Ethereum dominates the cryptocurrency market with an extraordinary price force, increasing more than 200% since April and positioning itself as the main most efficient asset in space. The rally has fueled growing optimism among analysts, with a lot of predicting that heights of all time could soon be at hand of bullish investors. The combination of robust fundamentals, increasing institutional participation and a favorable legal environment has created a perfect backdrop for the last wave of Ethereum.

One of the most striking developments supporting the rally is the historic drop in Ethereum’s supply on trade, now at its lowest levels of all time. This indicates a strong long -term detention behavior among investors and reduces the amount of ETH easily available for sale, by amplifying the potential for upward price movements. The institutional interest was particularly notable, with large -scale purchases adding a sustained purchase pressure to the market.

Some analysts now warn against a possible “shock of the offer” – a scenario where a rapid growing demand responds to the extremely limited offer, which potentially accelerates price gains. With the strengthening of the principles of the Ethereum network and the feeling reaching new heights, the coming weeks could prove to be decisive to determine whether the ETH grows in an unexplored territory and establishes new heights of all time in this market cycle.

The accumulation of Ethereum whales feeds the speculation of the institutional purchase

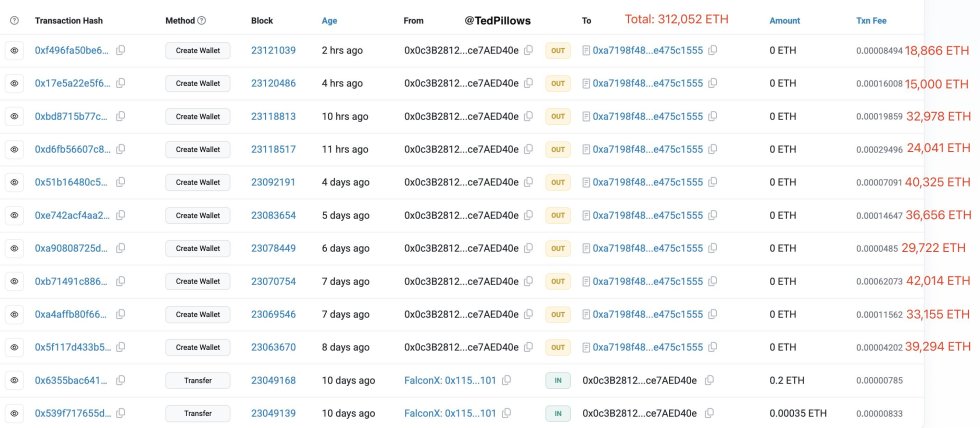

According to Top Crypto Analyst Ted Pillows, a mysterious portfolio bought an amazing $ 1.34 billion in Ethereum in the last eight days, marking one of the largest accumulation accumulation sequences in recent months. The pillows, which closely followed the portfolio transactions, suggest that the scale and the consistency of these purchases point to a major institutional player or a highly capitalized entity, which makes a long -term bet on the ETH.

Although the identity behind the portfolio remains unknown, the activity has aroused many speculations through the cryptographic community. Some market observers believe that this could be the result of over -the -counter transactions (OTC) designed to minimize the impact of the market, while others suspect that it can be a strategically positioning market company before a major decision. The lack of public disclosure leaves the exact reason, but the size of purchases highlights high -level confidence in the prospects of Ethereum.

Many consider the wave of purchase of the whale as a potential catalyst that could accelerate this decision, in particular with the supply of exchange to historic stockings and an increase in institutional demand. The next few days could be essential for the price of Ethereum prices. If the market interprets these massive entries as the start of a sustained institutional accumulation phase, the bullish momentum could intensify quickly.

ETH price analysis: resistance test around 2021 Ath

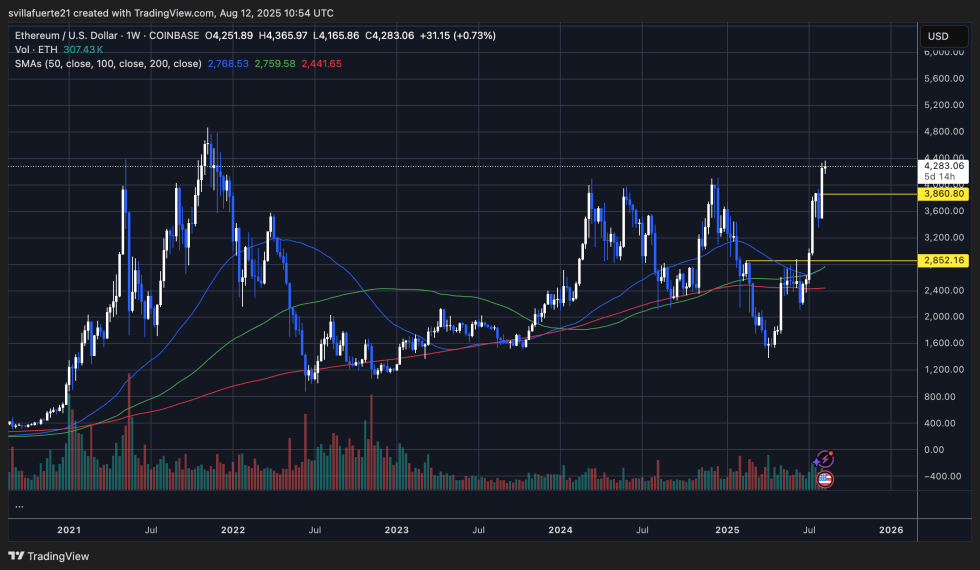

Ethereum (ETH) is negotiated at $ 4,283, displaying a 0.73% gain on the weekly graph with the approach of a major resistance zone near its peaks of all time in 2021. This push follows a net rally of the level of support of $ 2,852, which marked the point of breakdown of the current trend.

The graph shows that ETH negotiating well above its 50-week SMA ($ 2,768), 100-week SMA ($ 2,759) and 200 weeks SMA ($ 2441), reflecting a strong bullish dynamic and a firmly established long-term trend. The escape greater than $ 3,860 – now acting as immediate support – confirms the market force and could serve as a basis for the next leg.

However, the $ 4,300 zone at $ 4,400 has always been a critical inflection point. A decisive closure above this beach would probably trigger the purchase of momentum, opening the way to an unexplored territory and new summits of all potential time. Conversely, the failure to pierce could see the ETH RESTESTER $ 3,860 or even to demean $ 3,200 if the sales pressure is intensifying.

The volume resumed in particular during this rally, signaling a strong conviction among buyers. With fundamental principles and institutional interest, at the same time, ETH’s ability to overcome this resistance could determine whether the next Bull Run phase is accelerating in the coming weeks.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.