Digital asset analytics firm IntoTheBlock says certain factors could portend “speculative overheating” in the crypto market.

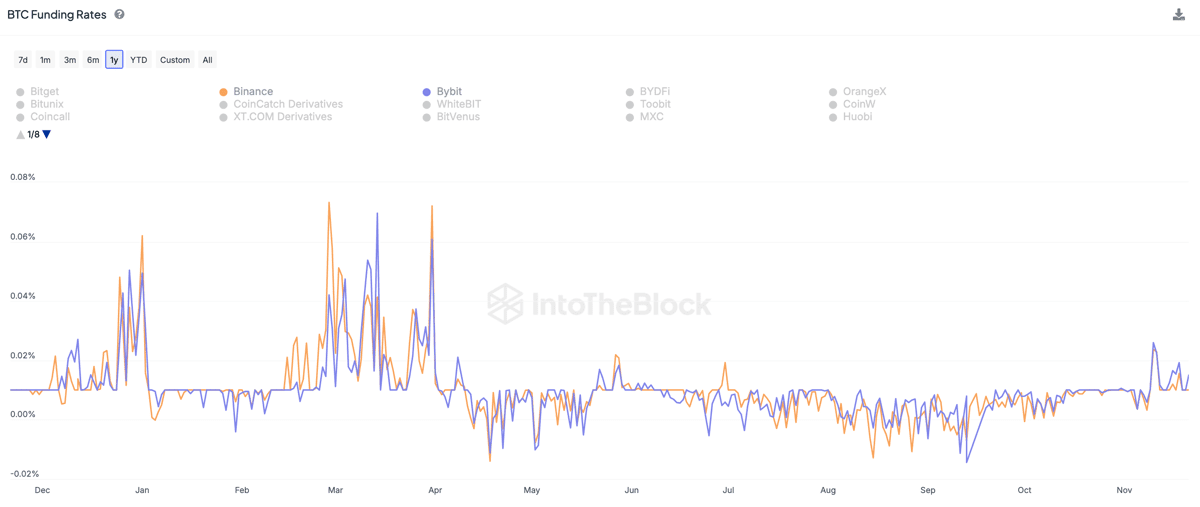

IntoTheBlock notes on social media platform

“Such high costs signal growing bullish sentiment among traders. Even if it remains below the peaks of the first quarter, sustained demand at these levels could portend speculative overheating…

The US government’s approach to crypto under Trump is likely a major factor. With “Bitcoin Strategic Reserves” on the horizon, many are feeling incredibly optimistic that Bitcoin could reach a valuation well above $100,000.

People really want $100,000 BTC. Past cycles show more than one significant decline. This wouldn’t be a bad place for such a step back. »

Bitcoin is trading at $98,783 at the time of writing. The top-ranked crypto asset by market cap hit a new all-time high of $99,645 at one point Friday morning and is up nearly 1% over the past 24 hours and over 8% over the past 24 hours. last week.

IntoTheBlock also notes that BTC saw net outflows of $4.5 billion off exchanges this week. The analytics firm defines net outflows as the number of coins that left crypto exchanges minus inflows, or withdrawals minus deposits.

Don’t miss a thing – Subscribe to receive email alerts straight to your inbox

Check Price Action

Follow us on XFacebook and Telegram

Surf the daily Hodl mix

Disclaimer: Opinions expressed on The Daily Hodl do not constitute investment advice. Investors should conduct due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and transactions are at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: halfway