- Injective has consolidated above its 2021 all-time high.

- Injective’s near-term bubble risk looks good.

Injective (INJ) is showing signs of strength despite recent market fluctuations. Over the past month, INJ has seen minimal gains of just 0.39%, according to CoinMarketCap.

However, the data reveals a decline of almost 4% over the past seven days, following a further decline of 2.7% at the time of writing.

Despite this, Injective’s price action looks promising on the weekly charts as it consolidates above its previous all-time high of 2021.

If INJ manages to expand to the $35 mark while maintaining its position above this crucial support, it could confirm a short-term uptrend, restoring confidence to investors.

Source: TradingView

INJ has the potential to achieve higher price targets, especially if it sustains above the key $21.60 level.

Enthusiasts remain bullish on INJ, believing that it could outperform the market over the coming year.

Although 2024 hasn’t been the best for INJ so far, many are predicting a long-term rally, with some projecting a target of $100 or more.

The price contraction observed over a 4-hour period is approaching a decision zone.

A strong rebound from this resistance level could trigger a 20-30% move in the short term, setting the stage for a parabolic rise by 2025.

Valuation and risk of INJ

When comparing Injective’s valuation to Bitcoin (INJ/BTC), the coin has seen a decline but now forms a potential recovery pattern.

A double bottom formation has broken to the upside and the price is now in a retesting phase.

If INJ/BTC manages to regain control and maintain its momentum, it could signal a bullish rally.

However, if it breaks below the 2021 high and invalidates the double bottom trend, a decline could occur before any potential rebound.

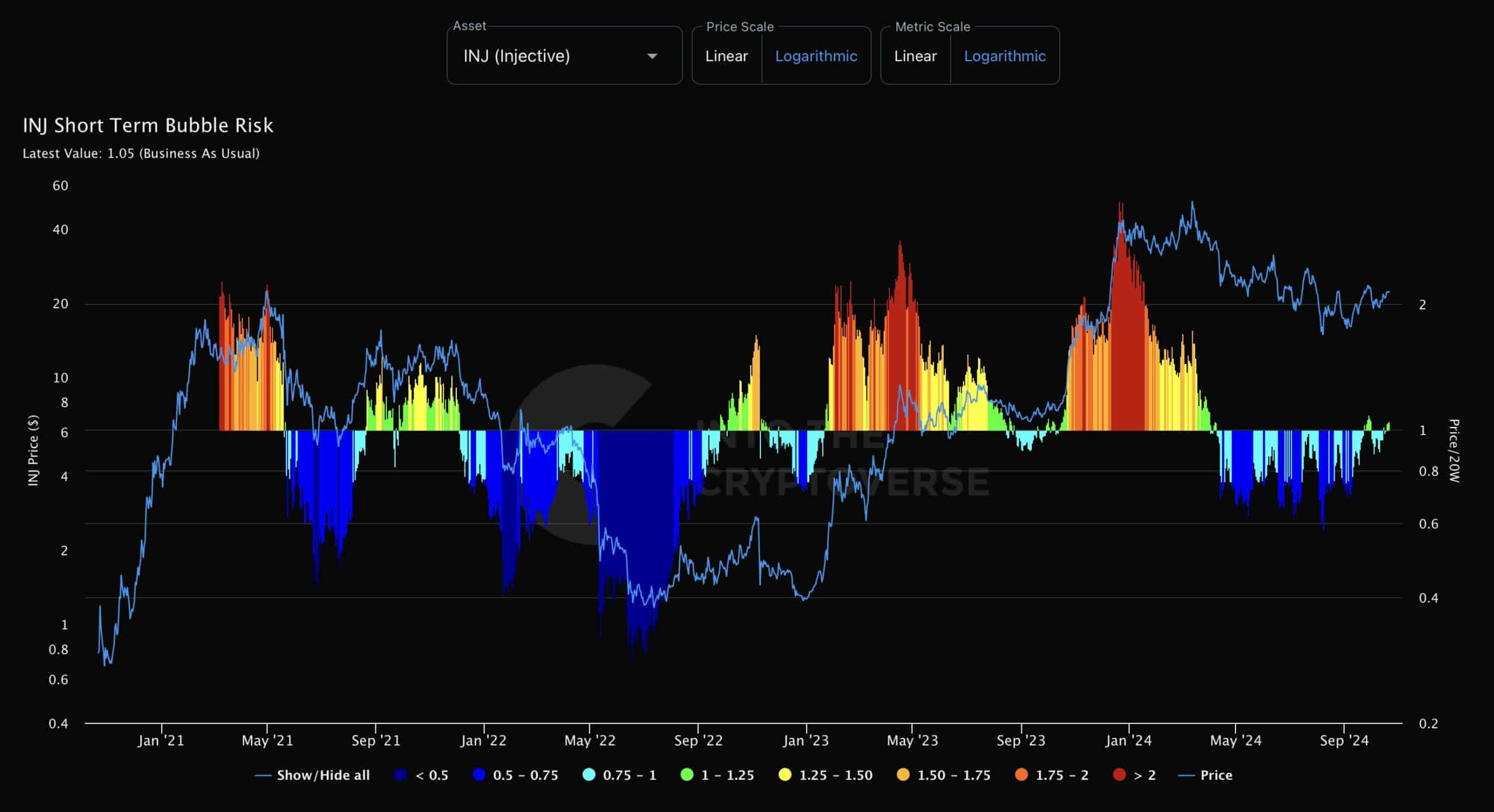

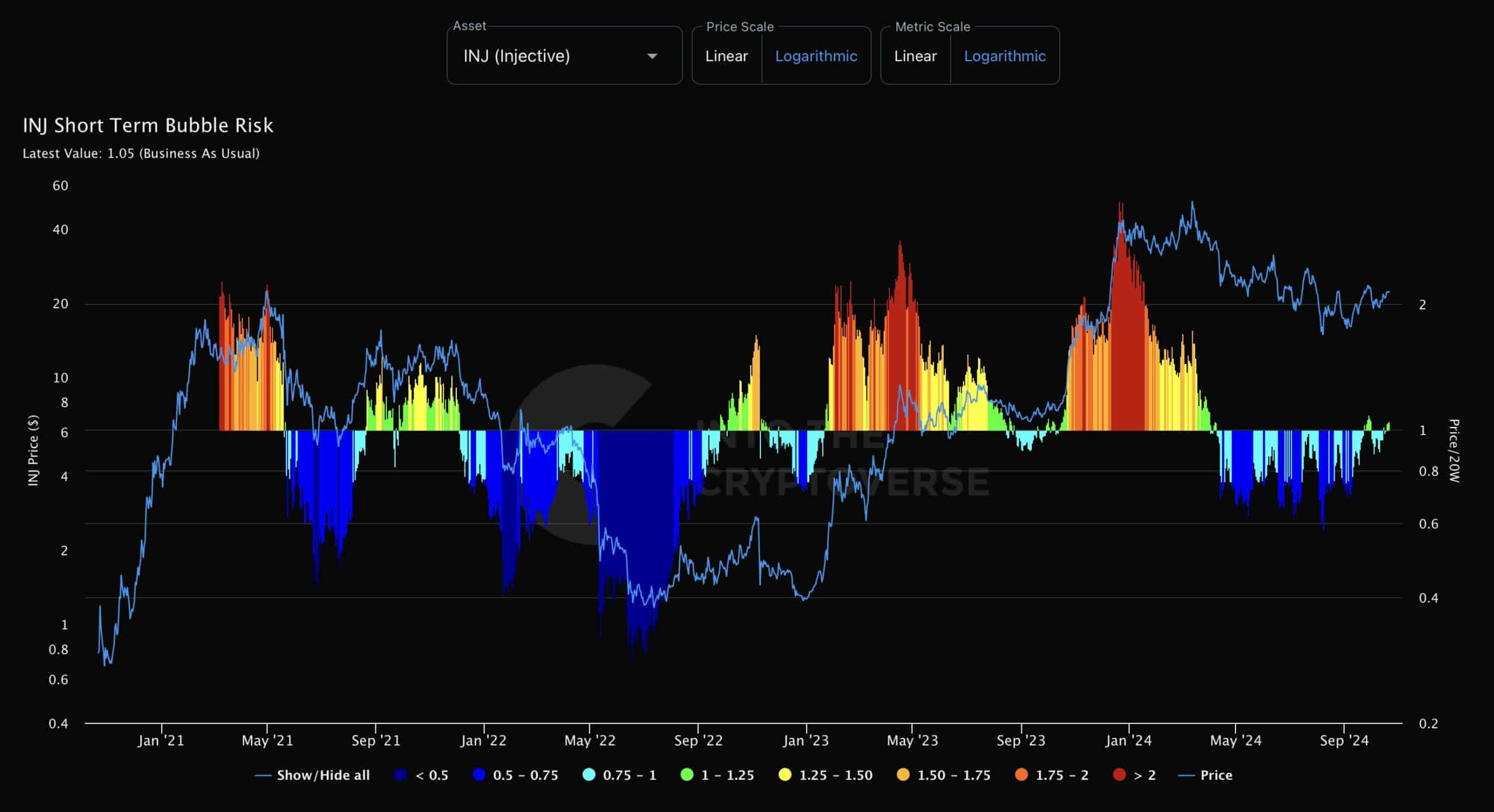

Source: In the cryptoverse

Also worth noting is Injective’s Short-Term Bubble Risk Indicator.

This metric gauges market sentiment and currently, the reading is 1.05, indicating that market sentiment remains stable.

This adds confidence to traders considering long positions, as current price action suggests potential gains.

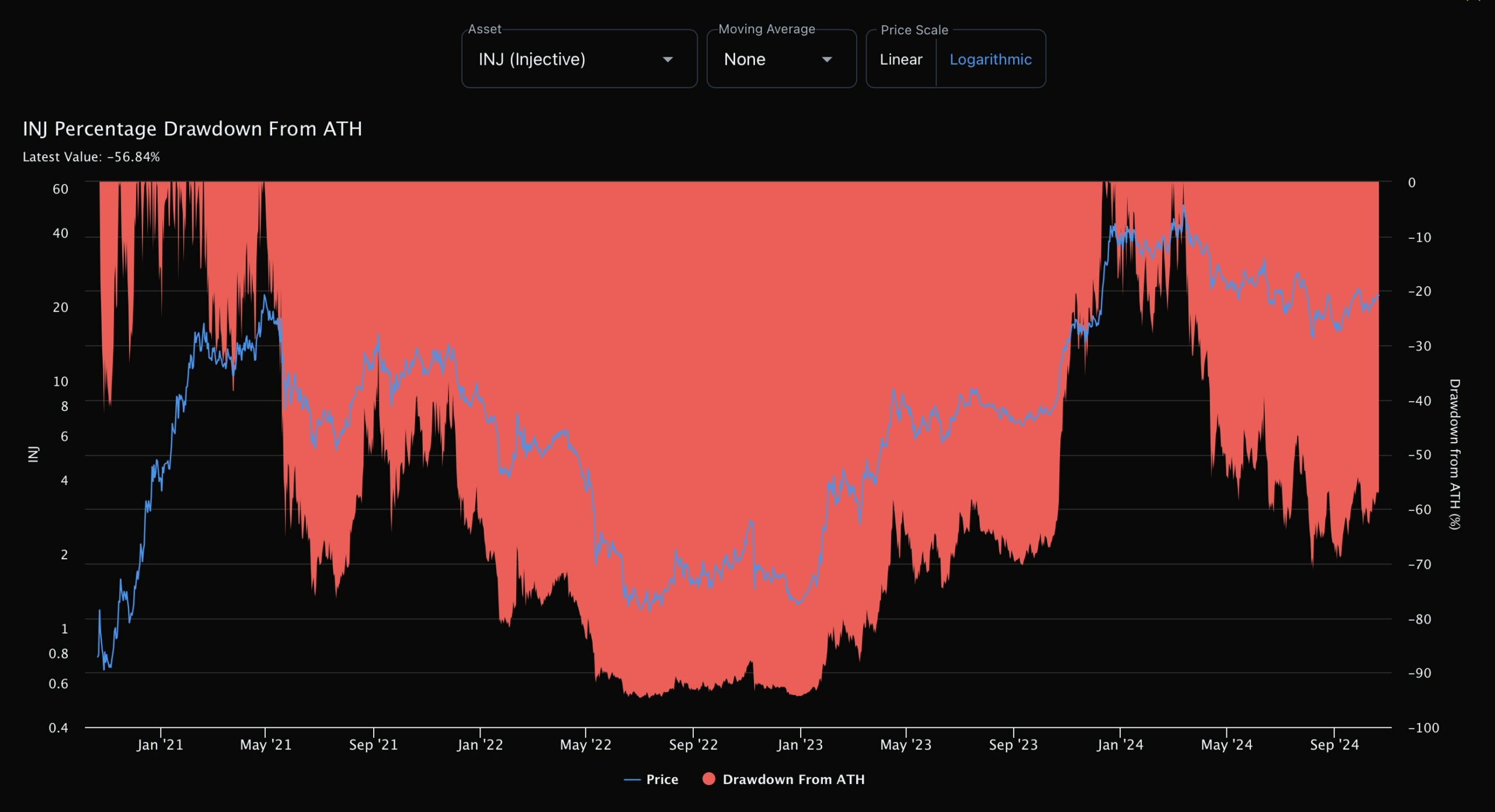

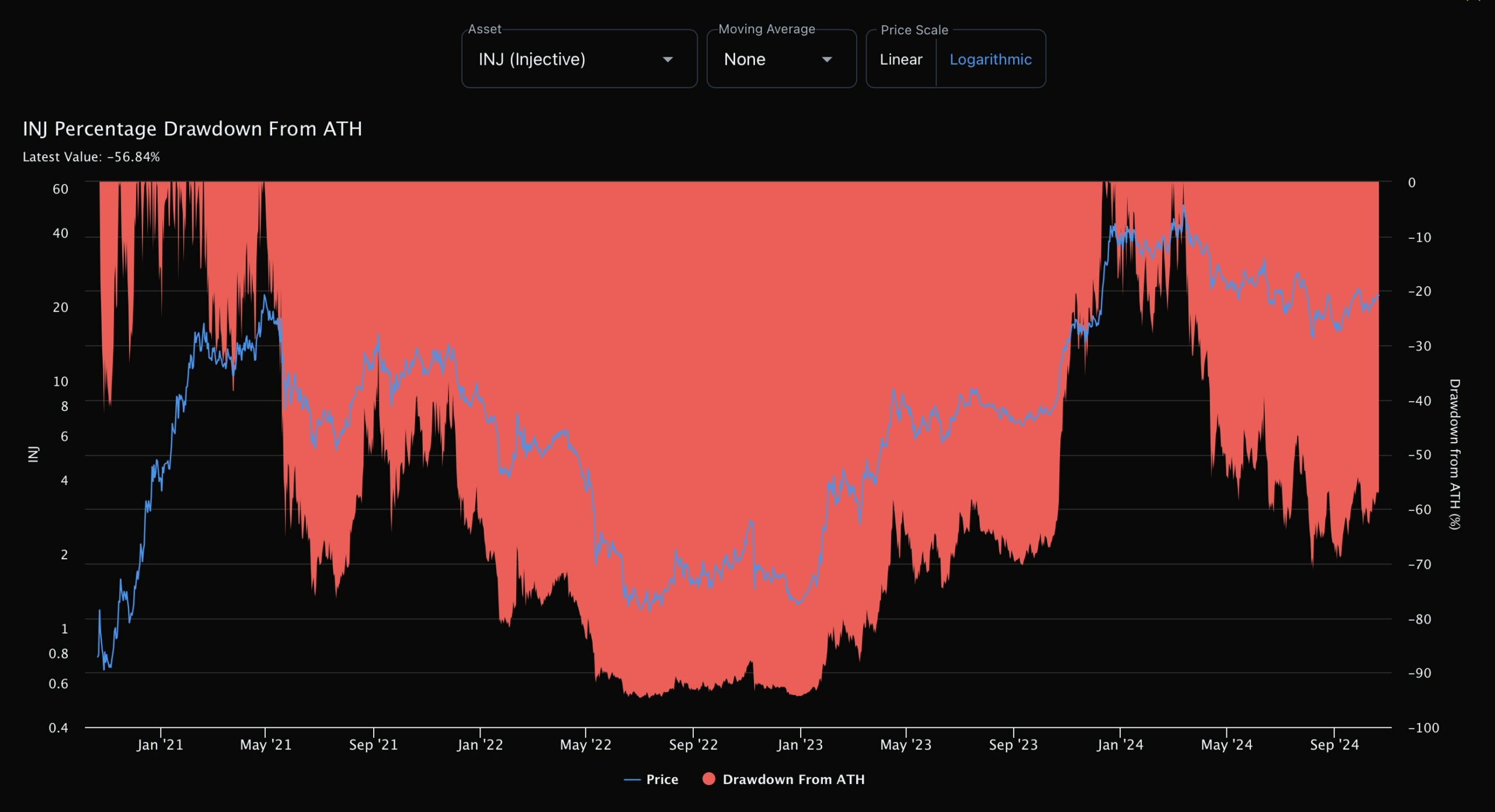

ATH Reduction Percentage

Finally, the percentage decline from INJ’s all-time high is approximately 56%, providing long-term holders the opportunity to anticipate a recovery.

However, given the unpredictable nature of the market, these gains are not guaranteed.

Source: In the cryptoverse

Read Injective (INJ) Price Prediction 2024-2025

As Bitcoin approaches the $70,000 mark, it could spark a broader uptrend in the crypto market, including INJ.

For now, it seems likely that Injective will hold above its 2021 high and continue to rally, although traders should remain cautious and closely monitor key levels to find entry points and optimal output.