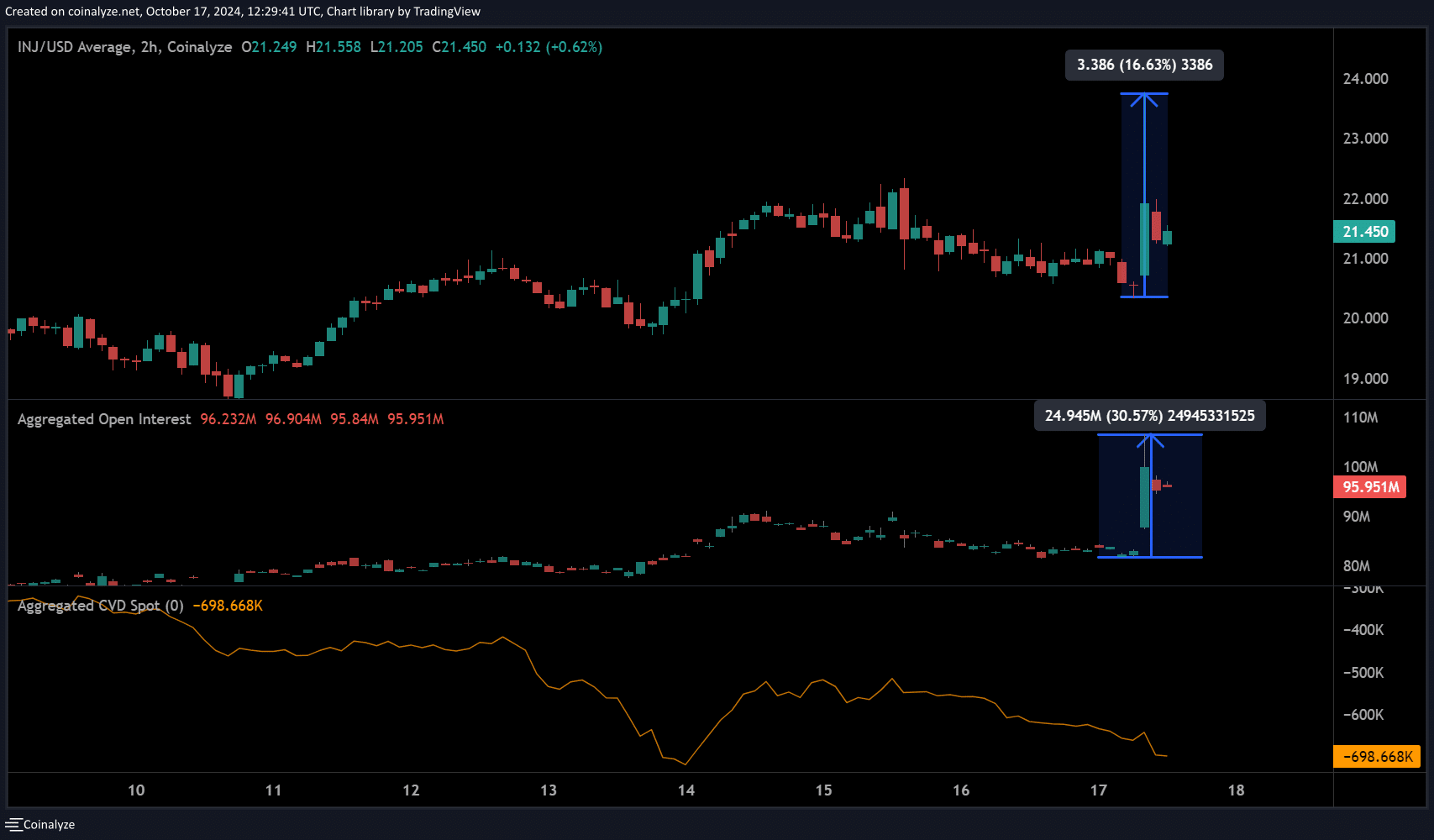

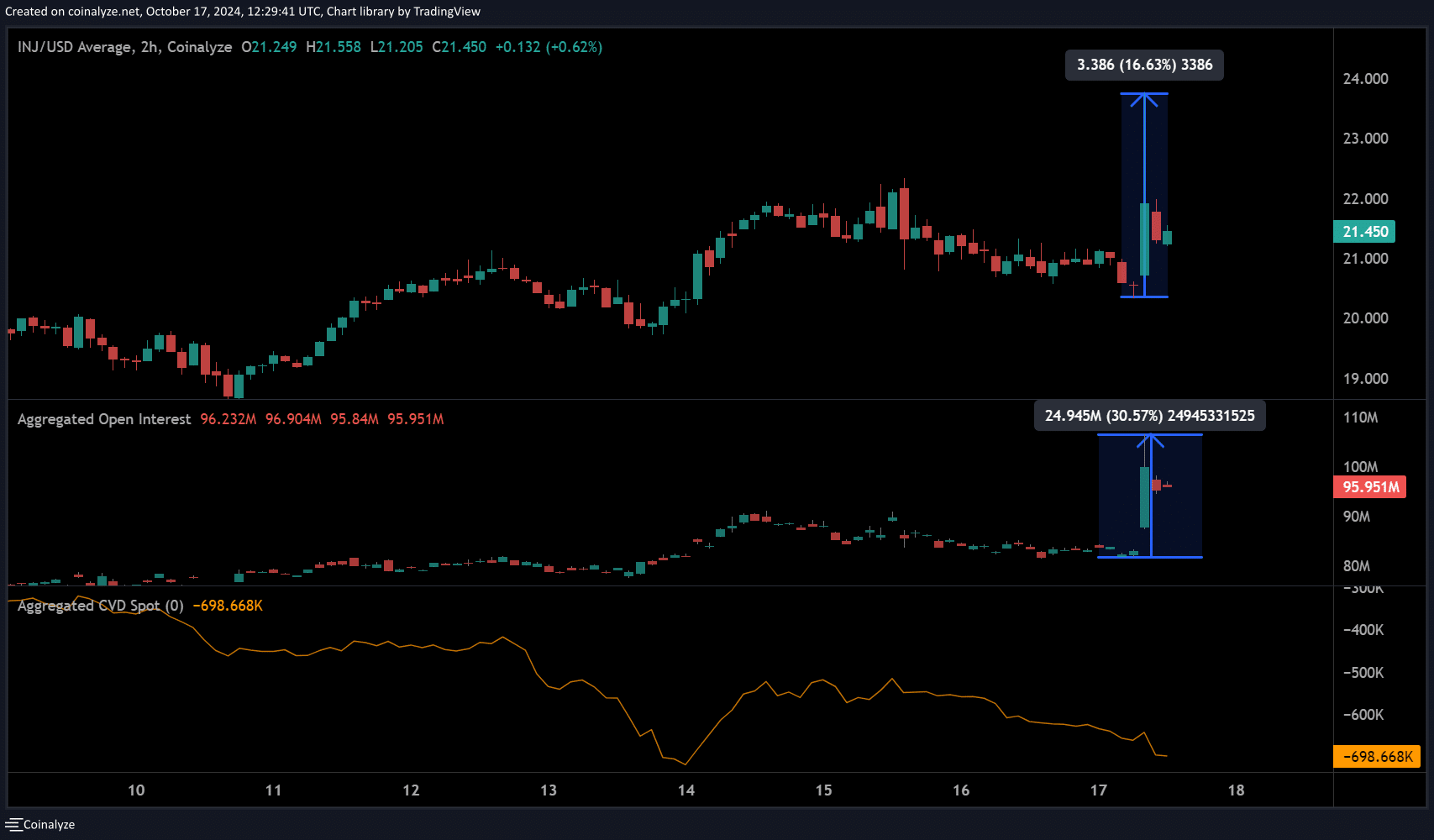

According to data from Coinalyze, the rally saw the addition of over 15 million INJ Open Interest on the Binance exchange.

This means that the explosive rally was led by leveraged traders while spot demand remained subdued, as shown by the low spot CVD (cumulative volume delta).

For context, CVD evaluates buying and selling volumes on exchanges, and the decline indicates that selling volume (sellers) was dominant.

Source: Coinalyse

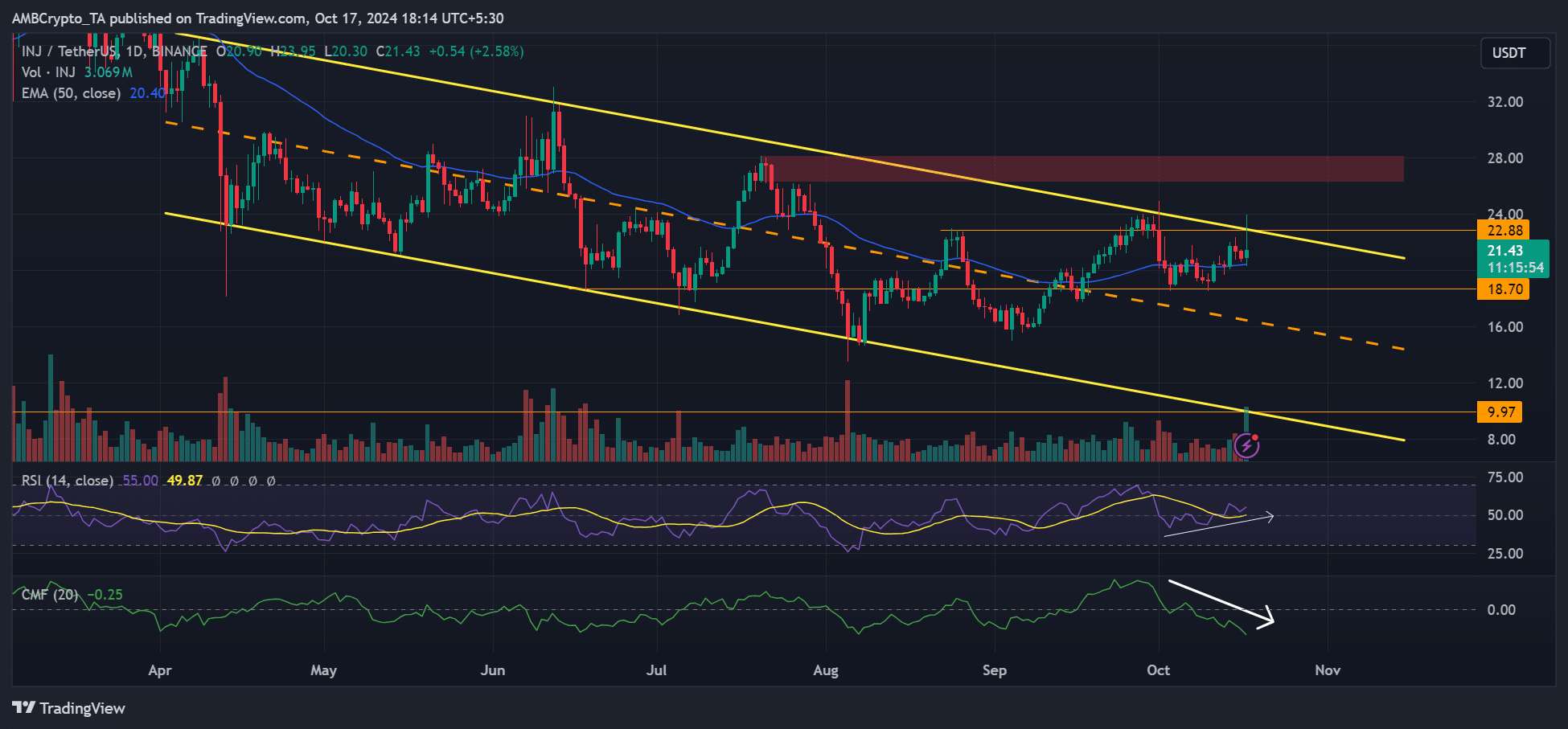

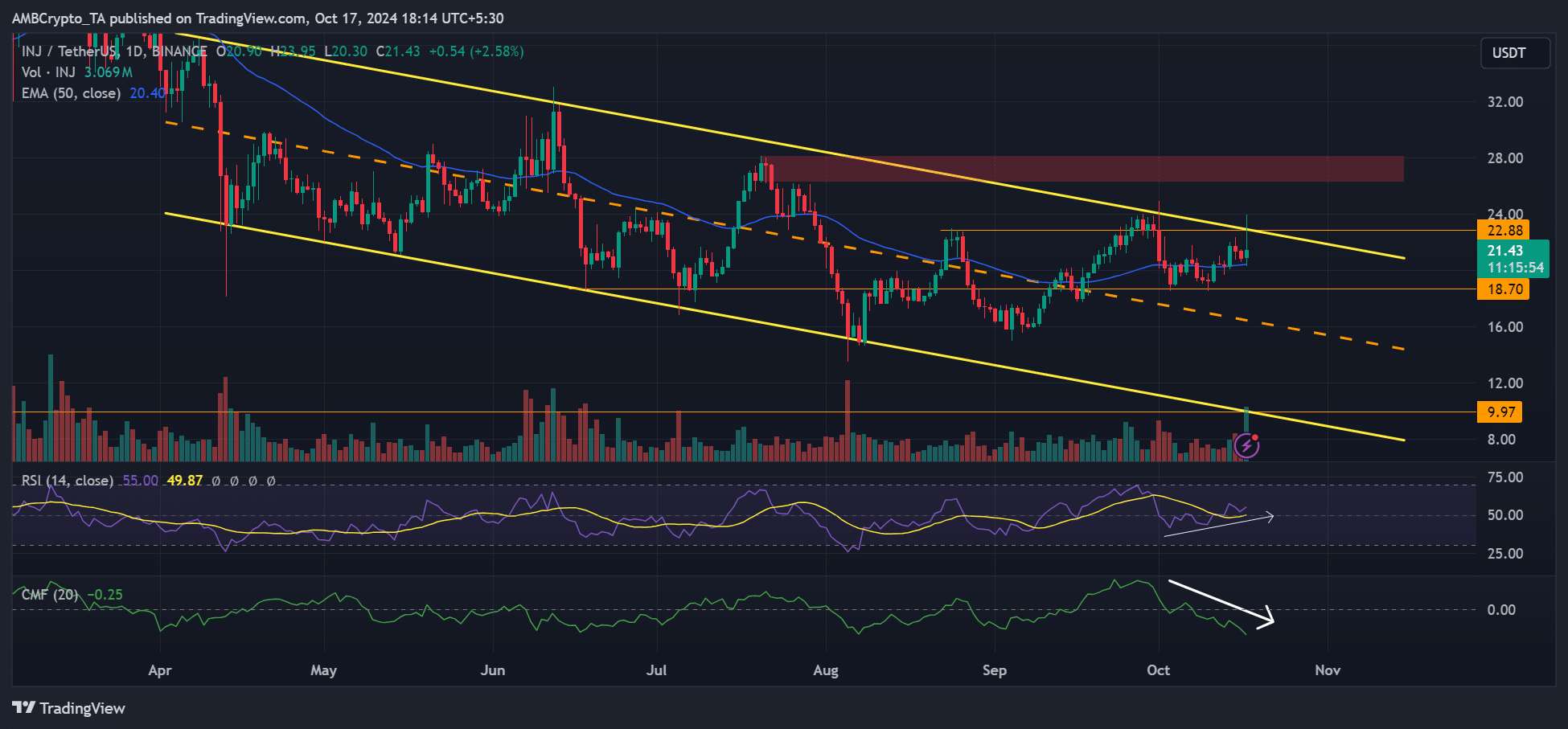

On the longer time frame charts, Thursday’s rise reinforced INJ’s bullish market structure. Especially since it recorded lows and highs in October.

The rally touched the high of the descending channel (yellow). However, the pump did not decisively break the downtrend structure.

Source: INJ/USDT, TradingView

Although INJ may face a breakout, it has been facing massive outflows from its market since late September. This was indicated by the southbound Chaikin Money Flow (CMF). Weak capital inflows could delay breakout prospects.

However, at press time, INJ defended the 50-day EMA as support and could attempt another move higher from the level. If so, $24 or $28 could be the next target, especially if the bullish momentum continues over the next few days.

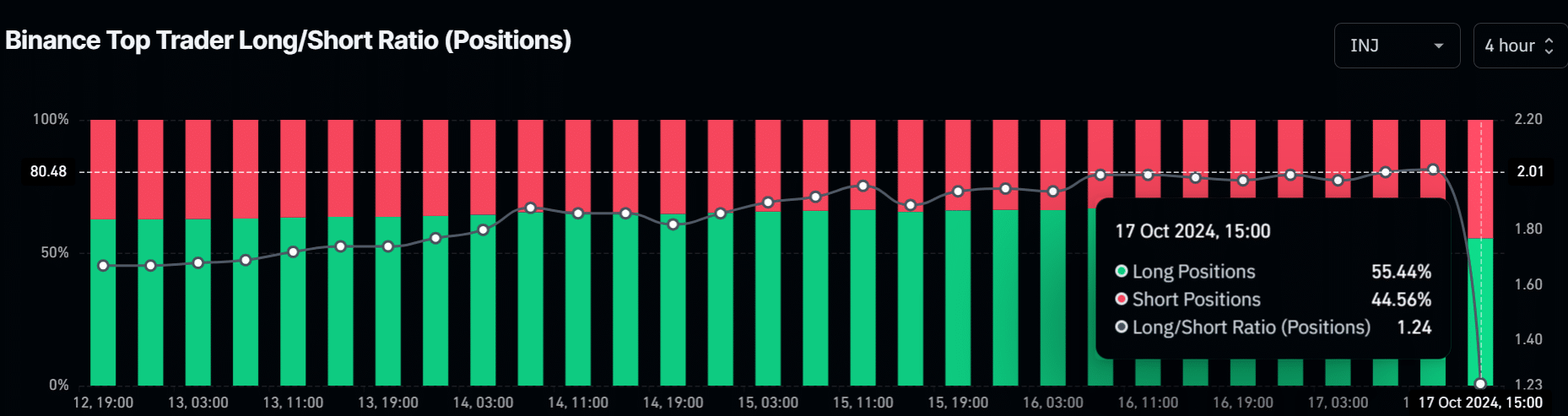

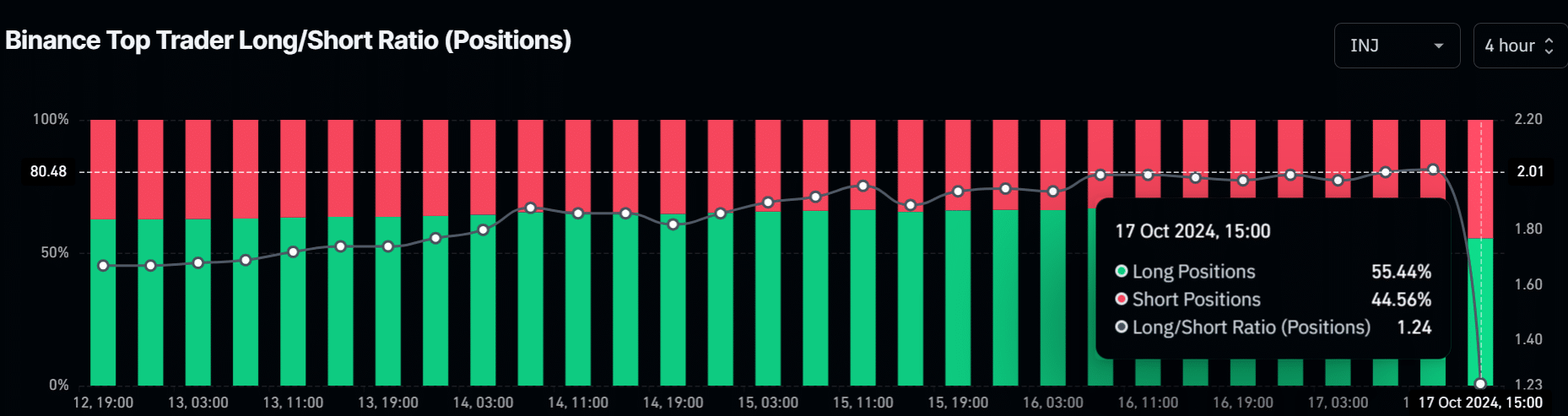

It’s worth noting, however, that smart money on Binance was net long the token, with 55% of positions betting on INJ’s price to rise.

Source: Coinglass