- BNB tested the $599.9 resistance but faces the risk of a double top formation.

- Momentum indicators suggest a potential breakout above $600.

Binance Coin (BNB) Washingtonis showing resilience as it approaches a critical level, trading at $597.2 with a slight decline of 0.08% at press time.

The main question for traders and investors is whether BNB can decisively break through the $600 resistance and trigger a stronger rally.

Let’s analyze the current price action, key technical levels and momentum indicators to understand if this breakout is possible.

Current BNB Price Structure: Are We Heading Up?

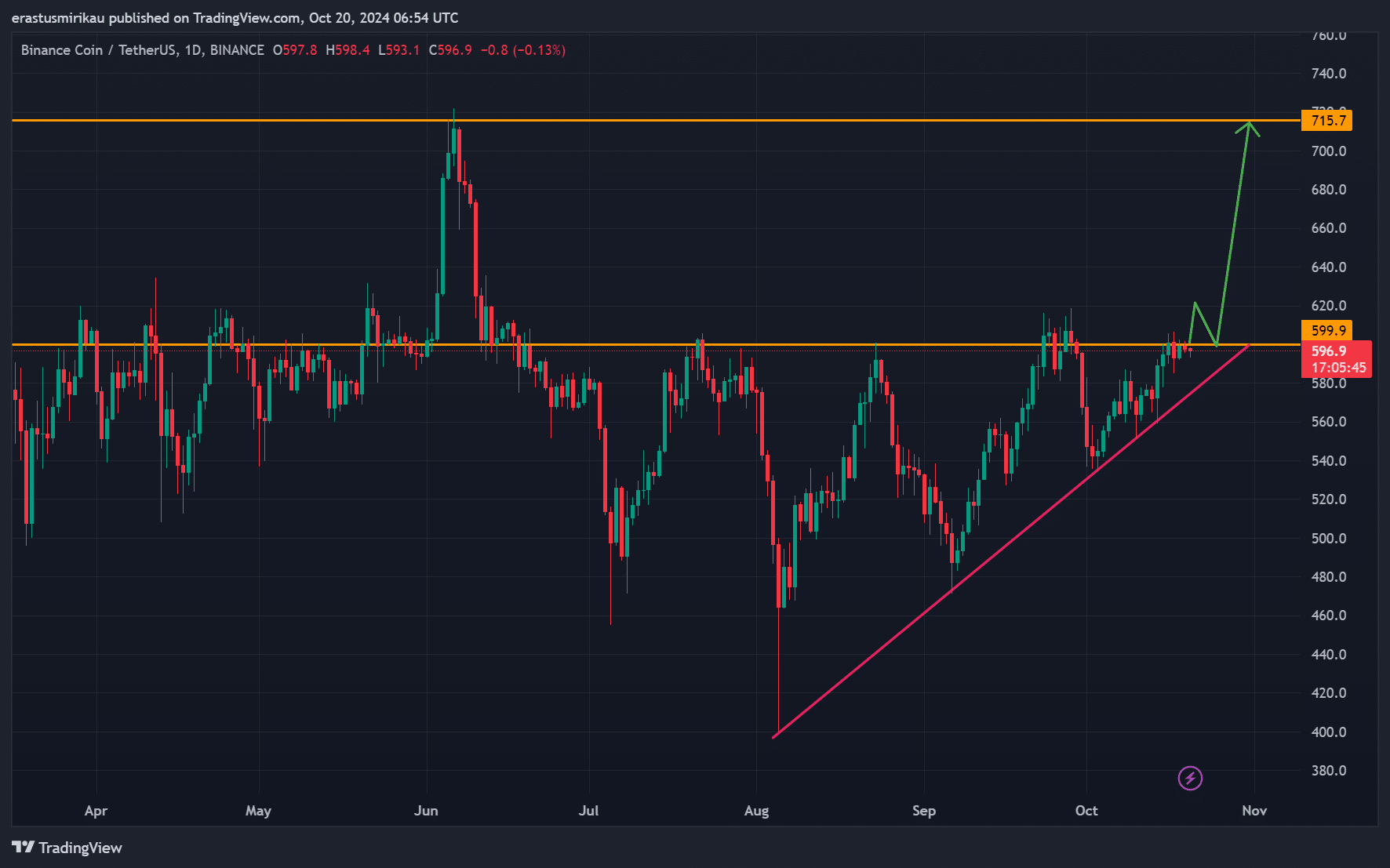

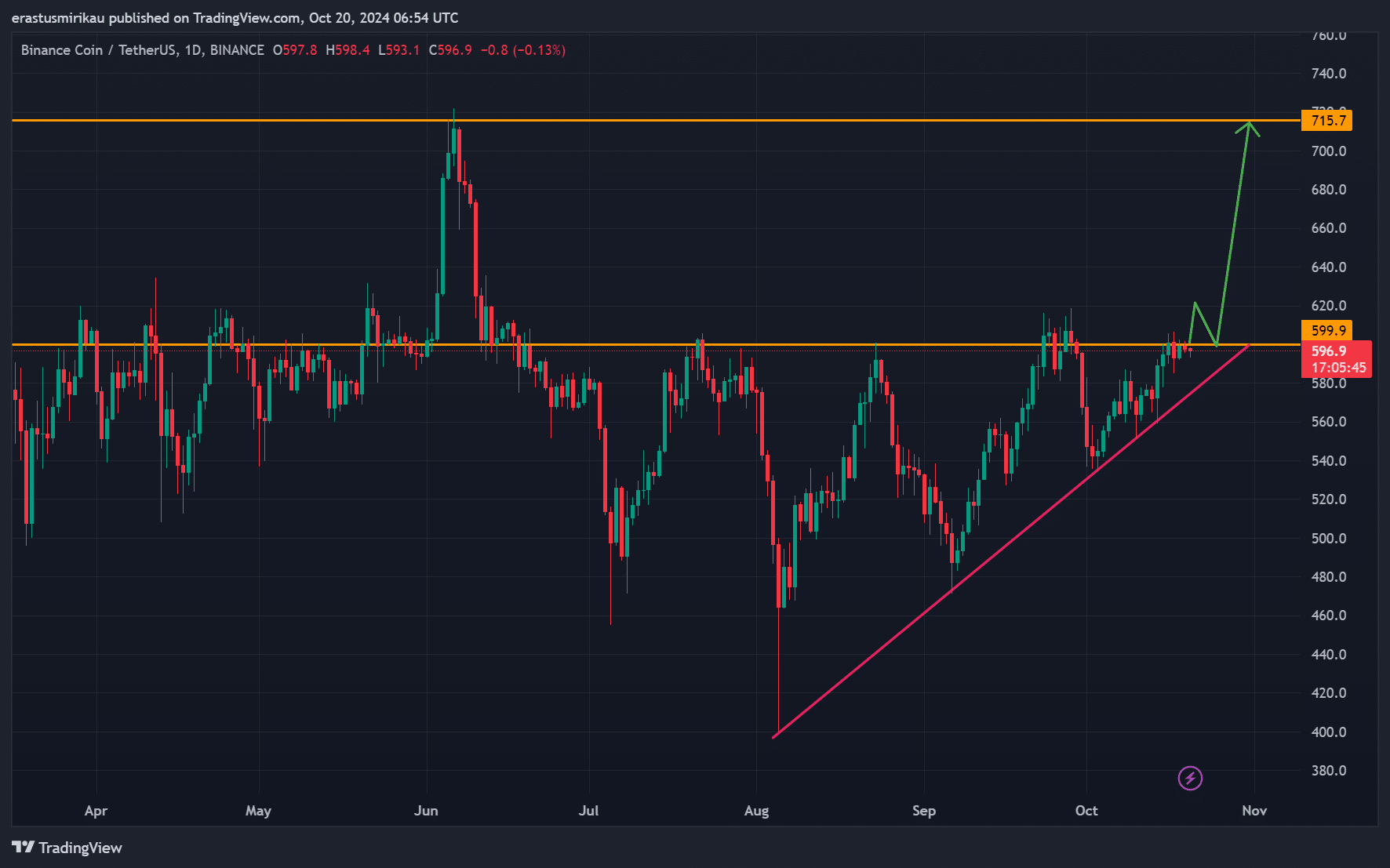

BNB has been trading in a range bound structure, hovering between $560 and $600 for several weeks. This follows a steady uptrend since August’s low of around $500, reflecting increasing buying pressure.

However, BNB faced repeated rejections around the $599.9 level. Despite this, there is growing optimism that BNB could break through this key resistance, potentially opening the door for a rally towards the $715.7 level seen in June.

Key Resistance and Support Levels to Watch

The $599.9 level remains the critical resistance, acting as a significant obstacle to further upside momentum. If BNB breaks this level with a strong close above $600, a rise towards $715.7 could follow.

Conversely, the $560 support level remains intact for now, providing a safety net in the event of a price pullback. Failing to hold on to $560 could result in a deeper decline towards the $500 mark.

A potential bearish signal to consider is the formation of the double top around the $599.9 resistance. This trend could indicate a trend reversal, and if BNB fails to break through higher, it could trigger a corrective move.

However, a strong break above $600 would invalidate this formation, creating a potential bullish extension.

Source: TradingView

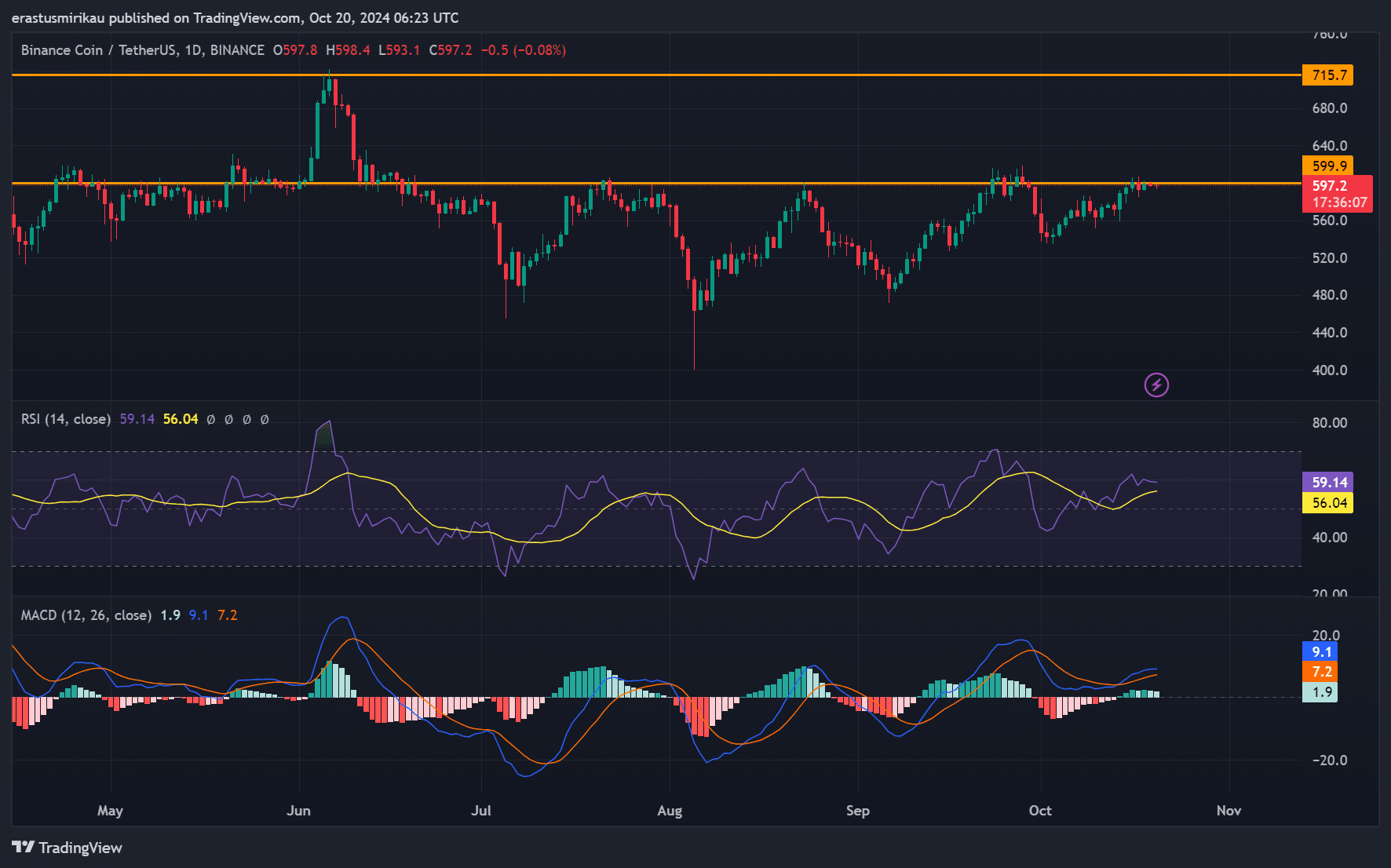

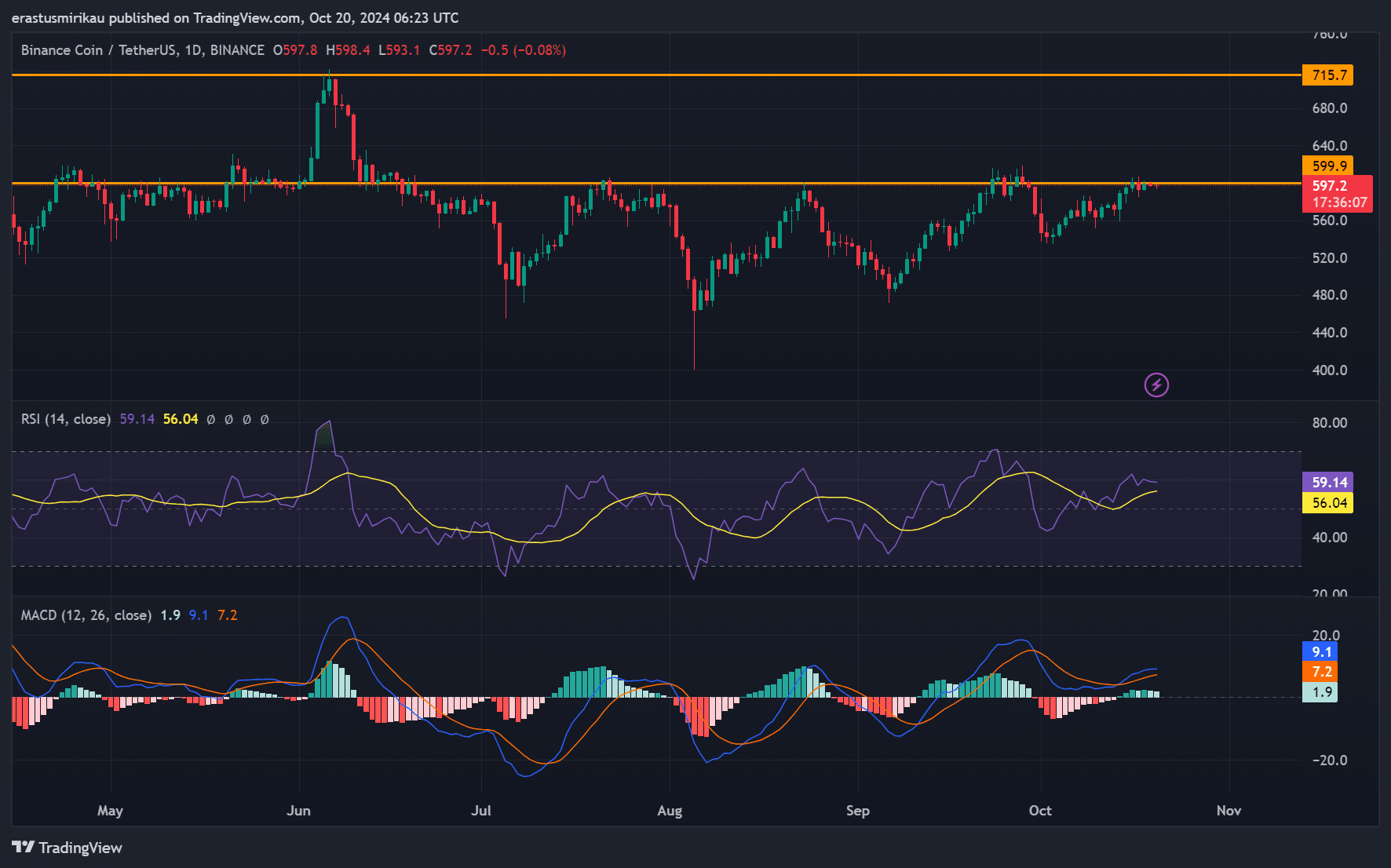

BNB Technical Indicators: RSI and MACD Featured

The Relative Strength Index (RSI) currently stands at 56, indicating neutral momentum with room for further upward movement.

Meanwhile, the MACD offered a bullish crossover as it was above the signal line at press time.

Therefore, both indicators suggest that bullish momentum is developing, increasing the likelihood of a potential breakout.

Source: TradingView

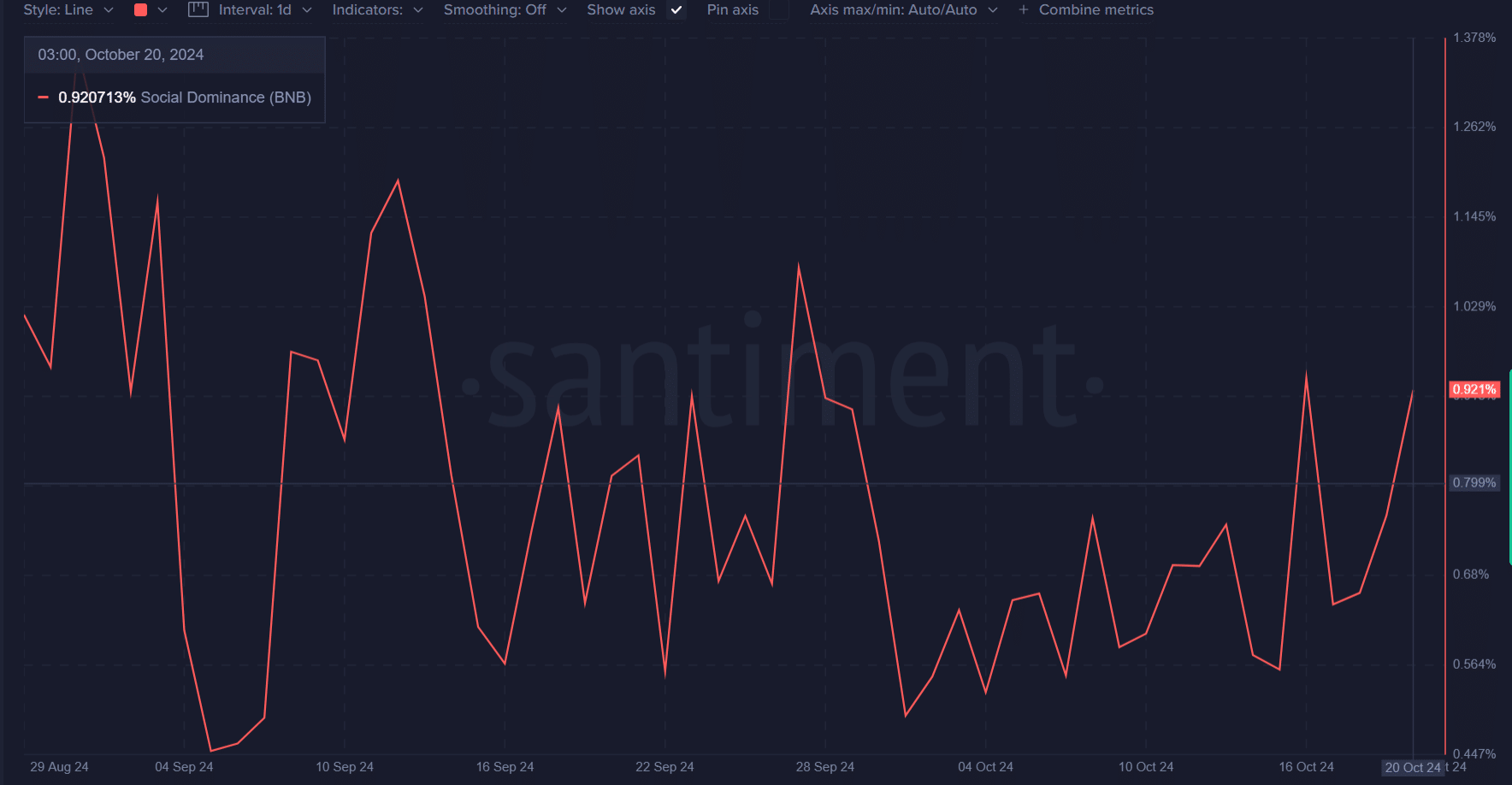

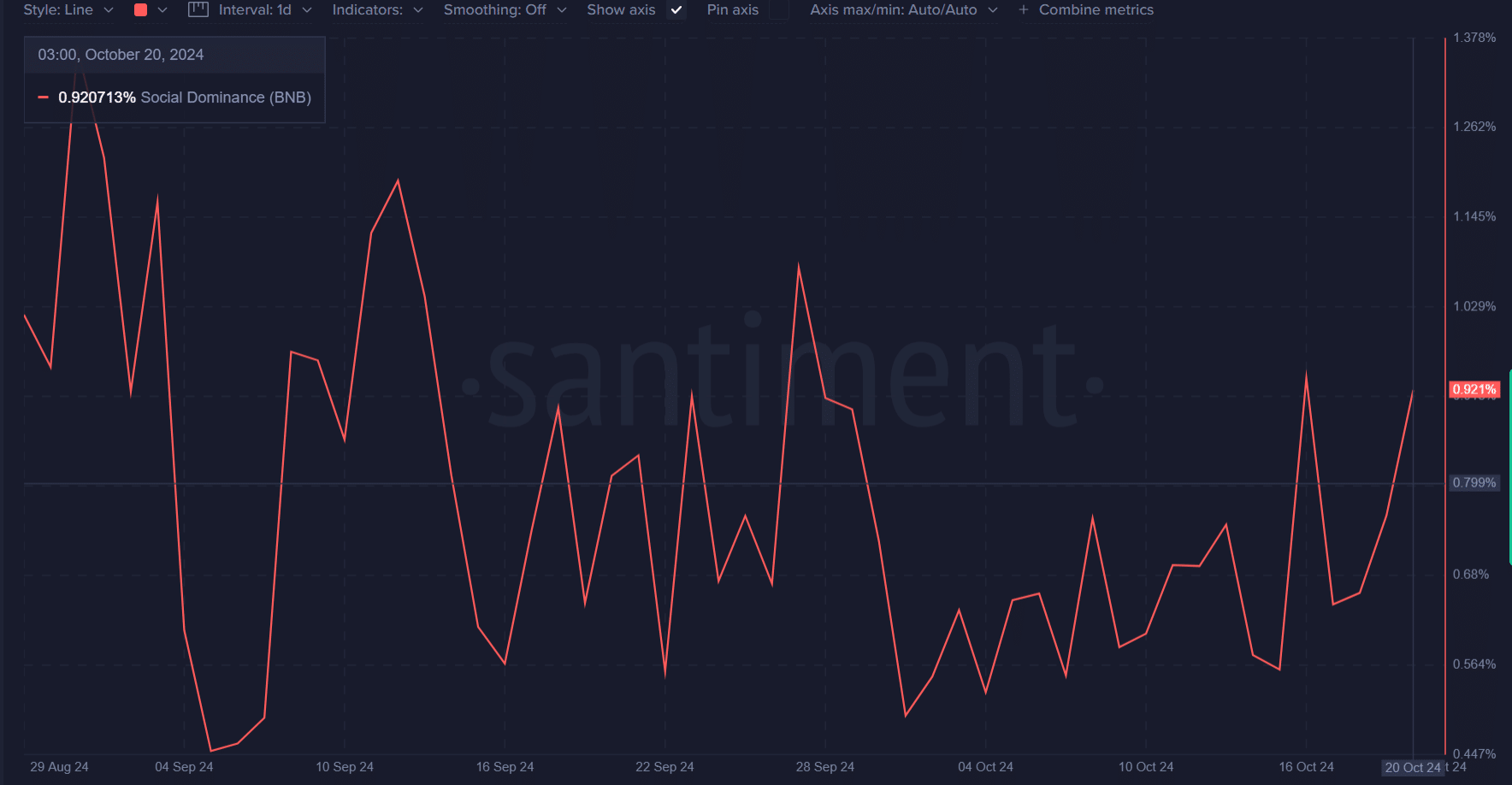

BNB’s social dominance: a bullish sign?

Additionally, BNB’s social dominance was on the rise at press time, at 0.92%. This increased attention could further fuel purchasing interest.

Historically, higher social dominance has often led to increased price volatility and, therefore, stronger price movements.

Source: Santiment

Read Binance Coin (BNB) Price Prediction 2024-2025

Is an escape imminent?

BNB finds itself at a pivotal moment. Although resistance at $599.9 remains a formidable obstacle, bullish technical indicators and growing social interest suggest a breakout could be on the horizon.

If BNB manages to close above $600, the next target would likely be $715.7. Therefore, traders should closely monitor price action in the coming days for a decisive move.