Crypto analytics platform Santiment says a key factor is increasing the chances of digital assets seeing a recovery.

In a new thread on social media platform observed in the fourth quarter of last year.

“Crypto has been a slight disappointment for traders over the past week, and we have seen higher than usual mentions of selling interest. Just like we saw throughout the bull rally in Fourth quarter, when the crowd starts to get too bearish, higher prices become much more likely.

Santiment’s chart shows that social media mentions of selling digital assets peaked on December 4, before the markets exploded. It also shows a spike in social media sell mentions on January 8, potentially foreshadowing another market-wide rally.

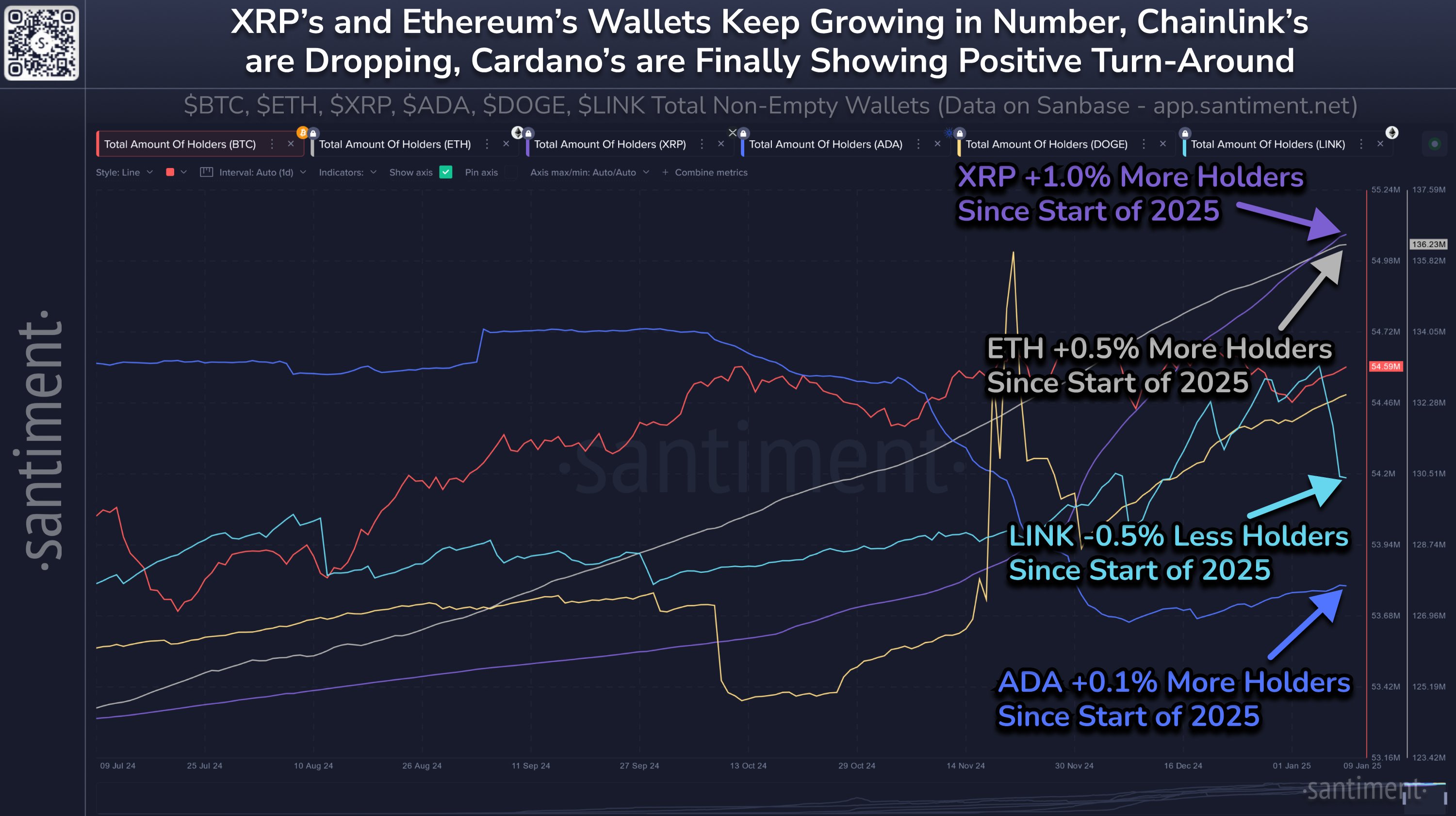

Santiment goes on to note that the growing number of crypto wallets tied to major assets such as Bitcoin (BTC), Ethereum (ETH), XRP, Cardano (ADA), and Dogecoin (DOGE) is also a good sign.

“BTC: +102,000 wallets.

ETH: +645,000 wallets.

XRP: +58,000 wallets.

ADA: +2,800 wallets.

DOGE: +29,000 wallets.

LINK: -3,300 wallets.

If portfolios grow quickly, the community is comfortable with the project in the long term. If portfolios are falling, there may be excess FUD (fear, uncertainty, and doubt) that indicates a buying opportunity (against the panicked crowd).

Don’t miss a thing – Subscribe to receive email alerts straight to your inbox

Check Price Action

Follow us on XFacebook and Telegram

Surf the daily Hodl mix

& nbsp

Disclaimer: Opinions expressed on The Daily Hodl do not constitute investment advice. Investors should conduct due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and transactions are at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Troyan