According to the latest data, artificial intelligence agent’s tokens (AI) have surpassed other cryptographic sectors in the past 30 days, experiencing remarkable two -digit prices.

This wave comes in the middle of a broader market resumption, AI agents emerging as the dominant story.

AI agents direct the recovery of the cryptography market

After having undergone significant losses in the first quarter of 2025, the AI agents sector experienced a notable turnaround. At the beginning of March, Beincryptto said that its market capitalization had dropped $ 4.4 billion, marking a sharp 77.5% drop in its top of all time.

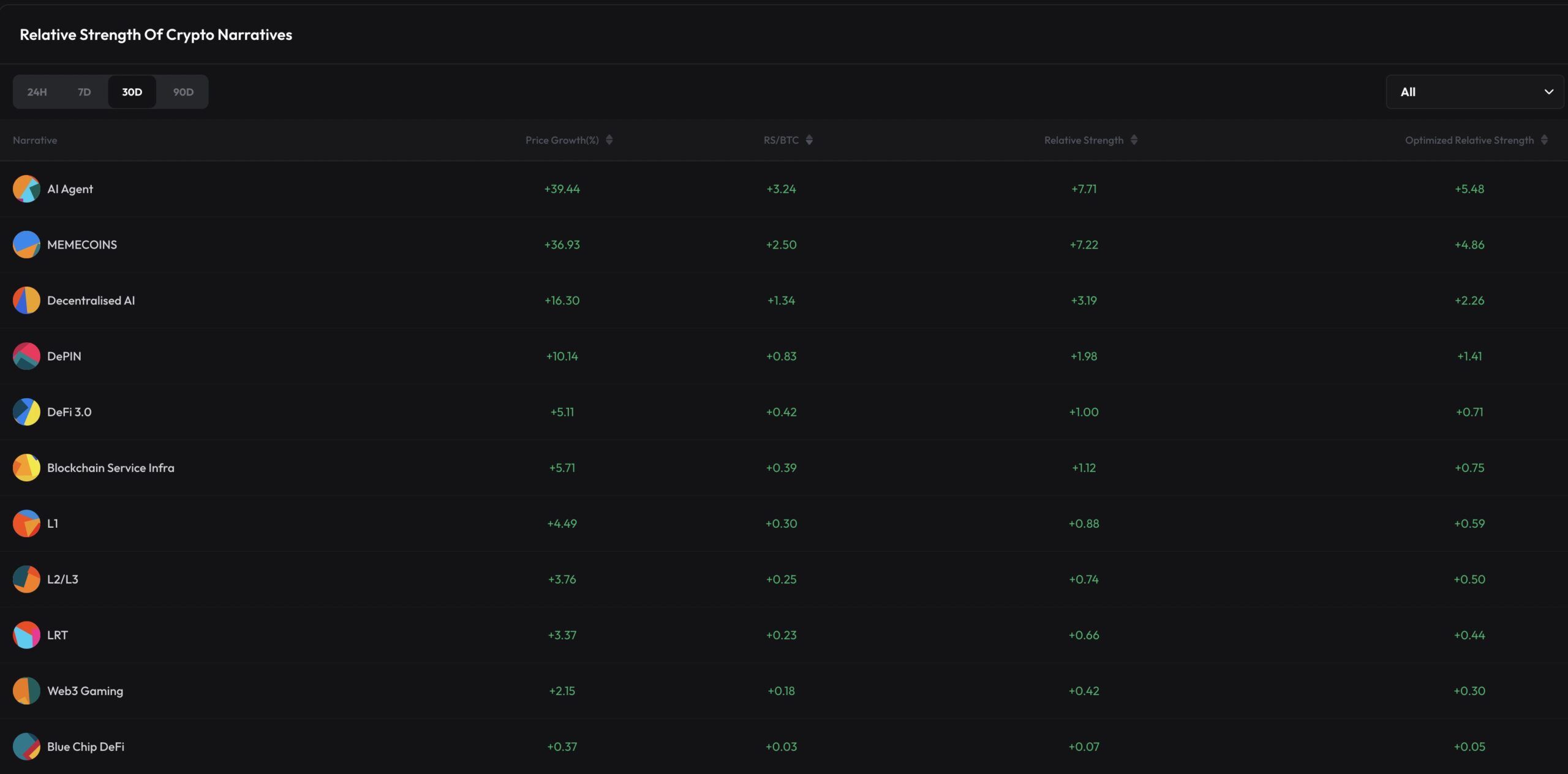

However, the momentum has reversed. During the last month, AI agents experienced price growth of 39.4%. The sector has exceeded other stories such as parts even (+ 36.9%) and a decentralized AI (+ 16.3%) in the last 30 days.

With the highest relative force score of +7.7, the tokens have demonstrated an exceptional dynamic, stressing their growing attraction among investors.

Coingecko data show that this overvoltage has propelled the total market capitalization of AI agent tokens at $ 6.4 billion. Among the ten best tokens, the virtual (virtual) protocol experienced an extraordinary increase of 142.8% of the value, reaching a two -month summit. The growth of the token is supported by a significant increase in active users, reporting a strong community commitment and an adoption.

In addition, AI16Z (AI16Z) and AIXBT by Virtuals (AixBT) jumped 72.1% and 66.1%, respectively.

“AI agents are hot rotation at the moment – and Santiment supports it with a clear wave of social domination for” AI agents “, reflecting the price rebound in the net sector,” noted a user on X.

The wider interest in the sector extends beyond the cryptography market, as evidenced by Google Trends data. Last week, the search volume for the keyword “IA agents” culminated at 100.

Does Fomo feed the last increase in AI agents?

Nevertheless, despite the bullish feeling, some experts remain skeptical. Simon dedic, CEO of Moonrock Capital, drew attention to the recent outperformance of AI and the same corners.

According to him, this trend reflects what he describes as the “ultimate trade in the mid-hawthorn curve”. In other words, many investors who had previously remained on the sidelines are now rushing to invest in these sectors. However, they are motivated by the fear of missing (FOMO) on potential gains as market conditions improve.

Thus, DEDIC is very critical of this behavior. He suggested that these investors focus more on the continuation of trends than long -term and long -term investment decision -making.

“They deserve to lose everything – and most of them will probably do it. The real Alpha will be in the fundamental remedial trade and that will surpass everything else,” said DEDIC.

While the market continues to evolve, only time will reveal if these tokens can maintain their momentum or if the speculative media threw ended in the end.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.