Key takeaways

- Bitcoin’s recent price surge to $71,000 is closely linked to large inflows into Bitcoin ETFs.

- Despite market fluctuations, Bitcoin maintains strong recovery momentum.

Share this article

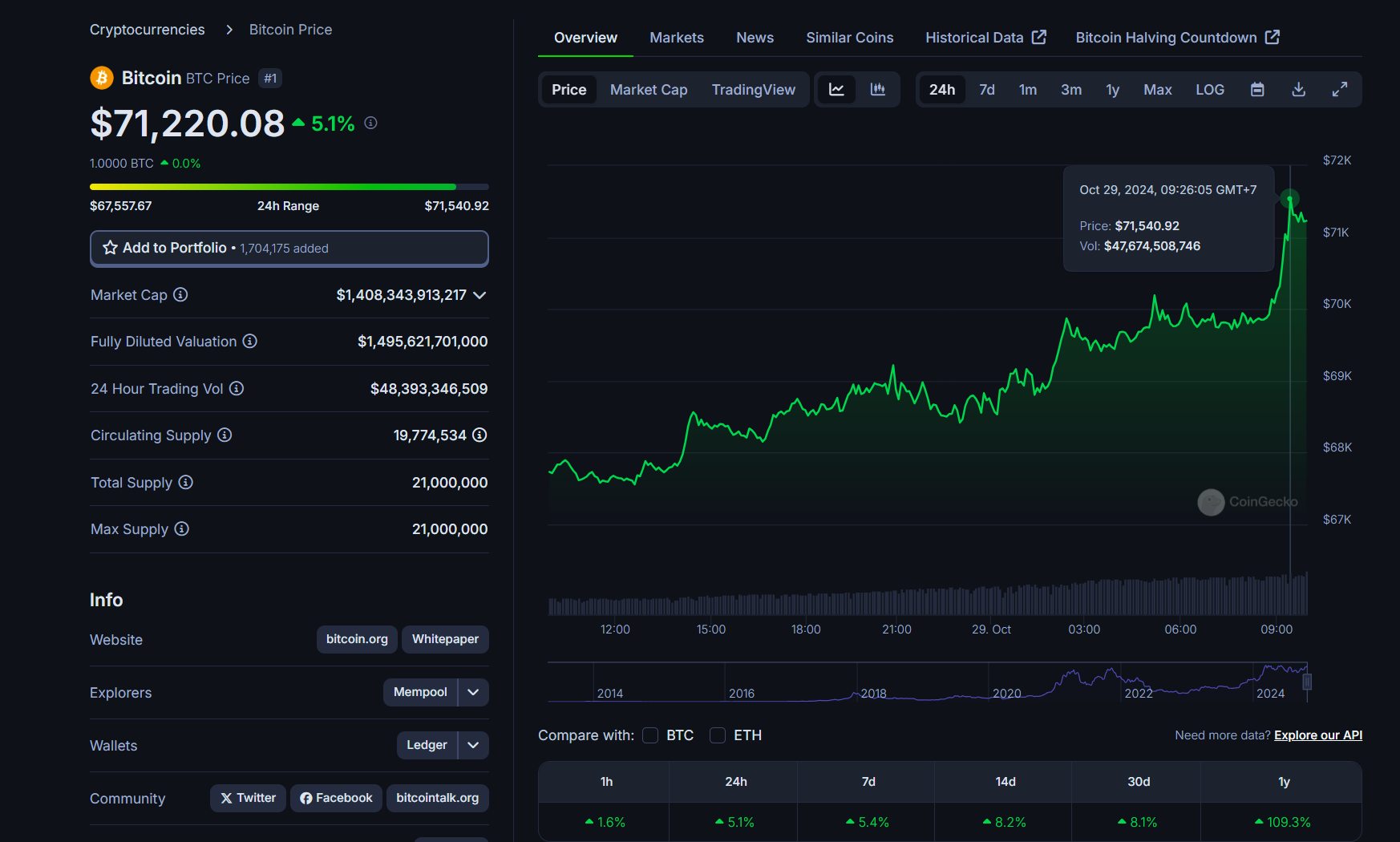

Bitcoin rose more than 5% to $71,500 and is now within range of its all-time high of $73,700. This surge comes as the US presidential election is just around the corner.

According to CoinGecko data, the largest crypto asset by market capitalization surpassed the $70,000 price level on Monday after a minor correction last week, mainly due to escalating conflict in the Middle East and alleged control regulatory on Tether.

Despite a sudden drop below $66,000, Bitcoin rebounded and consolidated in the $67,000-$68,000 range over the weekend. It finally broke out and climbed to $70,000 for the first time in over four months.

According to veteran trader Peter Brandt, the advance after the halving may have begun and Bitcoin may be entering a bullish phase.

“The 5-month inverted expansion triangle is now complete. Follow-up will be important. The post-halving advance may have begun. The series of ups and downs since March has come to an end,” Brandt said in a recent article on X.

As Crypto Briefing previously reported, some key indicators pointed to a potential upward trend in the price of Bitcoin.

Bollinger Bands, an indicator used to gauge price volatility, are at one of their tightest points in history. This “Bollinger Squeeze” often precedes periods of low volatility, which can lead to strong price breakouts.

Additionally, the Miner Position Index (MPI), which measures the flow of Bitcoin from miners to exchanges, shows that Bitcoin miners are currently in an accumulation phase, while block rewards are on the rise. The combination of low MPI and rising block rewards suggests a bullish outlook for Bitcoin.

Bitcoin ETF Inflows Rise and Election Day Approaches

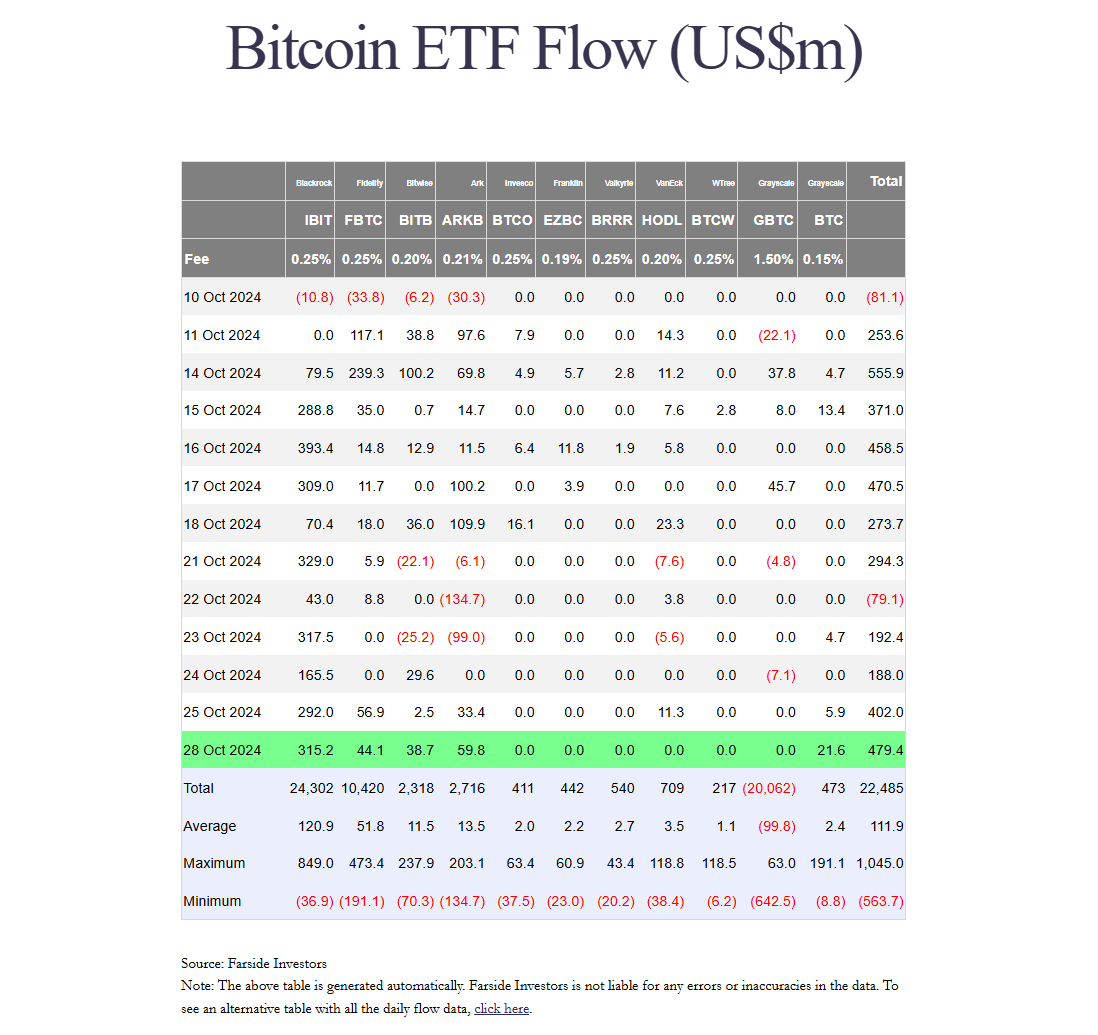

Demand for Bitcoin ETFs remains strong. According to data tracked by Farside Investors, U.S.-listed spot Bitcoin ETFs have seen approximately $3 billion in net inflows over the past two weeks.

These ETFs started this week on a high note, collectively raising approximately $479 million in net capital with no reported outflows. BlackRock continued its Bitcoin buying spree, recording more than $315 million in net purchases on Monday.

Matt Hougan, CIO of Bitwise, considers the reacceleration of Bitcoin ETF inflows among the key factors that could propel Bitcoin to six-figure prices, including the upcoming presidential election, increased whale accumulation, Bitcoin supply halving and global monetary adjustments.

Analysts at Standard Chartered estimate that Bitcoin could reach around $73,000 by Election Day, November 5.

Additionally, analysts suggest that if former President Donald Trump wins the election, Bitcoin could reach around $80,000, with a potential increase of up to $125,000 by the end of the year if the Republicans get the vote. control of Congress.

Bitfinex analysts also predict that the US presidential election could serve as a catalyst for Bitcoin’s rally, potentially pushing its price past $73,666 due to increased market activity and volatility surrounding the election.

At the same time, several other experts believe that Bitcoin’s long-term trajectory remains intact regardless of the election result.

Steven Lubka, head of private clients at Swan Bitcoin, predicts that Bitcoin will reach six-figure prices due to its strong correlation with fiscal and monetary conditions rather than political leadership.

Share this article