- Aerodrome surpasses PancakeSwap in terms of market capitalization.

- Post-crash DeFi dynamics see Aerodrome Finance reshaping its dominance with Layer 2-focused innovation.

Aerodrome Finance (AERO) has been creating a lot of buzz in the decentralized finance (DeFi) space recently, and has now reached a major milestone: overthrowing PancakeSwap (CAKE).

This development has sparked speculation about whether it could eventually compete with even Uniswap (UNI), one of the most established platforms in the industry.

If Uniswap’s overtaking is still uncertain, Aerodrome’s momentum is undeniable.

Could this disrupt current leaders and reshape the DeFi landscape, or is it too early to assess its full potential? As the DeFi world evolves rapidly, the rise of Aerodrome is certainly one to watch closely.

Aerodrome Finance overtakes PancakeSwap: A strategic shift?

PancakeSwap has long dominated as the leading DEX on the BNB chain. Thus, the rise of Aerodrome reflects the evolving DeFi landscape.

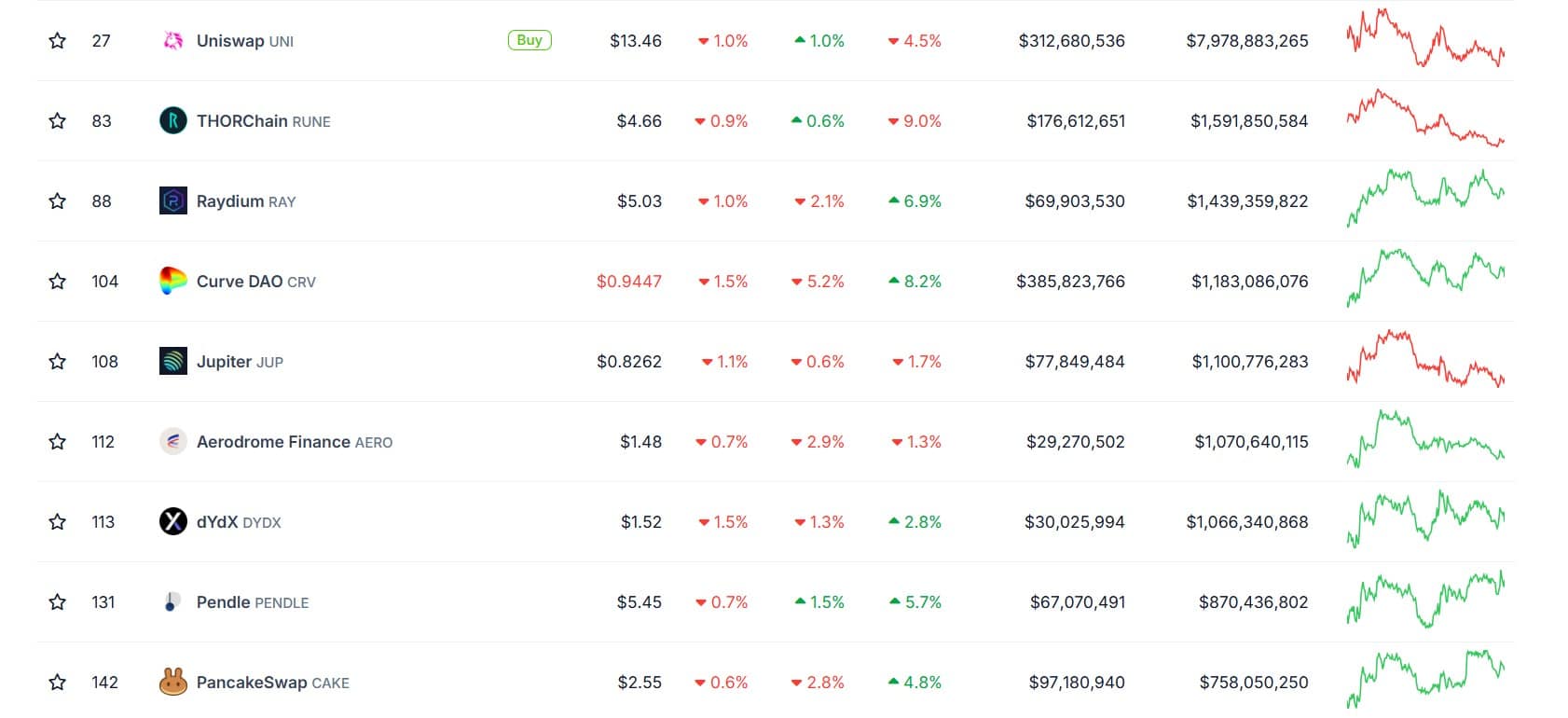

With a market capitalization of $1.07 billion compared to PancakeSwap’s $758 million, its growth has been fueled by high adoption rates, advanced liquidity incentives, and integration within layer 2 ecosystems. .

Source: CoinGecko

This advancement highlights Aerodrome’s ability to attract liquidity and maintain user engagement, leveraging innovative tokenomics and efficient pricing structures.

In contrast, PancakeSwap’s reliance on its established user base now faces pressure to scale as competition intensifies. The reversal signals a broader pivot, where adaptability is more important.

Asset dynamics

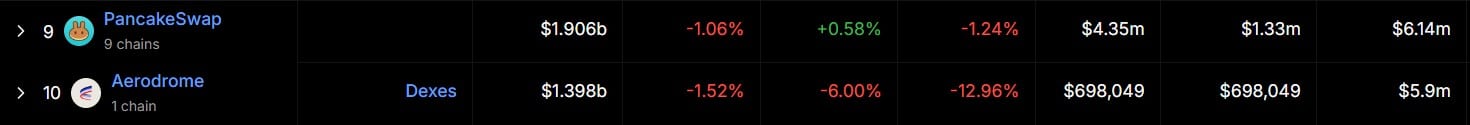

Additionally, with $1.398 billion in TVL spread across a single channel, Aerodrome demonstrates targeted efficiency compared to PancakeSwap’s $1.906 billion spread across nine channels.

However, it lags behind in daily revenue and fees, bringing in $698,000 compared to PancakeSwap’s $4.35 million, highlighting a disparity in trading volume and ecosystem maturity.

Source: DéfiLlama

PancakeSwap’s multi-chain strategy maintains broader liquidity coverage, but Aerodrome’s concentrated dominance in its layer 2 niche reveals strategic depth.

Notably, Aerodrome’s smaller operational scope translates into simpler metrics, with $5.9 million in annualized revenue, compared to PancakeSwap’s $6.14 million.

The data suggests the airfield’s scalability remains untested, but its rapid rise portends potential disruption if momentum continues.

Can Aerodrome challenge Uniswap in the near future?

Although Aerodrome Finance’s rise beyond PancakeSwap shows its disruptive potential, Uniswap remains a tough competitor.

With a market cap of $7.98 billion and a daily trading volume of $312.6 million, Uniswap dominates thanks to its cross-chain reach and institutional adoption.

In contrast, Aerodrome’s market cap of $1.07 billion and daily volume of $29.2 million speak to its relative infancy.

Although it excels in layer 2 integration and innovative tokenomics, it is essential to go beyond its concentrated niche.

Uniswap’s recent initiatives – expanding Layer 2 operations on Optimism and Arbitrum and integrating advanced MEV-resistant technologies – strengthen its position in the market.

Thus, the platform must increase transaction volumes, expand its ecosystem and attract institutions to be competitive.

Read Aerodrome Finance (AERO) Price Forecast 2025-2026

For now, Aerodrome signals a shift in the DeFi landscape, but it seems unlikely that it will be difficult to challenge Uniswap’s dominance in the short term.

The gap is significant and closing it would require a fundamental leap in adoption, technology and liquidity.