Join our Telegram channel to stay up to date with the latest news

AAVE (Aave) has seen impressive bullish momentum recently, driven by growing demand within the decentralized finance (DeFi) sector. However, with the broader cryptocurrency market currently slowing, many are wondering if AAVE can maintain its upward trajectory and revisit its recent high of $396.

AAVE Key Statistics

- Current price: 371$

- Market capitalization: $5.5 billion

- Trading volume (24h): $1.32 billion

- Circulating supply: 15 million AAVE

- Total offer: 16 MILLION AVERAGE

- CoinMarketCap Ranking: #28

AAVE fell 2.76% from its recent 30-day and 7-day highs, but staged an extraordinary rebound, soaring 147.49% and 60.88% from its highest levels. low of the same periods. This impressive rally highlights the coin’s growing strength and sustained bullish momentum despite a general downtrend at the time of this analysis.

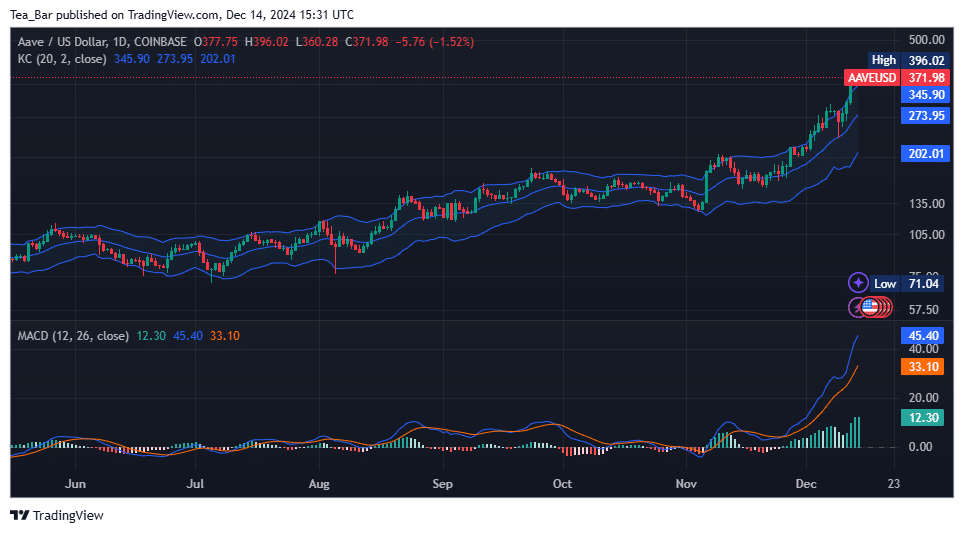

AAVE/USD Market

Key levels

- Resistance: $396, $410, $445

- Support: $345, $273, $202

The AAVE/USD daily chart highlights an impressive uptrend, with the price consolidating around $371.98 after reaching a high of $396.02. The bullish momentum has placed AAVE near critical resistance levels, the closest being at $396.02 (recent high). A break above this level could open the way towards the $410 mark, a psychological barrier, followed by $445, which aligns with the next potential target based on historical price action. However, signs of overextension in the MACD histogram suggest that the rally may encounter selling pressure in the near term.

On the other hand, immediate support lies at $345.90, corresponding to the middle line of the Keltner channel, which has acted as reliable dynamic support during the uptrend. If the bearish momentum intensifies, additional support can be found at $273.95 (lower boundary of the Keltner channel). A deeper correction could push the price to $202.01, a key level that previously marked consolidation zones. Subject to MACD trends and volume stability, AAVE could either resume its rise or enter a corrective phase, providing critical decision points for traders.

Can AAVE overcome market downturn to retest $396? Key factors to watch out for

Given the current bearish sentiment in the broader market, where most cryptocurrencies are experiencing declines, AAVE’s ability to reach its recent high of $396 is becoming more difficult. In a “red” market, the likelihood of sustained upward momentum for AAVE is reduced unless it can significantly outperform its peers. The general market slowdown could put downward pressure on AAVE, especially if weakness in major cryptocurrencies such as Bitcoin and Ethereum persists. As a result, AAVE may struggle to break above its resistance level at $396 in the near term.

How far can Aave go?

Under such market conditions, AAVE price could face increased volatility, which could result in a return to lower support levels like $345.90 or $273.95. Although the fundamentals of Aave’s DeFi platform remain strong, external factors such as global economic uncertainty, regulatory developments and investors’ risk appetite will play a crucial role. If market sentiment shifts toward more favorable conditions, AAVE could still attempt to retest $396, but caution is advised amid widespread market weakness.

AAVE/BTC Performance Overview

The AAVEBTC daily chart indicates a strong uptrend as AAVE trades above the upper band of the Keltner Channel (KC), signifying bullish momentum. The MACD histogram reflects continued buying interest, with the MACD line maintaining a notable gap above the signal line. Despite a slight decline (-1.85%), the price remains significantly elevated from its recent low of 0.001157 BTC and continues to hover near its high of 0.003913 BTC. This suggests that the bulls remain in control, although a potential retracement towards the KC mid-band (0.002789 BTC) could provide stronger support before resuming the uptrend.

Meanwhile, market information platform Santiment noted that Aave (AAVE) surpassed $300 in market value for the first time in over three years, supported by a broader altcoin rally . A significant decline in AAVE’s “average dollar investment age” indicates that key stakeholders are reactivating dormant tokens, thereby spurring bullish momentum. They also highlighted strong average returns for active traders over 30 days (+33%) and 365 days (+109%), reflecting AAVE’s impressive performance. As whale activity continues to fuel the rally, Santiment warned that a retracement is possible if large holders reduce circulation.

📈 While several altcoins are growing today, AAVE has reached a market value of over $300 for the first time in over 3 years. Pay attention to projects that have massive drops in “average dollar investment age” like AAVE. This indicates that the main key stakeholders are making progress previously, stagnating… pic.twitter.com/VmywKxRTzh

– Santiment (@santimentfeed) December 11, 2024

Alternatives to AAVE

Aave has firmly established itself as a pioneer in decentralized finance (DeFi), renowned for its revolutionary flash loan feature that allows users to borrow and repay funds in a single transaction, all without the need for collateral. Even though Aave continues to dominate, new projects are quickly gaining traction, including Wall Street Pepe ($WEPE) which stands out. Despite the current market turmoil, $WEPE managed to raise an impressive $20.3 million during its presale, demonstrating strong investor interest. At its current price of $0.000364, it presents an attractive opportunity for those looking to get in early.

Wall Street Pepe’s unique charm lies in its clever twist on the iconic Pepe the Frog meme, seamlessly integrating it into a utility-focused ecosystem designed for everyday crypto investors. At the heart of this ecosystem is a private community of insiders where traders can exchange ideas and refine their strategies. This is enhanced by a suite of advanced trading tools, real-time market signals and practical advice that aims to help small investors navigate the complexities of cryptocurrency trading.

Elon Musk loves Wall Street Pepe

The project’s momentum is also evident in its growing online presence, particularly in the expansion of the “WEPE Army” on Twitter. With over 4.7 billion WEPE tokens staked at an impressive 167% annual return, Wall Street Pepe is positioning itself as an attractive option for retail investors eager to explore its trader-centric ecosystem. As development continues, the project has the potential to carve out a profitable niche in the cryptocurrency space.

Visit Wall Street Pepe.

Related news

Newest ICO Coin – Wall Street Pepe

- Audited by Coinsult

- Early Access Presale Cycle

- Private Trading Alpha for the Army $WEPE

- Staking Pool – High Dynamic APY

Join our Telegram channel to stay up to date with the latest news