Aave’s native token (AAVE), the largest decentralized crypto lending protocol, was caught in the middle of Friday’s crypto flash crash while the protocol proved resilient in a historic liquidation cascade.

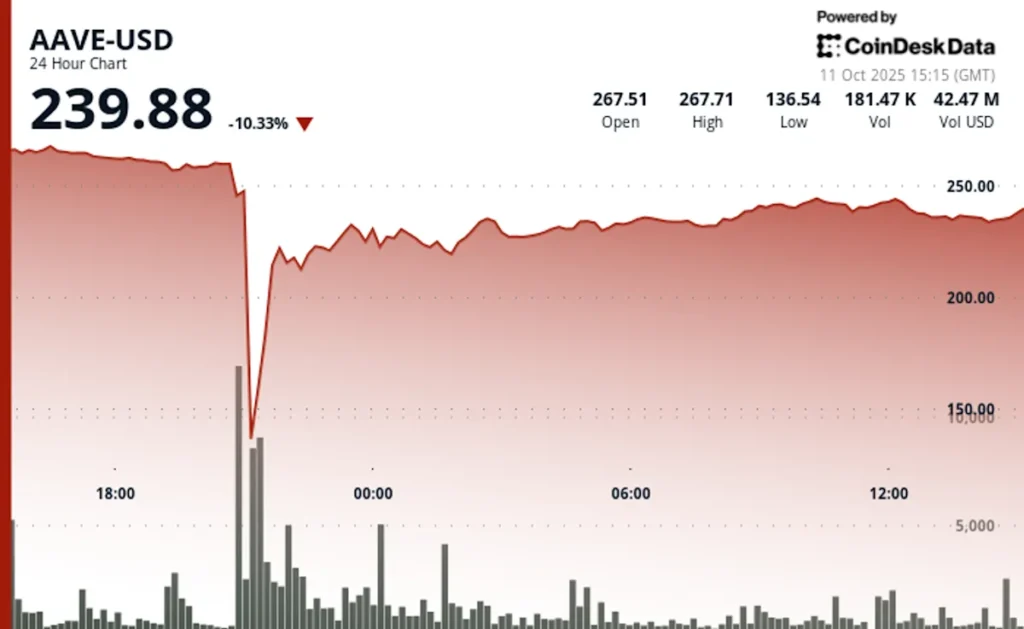

The token, which was trading at around $270 earlier Friday, plunged as much as 64% later in the session to touch $100, the lowest level in 14 months. It then saw a rapid rebound to near $240, still down 10% over the past 24 hours.

Stani Kulechov, founder of Aave, described Friday’s event as the “biggest stress test” ever for the protocol and its $75 billion lending infrastructure.

The platform allows investors to lend and borrow digital assets without conventional intermediaries, using innovative mechanisms such as flash loans. Despite the extreme volatility, Aave’s performance highlights the evolving maturity and resilience of DeFi markets.

“The protocol worked flawlessly, automatically liquidating a record $180 million collateral in just one hour, without any human intervention,” Kulechov said in a Friday X article. “Once again, Aave has proven its resilience.”

-

AAVE suffered a spectacular flash crash on Friday, falling 64%, from $278.27 to $100.18, before recovering to $240.09.

-

The DeFi protocol demonstrated remarkable resilience with its native token rallying 140% from intraday lows, supported by a strong trading volume of 570,838 units.

-

Following the volatility, AAVE entered a consolidation zone in a tight range of $237.71 to $242.80 as markets digested the dramatic price action.

-

Price range of $179.12 representing 64% volatility over a 24-hour period.

-

Volume climbed to 570,838 units, well above the average of 175,000.

-

Short-term resistance identified at $242.80, capping the rebound during the consolidation phase.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.