A recently launched cryptocurrency on the Solana blockchain has come under scrutiny following revelations of alleged insider trading, with multiple sources saying some investors obtained an outsized share of the token supply before to get rid of their assets to make extraordinary profits.

According to on-chain data and social media comments reported by Coin Telegraph, the project, known as FOCAI, reached a market cap of $50 million within minutes of launch, but has since seen its price rise and its valuation decline due to concerns about business practices and the underlying of the token. integrity.

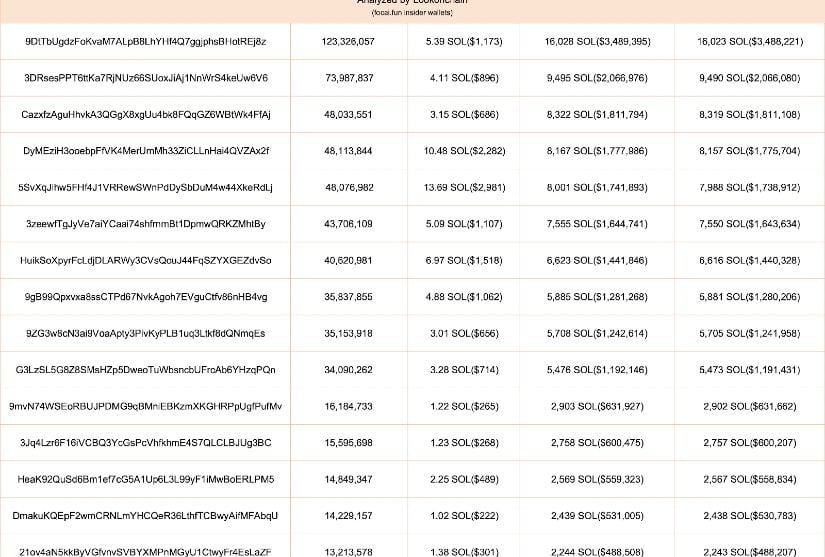

On-chain analytics posts shared on of FOCAI tokens, or approximately 60.5% of the total supply of the token. These transactions took place on Raydium, a decentralized exchange on Solana, and were then followed by the sale of all FOCAI tokens for 94,175 SOL, worth approximately $20.5 million once the transactions were completed. . Blockchain observers say this earned alleged insiders a profit of around $20.48 million.

Alleged Insider Trading – Source:

A follow-up correction from an analytics account indicates that these acquisitions were not isolated by ordinary buyers, but were made by members of the FOCAI team itself using various wallets. The revelation sparked a rapid backlash within the crypto community on X, with participants expressing skepticism and concern over the scale of the reported gains. A widely circulated article explains how a single address turned an investment of approximately $1,168 into $3.47 million in just three hours.

Market data also shows that FOCAI had a remarkable debut, reaching a market capitalization of $50 million in just 11 minutes. Trading volume reached $48.2 million in the first 47 minutes of launch, reflecting a high level of initial interest in the AI-themed token. However, prices fell significantly after news of the alleged insider trading broke; FOCAI price is currently hovering around $0.327, with the market cap down to $32.7 million.

Concerns over the legitimacy of FOCAI intensified when a crypto analyst called the project a potential scam on ‘Eliza, with minimal modification or addition of true blockchain functionality. The analyst’s report cites heavy use of popular terms such as “AI” and “blockchain” in FOCAI’s marketing, but alleges that the project lacks technical evidence to support these claims. The same report also flagged inconsistent or incomplete documentation in different languages, as well as missing token economics and unclear smart contract implementations.

These results reflect additional warnings from other observers. Some note that the code has been heavily hacked, key security measures appear absent, and there are few signs of a truly decentralized architecture. The discovery of an apparent internal strategy to acquire and then sell the majority of FOCAI tokens further fueled doubts about the transparency of the project, raising questions about how decentralized or fair the token launch was.

Market data from Pump.fun indicates that most traders who participated in FOCAI did not make significant profits, highlighting the asymmetric nature of these maneuvers.