Key Notes

- Amboss launches RailsX at PlanB forum, running atomic swaps entirely through Lightning Network channels without custody risk.

- Bitcoin DeFi surged 2,000% in 2024 to $6.5 billion TVL, with Babylon accounting for over 80% of the ecosystem’s growth.

- Lightning infrastructure grows as Taproot Assets enables support for multiple assets and Tether commits $8 million to stablecoin payments.

Amboss Technologies launched RailsX, a Lightning-native peer-to-peer (P2P) decentralized exchange, at the PlanB forum in El Salvador on January 30, 2026.

Unlike other exchanges that build separate protocol layers, RailsX executes transactions entirely through the Lightning Network. Transactions work like circular self-payments: funds flow through existing Lightning channels, exchange assets atomically, and then return to the sender. This eliminates custodial intermediaries and cross-chain bridge risks while retaining Bitcoin’s security model.

RailsX ANNOUNCEMENT:

The most powerful tool for financial access, advancing Bitcoin’s core principles of sovereignty and decentralization.RailsX enables peer-to-peer (P2P) trading with Lightning, enabling self-custodial KYC-free P2P trading. Lightning is now a DEX.

⚡️🧵 pic.twitter.com/IQepZozlpb

—AMBOSS ⚡ (@ambosstech) January 30, 2026

“RailsX represents the unstoppable next step in the evolution of Bitcoin, delivering true financial freedom to users around the world through scalable, self-custodial P2P exchanges,” said Jesse Shrader, CEO of Amboss Technologies in his announcement.

The platform builds on five years of development and integrates Amboss’ Magma liquidity market with its Rails automated liquidity service.

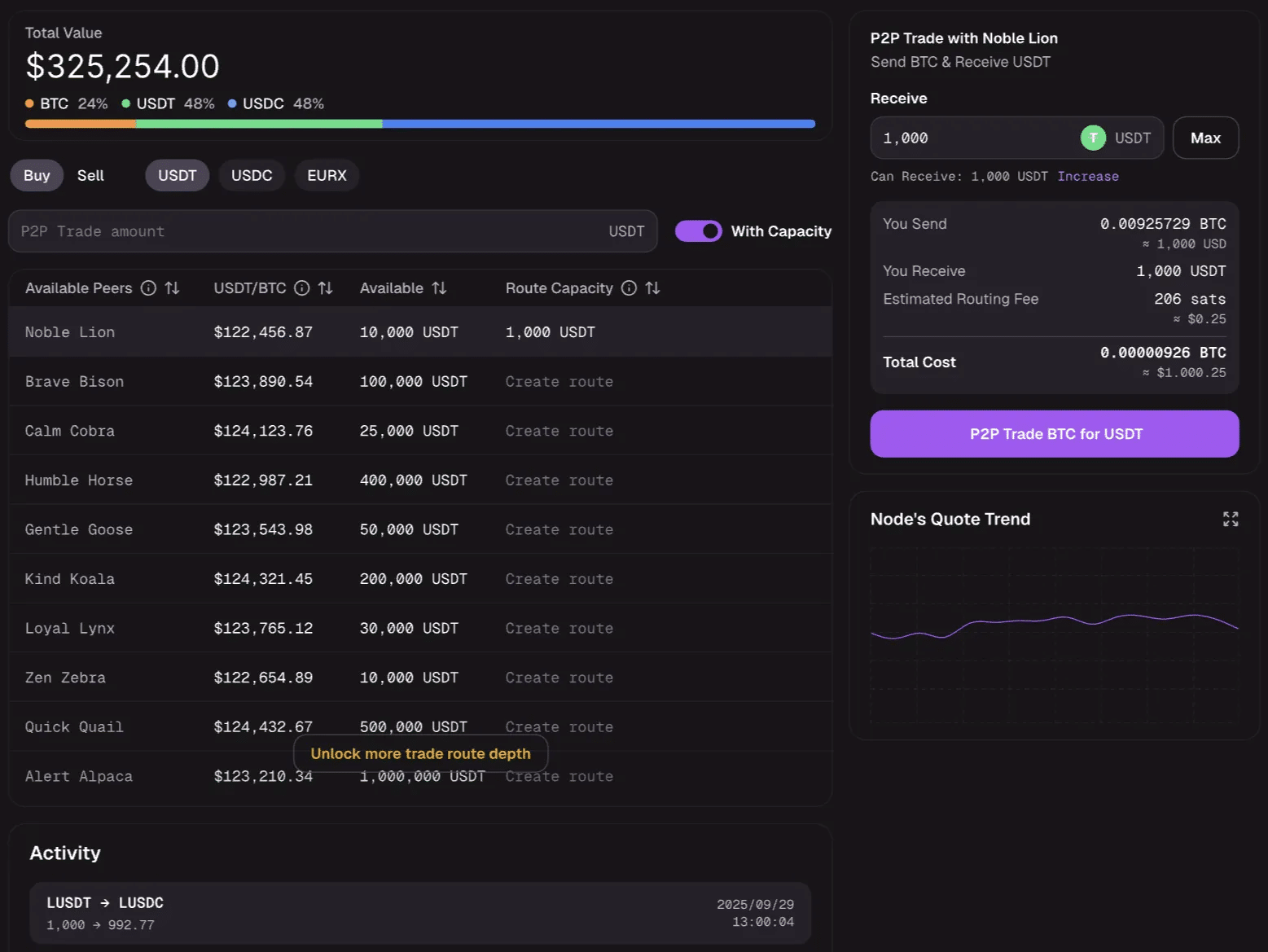

A first peak of the UI for RailsX | Source: Amboss blog

Bitcoin DeFi has just experienced its breakthrough in recent years

RailsX is launching into a growing Bitcoin ecosystem. Bitcoin

BTC

$78,562

24h volatility:

5.2%

Market capitalization:

$1.57T

Flight. 24h:

$67.16 billion

The total value locked in DeFi jumped 2,000% in 2024, from $307 million in January to $6.5 billion at the end of the year. Babylon, a staking protocol, drove most of this growth, accounting for over 80% of the industry’s TVL. Despite the current bear market, the Bitcoin DeFi ecosystem had a total value locked of nearly $6.11 billion as of January 30, according to DefiLlama.

In June 2025, Lightning Labs released Taproot Assets v0.6, enabling support for multiple assets on Lightning for the first time. Suddenly, stablecoins could move through Lightning channels for a fraction of the cost of traditional transfers.

Tether saw the opportunity. The company committed to issuing USDT as a Taproot asset and injected $8 million into Speed1 to increase Lightning stablecoin payments. Speed has already processed $1.5 billion in annual volume for 1.2 million users with instant settlement.

Bitcoin DeFi still lags behind Ethereum, with $66 billion TVL, but the gap is narrowing. RailsX connects Bitcoin-stablecoin pairs to the $9.5 trillion daily foreign exchange market, according to the company. Processing costs reach 0.29% in optimized configurations, although actual fees depend on channel liquidity.

Success depends on Lightning’s ability to handle actual transaction volume, something DEXs have promised for years but rarely delivered at scale.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

José Rafael Peña Gholam is a cryptocurrency journalist and editor with 9 years of experience in the industry. He has written in leading media outlets like CriptoNoticias, BeInCrypto and CoinDesk. Specializing in Bitcoin, blockchain and Web3, he creates news, analysis and educational content for global audiences in Spanish and English.

José Rafael Peña Gholam on LinkedIn