The data on the chain show that the profitability of Ethereum investors experienced a net reversal after the last rally of the price of the assets.

The profitability of the Ethereum holder recently observed a spectacular reversal

In a new article on X, DEFI institutional solutions provide Sentora (formerly intotheblock) explained how the loss of profit has changed on the Ethereum network.

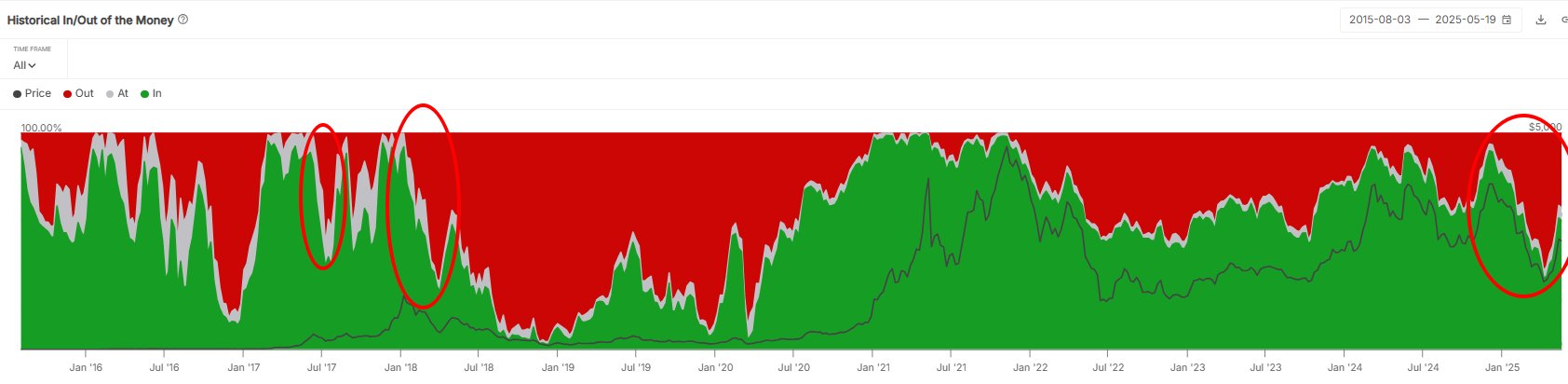

The chain relevance indicator here is the “history in / out of money”, which tells us which part of the user base of the ETH is in profit (“in money”), the loss (“out of money”) and the simple rupture (“to money”).

The metric works through history on the chain of each address on the network to see the average price where it has acquired its parts. If this average cost base is lower than the cash price of any portfolio, then this particular user is considered in money. Likewise, the address is supposed to be out of money in the opposite case and money when the two prices are equal.

Now here is a graphic that shows the trend of Ethereum Historical in / Out of money in the last decade:

Looks like the amount of green investors has gone up in recent days | Source: Sentora on X

As displayed in the above graph, Ethereum silver investors had observed a steep drop following the sale which started in December 2024. Before this decklessness, the metric was above 90%, which implies that the vast majority of users held unrealized gains. In April 2025, however, the situation had completely overturned investors because this value had only fallen at only 32%.

Now another change seems to have occurred for the addresses of the cryptocurrency, because the price of the ETH this time saw a net rally. Almost 60% of holders are now back in money, which, although not quite near the same level as at the end of last year, is significantly higher than the bottom.

In the graph, the analytical company stressed when Ethereum saw such profitability fluctuations for the last time. “The asset has not witnessed volatility on this scale since the 2017 cycle,” notes Sentora.

In some other news, ETH has recovered two important levels on the channel after its recovery race, as Glassnode discussed in its latest weekly report.

The price of the coin seems to have surpassed the True Market Mean | Source: Glassnode's The Week Onchain - Week 20, 2025

From the table, it is obvious that Ethereum recovered the price made at the start of the race. The price made represents the basis of the average cost of all investors on the ETH network. Currently, this level is located at $ 1,900, which means that at the current exchange rate, the holders would be in notable profit.

The cryptocurrency has also managed to exceed the market average located at $ 2,400, which is a model similar to the price made, with the exception of the fact that it aims to find a more precise level of average acquisition for the market by excluding the offer of limited dormants in the long term.

Ethereum has only one more level to recover: the price made active at $ 2,900, which is again a model which iterates on the price made.

Ethn price

Ethereum climbed $ 2,660 after a rally of around 4% last week.

The trend in the ETH price over the past five days | Source: ETHUSDT on TradingView

Star image of Dall-E, Glassnode.com, intotheblock.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.