- Solana has climbed $ 125, but whale outing and dense supply areas nearly $ 140 increased the risk of long pressure.

- The recent rebound was more like a temporary rescue rally.

Despite the recent resumption of Solana (soil) at $ 120, the great holders remain deep in the red, which affects the global feeling of the market.

Channel data shows a major recently liquidated whale 274,188 sol at an average price of $ 108. With an initial cost base of $ 148, this capitulation locked in an $ 11 million in losses made.

Even with soil which now oscillates about $ 125, marking a rebound of 30% compared to its lower April 7 of $ 95, the whale would still be underwater.

This behavior reflects a continuous distribution between intelligent money, as whales use liquidity points to go out rather than accumulate. For retail merchants, it is a flag of prudence in the middle of a fragile macro and chain background.

Key supply zone in the accent

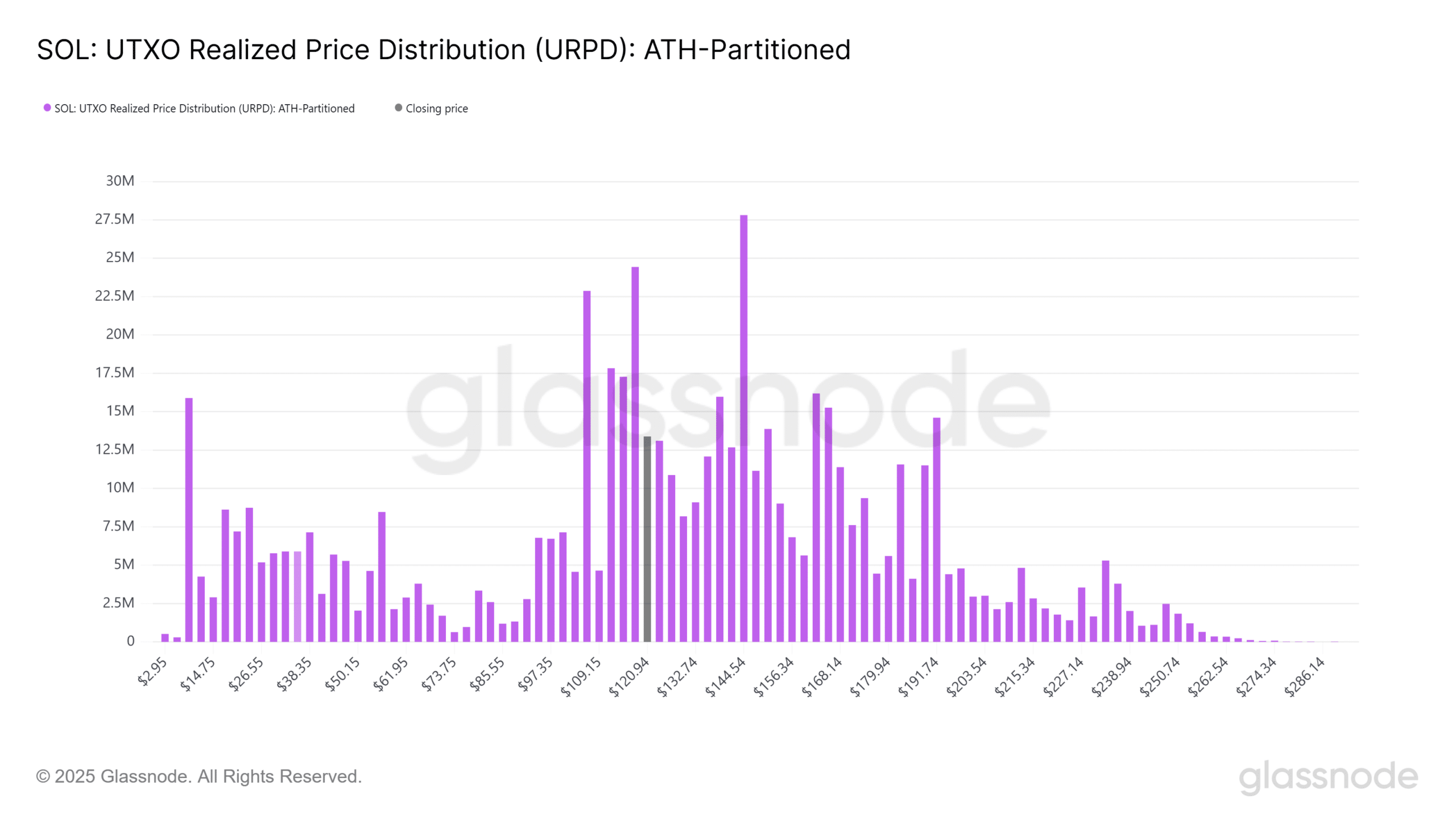

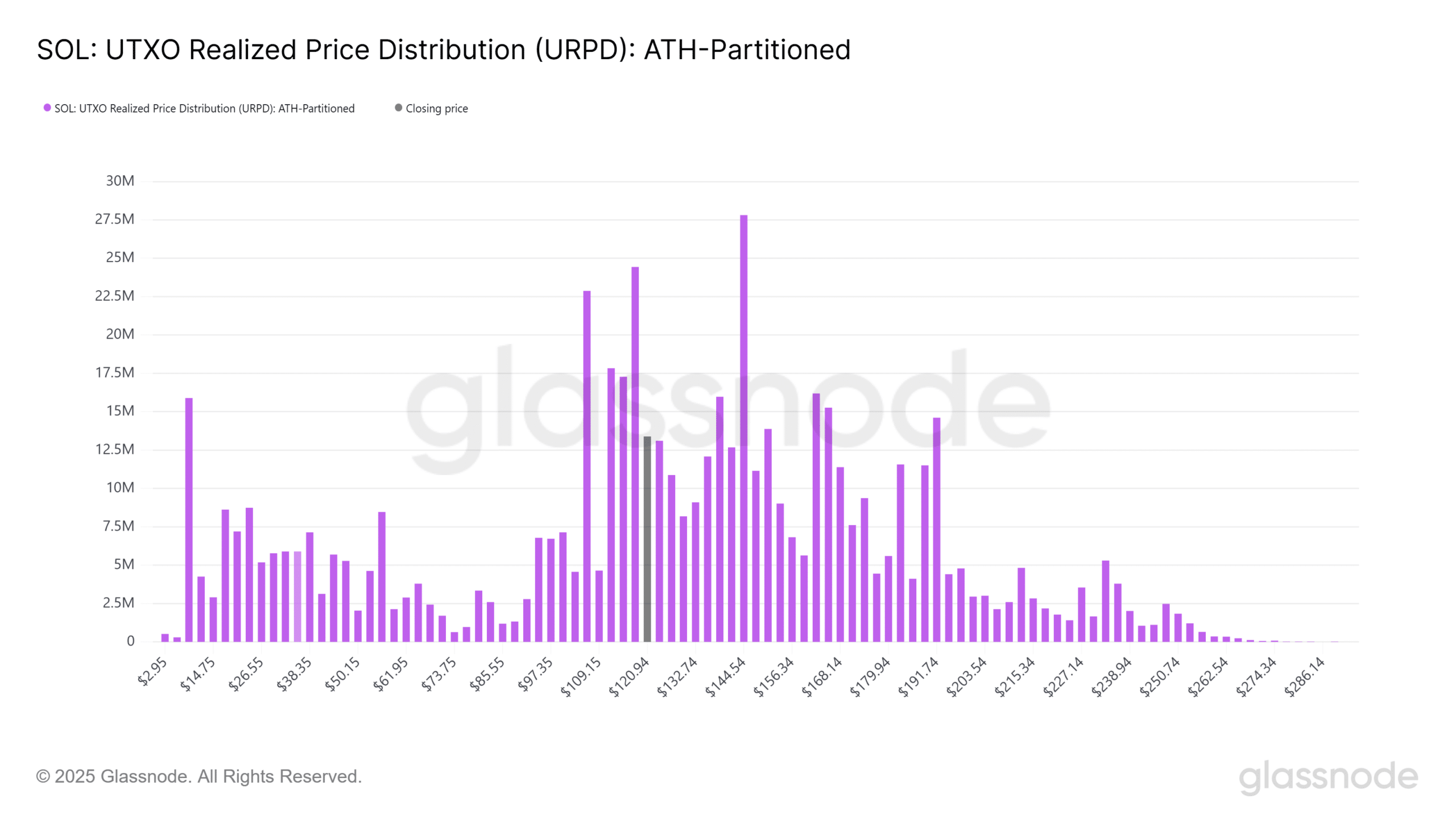

The distribution of prices produced UTXO (URPD) provides a granular rupture of the place where the solana parts were transgeated for the last time and mapped compared to the price levels.

For soil, the data highlights three main supply clusters – around $ 100, $ 120 and $ 140. These concentrations indicate that a significant share of the supply in circulation has been acquired at these levels.

Among them, the $ 140 zone stands out, with more than 27.8 million soils there, representing approximately 4.75% of the total traffic supply.

This cluster represents a key area of resistance, because many carriers are either near the profitability threshold, or confronted with unpaid losses.

Source: Glassnode

Therefore, the risk -based sales risk remains if soil does not recover the level of $ 140. A price return to this threshold could lead the holders to move to unrealized benefits, which has potentially triggered an upward rotation driven by the FOMO and the greed of the market.

In addition, 38 million soil remain grouped between $ 117 and $ 120, making this range a potential hot spot for taking advantage as the price breaks this ceiling.

Consequently, until the level of $ 140 is tested, the price volatility in the solara prices share is likely to persist.

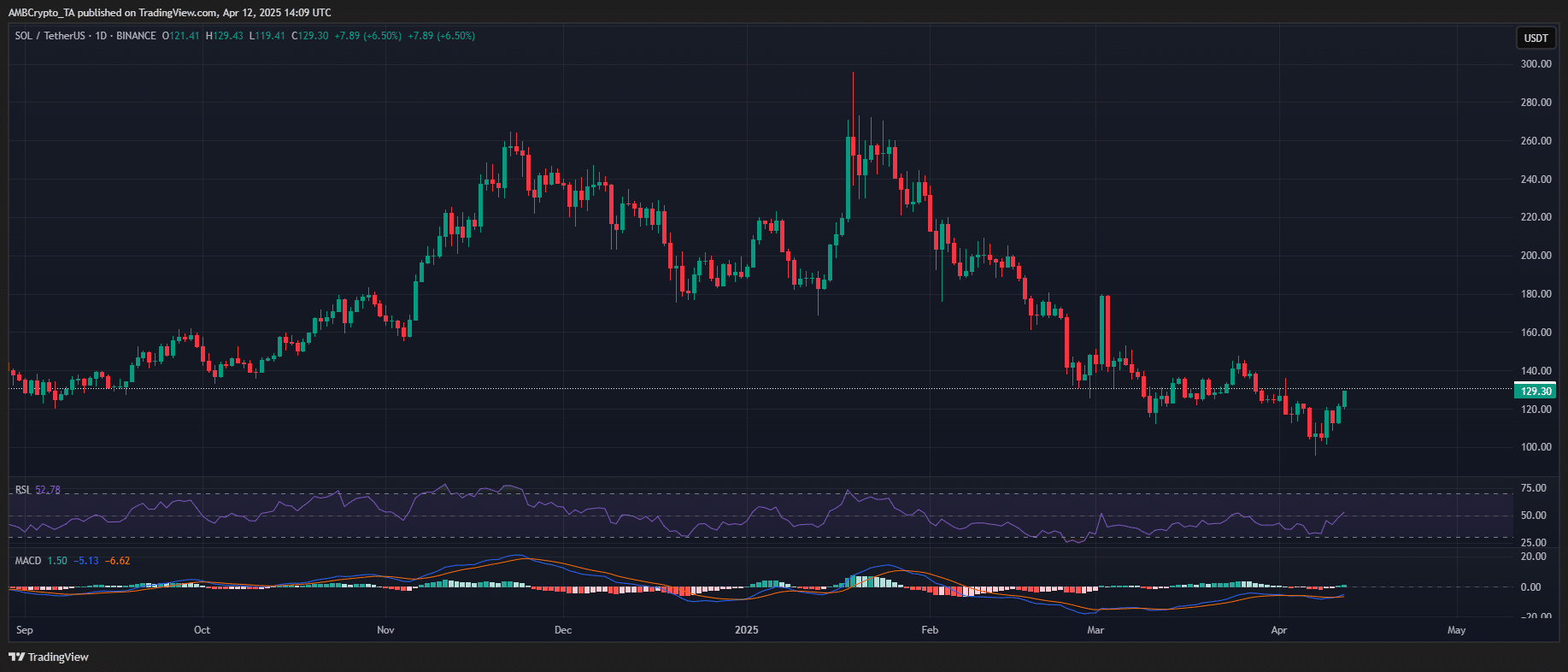

Tower data strengthens Solana market prospects

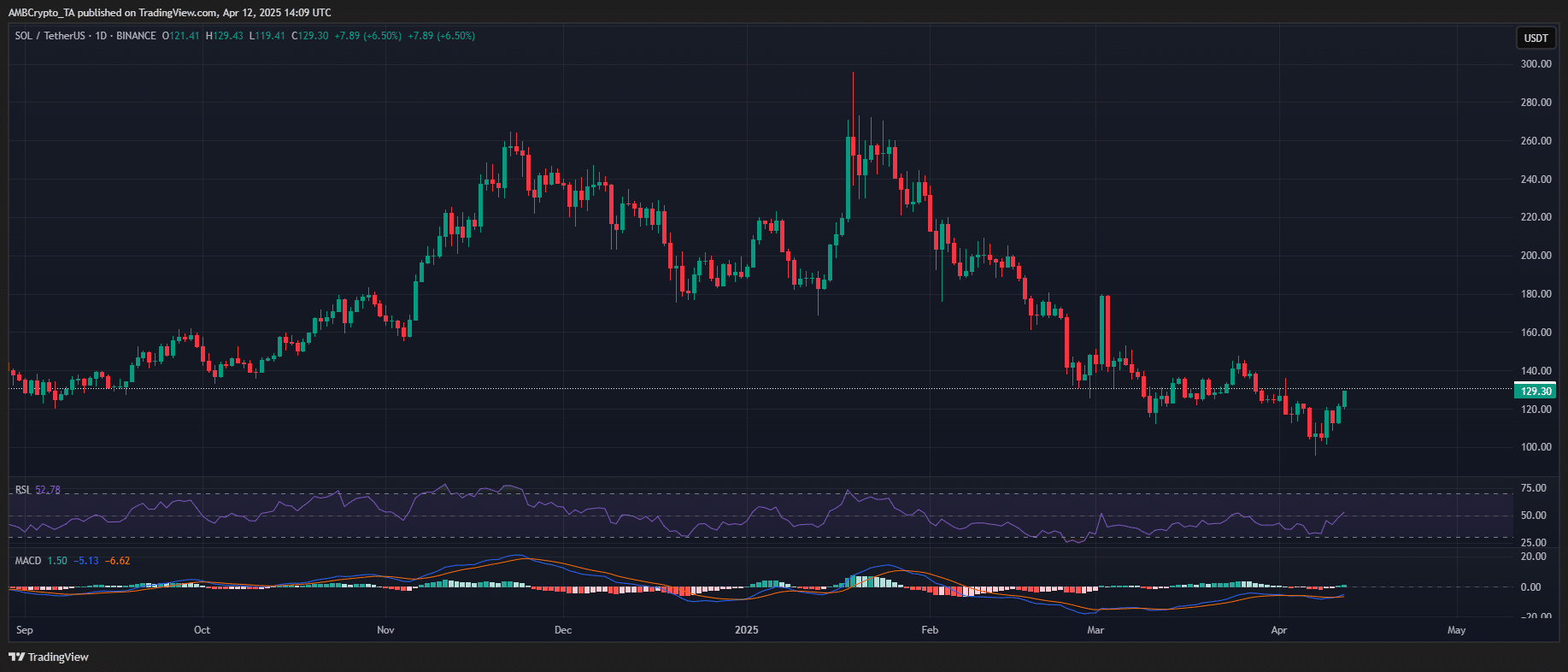

The daily rise of 7.07% Solana positions it as the main high -level active in terms of recovery speed.

This rally is not only focused on points – derivative data confirm the aggressive positioning. Open interest (OI) jumped from 13.89% to $ 5.23 billion, reporting a new wave of leverage exposure when entering the market.

At first glance, it seems bullied. However, it also introduces fragility.

The distribution of whales was still active and short -term holders (3 to 6 months) are still deep in the capitulation area. In addition, the recent violation of a high density supply area ($ 117 at $ 120) opens the ground for a risk of high liquidation.

Source: TRADINGVIEVE (Sol / USDT)

If Solana fails to support the momentum, a long cascading pressure could trigger a high volatility of the drawbacks, especially since the funding rates are starting to distort positive.

In short, although the recent rebound has triggered optimism, this gathering carries the characteristics of a rescue phase based on liquidity – not a confirmed trend reversal.

Until Solana recovers and holds above the $ 140 supply area with conviction, the downward risk remains firmly on the table.