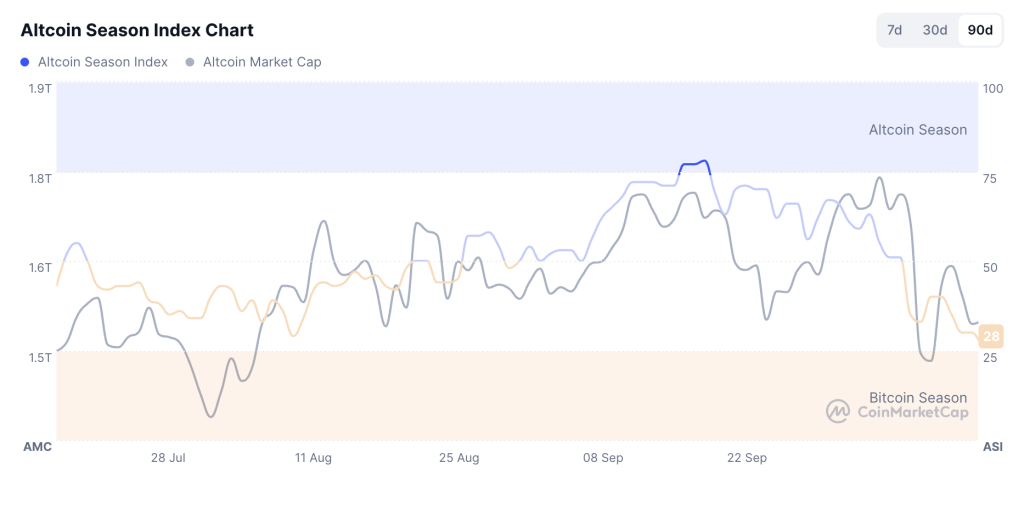

The Altcoin season is mild, with an index near 28, but the rotation has not stopped. Traders are always interested in names that combine liquidity with clear short-term signs, whether that’s a measured price gain, a defended support level, or an uptick in execution across platforms.

DeXe corresponds to the first profile. Tron is sitting in the second, stable after a retest of support. Jupiter belongs to the third group, where flatbed printing always generates higher turnover. Together, they outline a day driven more by participation patterns than by large gatherings.

Altcoin Season Index (Source: CoinMarketCap)

DeXe: gain measured with a support structure

DeXe is currently trading near $7.12, up 5% over 24 hours. The movement is not a peak. Intraday ranges tightened throughout the session while bids remained at levels seen at the start of the week. This combination often indicates accumulation rather than brief compression.

The interest is linked to regular use of governance and social trading features and consistent visibility on market trackers. Liquidity has been sufficient across major pairs, allowing for larger clips without significant slippage. If volume stays close to the current pace and spreads remain orderly, DeXe can maintain its place on the rotation screens even if the index remains weak.

“From agent reputation to policy as code and human-in-the-loop feedback, we sketch a future where AI quickly creates value and Web3 makes it trustworthy,” DeXe posted on social media.

A streak of higher lows over short periods of time helped trend followers stay engaged. A close above today’s intraday level would confirm this scenario and leave room for a continuation attempt.

Tron: support near $0.32 invites patience

Tron costs around $0.321, up 1.3% in 24 hours. The price sits in a well-watched band near $0.32 that many bureaus view as near-term support. Stabilization is important because it reduces downward pressure as the broader market cools.

Tron price (Source: CoinMarketCap)

Reports cite constant on-chain activity and consistent depth of sites as reasons why the level is maintained. The job here is position management rather than hunting. If $0.32 continues to serve as a base, the next checkpoint moves closer to $0.35, where previous attempts failed. A net loss of the basis would lead to a refocusing of attention on risk control.

Jupiter: fixed price with a clear increase in volume

Jupiter is trading near $0.362, roughly unchanged on the day, while 24-hour volume is up about 17% to $43 million. The rise in tickets without directional printing often appears when liquidity providers and programmatic strategies are busier, but buyers and sellers remain balanced.

A stable close with increasing turnover does not guarantee a break. This indicates deeper participation, which often precedes cleaner moves when order flow is skewed. Traders will be watching to see if additional activity persists into the next session and if liquidity migrates to one side of the book.

Altcoin Season Reading

A rating of 28 indicates that the width is thin, but today’s tape is informative. DeXe displays a controlled lead with a supportive structure and liquid pairs. Tron offers a reading on patient positioning at $0.32, useful in a market that is not running. Jupiter’s higher volume with no price change suggests engaged participants and healthier books than the title would suggest.

The checklist is simple. For DeXe, track volume versus spreads and whether higher lows continue to form. For Tron, watch the $0.32 base and reaction to approaches $0.35. For Jupiter, watch to see if the $43 million turnover becomes a trend and if the flow is skewed enough to throw prices out of balance. If these markers hold, the selective rotation can continue even if the altcoin season index remains weak.

The post Altcoin Season Index Slips to 28 as DeXe Advances, Tron Stabilizes and Jupiter Activity Increases appeared first on Cryptonews.

https://t.co/mb2vxHGgD1

https://t.co/mb2vxHGgD1