Introduction

Defi is always an unregulated border where market manipulation can occur, which has made many institutional and merchant players hesitate before entering space. However, the ability of the industry to detect and treat these practices improves rapidly.

In November, we showed how blockchain data can reveal these manipulation tactics, including washing trading on the United Pools. While manipulation detection of the cryptography market is still at its beginnings, data on the Kaiko chain can help regulators, exchanges and investors solve the problem over time.

Last week, data revealed that market manipulation is still occurring on Uniswap, especially thanks to so -called sandwich attacks. This tactic, inspired by high frequency trade in traditional finance, implies an attacker placing a purchase order before the transaction of a merchant and a sales order immediately after – in the same block – to manipulate the price for personal purposes. The attack was identified almost immediately and our data helps shed light on the event.

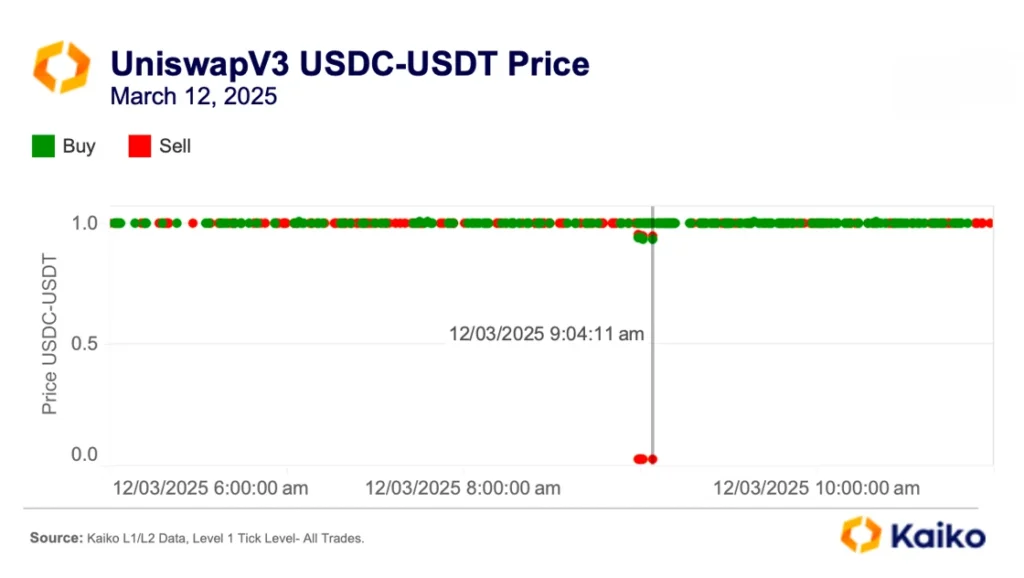

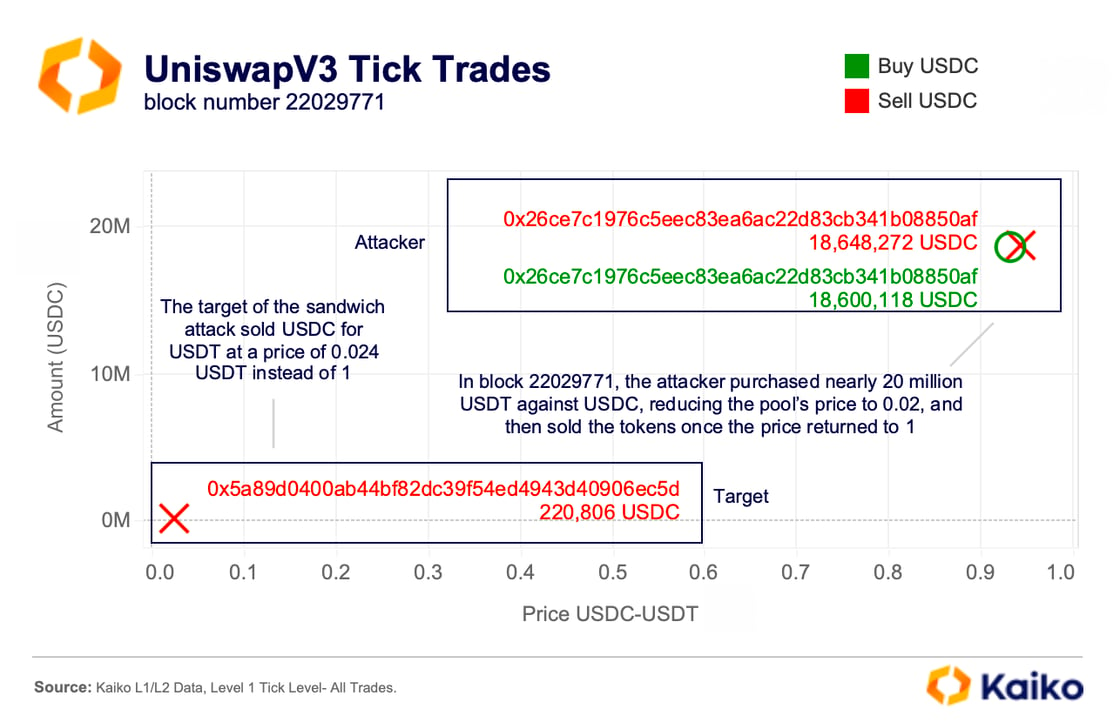

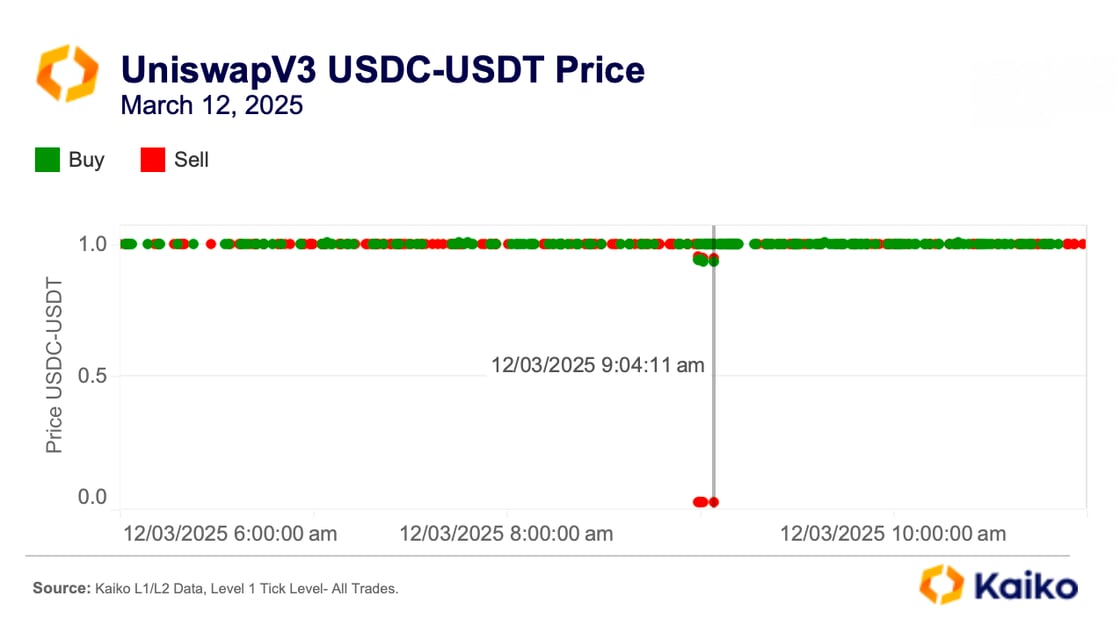

In this case, on a USDC-USDT liquidity pool on Uniswap V3 on Ethereum, a user tried to exchange 220.8k USDC for USDT. Just before the execution of the transaction, an attacker sold nearly 20 million USDC for the USDT, considerably lowering the price of the USDC to 0.024 USDT per USDC, due to the reduction in liquidity and the increase in shift in the swimming pool.

Consequently, the user exchange was executed at an unfavorable rate, receiving only 5.3K USDT instead of the planned 220.8k, resulting in a loss of USDT 215.5k. The attacker then bought the USDC at the lower price, in the same block, guaranteeing a profit even after having paid a tip of $ 200,000 to a block builder to prioritize their transaction.

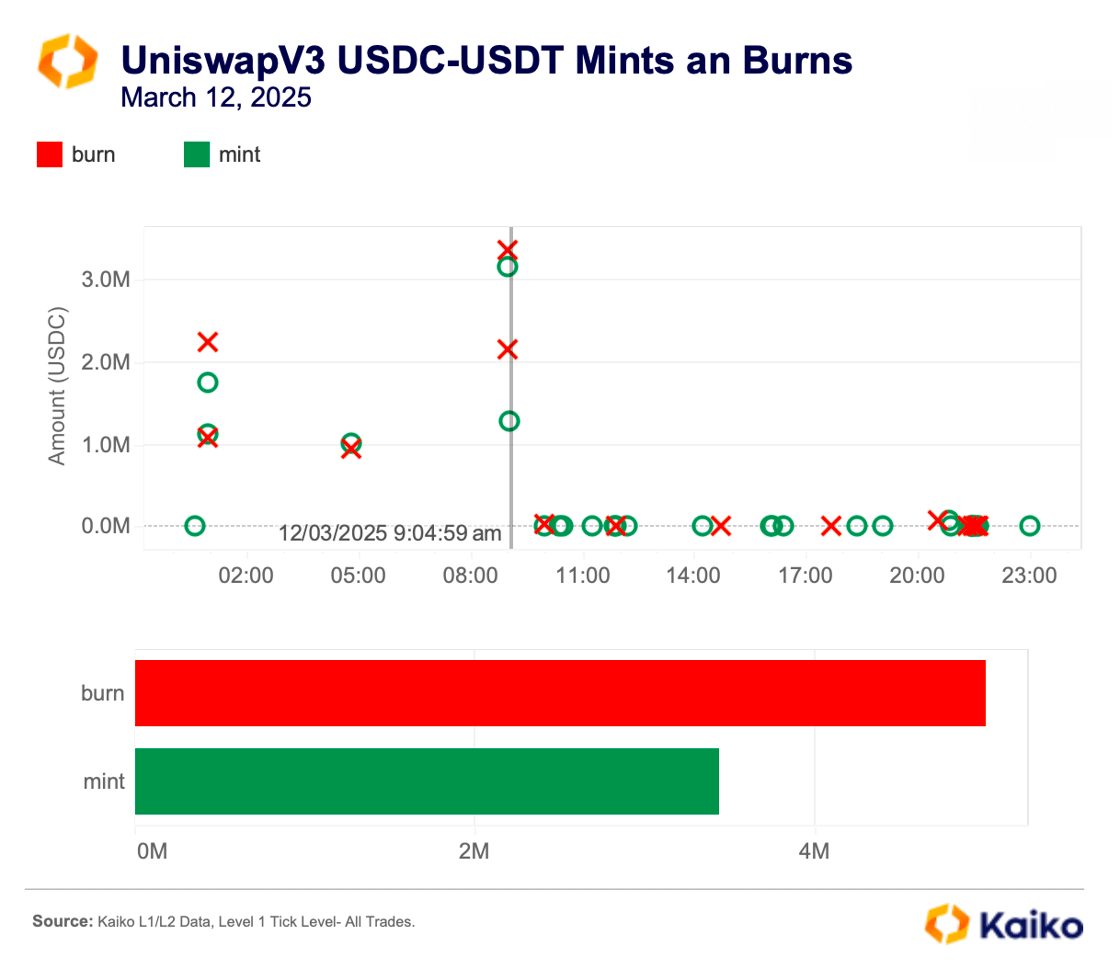

The attack coincided with a decrease in the liquidity of the USDC on Uniswap V3. On the day of the attack, more liquidity has been deleted than more, which allows the striker’s transactions to have a significant impact on the price.

The result was a massive shift – the difference between the expected price and the actual execution price – the market risk not only for the victim but also for all traders using this liquidity pool at the time.

Similar attacks have been observed on other decentralized exchanges such as hyperliquid, proving that these vulnerabilities are not limited to a single platform. It is suspected that a large merchant using the chain platform can participate in market manipulation by the usurpation of the usurpation.

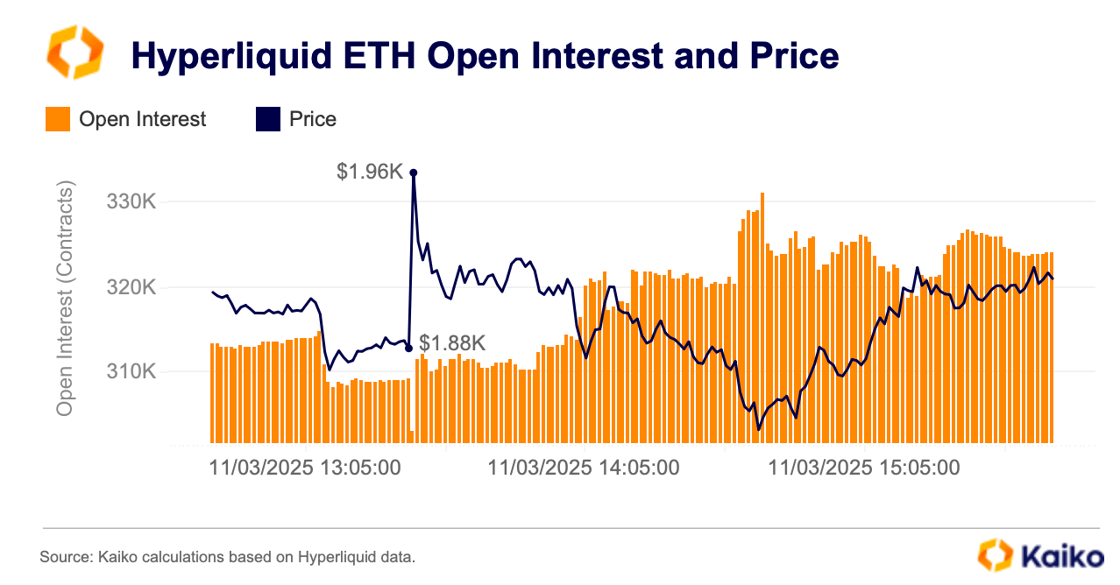

Last week, the big orders of this merchant moved considerably the market, which put the open interest from 310k to 300k in just one minute. The specific style of the merchant was compared to that of a former European trader who broke out the contracts by quickly entering and outside the positions in the German bond markets. The two traders exploited the market mechanics to gain an advantage and did it on a large scale.

However, the actions of the hyperliquid whale caused changes on the platform after intentionally liquidating an eth-dollar ETH position. This liquidation has caused $ 4 million to the hyperliquid safe. Consequently, traders must now maintain more margin for leverages.

As the cryptography industry ripens, take advantage of blockchain data can help detect and prevent such handling practices, making DEFI a fairer and more transparent commercial environment. However, until stronger protections are established, institutional actors will probably remain on the sidelines.

Data points

Will Pectra be enough to turn the trend for ETH?

Since the beginning of the year, the ETH has dropped from almost 40%to a 15-month hollow, underperforming most of the main active ingredients, including BTC (-14%) and soil (-35%). The ETH / BTC ratio, which has continued to drop since the merger, has reached a multi -year minimum of 0.023 last week. This signals the continuous underperformance of Ethereum compared to Bitcoin.

What if ETH’s low request, and could the next Pectra upgrade – the most important in terms of EIP – is the catalyst that he needs to bounce?

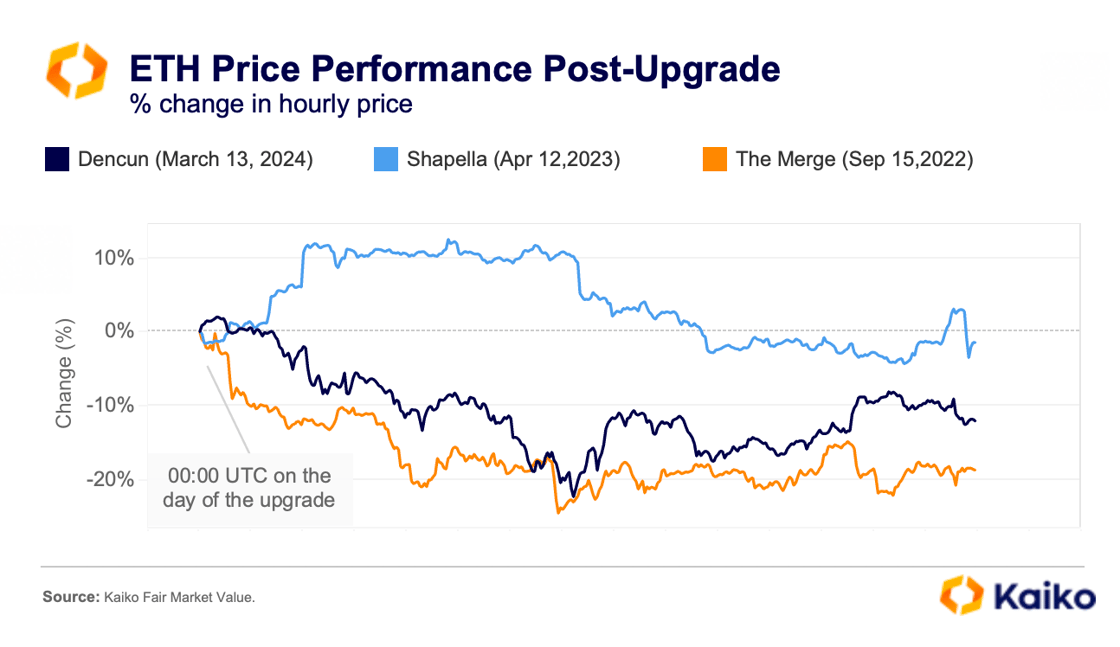

In recent years, the ETH has undergone several major upgrades without a hitch highlighting the network’s capacity to evolve despite its growing size and complexity. However, none of them was a major price engine. In fact, most were “sold the type of news” at prices down 12% and 18% during the period of two weeks after Dencun and the merger.

The price of the ETH only temporarily increased after Shapella, which allowed the millions of Eth to be no longer stacked by removing a significant risk for the ETH liquid derivative market.

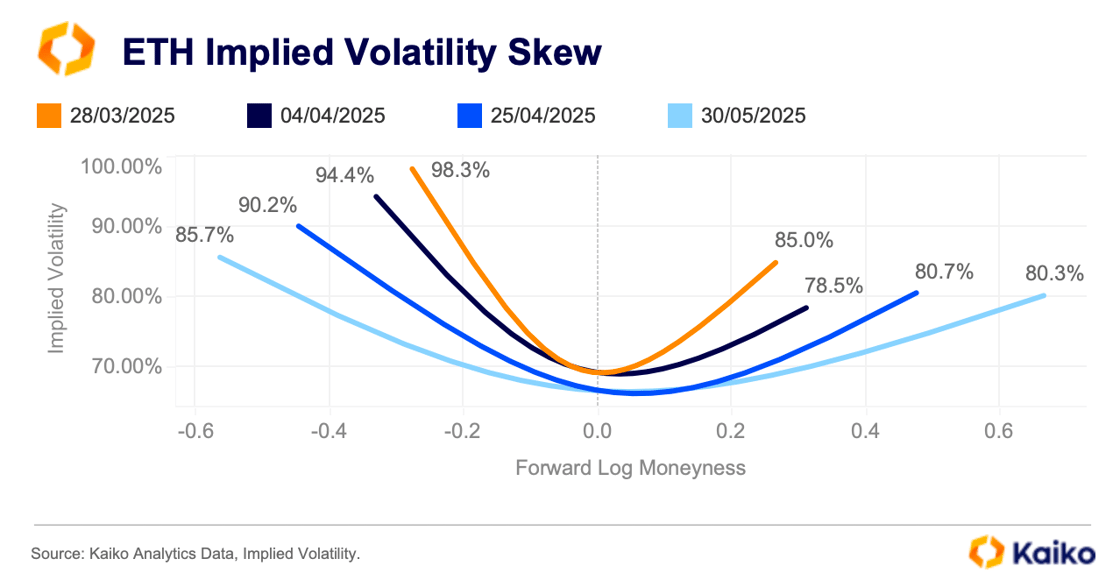

Sophisticated merchants are lowered for the post -level upgrade period, with implicit volatility on the left. The biggest bias is around the expiration of April 4, roughly when Pectra should be on the main one and suggests a high demand for coverage at that time.

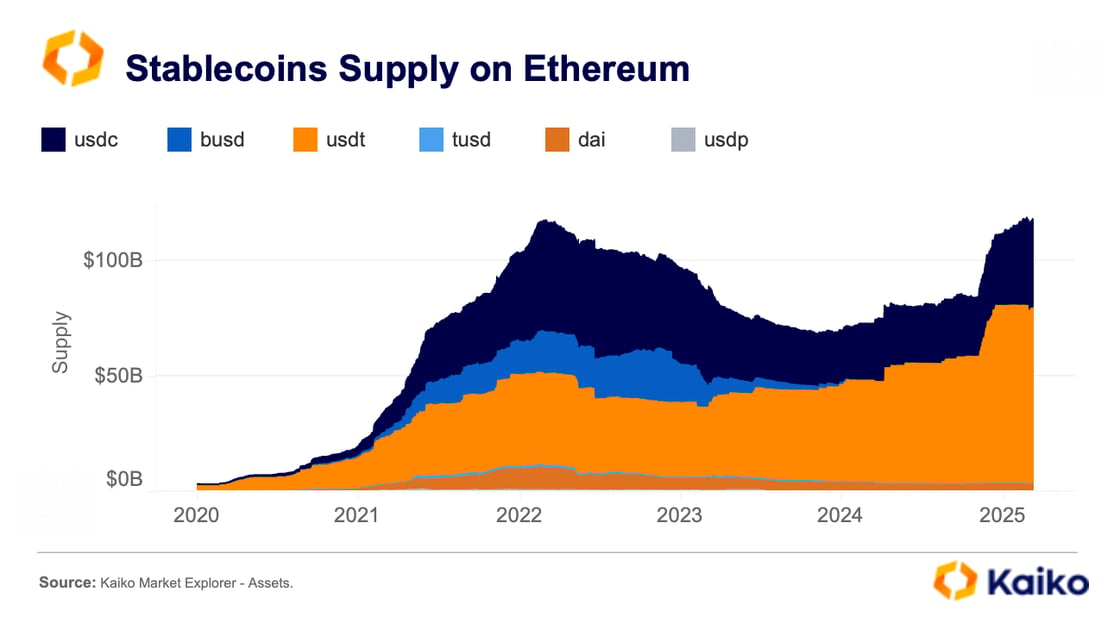

A major long -term catalyst for Ethereum is an adoption of Stablecoin and Rwa in tokenized. ETH remains the blockchain of choice for the program tokenized assets with a total Rwas of 3.8 billion dollars far exceeds the next most popular blockchain for Rwas – Stellar.

Stablecoin’s offer on blockchain exceeded $ 110 billion near its highest level since 2020 and ETH has a major market share compared to other blockchains. As we wrote last week, global regulatory clarity around Stablecoins improves, which potentially stimulates adoption.

Aave weakens after the rally inspired by the costs switch.

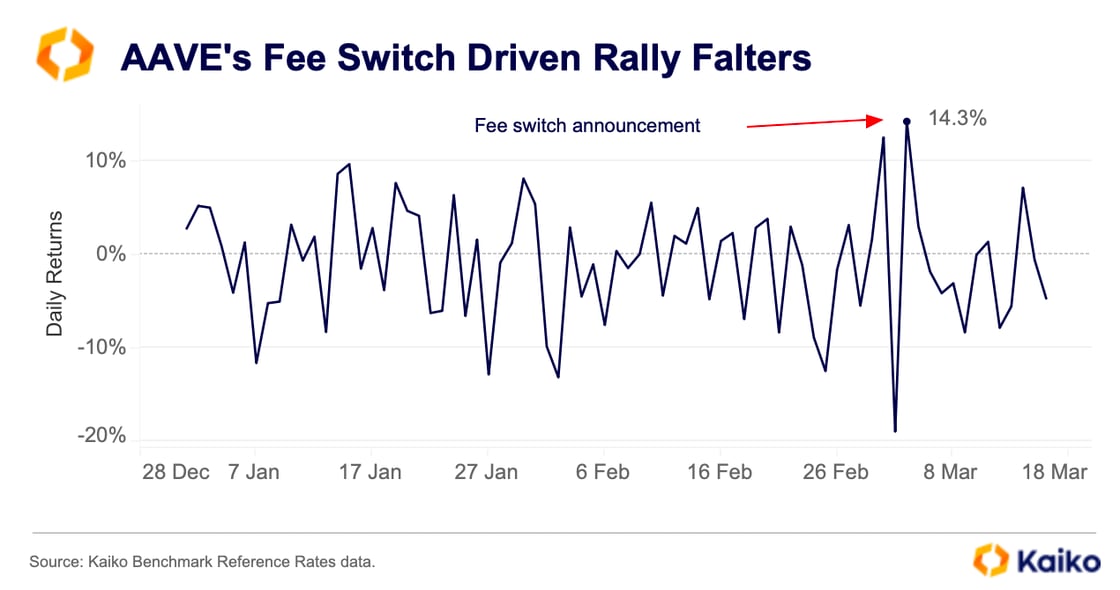

The Aave token jumped in early March after its price change proposal had advanced, which prompted a committee to buy a million dollars in Aave each week for six months. He initially joined 14% in one day despite wider market problems, but then decreased before bolishing 7% last Friday.

Prices have changed little today despite the vote adopted early on Monday and Marc Zeller of Aave-Chan inititave confirming that the acquisitions would begin this month. However, increased demand in the future should support stronger price performance.

Last month, we discussed the impact of a change in potential costs on the prices of our index on the Kaiko DEFI index. These proposals add a new dimension to the holding of a governance token, because the potential to gain income from the asset naturally increases demand. Although the rally may have fogled for the moment, the value of maintenance of the AAV tokens is planned to change fundamentally, which should modify the dynamics of demand in the future.

Is Binance.us ready for a return?

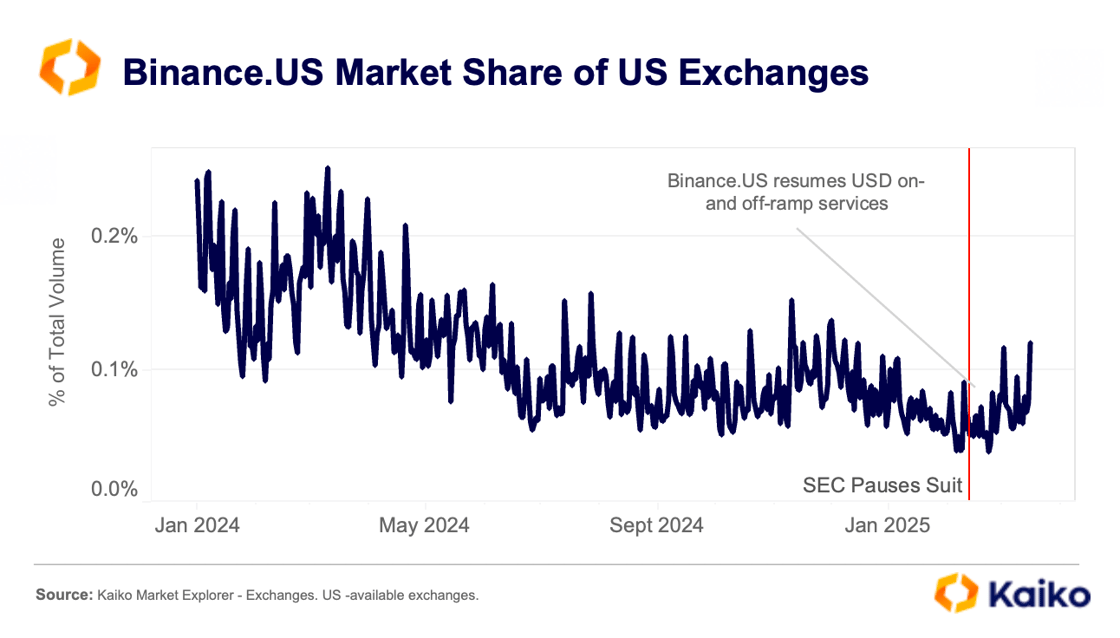

Since early February, Binance. The increase comes in the midst of speculation on the potential financial interests of the American president’s family.

While volumes remain low at around $ 2 billion a day, the exchange clearly benefits from the improvement of the regulatory environment. He recently revived USD services on and off ramp after obtaining a new banking partner.

Binance.us was once the third largest cryptographic platform in the United States, holding almost 20% of the market. It took an important blow following the continuation of the dry in June 2023.

Negotiation volumes increased from an average of $ 144 billion at the start of 2023 to less than $ 2 billion, and the number of active decision -makers on the stock market has decreased quadruple, from twenty to five. The exchange also went to a crypto model after losing key banking partners, which had an impact on liquidity.