- Bitcoin dominance likely needs to reach between 62% and 70% for an altcoin season to begin.

- However, other issues related to various measures also require attention.

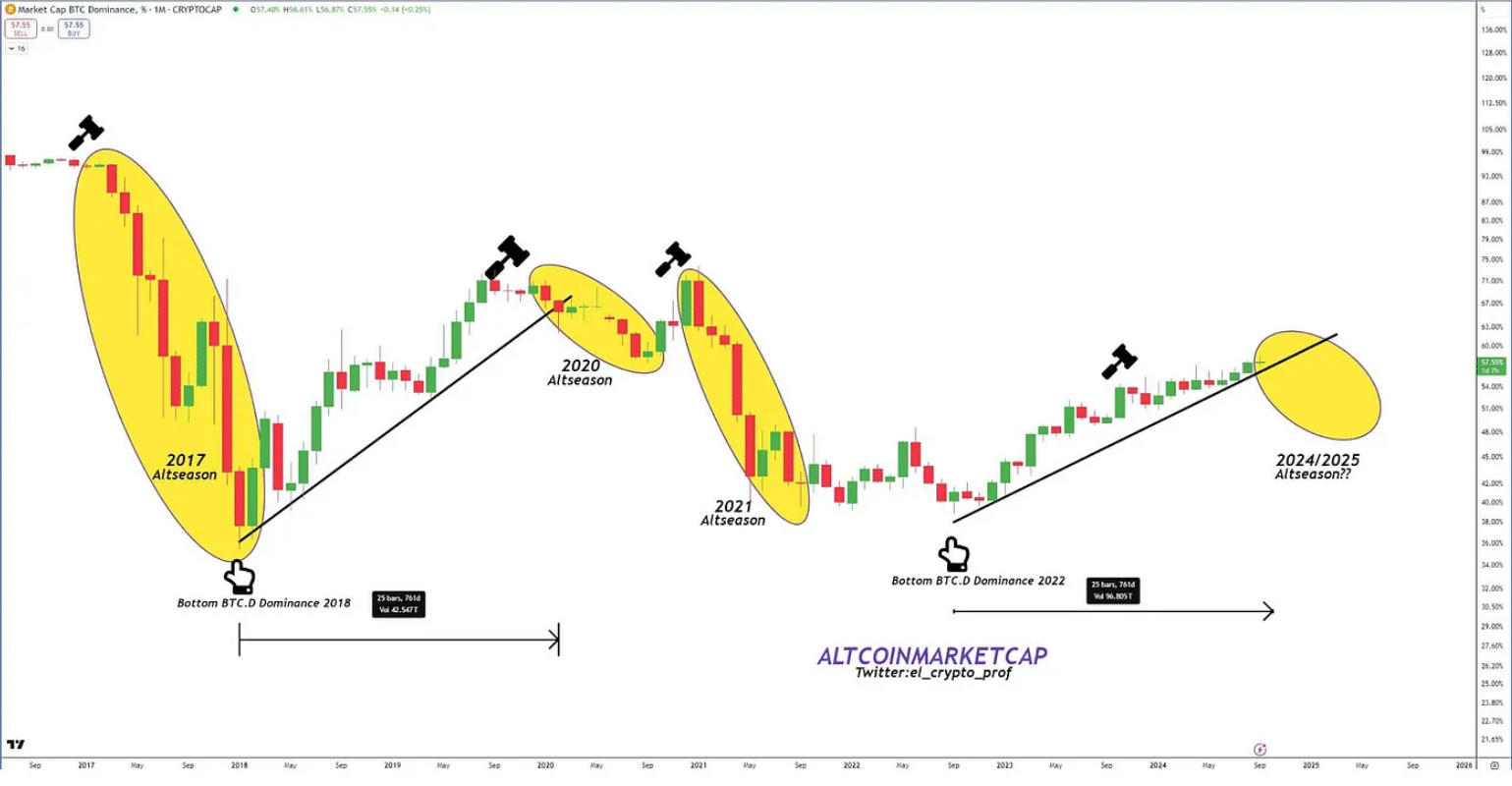

Market sentiment was generally bearish for altcoins in the third quarter, with Bitcoin (BTC) dominance reaching around 57%, recording a new all-time high. Altcoin Season Hint currently reading 35, having reached its lowest point in mid-August.

Generally, altcoins tend to do well after peaks of Bitcoin dominance. As Bitcoin gains market share early in a cycle, capital often shifts to altcoins once BTC’s dominance begins to fade. This cycle benefits altcoins as investors seek riskier, higher-reward assets.

Statistically speaking, Bitcoin’s market capitalization is expected to grow by around $280 billion to be in the 62-70% range and enable the start of an altcoin season. This growth is likely to occur when BTC hits $80,000, among other metrics.

Strong Bitcoin dominance is crucial

Over time, Bitcoin’s dominance declined significantly, from 90% in 2013 – when the market was still in its infancy – to a low of 39% in 2021, as altcoins began to gain traction.

Source:X

Notably, each altcoin season has been driven by specific catalysts, like the launch of new cryptocurrencies, technological innovations like ERC-20 tokens, and broader trends like DeFi and NFTs.

This suggests that beyond Bitcoin’s market share, individual altcoin contributions will also play a critical role in sparking the next altcoin season.

Currently, altcoin market positions are too limited to conduct a season independently, as altcoin losses often depend on Bitcoin returns for stability. For a change to occur, Bitcoin will likely need to lead with an initial rise.

This trend suggests that Bitcoin price may need to exceed $80,000 to achieve BTC dominance above 65%, which could trigger large capital inflows into the altcoin market.

Need a high risk appetite

In a recent reportAMBCrypto highlighted an emerging shift in the altcoin market, calling on Ethereum developers to take strategic steps to counter growing competition.

Internally, this requires careful evaluation, while externally, Bitcoin’s appeal suffers from a growing risk deficit, indirectly preventing altcoins from receiving their due momentum.

Source: xe.com

As gold prices reach new highs, driven by interest rate cuts and geopolitical tensions, Bitcoin’s stagnant performance highlights the market’s limited risk appetite for crypto.

Historically, an upward trend in the BTC/Gold ratio has been aligned with the altcoin season. Therefore, the current decline in risk appetite is having a negative impact on the altcoin’s performance, indicating that an increase in the BTC/Gold ratio could serve as a signal for more favorable conditions to come.

In short, as BTC suffers a pullback, the decline in the BTC/Gold ratio reflects a shift by investors toward assets perceived as safe havens, undermining Bitcoin’s appeal as a long-term store of value.

This migration highlights the importance of market confidence in BTC’s role as “digital gold” in supporting a broader altcoin rally – one likely to stabilize once BTC approaches the 80 mark 000 $.

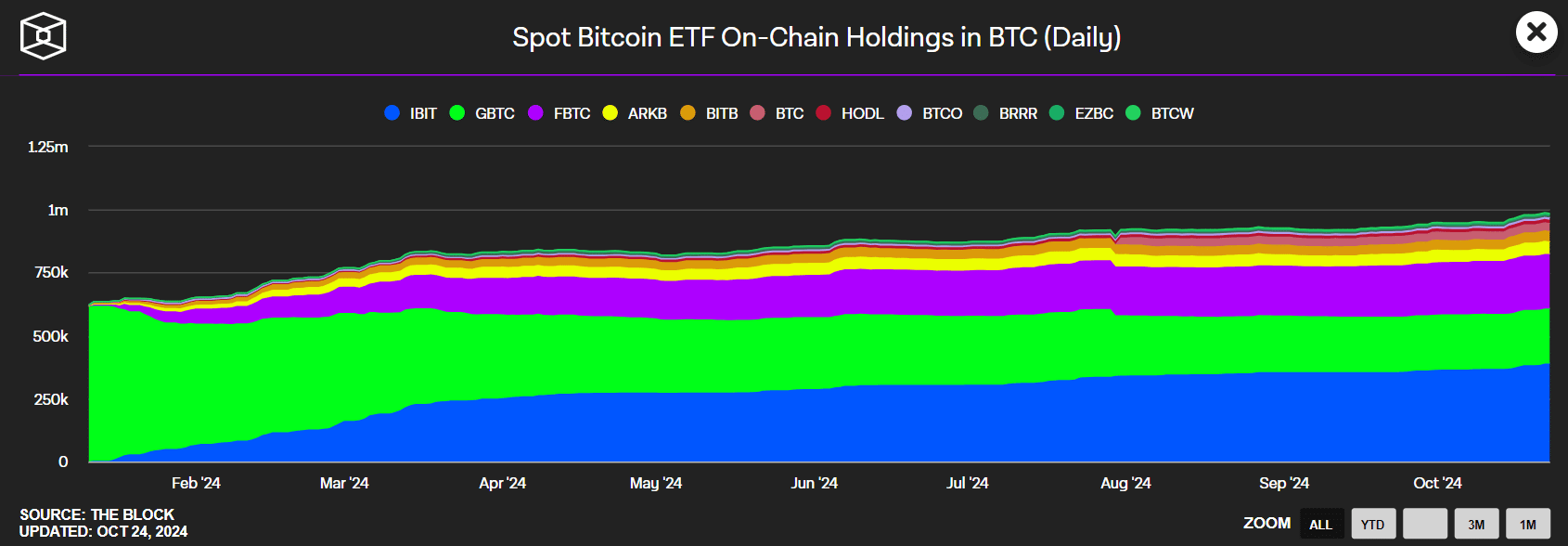

A dynamic less driven by ETFs

Another factor is the relationship between the Bitcoin price surge and ETFs. Although ETF-driven rallies are generally positive, the impact on altcoins can vary. The ETF market saw significant growth in 2024.

Source: The Block

However, when ETFs lead market dynamics, funds tend to stay in Bitcoin or Ether rather than moving into altcoins, as traditional investors often have limited direct access to them. Instead, capital is likely to flow into crypto-related stocks.

Read Bitcoin (BTC) Price Prediction 2024-25

As a result, a mix of internal and external factors continues to delay the start of the altcoin season, which remains closely linked to Bitcoin price action.

For altcoin season to materialize, Bitcoin will likely need to surpass $80,000, a threshold that, given current momentum, may be difficult to reach by the end of the fourth quarter.