- The assessment of the cryptocurrency sector consolidated 2.9 billions of dollars on Thursday after the break in the Fed interest rates increased market activity.

- Liquidations have reached $ 335 million in the last 24 hours, with $ 207 million in uncovered contracts, counting almost 60% of losses.

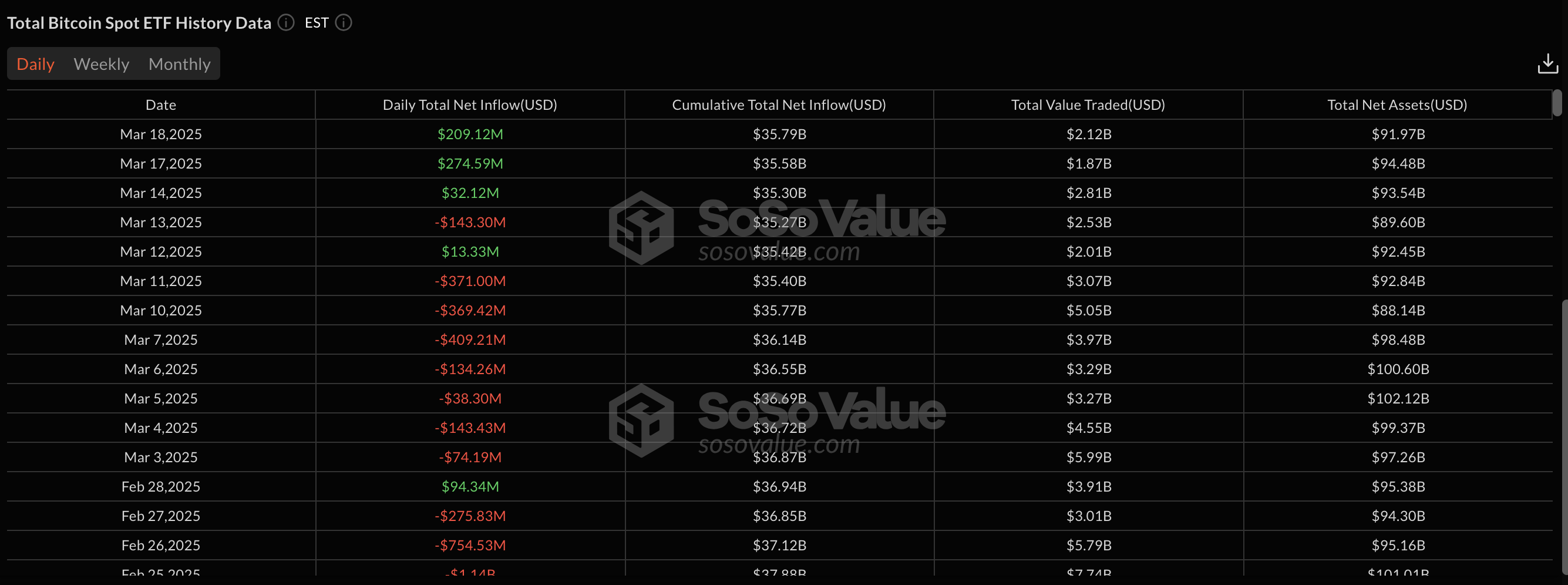

- On Wednesday, Bitcoin Spot ETF collected more dollars, which makes more than $ 527 million in BTC in four consecutive days.

Bitcoin market updates:

- The price of Bitcoin culminated at $ 87,450 before relying 1.7% towards the level of $ 85,200 at the press time on Thursday.

- On Wednesday, Bitcoin ETF recorded another $ 11 million entry, extending its purchase frenzy to four consecutive days.

Bitcoin Etfs | Sosovalue

Bitcoin Etfs | Sosovalue

Since last Friday, Bitcoin ETF has acquired more than $ 520 million in BTC in four consecutive days.

This is aligned with the story that the cooling of inflation, as evidenced by the break in the rate of the Federal Reserve (Fed) on Wednesday, raised the feeling of the BTC market, especially among American corporate investors.

Bitcoin holding above the level of support of $ 85,000, suggests that strategic traders are positioned for more upward signals as the Thursday negotiation session takes place.

Altcoin updates: What motivates cryptographic markets today?

Altcoins has carried out a considerable recovery in the past 24 hours, the bull traders capitalizing on several bull catalysts in the United States:

- Wednesday, wider markets received an initial boost when the United States Fed announced the decision to hold the unchanged interest rate at 4.5%, aligning market expectations.

- The CEO of Ripple also confirmed on Wednesday that the Securities and Exchange Commission (SEC) had abandoned all the accusations, ending a 5 -year overhang.

- President Donald Trump speaks to Digital Asset Summit organized by Blockworks in New York.

Table of the day: Sol, XRP, ADA all holding key support levels while the Fed break and Trump’s speech increase the market prospects

Altcoins organize a recovery, supported by recent Macro and regulatory developments Haussiers.

- Ethereum Price is down by 2%, negotiating $ 1,990, because bears make frantic efforts to avoid an escape greater than $ 2,000.

However, the latest market data show that Solana (soil), XRP and Cardano (ADA) all hold key support levels, signaling resilience in renewing the optimism of investors after break in the Fed rate.

-638780822834141291.png)

Cryptography market performance, March 20 | Flirtatious

- XRP Price jumped 6.5% by recovering the $ 2.49 mark, while the traders reacted positively to the news that the SEC had abandoned all the remaining accusations against Ripple. The long -standing legal battle had been a major front wind for XRP, and this resolution has fueled a renewal of purchase interest.

- Solana (soil) increased 1.7% in the last 24 hours, currently negotiating at $ 130.88. The recent announcement of the first launch of Solana Futures Fet led Sol at $ 136 earlier during the day.

- Cardano (ADA) has also shown a force, increasing 4% to be paid over $ 0.70, benefiting from the wider Altcoin rally.

These best -classified altcoins holding key support levels suggest that traders are currently adopting a Sit and Watch approach, pending the next market catalyst.

Before President Donald Trump’s speech to Digital Asset Summit (DAS) in New York, many traders occupied their positions, anticipating a potential impact that evolves the market.

However, as it ended without new politics announcements, the speech failed to trigger a major purchase frenzy as many had planned.

President Donald Trump speaks at the top of the digital assets of Blockworks, March 20, 2025

Trump’s upward policy position declaring that the United States will not sell its BTC early assets, could provide an additional back wind for cryptographic markets in the coming days.

Updates new crypto:

Kraken acquires Ninjatrader in an agreement of $ 1.5 billion to extend American -term exchanges

Kraken has announced an acquisition of $ 1.5 billion in Ninjatrader, an American retail negotiation platform.

The agreement, which should conclude in the first half of 2025, marks one of the largest integrations between traditional finance and the crypto.

Kraken aims to take advantage of Ninjatrader’s long-term trading infrastructure to extend his presence on the American derivative market and improve multi-active trading capacities.

“The traditional markets take place on the banking systems of the 1950s and after the Second World War, exchanges which close at 4 pm HE and delays in settlement which take days to resolve.

Crypto rails has solved these problems, operating with effective and real -time infrastructure.

But inherited finance and crypto have remained distinct ecosystems until today.

This transaction is the first step in our vision of an institutional quality trading platform where any active can be exchanged, at any time, “said Arjun Sethi, Kraken Co-PDG.

Ninjatrader, currently serves nearly two million merchants and is a merchant of the future commission registered by the CFTC, will continue to operate independently within the framework of the expansion suite of requests for negotiation and payment of Kraken.

-

Pakistan moves to legalize cryptocurrency to stimulate foreign investments

Pakistan is developing a legal framework for cryptocurrency to attract international investments and strengthening its ecosystem of digital assets.

Pakistan Crypto Council, led by Bilal Bin Saqib, writes regulatory directives to provide clarity and security to investors.

The country already has a strong presence of crypto, ranking ninth in the world in adoption with around 15 to 20 million users.

The initiative aligns with regional trends and reflects growing world interest in digital assets.

Pakistan’s decision also influences international regulatory strategies, including recent developments in the American cryptos market. The officials aim to position the country as a competitive center for the innovation and investment of the blockchain

-

Moonpay secures the 200 million dollax credit line from Galaxy to manage liquidity overvoltages

Moonpay obtained a 200 million dollars renewable credit line from the investment company Galaxy to manage sudden points of the volume of transactions.

This decision comes after the company had difficulty responding to liquidity requests when Donald Trump’s same launch of the same, which required $ 160 million in emergency funds.

Moonpay CEO Ivan Soto-Wright said that the credit line is intended for short-term access to capital events, not long-term debt.

This marks the first line of credit of Moonpay, despite the end of 2024 as a positive cash flow with net growth of net income of 112%.

The company, valued at $ 3.4 billion in 2021, chose to obtain additional liquidity after faced bank constraints when Trump Memecoin.

“The traditional banking system works Monday to Friday, from nine to five years, but Crypto works 24/7,” said Soto-Wright, highlighting the need for immediate funds outside of banking hours.