Data shows the crypto derivatives market took another hit over the past day as the retracement of Bitcoin and others reduced long positions.

The crypto sector just experienced $700 million in liquidations

Bitcoin and other digital assets were rocked by a violent crash on Friday, leading to a record number of liquidations in the futures market. A “liquidation” occurs when an open contract accumulates losses of a certain degree and is forcibly closed by its platform.

Last week’s market downturn was severe, so many positions were understandably caught off guard. Bitcoin alone saw liquidations of over $11 billion during this volatility, as data from Glassnode shows.

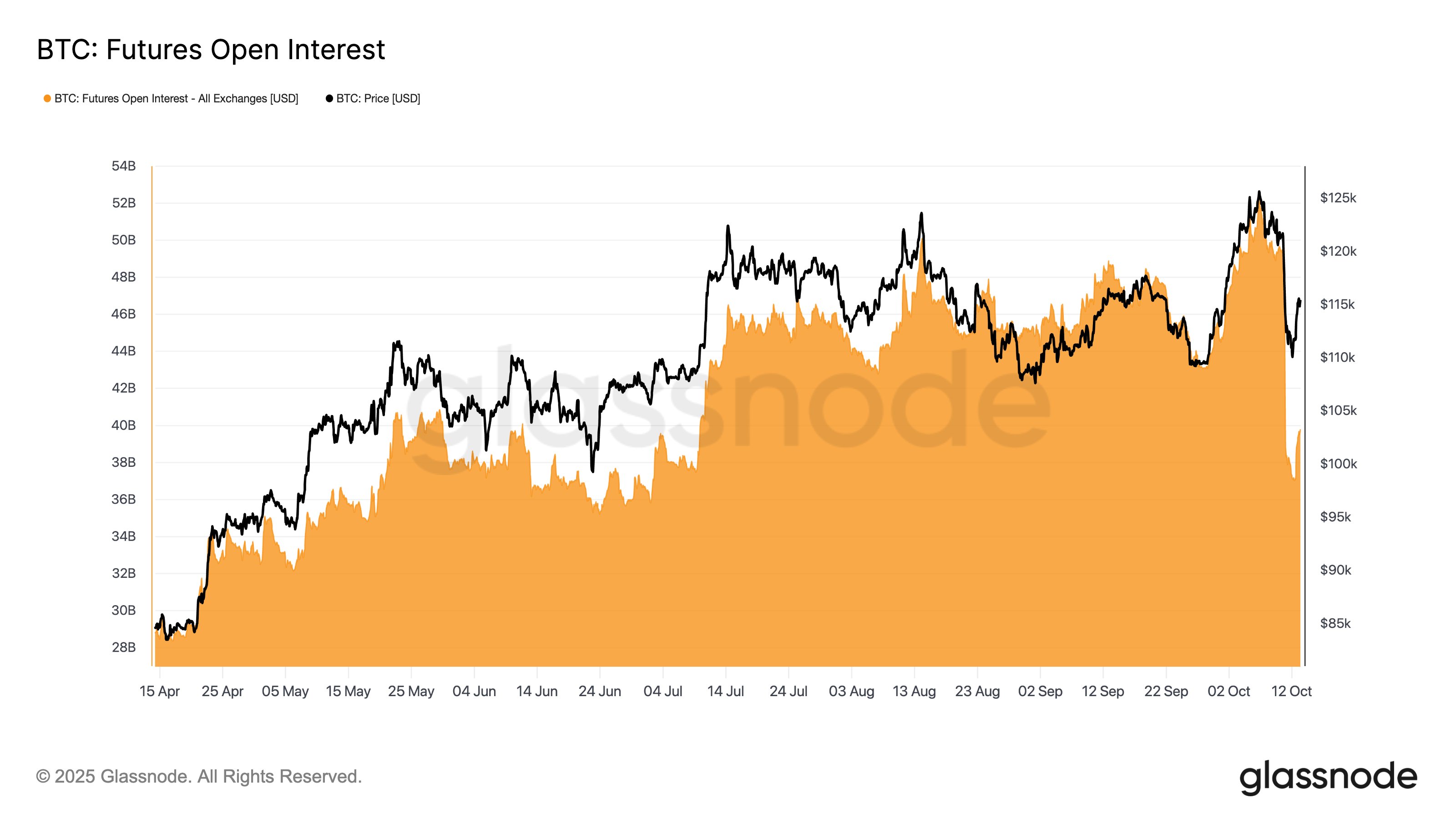

The trend in the BTC futures Open Interest over the last few months | Source: Glassnode on X

This drop in Bitcoin futures Open Interest was the largest in cryptocurrency history and caused a reset of speculative excesses in the derivatives market. Open interest here is naturally a USD measure of the total amount of BTC-related positions that are currently on all centralized exchanges.

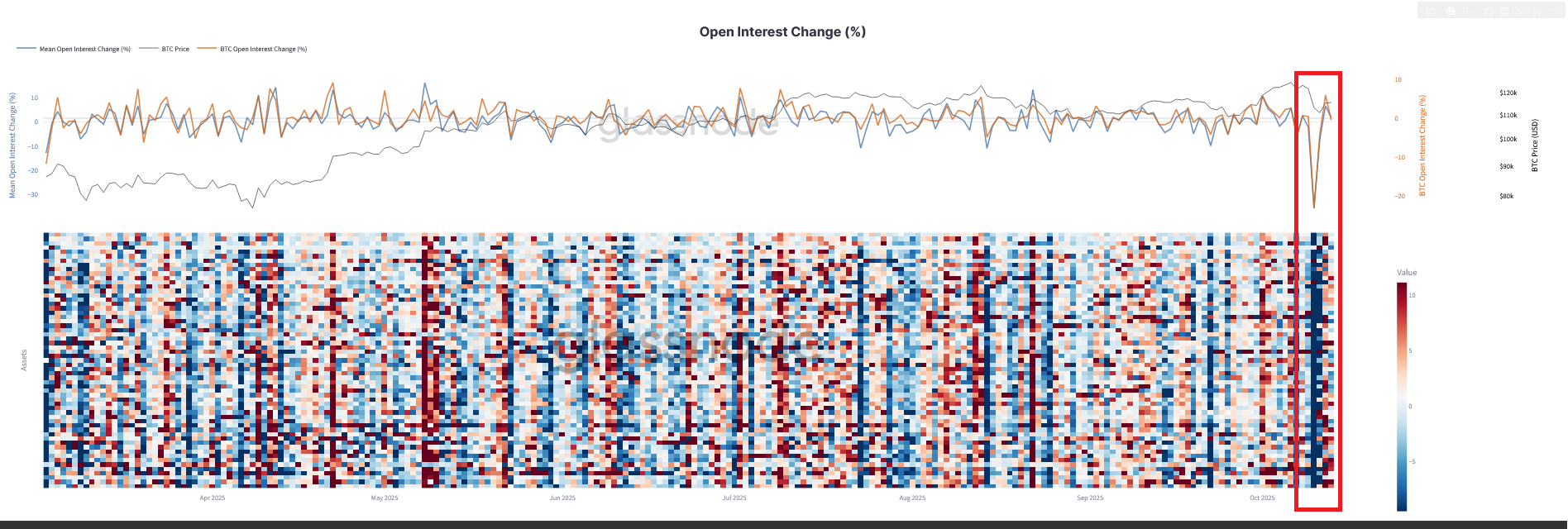

The analytics firm also shared a heat map that puts into perspective how intense open interest is moving across the top 100 coins by market cap.

The percentage change in the Open Interest of the top 100 cryptos | Source: Glassnode on X

Despite this recent crisis, traders were once again surprised by the volatility of the markets over the past day, as liquidations piled up across the various platforms.

As data from CoinGlass shows, the crypto sector saw nearly $708 million in liquidations on derivatives exchanges in the past 24 hours.

Looks like most of the liquidations involved long contracts | Source: CoinGlass

About $457 million of these liquidations, or 64% of the total, involved long positions. The derivatives surge was primarily triggered by a decline in Bitcoin and its company, so it makes sense that bullish bets took the brunt of the squeeze.

Overall, this mass liquidation event is significantly smaller than last week’s event, but this is because excess leverage has already seen some degree of reset at that point and the latest volatility has not been as strong.

In terms of individual symbols, Ethereum is the coin that contributed the most to liquidations, with over $234 million worth of contracts involved. Bitcoin was second with liquidations of $168 million and Solana was third with $42 million.

The distribution of the liquidations by symbol | Source: CoinGlass

A massive liquidation event like today’s is not uncommon in the crypto market, as coins can be volatile and extreme levels of leverage can easily be accessed. Yet the recent liquidations have been extraordinary.

BTC Price

At the time of writing, Bitcoin is floating around $113,300, down about 6.5% over the past seven days.

The price of the coin seems to be struggling to recover from the crash | Source: BTCUSDT on TradingView

Featured image from Dall-E, CoinGlass.com, Glassnode.com, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.