Africa’s blockchain and crypto space receives a much-needed boost at a difficult time for startups, some of which have pulled out of specific markets or closed their doors altogether due to issues such as a strict regulatory environment , macros or poor management.

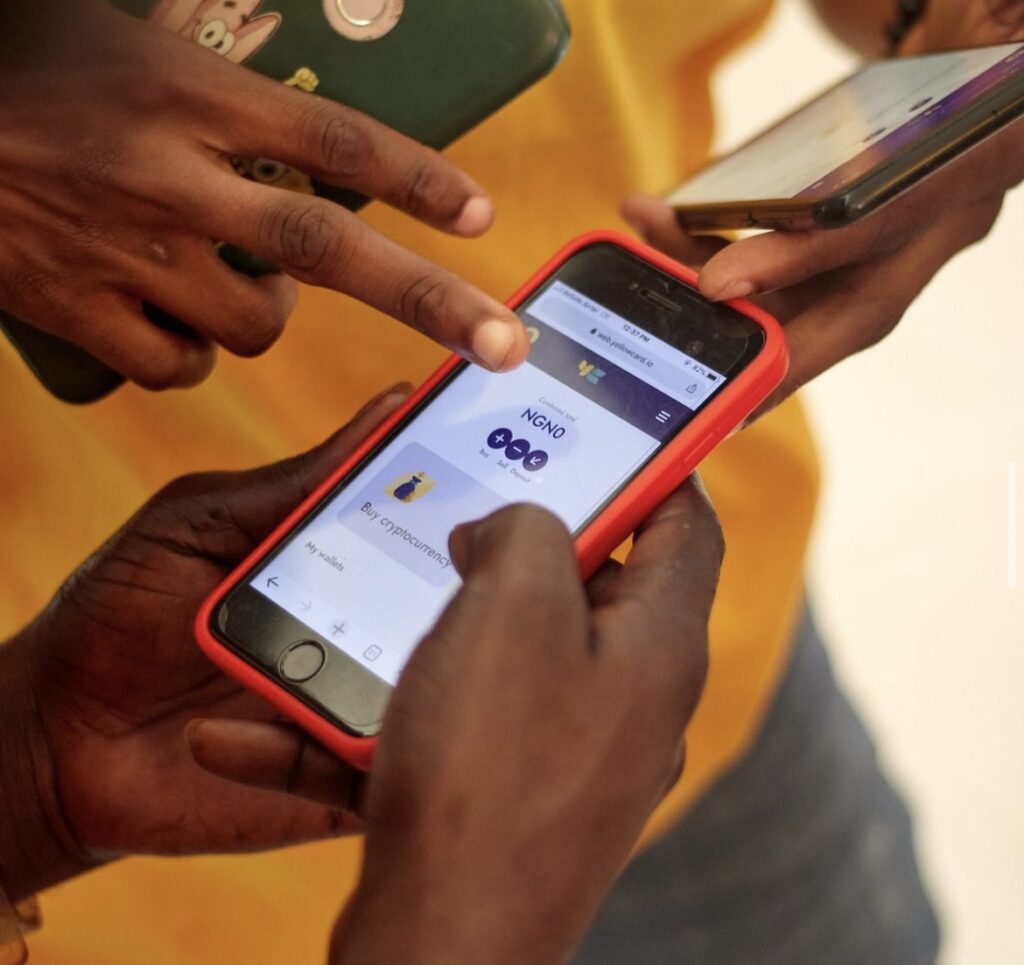

The boost concerns Yellow Card, the US-founded cryptocurrency platform launched in Nigeria in 2019, which has since become the continent’s most funded cryptocurrency exchange. The company confirmed to TechCrunch that it has raised $33 million in Series C investment led by decade-old venture capital firm Blockchain Capital, whose bets include Coinbase, Kraken, OpenSea and, most recently, Worldcoin. This brings Yellow Card’s total funding to at least $88 million.

Blockchain Capital’s joining Yellow Card comes as the crypto platform, which initially offered retail clients access to cryptocurrencies and stablecoins (USDT, USDC and PYUSD) in 20 African countries using the currencies local, is doubling down on its professional clients, a change that began with its $40 million Series B fundraising two years ago. (Yellow Card was valued at $200 million in this round; co-founder and CEO Chris Maurice, without disclosing details, says the crypto platform’s current valuation is “a significant increase from Series B .)

“The big change for us has been to now focus on working primarily with enterprises,” Maurice told TechCrunch. “When we started, we targeted the B2C market to serve retail customers. However, we realized that the real users who benefit the most from this technology are businesses.

Yellow Card served retail customers for the first two years after its launch. However, the turning point came when the company, which reached 1 million customers in 2021, according to Maurice, began to realize how incredibly expensive it was to manage individual users on the platform. While any crypto customer, regardless of size, must go through sanction check, KYC and on-chain analysis check, when it came to volumes, the margins were too thin to make the business sustainable with small retail users. On the other hand, small and large companies transported larger volumes and paid higher gas fees.

As a result, Yellow Card increased the minimum transaction amount, a deliberate move aimed at narrowing its large retail base and increasing its appeal to businesses using the platform to manage their treasury and access stablecoins.

“The use of our platform didn’t change – it was more about our changing targeting and positioning,” Maurice responded when asked if Yellow Card’s description of itself , transitioning from a cryptocurrency exchange platform to a licensed stablecoin on/off ramp, was the result of a change in how customers use the platform. “We are now more in tune with what our customers, especially enterprises, use us for, which is managing treasury and accessing stablecoins. This is what led to the change in messaging.

Move over, B2C, businesses are the new target

Today, Yellow Card works with around 30,000 businesses in Africa and around the world, helping them with payments and cash management, primarily through stablecoins.

At first glance, Yellow Card’s focus on businesses may seem like a departure from its original plan to make crypto accessible to the general public. However, Maurice says the company, founded eight years ago, is still headed in that direction, but is going about it differently.

First, it highlights that an individual and a small business are not mutually exclusive in Africa; an example is an individual owning a small kiosk. That’s why Yellow Card’s customer base, despite this slight shift, still ranges from a merchant selling imported shoes to some of the continent’s biggest companies, and everyone in between. “The way business and personal use mix on the continent creates a very different dynamic, making our approach relevant to both groups,” noted the CEO.

Second, the company believes that serving businesses means individuals could benefit more from the technology than if they interacted with it directly.

For example, by using Yellow Card for cash management, businesses that import food, pharmaceuticals and consumer goods can make essential items more affordable and accessible, benefiting the entire population, even if individuals do not engage directly with cryptography. In other words, the average person earns more by benefiting from cheaper goods and services – made possible by companies using the Yellow Card – than by using the technology itself.

While sub-Saharan Africa lags behind the rest of the world in crypto volume (accounting for less than 3% of total transactions made between July 2023 and 2024), the region has crypto use cases more practical and convincing than the West. Nigeria, for example, has the second highest crypto adoption rate in the world; Ethiopia, Kenya and South Africa are in the top 30, according to a recent report from Chainalysis.

Stablecoins, in particular, have become the center of utility of the African crypto-economy. What is the room? Most African countries have highly volatile local currencies and limited access to the US dollar. Thus, stablecoins, linked to the dollar, such as USDT and USDC, offer businesses and individuals a way to store value by protecting against inflation and currency devaluation and by facilitating international payments and cross-border trade.

Stablecoins Utility Drives Adoption

Maurice says the utility of stablecoins and demand for its technology from companies moving larger sums has contributed to Yellow Card’s transaction volumes rising from $1.7 billion at the start of the year. last year to more than 3 billion dollars. As a result, the company’s revenue, generated by the currency price gap, has increased sevenfold since January 2023, now reaching “well into eight figures”.

“For us, the main driver of adoption is utility. Stablecoins are useful. People need it,” emphasized the CEO. “They solve problems for people and businesses. People are adopting this technology because they need it. This is not a speculative use case. This is a utility use case.

Yellow Card offers two main products: the basic on-ramp and off-ramp and the API suite, which Maurice, on the call, playfully refers to as “Africa as a Service.” The API suite integrates Africa’s banking and mobile money infrastructure, makes it accessible to global companies like Coinbase and Block, and allows them to move their customers in and out of the continent using Yellow’s rails Card.

There is no doubt that Yellow Card’s recent funding validates the progress of stablecoins in Africa and their practicality on a global scale. The company will now seek to further exploit the opportunities offered by technology by improving its flagship product and its API (on which a widget is integrated).

“The future of payments lies in fast, affordable rails for everyone, powered by open networks,” said Aleks Larsen, general partner at Blockchain Capital. “We couldn’t be more excited to support Yellow Card as they bring Africa on-chain with stablecoins.”

Yellow Card, which describes itself as the largest and first licensed stablecoin entry/exit platform in Africa, said Polychain Capital, Block, Inc., Winklevoss Capital, Third Prime Ventures, Castle Island Ventures, Galaxy Ventures, Blockchain Coinvestors. , and Hutt Capital also invested in the Series C round.

He added that the funding will also enable it to develop new products, strengthen its team and systems, and continue to lead engagement with regulators across the continent.

Regulation is the bane of crypto platforms’ existence globally. Companies like Binance and Coinbase are facing lawsuits for allegedly offering unregistered securities in the United States. Meanwhile, crypto remains heavily restricted in some countries, including China, with a continued crackdown on mining and trading.

Moreover, the recent debacle between Binance and Nigeria – the country detained one of the crypto platform’s executives, Tigran Gambaryan, for eight months over allegations that Binance was undermining its local currency – is one of the reasons why crypto platforms must continue to discuss with regulators.

With strict and unclear rules governing how people use crypto in different markets, Mauritius says African regulators have been much more innovative and have a better understanding of the technology than other regions. He cites recent licensing guidelines in Nigeria, frameworks in countries like South Africa, Botswana, Tanzania and Zambia, as well as the introduction of a sandbox environment in Ghana to support his point.

“Obviously, the goal is that we continue to see and develop clear regulatory frameworks globally. I think Africa has an unfair reputation when it comes to regulation. In reality, it’s often a much more crypto-friendly environment than the United States right now,” Maurice said.