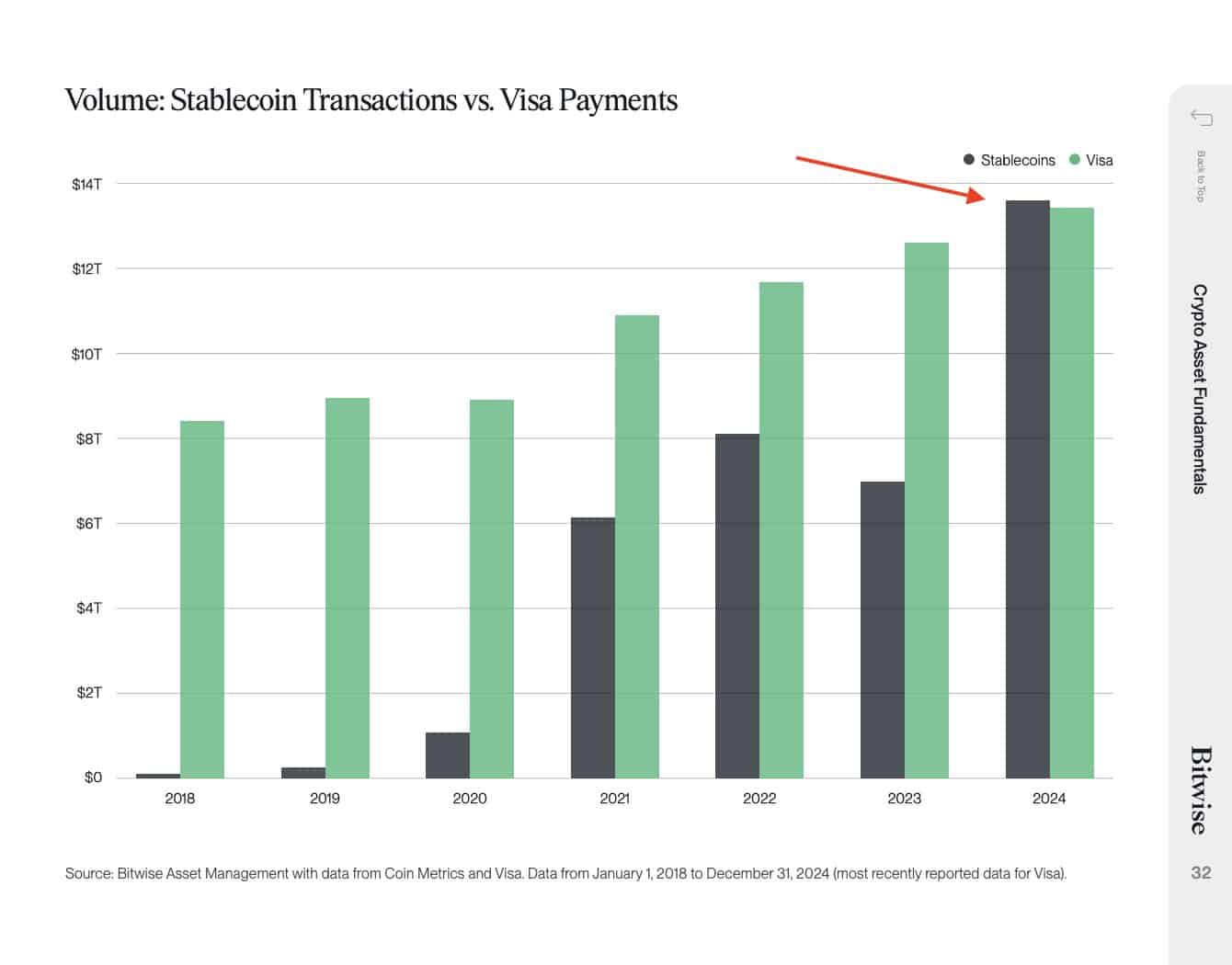

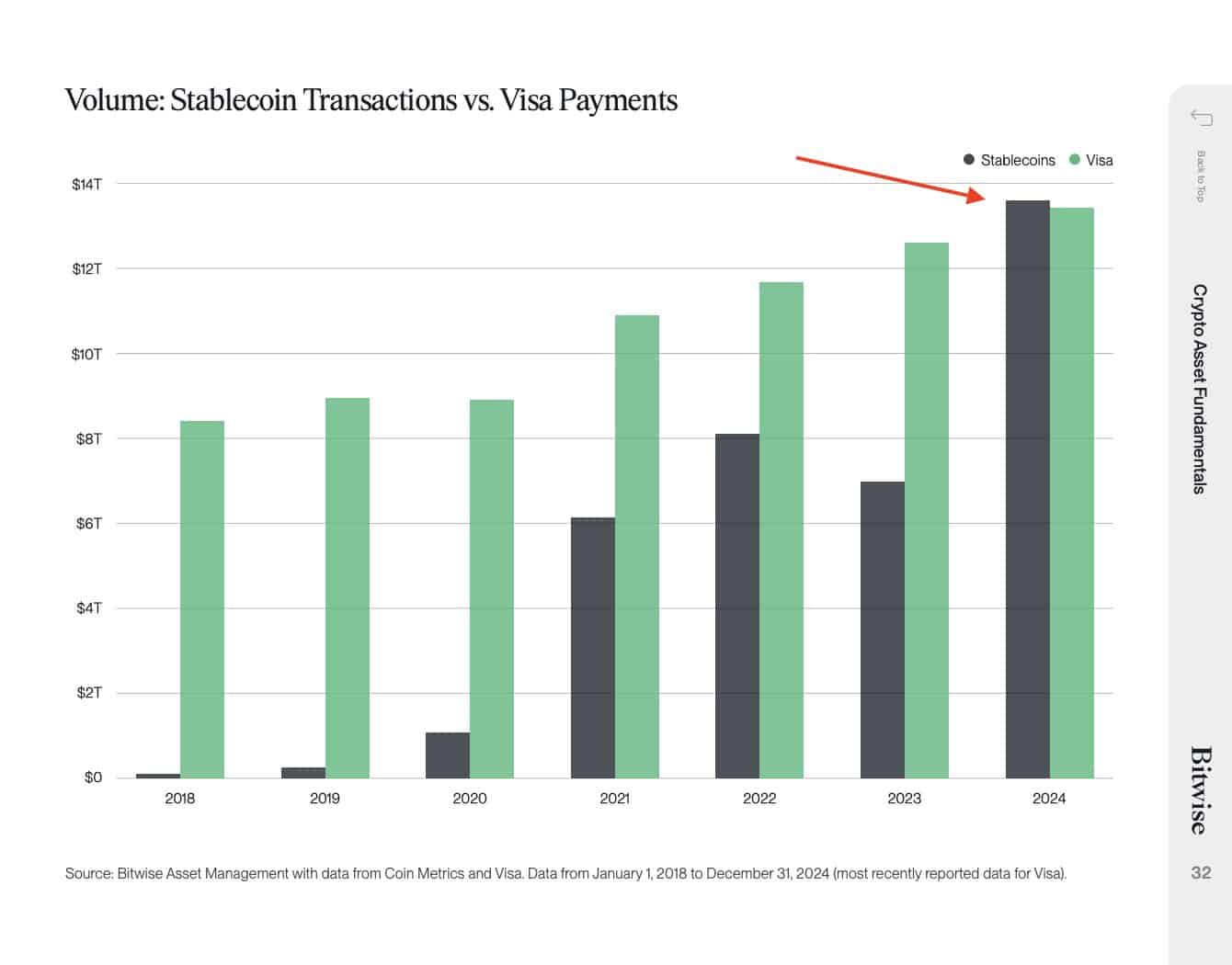

- Stable and total market capitalization has crossed $ 233 billion, the treated volume reached $ 27.6 billions of transactions in 2024 – higher than the visa.

- The problems of the Altcoin market suggest that capital is entering stable assets during periods of volatility.

The Stablescoin market has taken an important step because its total market capitalization has taken 233 billion dollars.

This increase in market capitalization of the stables occurs while the wider Altcoin market is still under pressure, regularly plunging on weekly graphics.

The contrasting movements raise a key question – if the market is experiencing an increasing adoption of stalins or a widespread outing of volatile cryptographic assets?

From marginal utility to financial backbone

A few years ago, stablecoins were mainly used for rapid transactions and arbitration. Quick advance until today, they are backstop infrastructure for cryptographic finance.

Stablecoins alone allowed 27.6 dollars in volume in 2024, more than the visa treated during the same period. Almost all of this volume was adjusted to Ethereum, solidifying the chain lock on the trading of the stables.

The figures speak hard, the stablecoins are no longer a niche because they become the basis of the transfer of numerical value.

Source: Bitwisewise

Are Stablecoins a safety net?

The growing market capitalization of Stablecoins is not simply indicated broader use – it is also a signal of attitude of investors.

During high volatility or slowdown in the cryptography market, investors often run altcoin capital in stable assets such as USDT, USDC and DAI.

Stable tokens serve paradise while allowing to participate in the world of cryptocurrencies without having to dive into other spaces.

This behavioral trend is more pronounced in bear cycles, where the appetite for risks is secondary to the need to preserve capital. The result is an increased influx in stablecoins and far from high beta assets like altcoins.

Altcoins are pressed in the form of liquidity flow

As stablecoins go up, altcoins do the opposite. Total market capitalization Altcoin has been losing field for a few weeks in early December.

This is a sign that the increase in supply may not reflect the new net capital entering crypto, but rather capital cycling on the market.

As more altcoins are converted into stablescoins, there is fewer liquidity available to help power Altcoin rally. This can suffocate prices and prolong recovery times.

It is a dynamic that can amplify a lower momentum in the Altcoin universe.

Source: tradingView

If the stablecoins continue their current trajectory, their role in the economy of cryptography will develop more. And with the volume already exceeding the visa in 2024, it is clear that it is only the beginning.

The next few years could make the 27.6 dollars of today modest today.