- AAVE is poised to continue its dominance in DeFi protocols.

- Aave expands into stablecoins and multichain integration.

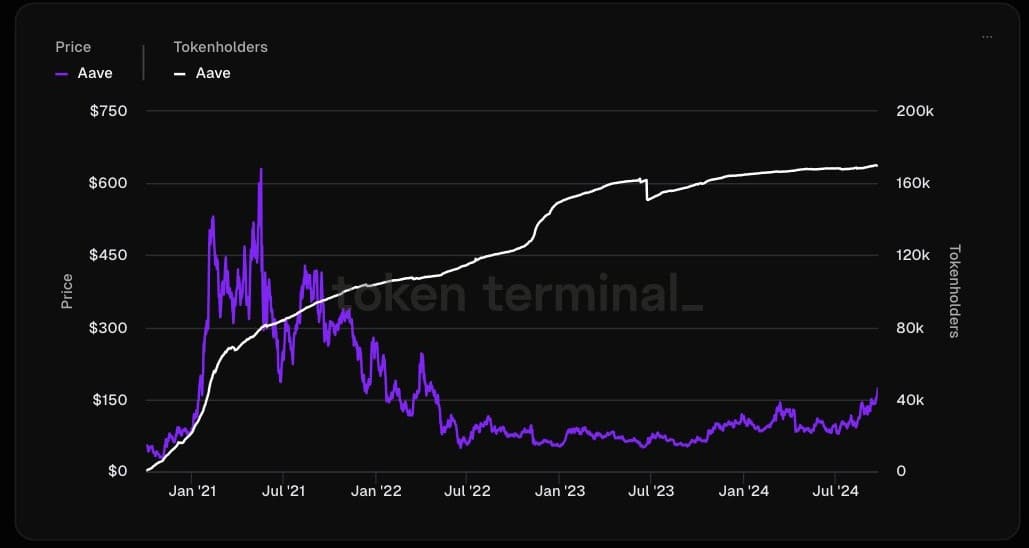

Aave (AAVE), arguably the leading DeFi protocol, has reached a new all-time high in token holders and has nearly $20 billion in user deposits. Aave continues to solidify its position as the market leader.

Despite the complexity of the DeFi sector and a temporary slowdown following the crashes of Terra Luna and Celsius, Aave remains one of the best investment opportunities in the crypto space.

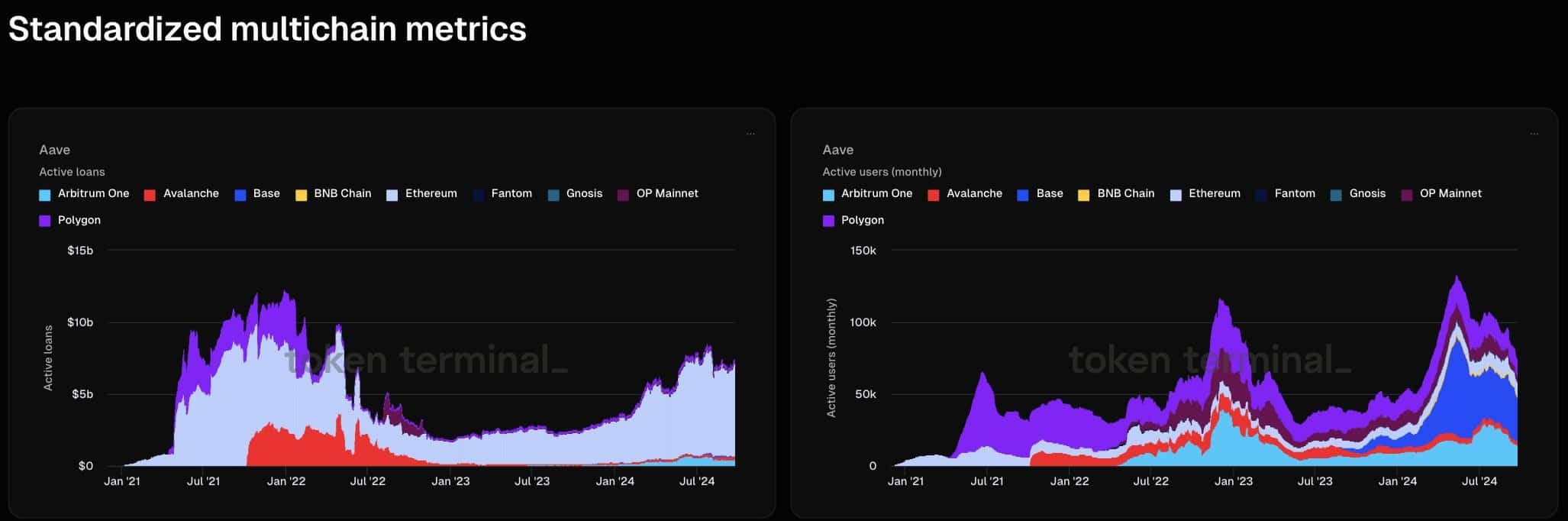

Aave offers a comprehensive platform where users can deposit, borrow, and earn interest on their cryptocurrency holdings. Its tokens incentivize users, and its standardized on-chain financial metrics reveal consistent growth in deposits and borrowing, further cementing Aave’s market dominance.

Source: Token Terminal

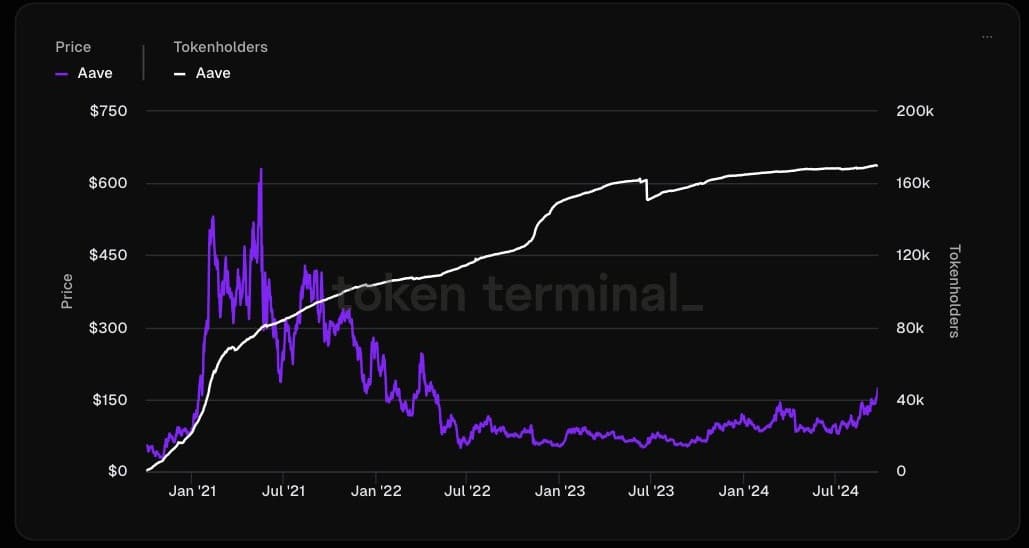

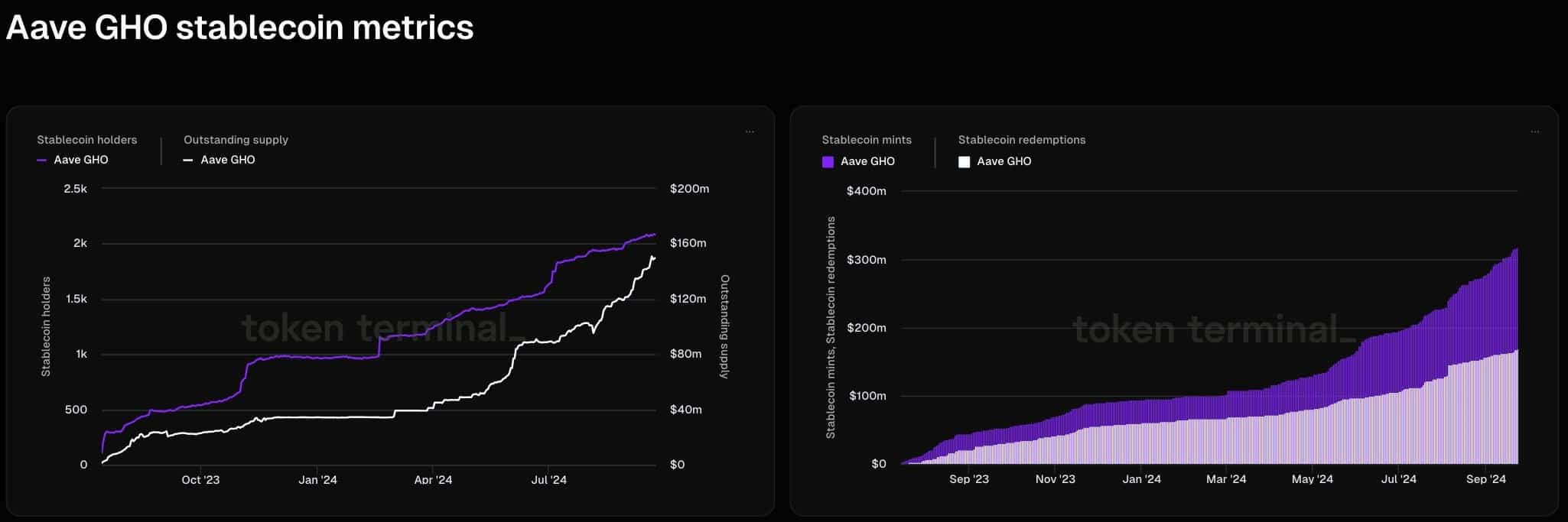

GHO Stablecoin Bullish Indicators

Aave’s GHO stablecoin continues to perform well, with metrics reaching all-time highs. GHO’s exceptional supply, as well as monthly transfer volume and sender activity, have been steadily increasing.

This reflects positive sentiment and further reinforces Aave’s bullish outlook. The growing success of Aave’s second business segment, GHO, is a key factor in maintaining the protocol’s long-term growth potential.

Source: Token Terminal

As more institutional players enter DeFi, the coin is well positioned to maintain its market leadership.

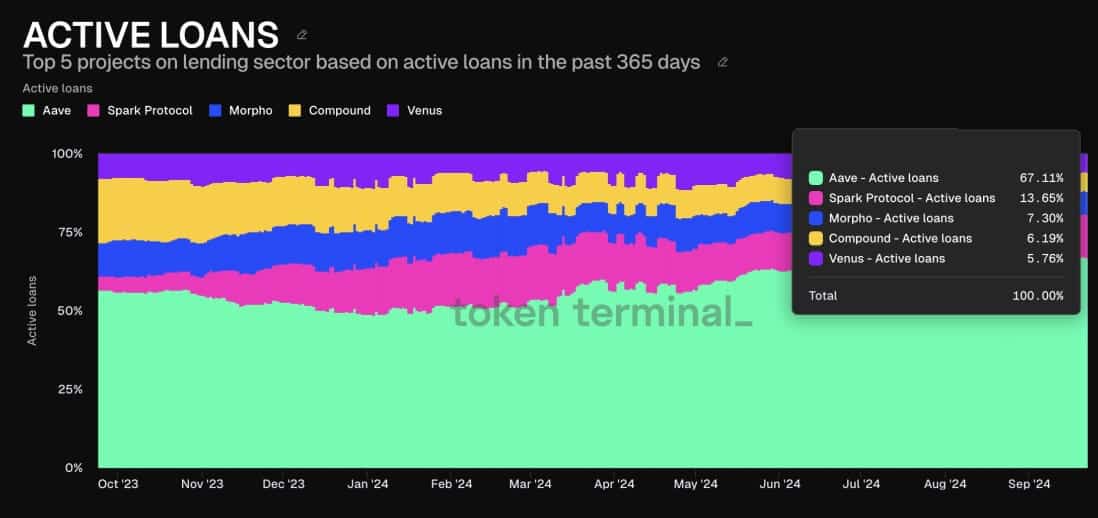

Aave, leader in the credit sector

Active loans in the DeFi sector have reached $11 billion, with $7.4 billion coming from Aave. The sector is gradually approaching its previous record of $20 billion from 2021.

Currently, Aave holds 67% of the market share in the lending sector and its dominance is expected to continue. Compared to traditional finance, where margin lending totals around $800 billion, Aave and DeFi as a whole have significant room to grow.

Source: Token Terminal

Borrowing on Aave requires collateral, and individuals, confident in the market’s rise, often use BTC or ETH as collateral to borrow in stablecoins and exchange for other cryptocurrencies, allowing them to profit when prices rise.

As cryptocurrency adoption increases, Aave’s dominance in this space will likely grow, positioning it to capture a larger share of the financial market.

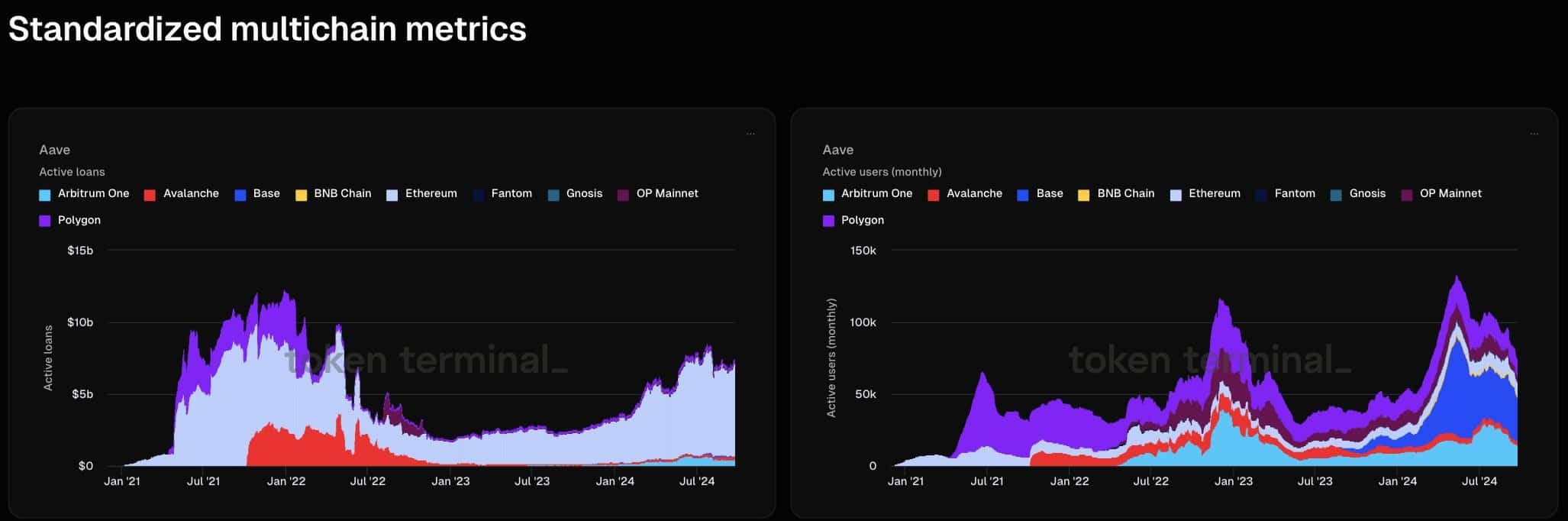

Aave’s multi-chain expansion

Aave’s expansion across multiple chains, including Arbitrum, Avalanche, Base, BNB Chain, Fantom, Optimism, and Polygon, further highlights its growth potential.

Metrics such as unique depositors, borrowers, and refunders show bullish trends across multiple blockchains. This multi-chain approach increases Aave’s reach and solidifies its position in DeFi, ensuring it continues to thrive.

Source: Token Terminal

Is Your Portfolio Green? Check Out the Aave Profit Calculator

In conclusion, Aave’s dominance, combined with the growth of its stablecoin GHO, solidifies its position in the DeFi space.

With bullish metrics, multi-chain expansion, and significant institutional interest, the altcoin’s price could surge even further, cementing its role as the leader in this cryptocurrency bull run.