This article is also available in Spanish.

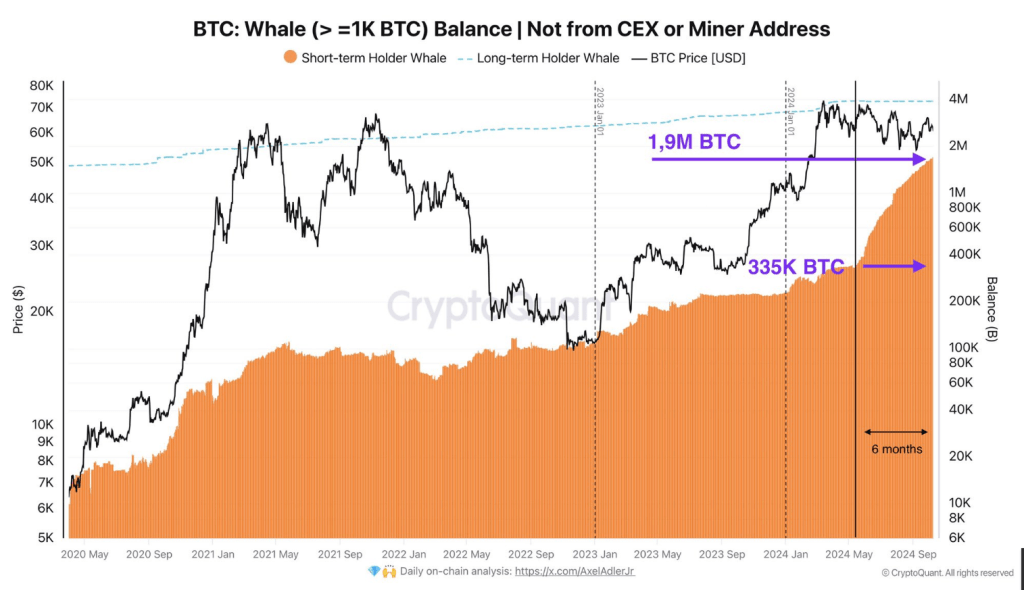

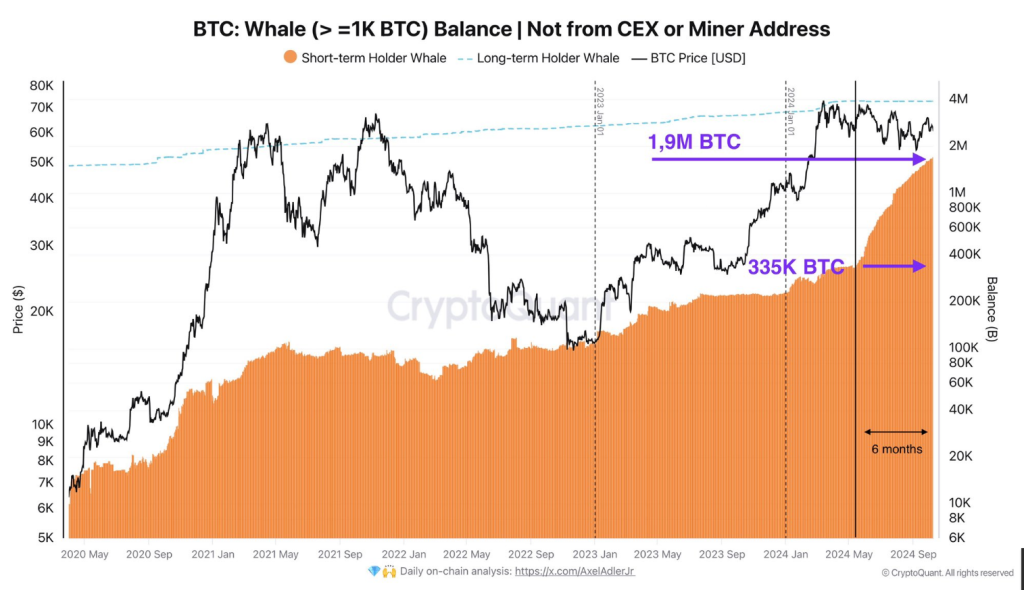

Bitcoin whales have stored $90 billion in BTC since May, a period marked by limited market conditions. According to an open disclosure from Axel Adler Jr. of CryptoQuant, investors holding more than 1,000 BTC have seen their balances grow rapidly.

Related reading

Whales’ appetite increases

Over the past six months, they have accumulated around 1.5 million BTC, representing a massive influx of capital worth around $90 billion at an average price of $60,000. However, these chips came from weaker hands that sold at a loss.

1.5 million BTC have been accumulated by whales (with >1,000 BTC in total) over the last 6 months.

There’s really nothing to discuss here. pic.twitter.com/7cAVWVEK15

– Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 10, 2024

The data shows significant growth among whales, who held just 335,000 BTC in early May, when Bitcoin was trading between $60,000 and $65,000. While prices have remained within this range, whales have continued to accumulate and now hold approximately 1.9 million BTC, indicating strong short-term confidence among wealthy investors.

Net flow measurements of large holders

Recent data shows that the accumulation frenzies have not subsided, despite recent price corrections. For example, yesterday BTC fell below $59,000 for the first time this month, leading to massive liquidations.

You don’t believe that the whales have accumulated 1.5 million BTC and you wonder where they got it from?

How about taking a look at loss-making on the stock exchanges?

In the last 24 hours, 24.1 thousand BTC were sold at a loss. pic.twitter.com/tAgeCI6qhe

– Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 11, 2024

Yet large holders, who represent 0.1% of the circulating supply, gained +629 BTC yesterday. Two days ago, this figure was even higher, with an inflow of 2,480 BTC.

Furthermore, statistics from CryptoQuant indicate that the Bitcoin exchange reserve has increased from 2.576 million tokens in early October to 2.571 million tokens, reflecting continued accumulation.

Price prediction and market implications

At the time of writing, Bitcoin was valued at $61,690, having lost 1.68% for the week. DMI had +DI at 18.3 and -DI at 23.3, a few points above but still falling.

Related reading

This simply means that despite the relentless selling pressure, they are somewhat weak. As it currently stands at -40.74, Williams %R is neutral. From here, Bitcoin could remain stuck in this range until strong buying or selling pressure appears.

Veteran analyst Peter Brandt believes Bitcoin will reach an all-time high of $150,000 this cycle, but warns that failure to break out of the current range will cause the price to explode and fall significantly, at worst by 75%.

Featured image from Pexels, chart from TradingView