- TON has decreased by 14.64% over the past month.

- Market fundamentals indicated a shift in market sentiment from bearish to bullish.

Over the past month, the crypto market has seen a surge, with Bitcoin (BTC) hitting a local high of $69,000.

However, over the past week the market has cooled and most cryptocurrencies have turned negative. Thus, recent losses have started to exceed monthly gains.

One of the worst-hit altcoins was Toncoin (TON). Since hitting a monthly high of $5.8, TON has seen a significant decline.

In fact, at the time of writing, Toncoin was trading at $4.95. This represents a decline of 2.42% over the past day.

Likewise, the altcoin fell by 14.64% on a monthly basis, with this downtrend extending by 6.06% on the weekly charts.

Notably, current market conditions have left the crypto community deliberating over the trajectory of the altcoin.

One of them is famous crypto analyst Ali Martinez, who suggested that TON’s current conditions signal a buying opportunity.

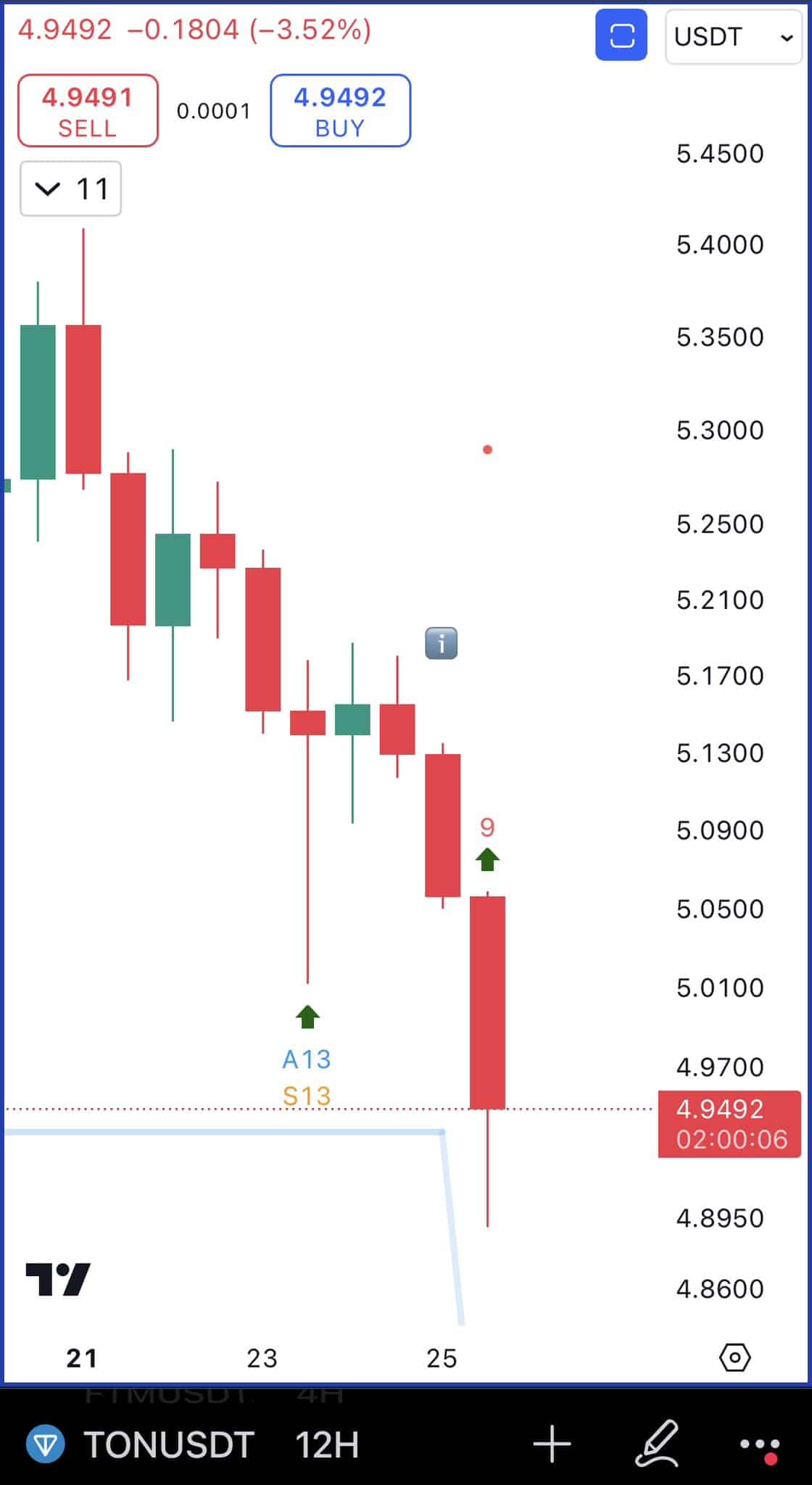

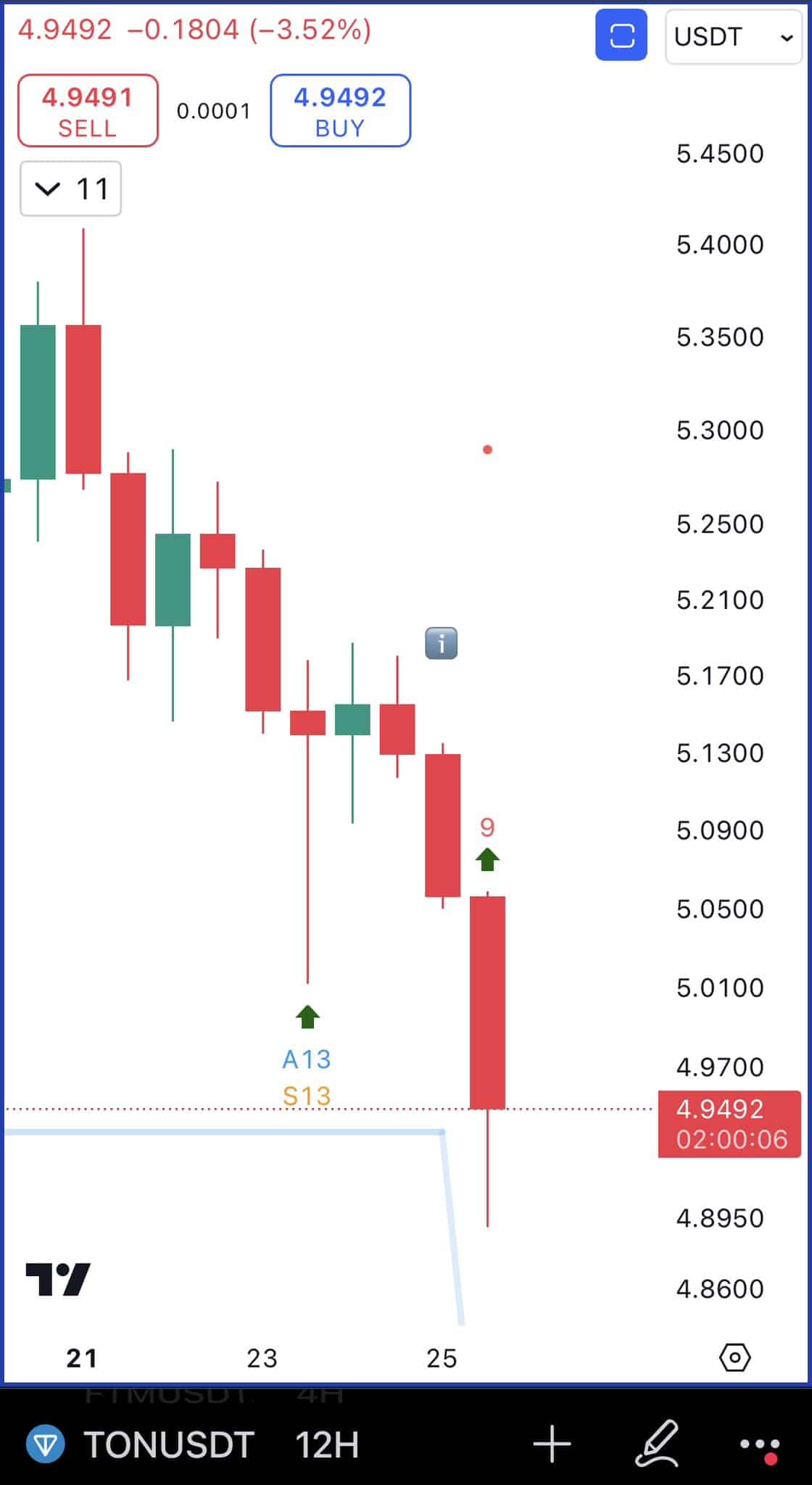

TON shows a buy signal

In his analysis, Martinez posited that sequential TD showed a buy signal on Toncoin’s 12-hour charts. This suggests a potential price rebound in the near future.

Source:

This means that the selling pressure is a warning and the bears are losing momentum. When sellers lose momentum, buyers can enter the market at lower prices, creating buying pressure.

The appearance of the buy signal led to an increase in trading activities over the past day. Thus, TON’s trading volume jumped 126% to $313.1 million. Thus, most traders entered the market at lower prices.

If the market runs its course, prices will bounce back and see further gains on the price charts.

Future gains?

Although TON has seen a sustained decline, current conditions suggest that the declines were sustained and the altcoin could see gains ahead.

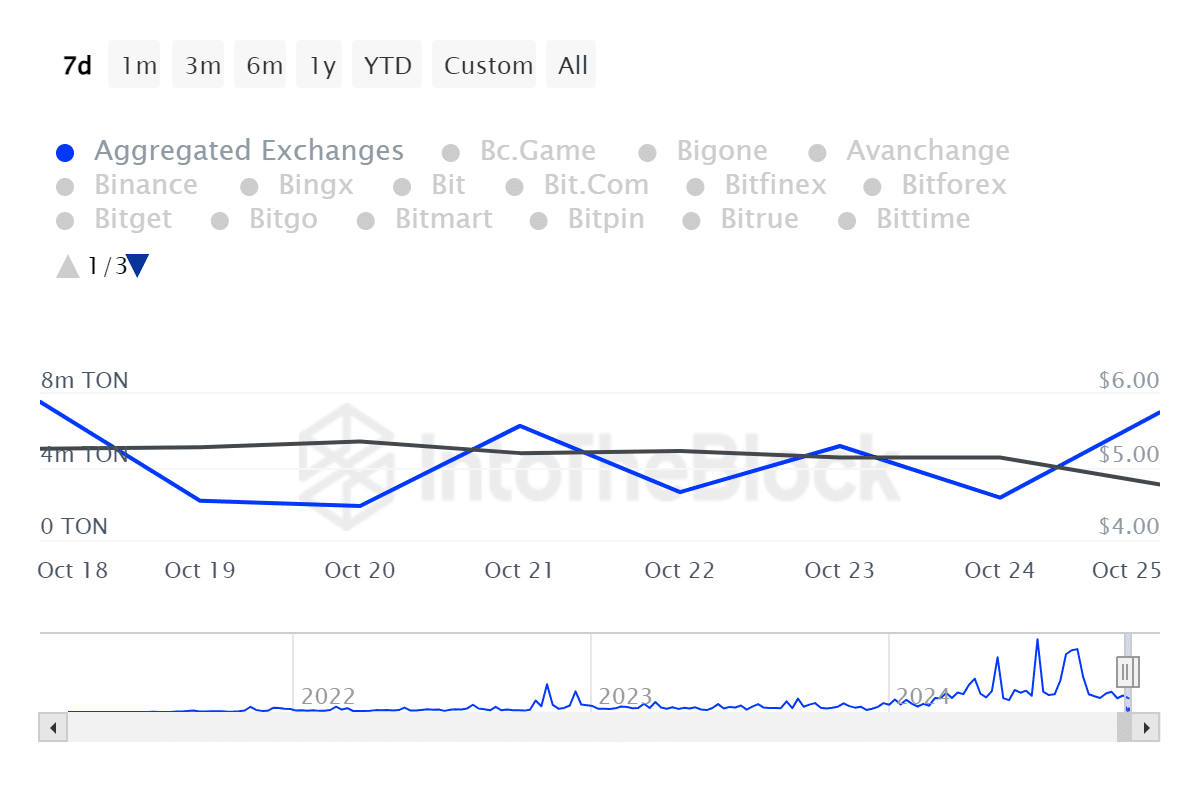

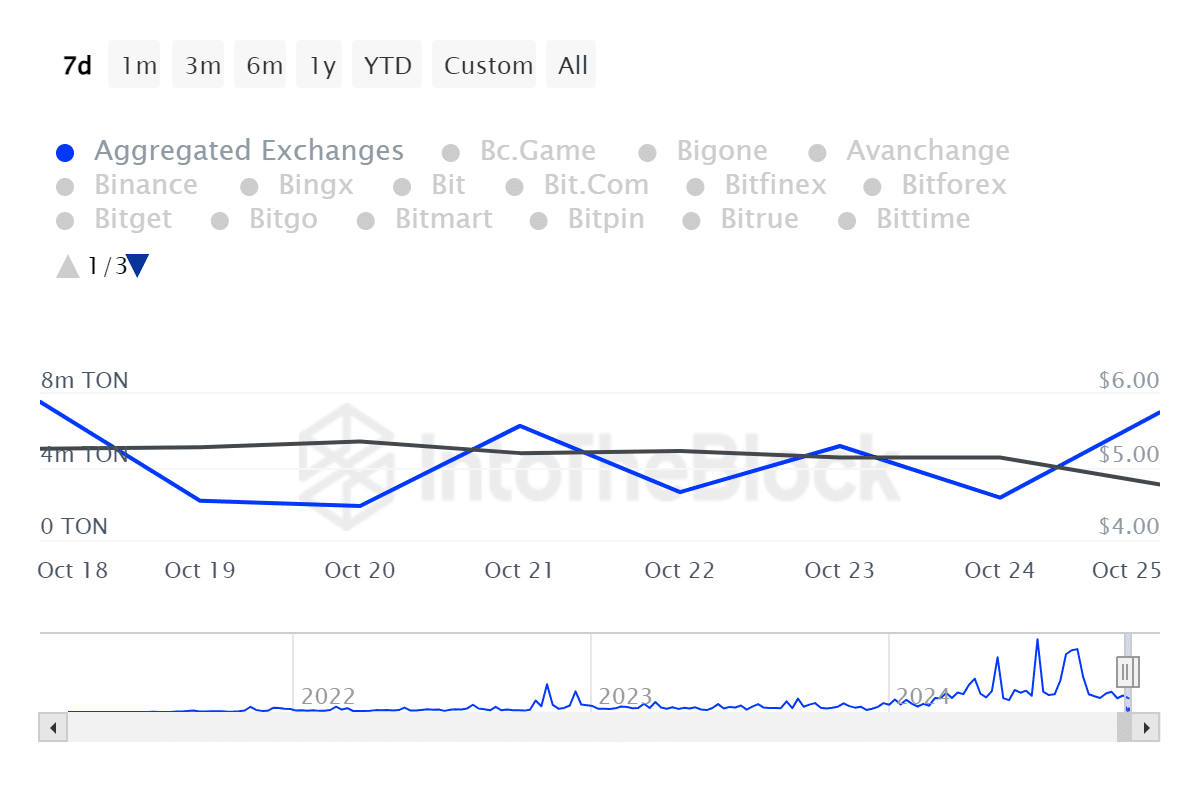

Source: In the block

For example, the Netflow ratio of large holder Toncoin fell from a monthly high of 289% to 70%. This showed a change in sentiment, with large holders accumulating their assets in anticipation of more gains.

Such a decline suggests market confidence.

Source: In the block

Additionally, Toncoin’s total outflows on aggregated exchanges increased from a low of 1.86 million tokens to 7 million.

This shows that most investors were withdrawing their tons from exchanges and storing them in cold wallets. Investors therefore seemed confident in the future prospects of the altcoin.

Read Toncoin (TON) Price Prediction 2024-2025

Simply put, TON was experiencing a shift in market sentiment from bearish to bullish at press time. If this feeling persists, you will return to a higher level.

Thus, the altcoin could attempt a resistance level of $5.4 in the short term. A breakout of this level will see Ton reach $5.8. However, if the bulls fail to take over the market, further decline will see TON fall to $4.02.